Updated on December 20th, 2024 by Bob Ciura

Spreadsheet data updated daily

Most companies distribute dividends on a quarterly or semi-annual payment schedule, but there are some that pay dividends monthly.

However, the number of companies that distribute monthly dividends is limited. You can see all monthly dividend stocks here.

You can also download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

This article provides an overview of monthly dividend stocks, and includes a top 10 list of monthly dividend stocks that most income investors haven’t heard of.

Table of Contents

- Monthly Dividend Stocks Overview

- Monthly Dividend Stocks You’ve Never Heard Of: Global Water Resources (GWRS)

- Monthly Dividend Stocks You’ve Never Heard Of: Apple Hospitality REIT (APLE)

- Monthly Dividend Stocks You’ve Never Heard Of: STAG Industrial (STAG)

- Monthly Dividend Stocks You’ve Never Heard Of: EPR Properties (EPR)

- Monthly Dividend Stocks You’ve Never Heard Of: LTC Properties (LTC)

- Monthly Dividend Stocks You’ve Never Heard Of: Gladstone Commercial Corp. (GOOD)

- Monthly Dividend Stocks You’ve Never Heard Of: Modiv Industrial REIT (MDV)

- Monthly Dividend Stocks You’ve Never Heard Of: Gladstone Investment Corp. (GAIN)

- Monthly Dividend Stocks You’ve Never Heard Of: Gladstone Capital Corp. (GLAD)

- Monthly Dividend Stocks You’ve Never Heard Of: Horizon Technology Finance (HRZN)

Monthly Dividend Stocks Overview

Monthly dividend payments are beneficial for one group of investors in particular; retirees who rely on dividend stocks for income.

With that said, monthly dividend stocks are better under all circumstances (everything else being equal), because they allow for returns to be compounded on a more frequent basis.

More frequent compounding results in better total returns, particularly over long periods of time.

Of course, there are also potential risk factors when investing in monthly dividend stocks.

Investors should note many monthly dividend stocks are highly speculative. On average, monthly dividend stocks tend to have elevated payout ratios.

An elevated payout ratio means there’s less margin for error to continue paying the dividend if business results suffer a temporary (or permanent) decline.

As a result, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession.

The following 10 dividend stocks pay dividends each month, but have risk factors and unique business models that investors should carefully consider before buying.

The following list is comprised of 10 monthly dividend stocks with market caps below $3 billion, which means they are smaller companies than the more widely-followed monthly dividend stocks.

The list excludes extremely speculative monthly dividend stocks such as oil and gas royalty trusts. It also excludes mortgage REITs which are also high-risk securities.

The 10 monthly dividend stocks you’ve never heard of are sorted by dividend yield, from lowest to highest.

