Updated on October 17th, 2024 by Aristofanis Papadatos

Investors who seek stable and dependable cash flow may find it advantageous to invest in companies that offer monthly dividend payments. These companies provide a more frequent and consistent source of income as opposed to those that distribute dividends quarterly or annually.

Opting for such companies allows investors to maintain a steady stream of income that caters to their financial requirements on a regular basis.

We have identified a total of 76 companies that currently offer a monthly dividend payment. While the number may be modest, it is significant enough to allow you to peruse and select the ones that align with your investment preferences.

You can see all 76 monthly dividend-paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

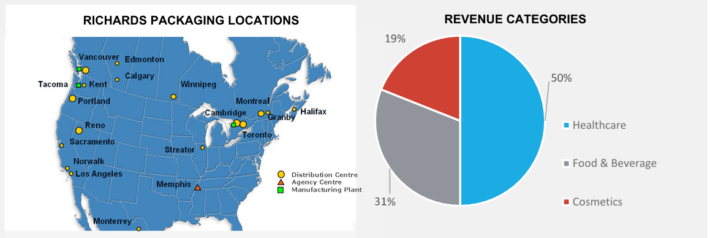

Richards Packaging Income Fund (RPKIF) is a Canadian trust that specializes in packaging containers and associated components.

The stock is currently offering a dividend yield of 4.4%, which, while not tremendous, is still more than triple the 1.2% yield of the S&P 500 Index.

Given that Richards Packaging’s distributions are paid on a monthly basis and the trust has maintained or raised its distributions for the past 14 years, the stock appears rather appealing for distribution growth investors who seek a regular stream of dependable payments.

Business Overview

Richards Packaging Income Fund, established on February 26, 2004, as a limited-purpose, open-ended trust, is committed to investing in distribution enterprises across North America.

Through its subsidiaries, each of which specializes in a different area, the trust caters to a vast clientele of over 17,000 regional businesses, including those in the food, beverage, cosmetics, and healthcare industries.

Its primary revenue stream comes from the distribution of over 8,000 diverse types of packaging containers and healthcare supplies and products sourced from a network of more than 900 suppliers, as well as their three specialized manufacturing facilities.

Source: Annual Report

Amidst the COVID-19 pandemic, the trust experienced a significant boost, as the surge in e-commerce orders due to lockdowns and other restrictions resulted in a spike in demand for containers and healthcare supplies. Thus, revenues in fiscal 2020 soared by 46% to C$489.2 million, compared to C$334.2 million in fiscal 2019.

Since then, the trust’s subsidiaries have managed to bolster their market position, retaining an elevated revenue base. Nevertheless, there are indications of a reversal in the impact of the pandemic, as evidenced in the trust’s results.

In fiscal 2023, the trust’s revenue was down 4.7% due mainly to a 21.4% drop in food and beverage reflecting a shifting demand and overstocked market, and 4.7% lower sales of pumps and sprayers due to an oversupplied market. These effects were partly offset by 6.6% growth in healthcare.

Operating income decreased 3%, from US$42.5 to US$42.1 million, and earnings per share dipped 3%, from $2.43 to $2.35.

A 3% decrease in the bottom line is not dramatic but investors should note that the earnings per share of Richards Packaging in 2023 were 33% lower than the 10-year high earnings per share of $3.51, which the company posted in 2020. The performance of the trust in the first half of this year has stabilized and hence we expect essentially flat earnings per share this year.

Growth Prospects

Richards Packaging Income Fund’s growth is being powered by the trust’s underlying businesses, as well as accretive acquisitions or dispositions of its assets.

In 2020, for instance, the trust acquired Clarion Medical Technologies, a leading Canadian provider of medical, aesthetic, vision care, and surgical equipment and consumables. In late 2022, Richards Canada sold the Rexplas manufacturing facility to a strategic supplier who will continue to produce bottles for the trusts’ needs.

Over the years, the trust has managed to grow steadily following this strategy. More precisely, over the last nine years, the trust’s revenues have grown at a compound annual growth rate (CAGR) of 6.4%.

Dividend per unit (DPU) has grown at a slower pace, partly due to a depreciation of the exchange rate between CAD and USD. DPU has grown at a CAGR of 3.2% over the last nine years.

Management outlined its focus for 2024, stating that the primary goal is to sustain the growth of core revenues within the range of 2% to 5%, provided that the economy does not face a recession.

Management also affirmed that acquisitions would continue to play a significant role in the trust’s strategic direction. However, organic growth is expected to slow down compared to past levels due to the likelihood of reduced demand for the trust’s packaged products during an economic downturn.

Dividend Analysis

Richards Packaging Income Fund has paid monthly distributions since its inception. Payouts were temporarily suspended during the Great Financial Crisis and were then resumed at a lower rate.

On the bright side, since then, the trust has either kept the monthly distribution stable or has grown it.

With the trust paying a constant distribution for six consecutive years, DCFU’s growth has outperformed that of DPU over the past decade. Specifically, the trust’s DPU has grown at a 10-year CAGR of 3% compared to DCFU’s equivalent rate of 9%.

As a result, the trust’s payout ratio has improved notably during this period. It was 62% in 2012 and 40% in 2023. Therefore, we believe the trust is to turn more favorable toward resuming distribution growth moving forward. This is also signaled by the fact that the trust has started paying special distributions to pay out its earnings surplus.

In March 2022, March 2023 and March 2024, special distributions of US$0.539, US$0.275 and US$0.266 were paid, respectively.

At its current annualized rate of C$1.32 ($0.98), the trust yields roughly 4.4%. It used to yield up to 11% in previous years, but the yield has slowly declined following the stock’s gradual gains against a rather stagnated distribution.

Final Thoughts

Richards Packaging Income Fund has displayed decent growth over the years, with accretive acquisitions, smart dispositions, and the organic expansion of its underlying businesses, contributing to satisfactory DCFU growth.

The trust’s current yield may not be sufficient to meet the needs of some investors seeking substantial income. That said, its prospects for significant distribution hikes and special distributions are promising, given the consistent improvement in the payout ratio of the stock.

Assuming stable DCFU in fiscal 2024 following management’s conservative outlook, the stock is currently trading at a P/DCFU of about 9.3. The multiple reflects investors’ expectations for below-average growth in the near term, but it can also signal a buying opportunity, if growth picks up steam in the medium term.

In any case, we believe that the trust’s base monthly distribution is very safe, and the stock is likely to cater to investors who seek regular distributions with the potential for growth.

In any case, we believe that the trust’s base monthly distribution is very safe, and the stock is likely to cater to investors who seek regular distributions with the potential for growth.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more