Updated on April 2nd, 2025 by Bob Ciura

Spreadsheet data updated daily

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually.

This research report focuses on all 76 individual monthly paying securities. It includes the following resources.

Resource #1: The Monthly Dividend Stock Spreadsheet List

This list contains important metrics, including: dividend yields, payout ratios, dividend growth rates, 52-week highs and lows, betas, and more.

Note: We strive to maintain an accurate list of all monthly dividend payers. There’s no universal source we are aware of for monthly dividend stocks; we curate this list manually. If you know of any stocks that pay monthly dividends that are not on our list, please email support@suredividend.com.

Resource #2: The Monthly Dividend Stocks In Focus Series

The Monthly Dividend Stocks In Focus series is where we analyze all monthly paying dividend stocks. This resource links to stand-alone analysis on each of these securities.

Resource #3: The 10 Best Monthly Dividend Stocks

This research report analyzes the 10 best monthly dividend stocks as ranked by expected total return.

Resource #4: Other Monthly Dividend Stock Research

– Monthly dividend stock performance

– Why monthly dividends matter

– The dangers of investing in monthly dividend stocks

– Final thoughts and other income investing resources

The Monthly Dividend Stocks In Focus Series

You can see detailed analysis on the individual monthly dividend securities we cover by clicking the links below:

- Agree Realty (ADC)

- AGNC Investment (AGNC)

- Atrium Mortgage Investment Corporation (AMIVF)

- Apple Hospitality REIT, Inc. (APLE)

- ARMOUR Residential REIT (ARR)

- Banco Bradesco S.A. (BBD)

- Diversified Royalty Corp. (BEVFF)

- Boston Pizza Royalties Income Fund (BPZZF)

- Bridgemarq Real Estate Services (BREUF)

- BSR Real Estate Investment Trust (BSRTF)

- Canadian Apartment Properties REIT (CDPYF)

- ChemTrade Logistics Income Fund (CGIFF)

- Choice Properties REIT (PPRQF)

- Cross Timbers Royalty Trust (CRT)

- CT Real Estate Investment Trust (CTRRF)

- SmartCentres Real Estate Investment Trust (CWYUF)

- Dream Office REIT (DRETF)

- Dream Industrial REIT (DREUF)

- Dynex Capital (DX)

- Ellington Residential Mortgage REIT (EARN)

- Ellington Financial (EFC)

- EPR Properties (EPR)

- Exchange Income (EIFZF)

- Extendicare Inc. (EXETF)

- Flagship Communities REIT (MHCUF)

- First National Financial Corporation (FNLIF)

- Freehold Royalties Ltd. (FRHLF)

- Firm Capital Property Trust (FRMUF)

- Fortitude Gold (FTCO)

- Gladstone Capital Corporation (GLAD)

- Gladstone Commercial Corporation (GOOD)

- Gladstone Investment Corporation (GAIN)

- Gladstone Land Corporation (LAND)

- Global Water Resources (GWRS)

- Granite Real Estate Investment Trust (GRP.U)

- Grupo Aval Acciones y Valores S.A. (AVAL)

- H&R Real Estate Investment Trust (HRUFF)

- Horizon Technology Finance (HRZN)

- Itaú Unibanco (ITUB)

- The Keg Royalties Income Fund (KRIUF)

- LTC Properties (LTC)

- Sienna Senior Living (LWSCF)

- Main Street Capital (MAIN)

- Modiv Inc. (MDV)

- Mullen Group Ltd. (MLLGF)

- Northland Power Inc. (NPIFF)

- NorthWest Healthcare Properties REIT (NWHUF)

- Orchid Island Capital (ORC)

- Oxford Square Capital (OXSQ)

- Permian Basin Royalty Trust (PBT)

- Phillips Edison & Company (PECO)

- Pennant Park Floating Rate (PFLT)

- Peyto Exploration & Development Corp. (PEYUF)

- Pine Cliff Energy Ltd. (PIFYF)

- Primaris REIT (PMREF)