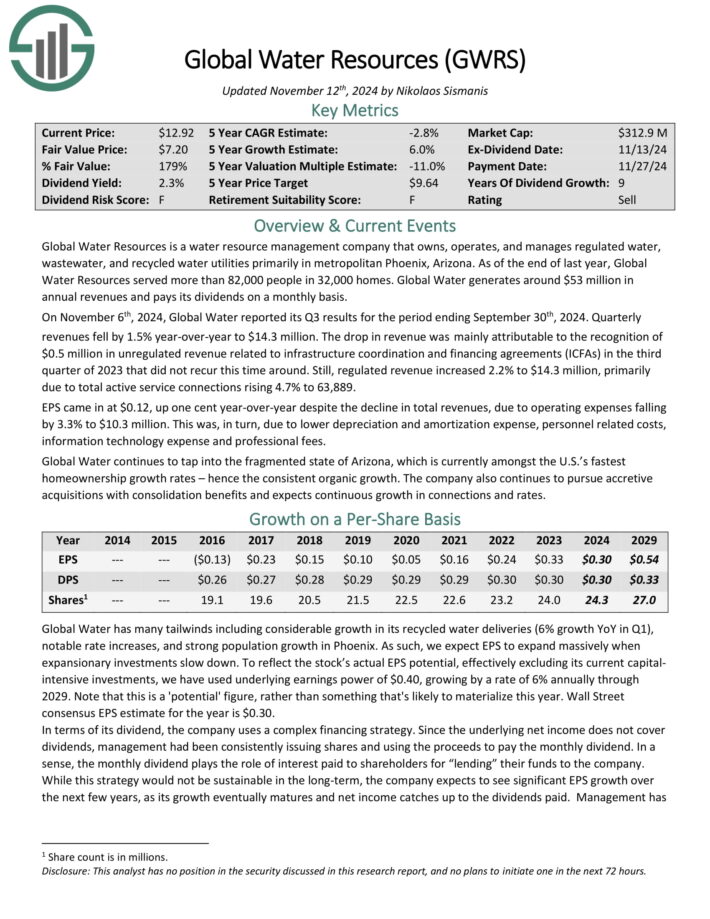

Monthly Dividend Stock You’ve Never Heard Of: Global Water Resources (GWRS)

Global Water Resources is a water resource management company. It owns, operates, and manages water, wastewater, and recycled water utilities in Phoenix, Arizona.

It owns 25 water and wastewater utilities in Phoenix and serves more than 74,000 people. It also recycles more than 1 billion gallons of water every year.

The company believes it has the capacity for hundreds of thousands of service connections, but its current scale is quite small.

Annual revenue is about $42 million, and the stock trades with a market capitalization of ~$300 million.

Source: Investor relations

On November 6th, 2024, Global Water reported its Q3 results for the period ending September 30th, 2024. Quarterly revenues fell by 1.5% year-over-year to $14.3 million.

The drop in revenue was mainly attributable to the recognition of $0.5 million in unregulated revenue related to infrastructure coordination and financing agreements (ICFAs) in the third quarter of 2023 that did not recur this time around.

Still, regulated revenue increased 2.2% to $14.3 million, primarily due to total active service connections rising 4.7% to 63,889.

Click here to download our most recent Sure Analysis report on GWRS (preview of page 1 of 3 shown below):

Monthly Dividend Stock You’ve Never Heard Of: Apple Hospitality REIT (APLE)

Apple Hospitality REIT is a hotel REIT that owns a portfolio of hotels with tens of thousands of rooms located across dozens of states.

It franchises its properties out to leading brands, including Marriott-branded hotels, Hilton-branded hotels, and Hyatt-branded hotels.

Source: Investor Presentation

Apple Hospitality REIT, Inc. (APLE) reported its second-quarter 2024 financial results, demonstrating solid performance across key metrics.

The company posted earnings per share (EPS) of $0.31, beating estimates by $0.01, and generated revenue of $390.08 million, representing a 7.87% year-over-year increase and surpassing expectations by $2.57 million.

For the second quarter, Apple Hospitality recorded net income of $73.9 million, an increase of 13.2% compared to the same period in 2023, with a net income per share of $0.31, up 6.9%.

The company’s operating income for Q2 was $93.5 million, up 12.6%, and the operating margin improved by 100 basis points to 24%.

Click here to download our most recent Sure Analysis report on APLE (preview of page 1 of 3 shown below):

Monthly Dividend Stock You’ve Never Heard Of: STAG Industrial (STAG)

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has ~560 buildings across 41 states in the United States.

The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

Source: Investor Presentation

However, STAG Industrial executes a deep quantitative and qualitative analysis on its tenants. As a result, it has incurred credit losses that have been less than 0.1% of its revenues since its IPO.

In late October, STAG Industrial reported (10/29/24) financial results for the third quarter of fiscal 2024. Core FFO per share grew 2% over the prior year’s quarter, from $0.59 to $0.60, in line with the analysts’ consensus, thanks to the sustained strength of the REIT’s tenants and hikes in rent rates.

Net operating income grew 5% over the prior year’s quarter even though the occupancy rate remained flat at 97.1%.

