Updated on August 27th, 2024 by Bob Ciura

Business Development Companies – or BDCs, for short – can be a great source of current yield for income investors.

Main Street Capital Corporation (MAIN) is a great example of this. MAIN stock has a current dividend yield of 6.0%.

Better yet, Main Street Capital stock pays monthly dividends.

You can download our full Excel spreadsheet of all ~80 monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The stock’s high dividend yield and monthly payments make it a solid choice for income investors.

Main Street Capital’s business appears to be performing well. This article will discuss the investment prospects of Main Street Capital Corporation in detail.

Business Overview

Main Street Capital Corporation is a Business Development Company, or BDC. You can see our full BDC list here.

The company operates as a debt and equity investor for lower middle market companies (those with $10-$150 million of annual revenues) seeking to transform their capital structures.

BDCs have the ability to invest in both debt and equity, which give them an advantage over companies who invest in private debt or private equity alone.

Main Street Capital Corporation also invests in the private debt of middle-market companies (not lower middle-market companies) and has a budding asset management advisory business.

Source: Investor Presentation

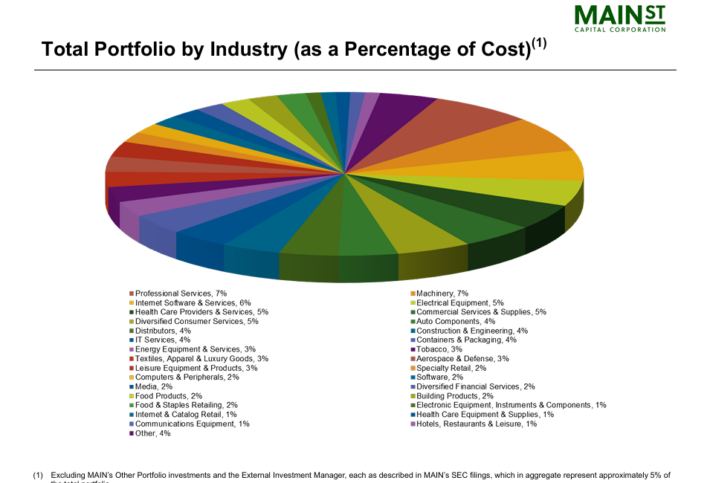

Holdings are highly diversified by both transaction type and geography. By transaction type, the BDC acquires most of its deals via recapitalization and leveraged buyouts.

Main Street Capital Corporation also has a very high degree of diversification by industry.

At the end of Q2 2024, Main Street had an interest in 83 lower middle market companies (valued at $2.4 billion), 19 middle market companies ($184 million) and 92 private loan investments ($1.7 billion).

Growth Prospects

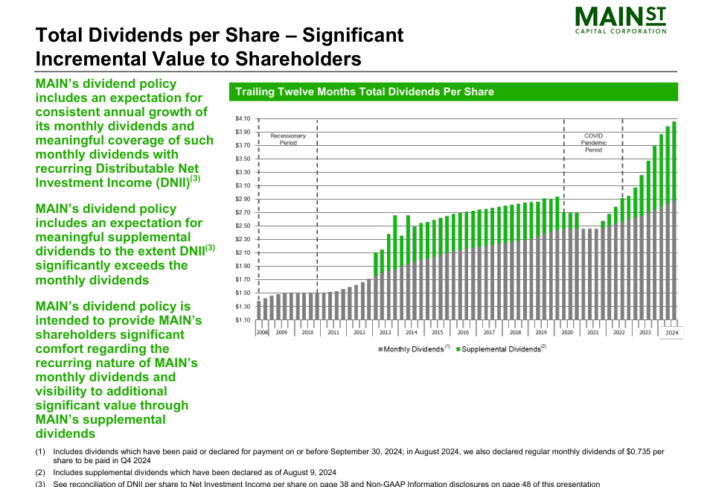

Main Street Capital Corporation’s growth prospects come from its unique strategy of driving investment returns. In turn, the BDC sustains its high monthly dividend payout, and grows it over time.

On May 7th, 2024, Main Street Capital announced a 2.1% dividend increase, to $0.245 per share paid monthly. The current annualized dividend payout is $2.94 per share.

On August 8th, 2024, Main Street Capital reported second quarter 2024 results. Net investment income of $87.3 million increased 2%, compared to $85.7 million in Q2 2023. Net investment income per share of $1.01, declined 5% year-over-year.

Distributable net investment income per share totaled $1.07, down 4% from $1.12 in Q2 2023. Main Street’s net asset value ended the quarter at $29.80, a 2.1% increase from the end of last year.

Main Street has put together a solid record in the past decade, with a nine-year and five-year net investment income per share CAGR of 7.3% and 9.8%, respectively.

We expect MAIN to grow its net investment income per share by 1% per year over the next five years.

Dividend Analysis

MAIN pays a monthly dividend. The company has also paid substantial supplemental dividends on various occasions. The most recent example was a supplemental payout of $0.30 per share that was declared on August 6th, 2024.

These are one-time special dividends, but we expect the company to continue this tradition of special dividends when distributable NII per share significantly exceeds its monthly dividend payouts.

The supplemental dividends have been a result of generating realized gains from Main Street’s equity investments.

Source: Investor Presentation

The dividend appears secure. For example, based on NII-per-share the company easily covered its dividend over the past two years.

For 2024, we expect MAIN to generate NII-per-share of $4.13. With a forward annualized dividend payout of $2.94 per share, MAIN has an expected dividend payout ratio of approximately 71% for 2024.

Its regular dividend growth alongside occasional special dividends also imply that its dividend is in good shape.

In order to avoid corporate income tax as a BDC, Main Street must distribute at least 90% of its taxable income, leaving little wiggle room to fund growth.

While this strategy has worked extremely well since the last recession, we do caution that this method of funding becomes substantially less attractive (and more expensive) in weaker economic periods.

The main threat to the dividend is if the economy goes into recession, forcing many borrowers to default and interest rates on its floating rate loans to plummet.

As a result, earnings per share would likely decline rapidly, forcing the company to right-size its dividend. For now, however, the dividend appears to be safe.

Final Thoughts

Although Main Street Capital Corporation is off-the-radar for most dividend growth investors, this BDC has a strong history of delivering substantial shareholder returns.

The firm’s strong track record of superior investment management and expertise in the lower middle market segment gives it a strong competitive advantage in the private equity and debt industry.

Further, Main Street Capital Corporation is shareholder-friendly BDC with a high yield and monthly payouts.

Further Reading: 20 Highest-Yielding BDCs

Don’t miss the resources below for more monthly dividend stock investing research.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more