Updated on October 9th, 2024 by Aristofanis Papadatos

Pine Cliff Energy (PIFYF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 6.0% dividend yield.

Related: List of 5%+ yielding stocks

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Pine Cliff Energy’s combination of a high dividend yield and a monthly dividend make it appealing to individual investors.

But there’s more to the company than just these factors. Keep reading this article to learn more about Pine Cliff Energy.

Business Overview

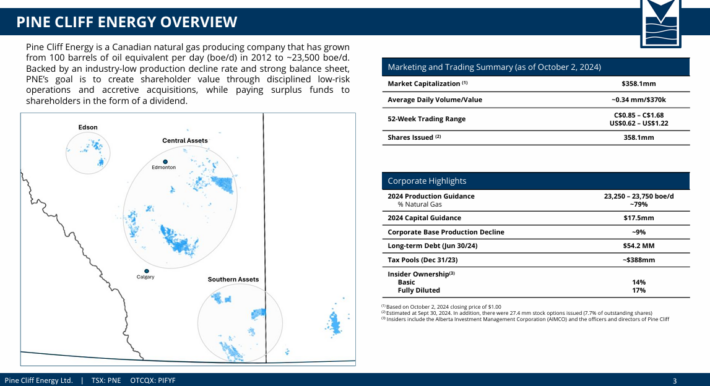

Pine Cliff Energy engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in the Western Canadian Sedimentary Basin.

The company primarily holds interest in oil and gas properties in the Southern Alberta, Southern Saskatchewan, and Edson areas, as well as in the Viking and Ghost Pine area of Central Alberta. The company was formed in 2004 and is headquartered in Calgary, Canada.

Pine Cliff Energy produces oil and gas at a ratio of 21/79 and hence it should be considered primarily a natural gas producer. As a gas producer, Pine Cliff Energy is highly cyclical due to the dramatic swings of the price of natural gas. Notably, the company has reported losses in 7 of the last 10 years and initiated a dividend only in 2022.

On the other hand, Pine Cliff Energy claims that it has some advantages when compared to the well-known oil and gas producers.

First, the company claims that it has a decent balance sheet (more on this later), which is paramount in the oil and gas industry, as this industry is characterized by fierce downturns every few years.

Source: Investor Presentation

In addition, the management team of Pine Cliff Energy owns 14% of the company and hence it is aligned with the shareholders. This is an important characteristic, which should not be undermined by investors.

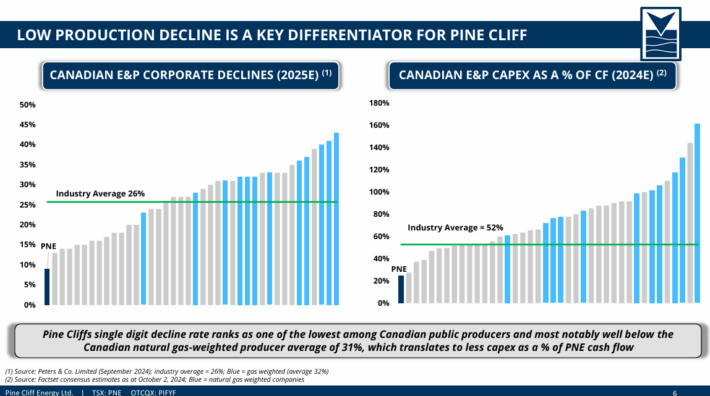

Moreover, Pine Cliff Energy has the lowest natural production decline rate among all Canadian public producers. This reduces the amount of capital expenses required to sustain a given level of production.

Just like almost all the oil and gas producers, Pine Cliff Energy incurred losses in 2020 due to the collapse of the prices of oil and gas caused by the coronavirus crisis.

However, thanks to the massive distribution of vaccines worldwide, global demand for oil and gas recovered in 2021 and thus the company became profitable in that year.

Even better for Pine Cliff Energy, the Ukrainian crisis triggered a rally of the prices of oil and gas to 13-year highs in 2022. As a result, the company posted 10-year high earnings per share of $0.22 in that year. It also initiated a dividend in June of 2022, after more than a decade without a dividend.