Click here to download our most recent Sure Analysis report on STAG Industrial Inc. (STAG) (preview of page 1 of 3 shown below):

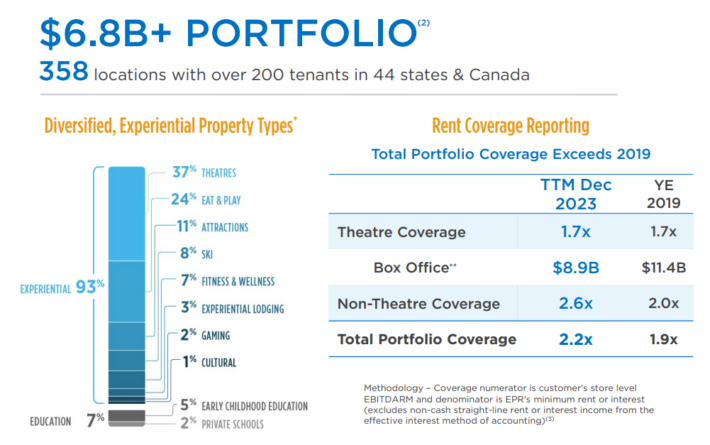

Monthly Dividend Stock You’ve Never Heard Of: EPR Properties (EPR)

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively.

It selects properties it believes have strong return potential in Entertainment, Recreation, and Education. The portfolio includes about $7 billion in investments across 350+ locations in 44 states, including over 200 tenants.

Source: Investor Presentation

EPR posted third quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Funds-from-operations came to $1.29, which was two cents ahead of estimates. FFO was down from $1.47 per share a year ago. On a dollar basis, FFO fell from $113 million to just over $100 million.

Revenue was off almost 5% year-over-year to $180.5 million, which was $21.5 million ahead of expectations. For the nine months, revenue was off from $534 million to $521 million.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

Monthly Dividend Stock You’ve Never Heard Of: LTC Properties (LTC)

LTC Properties is a REIT that invests in senior housing and skilled nursing properties. Its portfolio consists of approximately 50% senior housing and 50% skilled nursing properties.

Just like other healthcare REITs, LTC benefits from a strong secular trend, namely the high growth of the population that is above 80 years old. This growth results from the aging of the baby boomers’ generation and the steady rise of life expectancy thanks to sustained progress in medical sciences.

The REIT owns 194 investments in 26 states, with 31 operating partners.

Source: Investor Presentation

In late October, LTC reported (10/29/24) financial results for the third quarter of fiscal 2024. Funds from operations (FFO) per share grew 5% over the prior year’s quarter, from $0.65 to $0.68, but missed the analysts’ consensus by $0.01.

The increase in FFO per share resulted primarily from higher income from previously transitioned properties and higher income from loan originations. LTC drastically improved its leverage ratio (Net Debt to EBITDA) from 5.3x to 4.2x thanks to various asset sales.

Click here to download our most recent Sure Analysis report on LTC (preview of page 1 of 3 shown below):

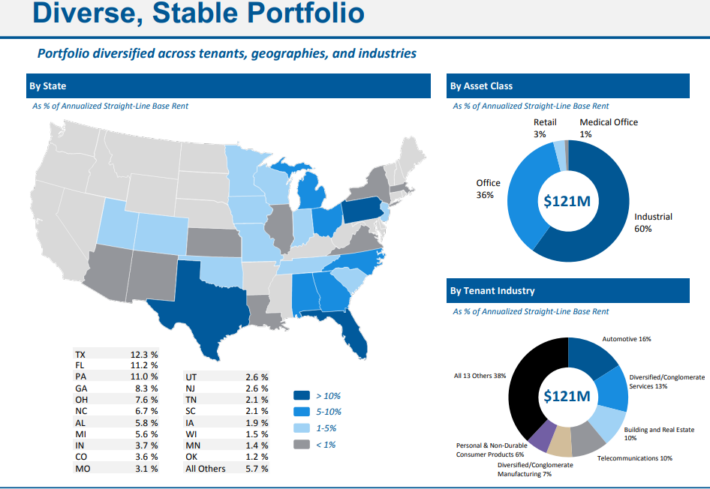

Monthly Dividend Stock You’ve Never Heard Of: Gladstone Commercial (GOOD)

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net leased industrial and office properties across the U.S.

The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends.

Source: Investor Presentation

The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants.

Gladstone posted second quarter earnings on August 6th, 2024, and results were better than expected on both the top and bottom lines. Funds-from-operations came to 36 cents, which was a penny ahead of estimates.

