Published on March 20th, 2025 by Bob Ciura

Many investors have a desire to ‘beat the market’.

This sounds like a good goal. After all, the market is ‘just average’, so it would make sense to at least beat average.

But instead of focusing on an arbitrary benchmark or compounding target (‘I want to compound at 20% annually’ as an example), I believe it makes more sense to focus on the reason you are investing.

Broadly, that’s to make money. But more specifically, the point of dividend growth investing is to build a rising passive income stream.

And the underlying purpose there is to have a growing passive income stream that exceeds your expenses – so you have true, lasting financial freedom.

The securities you select for your dividend growth portfolio in order to achieve lasting financial freedom through rising passive income certainly matter.

That’s where dividend growth stocks come in–more specifically, blue chip stocks that have increased their dividends for at least 10 consecutive years.

You can download our free blue chip stocks list with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

There are currently more than 500 securities in our blue chip stocks list.

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less established stocks.

Instead of chasing returns, investors can start building long-term passive income through dividend growth stocks.

The following 10 blue chip stocks have increased their dividends for at least 10 years, and have Dividend Risk Scores of ‘C’ or better in the Sure Analysis Research Database, plus the highest dividend growth.

The 10 blue chip stocks are sorted by dividend growth rate.

Table of Contents

The table of contents below allows for easy navigation.

- Blue Chip #10: Raymond James Financial (RJF)

- Blue Chip #9: Intuit Inc. (INTU)

- Blue Chip #8: Visa Inc. (V)

- Blue Chip #7: Apple Inc. (AAPL)

- Blue Chip #6: UnitedHealth Group (UNH)

- Blue Chip #5: Mastercard Inc. (MA)

- Blue Chip #4: Zoetis Inc. (ZTS)

- Blue Chip #3: Eli Lilly & Co. (LLY)

- Blue Chip #2: Comfort Systems USA (FIX)

- Blue Chip #1: Badger Meter Inc. (BMI)

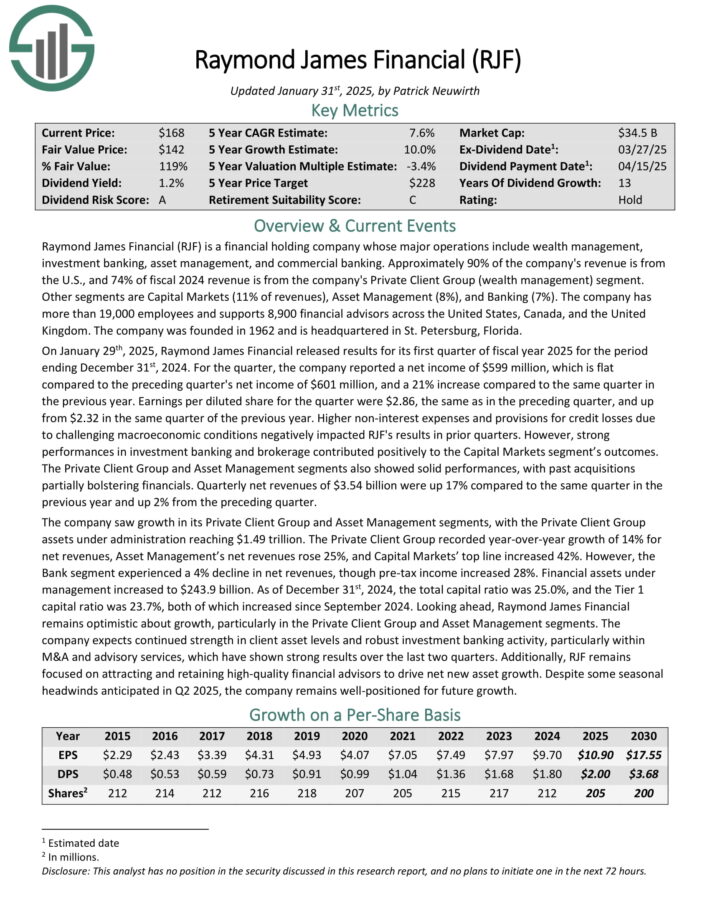

Blue Chip #10: Raymond James Financial (RJF)

- Dividend History: 13 years of consecutive increases

- Dividend Growth: 13.0%

Raymond James Financial (RJF) is a financial holding company whose major operations include wealth management, investment banking, asset management, and commercial banking. Approximately 90% of the company’s revenue is from the U.S., and 74% of fiscal 2024 revenue is from the company’s Private Client Group (wealth management) segment.

