Published on October 16th, 2024 by Aristofanis Papadatos

Freehold Royalties (FRHLF) has two appealing investment characteristics:

#1: It is a high-yield stock based on its 7.7% dividend yield.

Related: List of 5%+ yielding stocks.

#2: It pays dividends monthly instead of quarterly.

Related: List of monthly dividend stocks

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

The combination of a high dividend yield and a monthly dividend render Freehold Royalties appealing to income-oriented investors. In addition, the company is ideally positioned to benefit from high production growth in exceptionally rich resource areas in North America. In this article, we will discuss the prospects of Freehold Royalties.

Business Overview

Freehold Royalties is focused on acquiring and managing royalty interest in crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States. The company was founded in 1996 and is headquartered in Calgary, Canada.

Freehold Royalties aims to deliver growth and attractive risk-adjusted returns to its shareholders by acquiring high-quality assets with acceptable risk profiles and long economic life. It then tries to generate highly profitable lease out programs for the development of its properties.

Freehold Royalties generates approximately 93% of its revenues from oil and natural gas liquids and the remaining 7% from natural gas.

Source: Investor Presentation

Moreover, the company generates 55% of its revenue from its properties in Canada and the remaining 45% of its revenues from its properties in the U.S.

As an oil and gas royalty company, it is only natural that Freehold Royalties has exhibited a highly volatile performance record. The royalties that its new customers are willing to pay are greatly affected by the prevailing conditions in the oil and gas market and the underlying prices of oil and gas.

In addition, the oil and gas production of its existing customers significantly varies from year to year, as it is dependent on the prevailing prices of oil and gas. It is thus not surprising that Freehold Royalties has posted losses in 3 of the last 10 years.

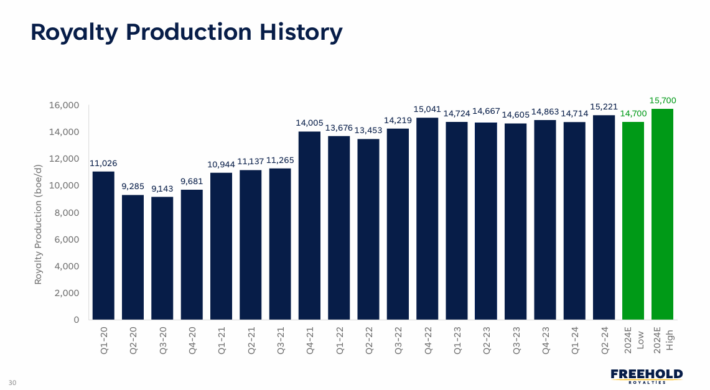

On the other hand, Freehold Royalties greatly benefits from the ample reserves of oil and gas in the areas in which the company is present. The company has grown its production by an impressive 38% since the beginning of 2020, from 11,026 barrels per day to a new all-time high of about 15,200 barrels per day this year.

Source: Investor Presentation

This admirable performance is in sharp contrast to that of most oil majors, which are struggling to grow their production organically.

Just like most oil and gas producers, Freehold Royalties incurred losses (-$0.09 per share) in 2020 due to the plunge of the prices of oil and natural gas caused by the pandemic. However, thanks to the massive distribution of vaccines worldwide, the global consumption of oil and gas recovered in 2021 and thus the company returned to high profitability in that year.

In early 2022, the onset of the war in Ukraine rendered the global oil and gas markets extremely tight. As a result, the prices of oil and natural gas rallied to 13-year highs in 2022. That rally created an exceptionally favorable business environment for Freehold Royalties, which thus posted 10-year high earnings per share of $1.03 in that year.

However, the global oil and gas markets have absorbed the impact of the Ukrainian crisis since early last year. The price of natural gas has remained depressed since last year due to abnormally warm winter weather for two consecutive years. The price of oil has corrected almost 50% off its peak in 2022, as Russia has found alternative ways to direct its barrels amid the sanctions of western countries. As a result, Freehold Royalties saw its earnings per share decline 36% last year, from $1.03 to $0.66.