However, the price of natural gas has slumped since early last year due to abnormally warm winter weather for two consecutive years. This has resulted in exceptionally high gas inventories in North America.

As a result, Pine Cliff Energy saw its earnings per share collapse last year, from $0.22 to $0.02. The company has also posted a marginal loss per share of -$0.02 in the first half of this year.

Growth Prospects

As mentioned above, Pine Cliff Energy has the lowest natural production decline rate among all Canadian public producers.

Source: Investor Presentation

The natural decline of the producing wells is paramount in the oil and gas industry, as high decline rates result in excessive capital expenses required to sustain a given level of production. It is thus evident that Pine Cliff Energy has a significant competitive advantage when compared to its peers.

On the other hand, as an oil and gas producer, Pine Cliff Energy is highly sensitive to the inevitable cycles of the prices of oil and gas. More precisely, as the company produces 79% gas and 21% oil, it is especially sensitive to the cycles of the price of natural gas.

Thanks to the rally of the prices of oil and gas to 13-year highs in 2022, Pine Cliff Energy posted 10-year high earnings per share in 2022. However, both prices have plunged off their highs in 2022. As a result, the company is likely to post much lower earnings per share this year.

Given the highly cyclical nature of the oil and gas industry but also our expectations for slightly higher gas prices in the upcoming years, we expect the earnings per share of Pine Cliff Energy to grow by about 5.0% per year on average over the next five years, from $0.05 in 2024 to $0.06 in 2029.

Dividend & Valuation Analysis

Pine Cliff Energy is currently offering an above average dividend yield of 6.0%. It is thus an interesting candidate for income-oriented investors, but those investors should be aware that the dividend is far from safe due to the dramatic cycles of the prices of oil and gas.

Pine Cliff Energy has a forward payout ratio of 80%, which is especially high, particularly for the energy sector. The company also has a decent but somewhat leveraged balance sheet, with net debt of $249 million. As this amount is 94% of the market capitalization of the stock, it is manageable under normal business conditions.

However, the balance sheet has weakened during the last 12 months. We also note that the current assets ($25.2 million) have become lower than the current liabilities ($50.3 million), which are due within the next 12 months.

Overall, the balance sheet has weakened in recent quarters and thus the company will be vulnerable whenever the next downturn of the energy sector shows up.

Moreover, it is critical to note that Pine Cliff Energy initiated a dividend only in 2022, amid multi-year high commodity prices. It failed to offer a dividend in the preceding years, as it incurred material losses in most of those years. Therefore, it is evident that the dividend of the company is far from safe.

In reference to the valuation, Pine Cliff Energy is currently trading for 14.6 times its expected earnings per share this year. Given the high cyclicality of the company, we assume a fair price-to-earnings ratio of 10.0 for the stock.

Therefore, the current earnings multiple is much higher than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will incur a -7.3% annualized drag in its returns.

Taking into account the 5.0% annual growth of earnings per share, the 6.0% current dividend yield and a -7.3% annualized contraction of valuation level, Pine Cliff Energy could offer just a 3.8% average annual total return over the next five years.

This is a low expected return, which results from the fact that we have passed the peak of the oil and gas industry. The stock is highly risky right now and hence investors should wait for the next downturn of the energy sector before evaluating the stock again.

Final Thoughts

Pine Cliff Energy is offering an exceptionally high dividend yield of 6.0%, which is five times as much as the 1.2% dividend yield of the S&P 500. As a result, the stock is likely to entice some income-oriented investors.

However, the company has a high payout ratio of 80% and a weakening balance sheet. In addition, it has proved highly vulnerable to the cycles of the prices of oil and gas.

As these prices seem to have peaked in this cycle, the stock is highly risky right now. Therefore, investors should wait for a much lower entry point.

Moreover, Pine Cliff Energy is characterized by extremely low trading volume. This means that it is hard to establish or sell a large position in this stock.

Additional Reading

Don’t miss the resources below for more monthly dividend stock investing research.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more