Other segments are Capital Markets (11% of revenues), Asset Management (8%), and Banking (7%). The company has more than 19,000 employees and supports 8,900 financial advisors across the United States, Canada, and the United Kingdom.

On January 29th, 2025, Raymond James Financial released results for its first quarter of fiscal year 2025 for the period ending December 31st, 2024.

For the quarter, the company reported a net income of $599 million, which is flat compared to the preceding quarter’s net income of $601 million, and a 21% increase compared to the same quarter in the previous year.

Earnings per diluted share for the quarter were $2.86, the same as in the preceding quarter, and up from $2.32 in the same quarter of the previous year. Strong performances in investment banking and brokerage contributed positively to the Capital Markets segment’s outcomes.

Click here to download our most recent Sure Analysis report on RJF (preview of page 1 of 3 shown below):

Blue Chip #9: Intuit Inc. (INTU)

- Dividend History: 13 years of consecutive increases

- Dividend Growth: 13%

Intuit is a cloud-based accounting and tax preparation software giant, headquartered in Mountain View, California. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide.

Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers. The company recorded $16.3 billion in revenues last year and is headquartered in Mountain View, California.

On February 25th, 2025, Intuit published its fiscal Q2 results for the period ending January 31st, 2025. This was another solid quarter, with “Global Business Solutions Group” revenues up 19% year-over-year.

Specifically, QuickBooks Online Accounting revenues grew 22% year-over-year, driven by customer growth, higher effective prices, and mix-shift.

Adjusted EPS for the quarter grew by 26% to $3.32 compared to FQ2 2024.

Management reiterated its revenue and nonGAAP EPS guidance for FY2025. Revenues are expected to be in a range of $18.160 billion to $18.347 billion, implying a growth rate between 12% and 13% from last year.

Adjusted EPS is expected to be between $19.16 and $19.36. This implies a year-over-year growth of 18% to 19%.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