The company has posted somewhat higher earnings this year, as it has reported earnings per share of $0.36 in the first half of this year. Nevertheless, the consumption of oil of China has somewhat weakened while some OPEC members have begun to disapprove of the strict production quotas of the cartel. As a result, the outlook is uncertain for Freehold Royalties.

Growth Prospects

Freehold Royalties currently enjoys decent business momentum. The company has grown its production by 38% over the last four years, to a new record level.

Such a high production growth rate is extremely rare in the oil and gas industry. To provide a perspective, most oil majors, such as Shell (SHEL) and BP (BP), have failed to grow their output over the last several years. This is a key difference between Freehold Royalties and most oil and gas producers.

On the other hand, Freehold Royalties is inevitably sensitive to the cycles of the oil and gas industry. This is clearly reflected in the volatile performance record of the company. During the last decade, Freehold Royalties has failed to grow its earnings per share. In addition, the company has posted losses in 3 of the last 10 years and has posted negligible profits in 3 of the last 10 years.

Freehold Royalties currently enjoys decent business momentum, not only thanks to its high production growth, but also thanks to the deep production cuts implemented by OPEC in an effort of the cartel to support the price of oil. The price of natural gas has remained depressed this year, primarily due to an abnormally warm winter, but the price of oil has remained above average. As a result, Freehold Royalties is likely to post above average profits this year.

Given the decent business momentum but also the cyclical nature of the business of Freehold Royalties, we expect approximately flat earnings per share in five years from now.

Dividend & Valuation Analysis

Freehold Royalties is currently offering an exceptionally high dividend yield of 7.7%, which is more than six times as much as the 1.2% yield of the S&P 500. The stock is thus an interesting candidate for income-oriented investors but the latter should be aware that the dividend is not safe due to the cyclical nature of the oil and gas industry.

Freehold Royalties is paying a generous dividend but its earnings have decreased significantly vs. the 10-year high earnings per share of $1.03 in 2022. As a result, the payout ratio has risen from 68% in 2022 to 109% now. Such a payout ratio is unsustainable over the long run.

Fortunately, the company has a rock-solid balance sheet. It pays negligible interest expense and its net debt is only $174 million, which is just 9% of the market capitalization of the stock. Overall, Freehold Royalties has one of the strongest balance sheets in the energy sector.

Management should be praised for the pristine balance sheet, which is paramount in the energy sector given the dramatic cycles of the sector. On the other hand, due to the inevitable swings of the prices of oil and gas, the dividend of Freehold Royalties is far from safe. Notably, the company has cut its dividend in 3 of the last 10 years.

In addition, U.S. investors should be aware that the dividend received from this stock depends on the exchange rate between the Canadian dollar and the USD.

In reference to the valuation, Freehold Royalties is currently trading for 14.3 times its earnings per share in the last 12 months. We assume a fair price-to-earnings ratio of 10.0 for the stock. Therefore, the current earnings multiple is much higher than our assumed fair price-to-earnings ratio. If the stock trades at its fair valuation level in five years, it will incur a -6.9% annualized drag in its returns.

Taking into account the flat earnings per share, the 7.7% dividend yield and a -6.9% annualized contraction of valuation level, Freehold Royalties could offer just a 1.6% average annual total return over the next five years. This is a low expected total return and hence we recommend waiting for a significantly lower entry point in order to enhance the margin of safety and increase the expected return from this highly cyclical stock.

Final Thoughts

Freehold Royalties has much better prospects in growing its production and its reserves than most of its peers and is offering an above average dividend yield of 7.7%. The company also has a rock-solid balance sheet. As a result, it is likely to entice some income-oriented investors.

However, the company has exhibited a highly volatile performance record due to the cycles of its business and seems almost fully valued right now. Therefore, investors should wait for a much more attractive entry point.

Moreover, Freehold Royalties is characterized by low trading volume. This means that it may be hard to establish or sell a large position in this stock.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

- 3 Top ‘Hold Forever’ Monthly Dividend Stocks

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more