Updated on April 10th, 2025 by Nathan Parsh

Real Estate Investment Trusts – or REITs, for short – can be a fantastic source of yield, safety, and growth for dividend investors. For example, Choice Properties Real Estate Investment Trust (PPRQF) has a 5.4% dividend yield.

Choice Properties also pays its dividends monthly, which is rare in a world where the vast majority of dividend stocks make quarterly payouts.

We currently cover only 76 monthly dividend stocks. You can see our full list of monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Choice Properties’ high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though its dividend payment has been largely stagnant in recent years.

This article will analyze the investment prospects of Choice Properties.

Business Overview

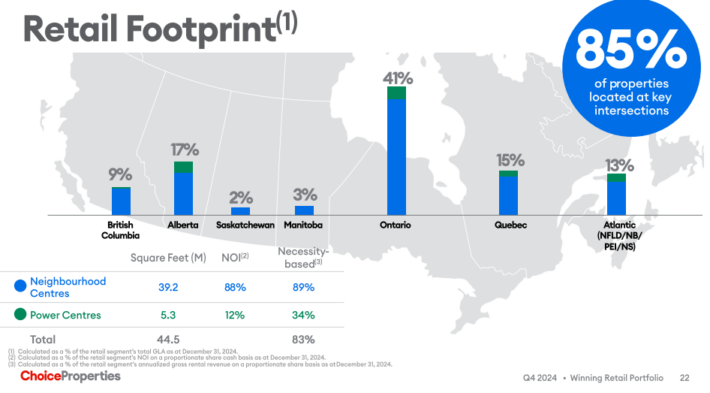

Choice Properties is a Canadian REIT with concentrated operations in many of Canada’s largest markets. Given its size and scale and the fact that its operations are solely focused in Canada, it is one of Canada’s premier REITs. The trust has bet big on Canada’s real estate market, and thus far, the strategy has worked.

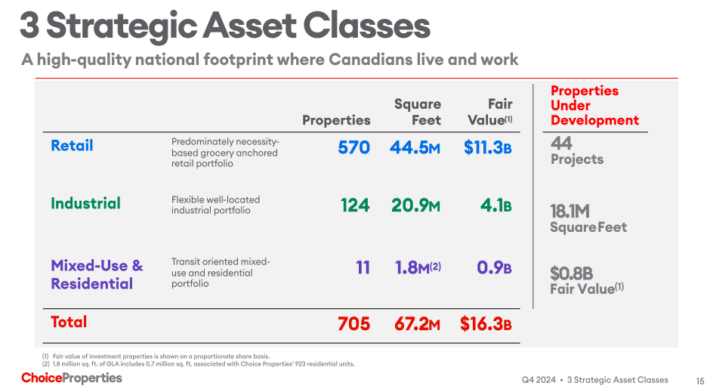

The company has a high-quality real estate portfolio of over 700 properties, which make up more than 67 million square feet of gross leasable area (GLA).

Source: Investor Presentation

Properties include retail, industrial, office, multi-family, and development assets. Over 500 of Choice Properties’ investments are to their largest tenant, Canada’s largest retailer, Loblaw.

From an investment perspective, Choice Properties has some interesting characteristics, not the least of which is its yield. However, it also has an unusual dependency on one tenant, a lack of diversification that we find somewhat troubling.

While grocery stores are generally quite stable, this level of concentration on what amounts to one tenant is very rare. This lack of diversification is a significant consideration for investors that are looking at Choice Properties.

While it would be preferable for the company to diversify to fix its concentration, that is a slow process. In addition, since the tenant is so dependent upon is generally stable, we don’t necessarily see a huge risk due to the industry struggling. However, this sort of concentration on one tenant is extremely unusual for a REIT, and it is worth noting.

Growth Prospects

Choice Properties has struggled with growth since it came public in 2013. Since 2015, the trust has compounded adjusted funds-from-operations per share at a rate of just 2.6% per year.

The trust has grown steadily in terms of portfolio size and revenue, but relatively high operating costs and dilution from share issuances have kept a lid on shareholder returns. History has shown Choice Properties can exhibit strong growth characteristics on a dollar basis, but investors have been left wanting once translated to a per-share basis.

Source: Investor Presentation

Dividend Analysis

In addition to its growth woes, Choice Properties’ dividend appears to be shaky for the time being. The expected dividend payout ratio for 2025 is 79%.

While even that payout ratio is high, it is also true that REITs generally distribute close to all of their income, so it is hardly unusual that Choice’s payout ratio is close to 80%. Choice Properties’ current distribution gives the stock a 5.4% yield, which is an attractive dividend yield.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

Investors should not expect Choice Properties to be a dividend growth stock, as the distribution has remained relatively flat since May 2017. With the payout ratio as high as it is, and FFO-per-share growth muted, investors should not expect the payout to see a massive raise anytime soon.

Choice Properties has also not cut the distribution, and we don’t see an imminent threat of that right now. But it is worth mentioning that if FFO-per-share deteriorates significantly going forward, the trust will likely have to cut the distribution due to its high payout ratio.

This is particularly true because we see Choice Properties’ borrowing capacity as limited, given its already high leverage. Choice Properties has a debt-to-equity ratio of almost 1.4, which, according to the company, is below that of its industry peers.

In addition, it has large amounts of debt coming due in stages in the coming years, so we see the trust’s debt financing as near capacity today. Choice has steady debt maturities in the coming years, and while they are spread out, the amounts are significant. Choice has no ability to pay these off as they mature, so refinancing appears to be the only viable option.

Should it experience a downturn in earnings, Choice Properties would have to turn to more dilution for additional capital. While we don’t see a dividend cut in the near future, the combination of a lack of adjusted FFO-per-share growth, the high payout ratio, and a high level of debt appears risky.

Final Thoughts

Choice Properties is a high dividend stock and its monthly dividend payments make it stand out to income investors. However, a number of factors make us cautious about Choice Properties today, such as its lack of diversification within its property portfolio and its alarmingly high level of debt.

We view the stock with a somewhat risky dividend as unattractive for risk-averse income investors. Investors looking for a REIT that pays monthly dividends have better choices with more favorable growth prospects, higher yields, and safer dividends.

Don’t miss the resources below for more monthly dividend stock investing research.

- The Monthly Dividend Stocks List

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more