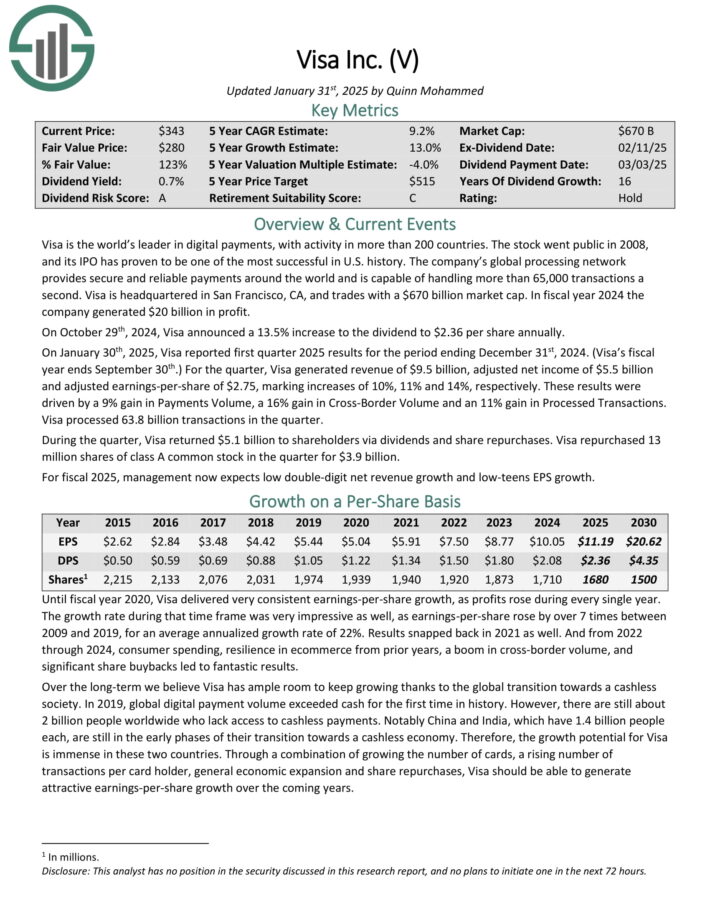

Blue Chip #8: Visa Inc. (V)

- Dividend History: 16 years of consecutive increases

- Dividend Growth: 13%

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second.

On January 30th, 2025, Visa reported first quarter 2025 results for the period ending December 31st, 2024. (Visa’s fiscal year ends September 30th.)

For the quarter, Visa generated revenue of $9.5 billion, adjusted net income of $5.5 billion and adjusted earnings-per-share of $2.75, marking increases of 10%, 11% and 14%, respectively.

These results were driven by a 9% gain in Payments Volume, a 16% gain in Cross-Border Volume and an 11% gain in Processed Transactions. Visa processed 63.8 billion transactions in the quarter.

Click here to download our most recent Sure Analysis report on Visa (preview of page 1 of 3 shown below):

Blue Chip #7: Apple Inc. (AAPL)

- Dividend History: 12 years of consecutive increases

- Dividend Growth: 13.9%

Apple is a technology company that designs, manufactures, and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV. Apple also has a services business that sells music, apps, and subscriptions.

On January 30th, 2025, Apple reported financial results for the first quarter of fiscal year 2025 (Apple’s fiscal year ends the last Saturday in September).

Total sales grew 4% over the prior year’s quarter, to a new record of $124.3 billion, thanks to sustained growth in iPhone, iPad and Wearables across all regions.

Earnings-per-share grew 10%, from $2.18 to $2.40, and exceeded the analysts’ consensus by $0.05. Notably, Apple has missed the analysts’ estimates only once in the last 25 quarters.

Going forward, Apple’s earnings growth will be driven by several factors. One of these is the ongoing cycle of iPhone releases, which creates lumpy results. In the long run, Apple should be able to grow its iPhone sales, albeit in an irregular fashion.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

Blue Chip #6: UnitedHealth Group (UNH)

- Dividend History: 15 years of consecutive increases

- Dividend Growth: 14%

UnitedHealth dates back to 1974 when Charter Med was founded by a group of health care professionals looking for ways to expand healthcare options for consumers.

The company has two major reporting segments: UnitedHealth and Optum. The former provides global healthcare benefits to individuals, employers, and Medicare/Medicaid beneficiaries. The Optum segment is a services business that seeks to lower healthcare costs and optimize outcomes for its customers.

UnitedHealth posted fourth quarter and full-year earnings on January 16th, 2025, and results showed a rare miss on the top line. Despite the fact that shares were well off their highs prior to the report, the stock declined anyway as the company disappointed investors for the first time in a while.

Adjusted earnings-per-share came to $6.81, which was seven cents ahead of estimates. However, revenue was up only 6.8% to $100.8 billion, missing by almost a billion dollars.

UnitedHealthcare saw revenue of $74.1 billion during the quarter, missing consensus by $1.3 billion. OptumRx posted $35.8 billion of revenue, up 15% year-over-year and beating estimates. OptumHealth saw 5% growth year-over-year to $25.7 billion, also beating estimates.

The company’s medical care ratio was 85.5% in 2024, a deterioration of about 230 basis points year-over-year. This was attributable to increased Medicare funding reductions and member mix, primarily. The company issued guidance for this year of $29.50 to $30.00 in adjusted earnings-per-share.