- Paramount Resources Ltd. (PRMRF)

- PermRock Royalty Trust (PRT)

- Prospect Capital Corporation (PSEC)

- Permianville Royalty Trust (PVL)

- Pizza Pizza Royalty Corp. (PZRIF)

- Realty Income (O)

- RioCan Real Estate Investment Trust (RIOCF)

- Richards Packaging Income Fund (RPKIF)

- Sabine Royalty Trust (SBR)

- Stellus Capital Investment Corp. (SCM)

- Savaria Corp. (SISXF)

- San Juan Basin Royalty Trust (SJT)

- Sir Royalty Income Fund (SIRZF)

- SL Green Realty Corp. (SLG)

- Whitecap Resources Inc. (SPGYF)

- Slate Grocery REIT (SRRTF)

- Stag Industrial (STAG)

- Timbercreek Financial Corp. (TBCRF)

- Tamarack Valley Energy (TNEYF)

- U.S. Global Investors (GROW)

- Whitestone REIT (WSR)

The 10 Best Monthly Dividend Stocks

This research report examines the 10 monthly dividend stocks from our Sure Analysis Research Database with the highest 5-year forward expected total returns.

We currently cover almost all monthly dividend stocks every quarter in the Sure Analysis Research Database.

Use the table below to quickly jump to analysis on any of the top 10 best monthly dividend stocks as ranked by expected total returns.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- Monthly Dividend Stock #10: EPR Properties (EPR)

- Monthly Dividend Stock #9: LTC Properties (LTC)

- Monthly Dividend Stock #8: PennantPark Floating Rate Capital (PFLT)

- Monthly Dividend Stock #7: STAG Industrial (STAG)

- Monthly Dividend Stock #6: Ellington Financial (EFC)

- Monthly Dividend Stock #5: AGNC Investment Corporation (AGNC)

- Monthly Dividend Stock #4: Orchid Island Capital (ORC)

- Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

- Monthly Dividend Stock #2: Itau Unibanco (ITUB)

- Monthly Dividend Stock #1: Ellington Credit Co. (EARN)

Monthly Dividend Stock #10: EPR Properties (EPR)