FFO was up from 34 cents in Q1, primarily due to accelerated rent related to a termination fee on a property sold during the quarter. Revenue was off 4% year-over-year, but still beat estimates by $1.1 million at $37.1 million.

Click here to download our most recent Sure Analysis report on GOOD (preview of page 1 of 3 shown below):

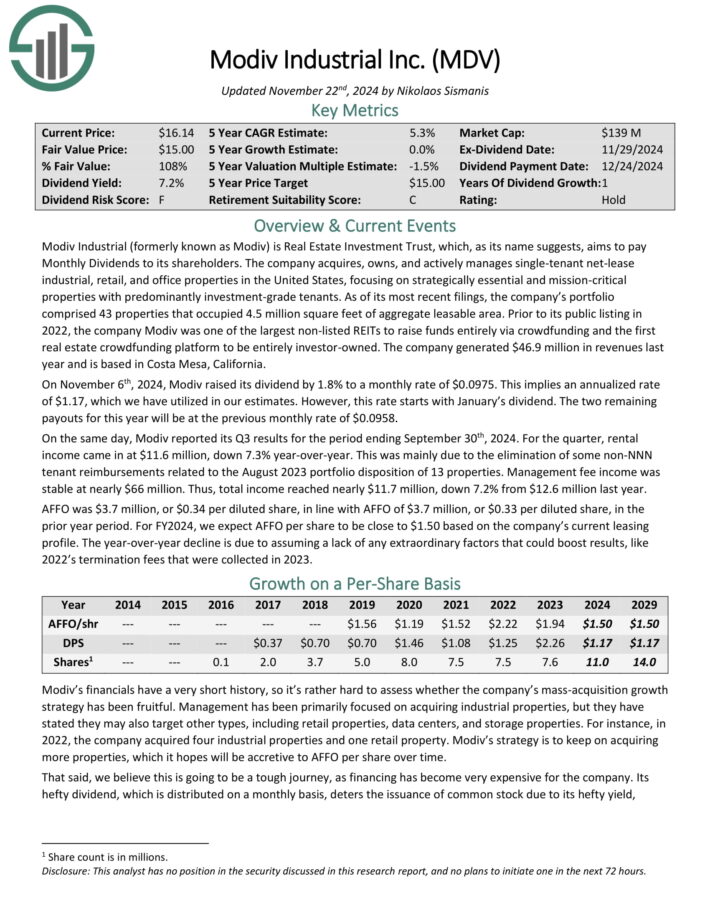

Monthly Dividend Stock You’ve Never Heard Of: Modiv Industrial REIT (MDV)

Modiv Industrial acquires, owns, and actively manages single-tenant net-lease industrial, retail, and office properties in the United States, focusing on strategically essential and mission-critical properties with predominantly investment-grade tenants.

As of its most recent filings, the company’s portfolio comprised 44 properties that occupied 4.6 million square feet of aggregate leasable area.

Modiv has nearly 43 properties in its portfolio that occupy 4.5 million square feet of aggregate leasable area.

Modiv reported its Q3 results for the period ending September 30th, 2024. For the quarter, rental income came in at $11.6 million, down 7.3% year-over-year.

This was mainly due to the elimination of some non-NNN tenant reimbursements related to the August 2023 portfolio disposition of 13 properties.

Management fee income was stable at nearly $66 million. Total income reached nearly $11.7 million, down 7.2% from $12.6 million last year.

AFFO was $3.7 million, or $0.34 per diluted share, in line with AFFO of $3.7 million, or $0.33 per diluted share, in the prior year period.