Click here to download our most recent Sure Analysis report on UNH (preview of page 1 of 3 shown below):

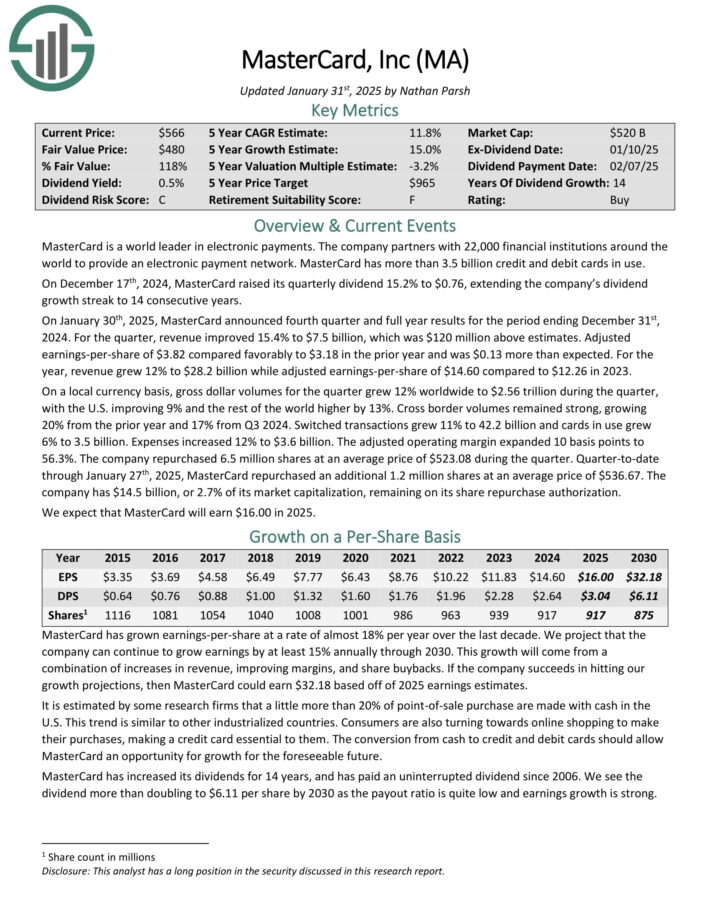

Blue Chip #5: Mastercard Inc. (MA)

- Dividend History: 14 years of consecutive increases

- Dividend Growth: 15%

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On January 30th, 2025, MasterCard announced fourth quarter and full year results for the period ending December 31st, 2024.

For the quarter, revenue improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 compared favorably to $3.18 in the prior year and was $0.13 more than expected.

For the year, revenue grew 12% to $28.2 billion while adjusted earnings-per-share of $14.60 compared to $12.26 in 2023.

On a local currency basis, gross dollar volumes for the quarter grew 12% worldwide to $2.56 trillion during the quarter, with the U.S. improving 9% and the rest of the world higher by 13%.

Cross border volumes remained strong, growing 20% from the prior year and 17% from Q3 2024.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

Blue Chip #4: Zoetis Inc. (ZTS)

- Dividend History: 11 years of consecutive increases

- Dividend Growth: 15%

Zoetis is a drug company that focuses on animal health, including discovering, developing, manufacturing, and commercialising medicines, vaccines, and diagnostic products.

Biodevices, genetic tests, and precision livestock farming complement the company’s offerings. The Vaccine segment is the largest revenue generating segment, with 22% of the total revenue, while the United States generates 54% of the revenue.

On February 13th, 2025, Zoetis Inc. reported strong financial results for the fourth quarter of 2024, with revenue reaching $2.3 billion, a 5% increase from the previous year and up 6% on an operational basis. The company experienced growth in both its U.S. and International segments, driven primarily by strong demand for companion animal products.

In the U.S. segment, revenue was $1.3 billion, reflecting a 4% increase compared to Q4 2023. Sales of companion animal products grew by 7%, fueled by continued strong demand for Simparica Trio, dermatology products such as Apoquel and Cytopoint, and monoclonal antibody treatments for osteoarthritis pain.

Growth was partially offset by the impact of the initial stocking of Librela and Apoquel Chewable products during their prior-year launches. Livestock product sales declined by 8%, primarily due to the divestiture of the medicated feed additive portfolio and certain water-soluble products.

Click here to download our most recent Sure Analysis report on ZTS (preview of page 1 of 3 shown below):

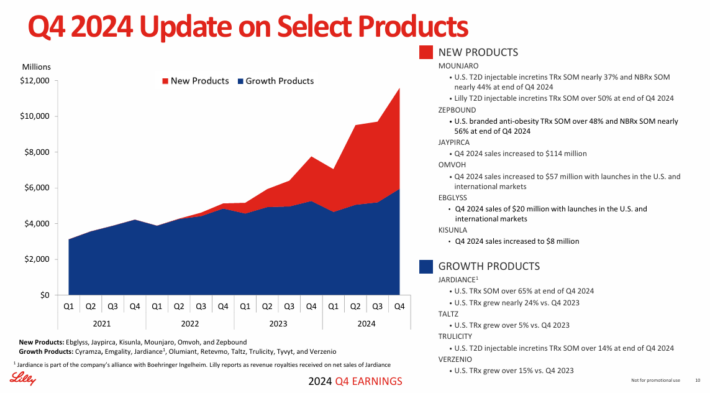

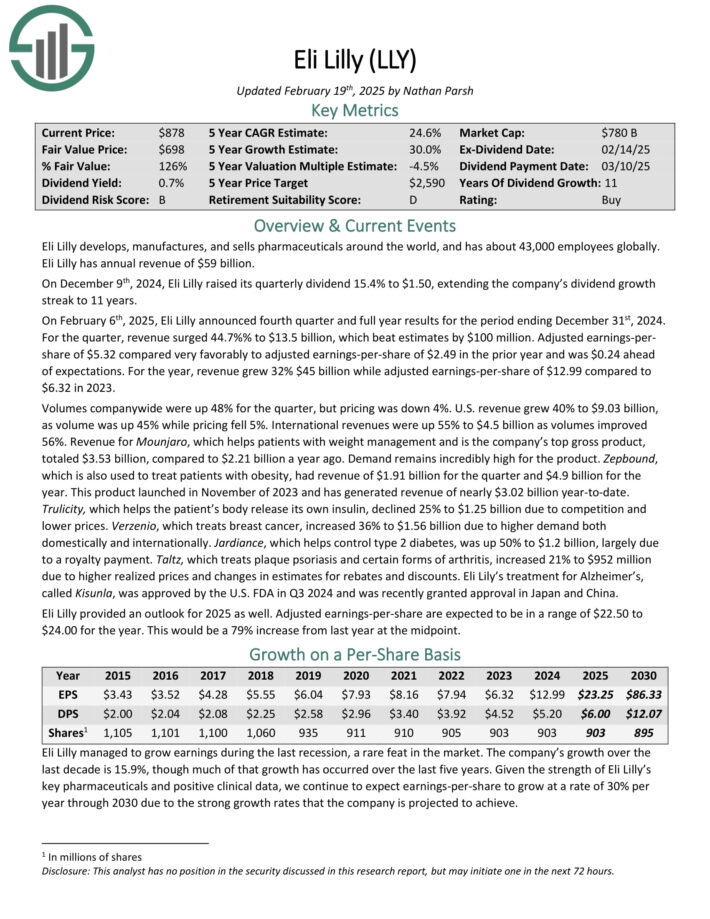

Blue Chip #3: Eli Lilly & Co. (LLY)

- Dividend History: 11 years of consecutive increases

- Dividend Growth: 15%

Eli Lilly develops, manufactures, and sells pharmaceuticals around the world, and has about 43,000 employees globally. Eli Lilly has annual revenue of $59 billion.

On December 9th, 2024, Eli Lilly raised its quarterly dividend 15.4% to $1.50, extending the company’s dividend growth streak to 11 years.