Click here to download our most recent Sure Analysis report on MDV (preview of page 1 of 3 shown below):

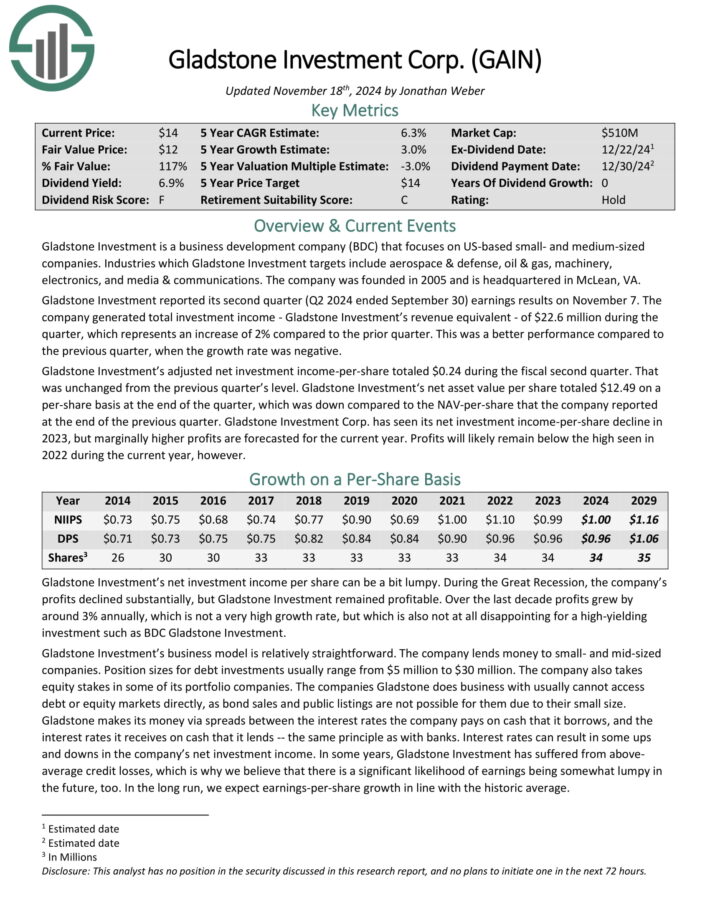

Monthly Dividend Stock You’ve Never Heard Of: Gladstone Investment Corp. (GAIN)

Gladstone Investment is a business development company (BDC) that focuses on US-based small- and medium-sized companies.

Industries which Gladstone Investment targets include aerospace & defense, oil & gas, machinery, electronics, and media & communications.

A rundown of GAIN’s investment process can be seen in the image below:

Source: Investor Presentation

Gladstone Investment reported its second quarter (Q2 2024 ended September 30) earnings results on November 7. The company generated total investment income of $22.6 million during the quarter, which represents an increase of 2% compared to the prior quarter.

This was a better performance compared to the previous quarter, when the growth rate was negative.

Gladstone Investment’s adjusted net investment income-per-share totaled $0.24 during the fiscal second quarter. That was unchanged from the previous quarter’s level.

Gladstone Investment‘s net asset value per share totaled $12.49 on a per-share basis at the end of the quarter.

Click here to download our most recent Sure Analysis report on GAIN (preview of page 1 of 3 shown below):