On February 6th, 2025, Eli Lilly announced fourth quarter and full year results for the period ending December 31st, 2024. For the quarter, revenue surged 44.7%% to $13.5 billion, which beat estimates by $100 million.

Source: Investor Presentation

Adjusted earnings-per-share of $5.32 compared very favorably to adjusted earnings-per-share of $2.49 in the prior year and was $0.24 ahead of expectations.

For the year, revenue grew 32% $45 billion while adjusted earnings-per-share of $12.99 compared to $6.32 in 2023. Volumes company-wide were up 48% for the quarter, but pricing was down 4%.

U.S. revenue grew 40% to $9.03 billion, as volume was up 45% while pricing fell 5%. International revenues were up 55% to $4.5 billion as volumes improved 56%.

Revenue for Mounjaro, which helps patients with weight management and is the company’s top gross product, totaled $3.53 billion, compared to $2.21 billion a year ago.

Demand remains incredibly high for the product. Zepbound, which is also used to treat patients with obesity, had revenue of $1.91 billion for the quarter and $4.9 billion for the year.

Click here to download our most recent Sure Analysis report on LLY (preview of page 1 of 3 shown below):

Blue Chip #2: Comfort Systems USA (FIX)

- Dividend History: 13 years of consecutive increases

- Dividend Growth: 15%

Comfort Systems USA provides mechanical and electrical contracting services across the U.S. The company specializes in HVAC, plumbing, piping, controls, and electrical system installations and services, running 47 units with 178 locations in 136 cities.

Serving primarily commercial, industrial, and institutional markets, Comfort Systems USA works in sectors like manufacturing, healthcare, education, and government.

The company generated $7.0 billion in revenues last year, with 56.7% of it coming from new facility installations and 43.3% coming from services for existing buildings. On February 20th, 2025, Comfort Systems raised its dividend by 14.3% to a quarterly rate of $0.40.

On the same day, the company posted its Q4 and full-year results for the period ending December 31st, 2024. Revenue for the period was $1.87 billion, up 37.5% compared to last year.

The rise included strong same-store activity growth and contributions from acquisitions. The same-store revenue growth was largely driven by continued strength in market conditions, particularly in data centers and chip plants.

The mechanical segment recorded revenue growth of over 40% year-over-year, fueled by robust organic growth in construction and services. The electrical segment also maintained solid performance, reflecting sustained demand. EPS increased by about 60% to $4.09.

For the full year, the company reported EPS of $14.64, exceeding prior estimates. The company’s backlog remained strong, reaching $5.99 billion at the end of December.

Click here to download our most recent Sure Analysis report on FIX (preview of page 1 of 3 shown below):

High Yield Blue Chip #1: Badger Meter Inc. (BMI)

- Dividend History: 32 years of consecutive increases

- Dividend Growth: 15%

Badger Meter was founded in 1905 in Milwaukee, WI. It manufactures and markets meters and valves that are used to measure and control the flow of liquids, such as water, oil and various chemicals.

Its products are also used to control the flow of air and other gases. Badger Meter generates ~$827 million in annual revenues.

On January 31st, 2025, Badger Meter announced fourth quarter and full year earnings results for the period ending December 31st, 2025. For the quarter, revenue improved 12.5% to $205.2 million, which topped estimates by $2.45 million.

Earnings-per-share of $1.04 compared favorably to earnings-per-share of $0.84 in the prior year and was $0.04 more than expected. For the year, revenue grew 18% to a new record $826.6 million. Earnings-per-share totaled $4.23, which was a new record and was up from $3.14 in 2023.

The utility water business once again grew 14% for the quarter. As with prior periods, this growth was led by an increase in demand for ORION Cellular endpoint, E-Series Ultrasonic meters, and BEACON Software as a Service.

Click here to download our most recent Sure Analysis report on BMI (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding other high-yield securities, the following Sure Dividend resources may be useful:

High-Yield Individual Security Research

- 10 Highest Yielding Blue Chip Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 4 Highest Yielding Royalty Trusts

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month