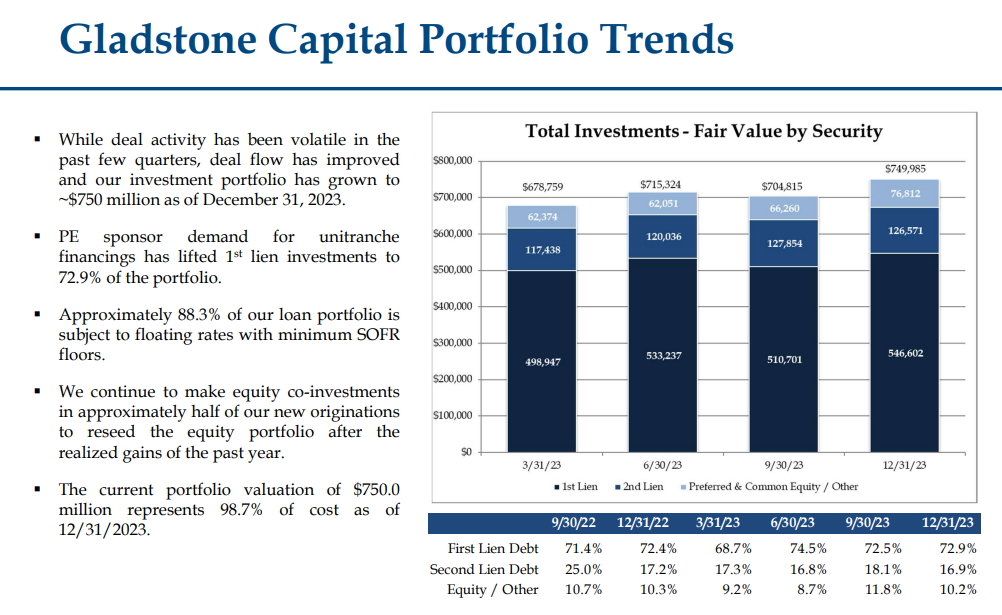

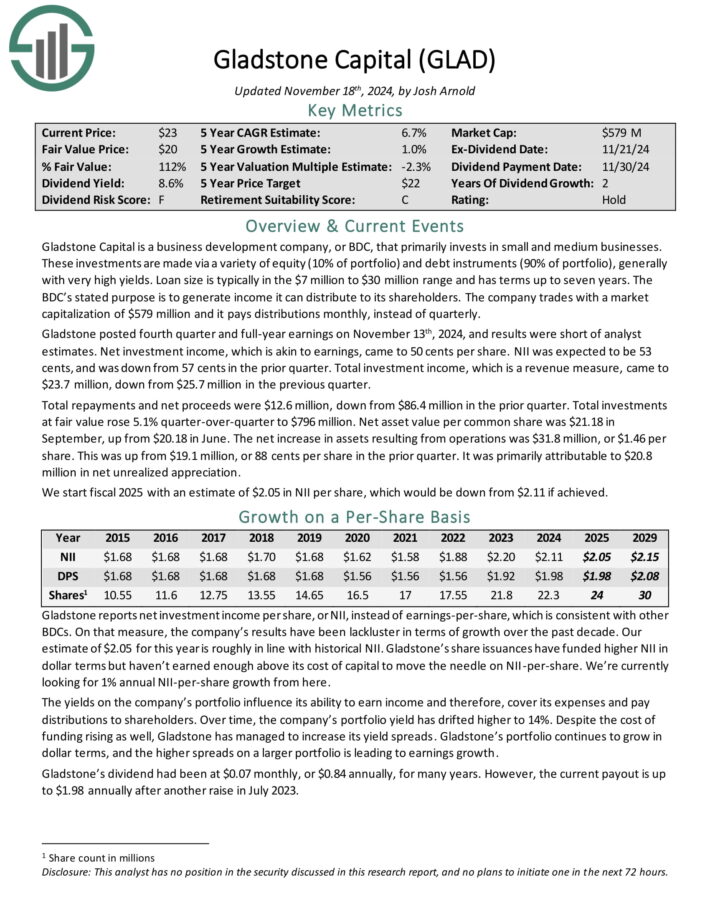

Monthly Dividend Stock You’ve Never Heard Of: Gladstone Capital Corp. (GLAD)

Gladstone Capital is a business development company, or BDC, that primarily invests in small and medium businesses. These investments are made via a variety of equity (10% of portfolio) and debt instruments (90% of portfolio), generally with very high yields.

Loan size is typically in the $7 million to $30 million range and has terms up to seven years.

Source: Investor Presentation

Gladstone posted fourth quarter and full-year earnings on November 13th, 2024, and results were short of analyst estimates. Net investment income, which is akin to earnings, came to 50 cents per share.

NII was expected to be 53 cents, and was down from 57 cents in the prior quarter. Total investment income, which is a revenue measure, came to $23.7 million, down from $25.7 million in the previous quarter.

Total repayments and net proceeds were $12.6 million, down from $86.4 million in the prior quarter. Total investments at fair value rose 5.1% quarter-over-quarter to $796 million. Net asset value per common share was $21.18 in September, up from $20.18 in June.

Click here to download our most recent Sure Analysis report on GLAD (preview of page 1 of 3 shown below):

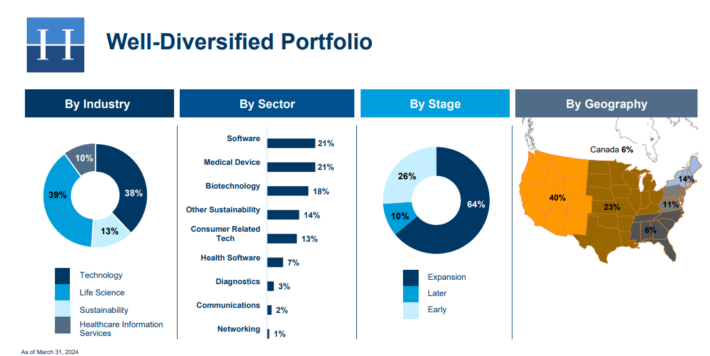

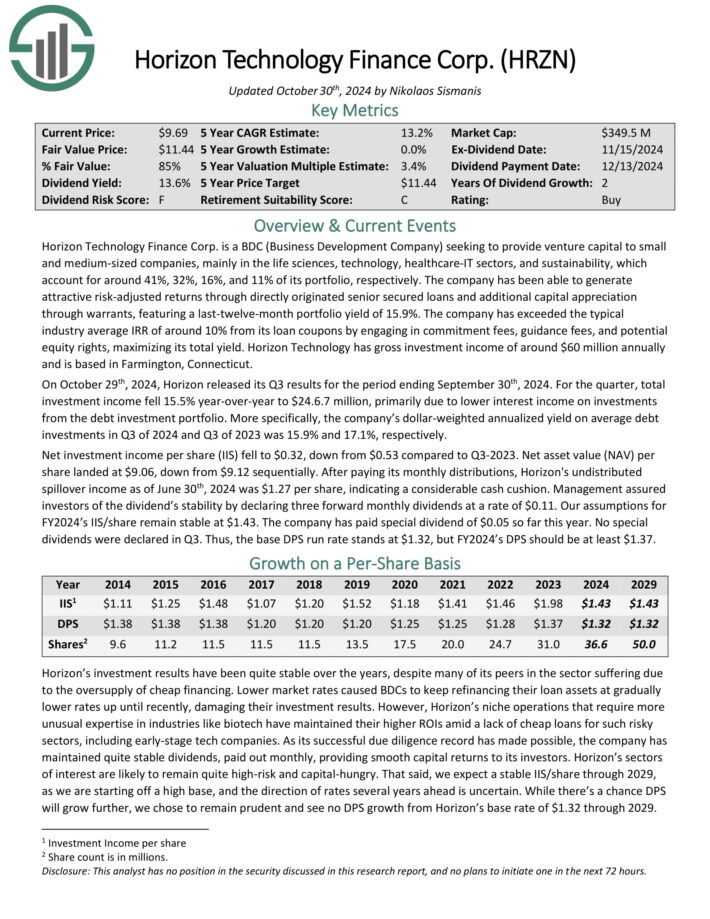

Monthly Dividend Stock You’ve Never Heard Of: Horizon Technology Finance (HRZN)

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On October 29th, 2024, Horizon released its Q3 results for the period ending September 30th, 2024. For the quarter, total investment income fell 15.5% year-over-year to $24.6.7 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q3 of 2024 and Q3 of 2023 was 15.9% and 17.1%, respectively.

Net investment income per share (IIS) fell to $0.32, down from $0.53 compared to Q3-2023. Net asset value (NAV) per share landed at $9.06, down from $9.12 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of June 30th, 2024 was $1.27 per share, indicating a considerable cash cushion.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Additional Reading

Monthly dividend stocks may be more attractive for income investors due to their frequent payouts.

Additionally, many monthly dividend payers offer investors high yields. The combination of a monthly dividend payment and a high yield could be especially appealing.

We have compiled a reading list for additional dividend growth stock investing ideas:

- The Dividend Aristocrats List is comprised of 66 S&P 500 stocks with 25+ years of consecutive dividend increases.

- The 10 Best Dividend Aristocrats You’ve Never Heard Of: Under-the-radar Dividend Aristocrats

- The 10 Best Dividend Kings You’ve Never Heard Of: Under-the-radar Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The 20 Highest Yielding Dividend Aristocrats

- The 10 Safest Dividend Aristocrats For 2024

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.