- 5-Year Expected Total Return: 8.9%

- Dividend Yield: 6.8%

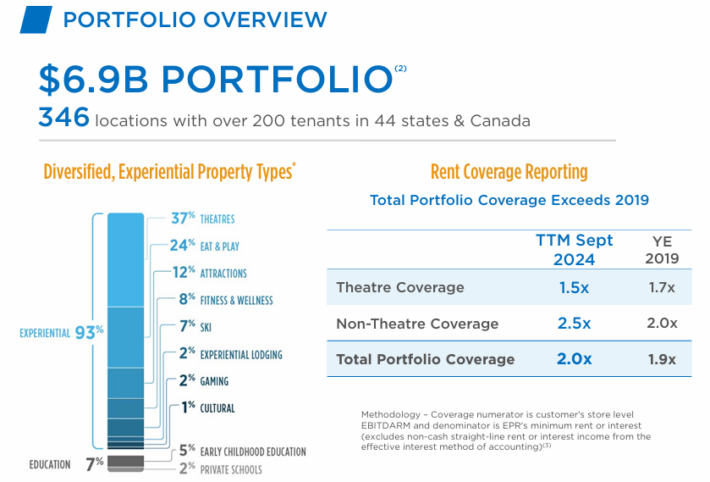

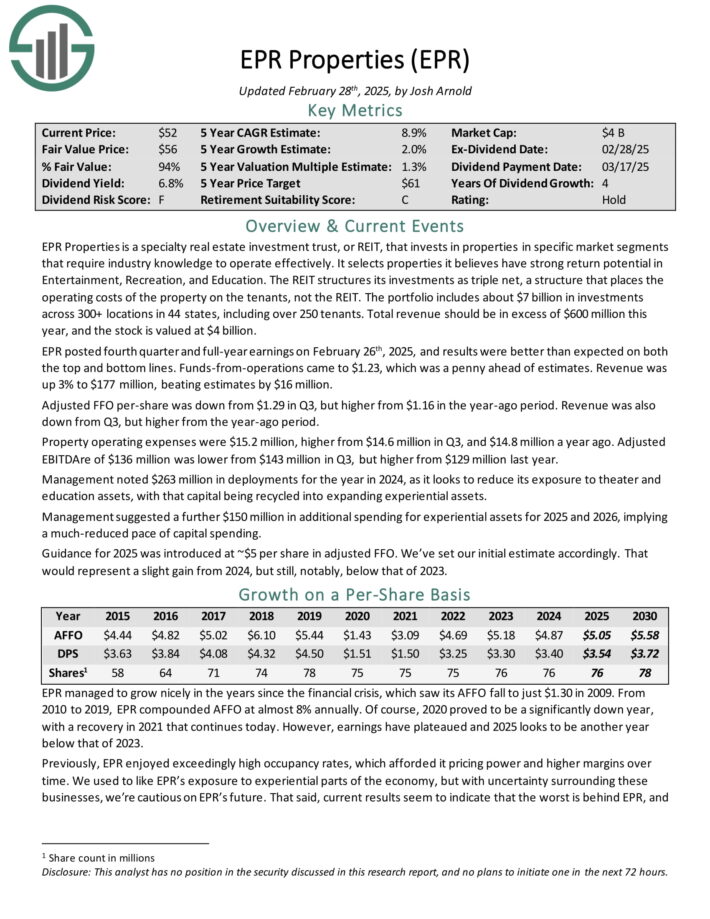

EPR Properties is a specialty real estate investment trust, or REIT, that invests in properties in specific market segments that require industry knowledge to operate effectively.

It selects properties it believes have strong return potential in Entertainment, Recreation, and Education. The portfolio includes about $7 billion in investments across 340+ locations in 44 states, including over 200 tenants.

Source: Investor Presentation

EPR posted fourth quarter and full-year earnings on February 26th, 2025, and results were better than expected on both the top and bottom lines.

Funds-from-operations came to $1.23, which was a penny ahead of estimates. Revenue was up 3% to $177 million, beating estimates by $16 million.

Adjusted FFO per-share was down from $1.29 in Q3, but higher from $1.16 in the year-ago period. Revenue was also down from Q3, but higher from the year-ago period.

Property operating expenses were $15.2 million, higher from $14.6 million in Q3, and $14.8 million a year ago. Adjusted EBITDAre of $136 million was lower from $143 million in Q3, but higher from $129 million last year.

Click here to download our most recent Sure Analysis report on EPR (preview of page 1 of 3 shown below):

Monthly Dividend Stock #9: LTC Properties (LTC)

- 5-Year Expected Total Return: 6.4%

- Dividend Yield: 8.9%

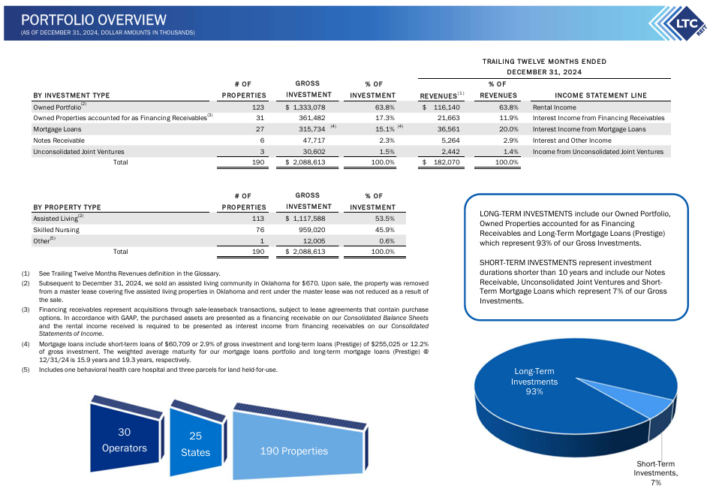

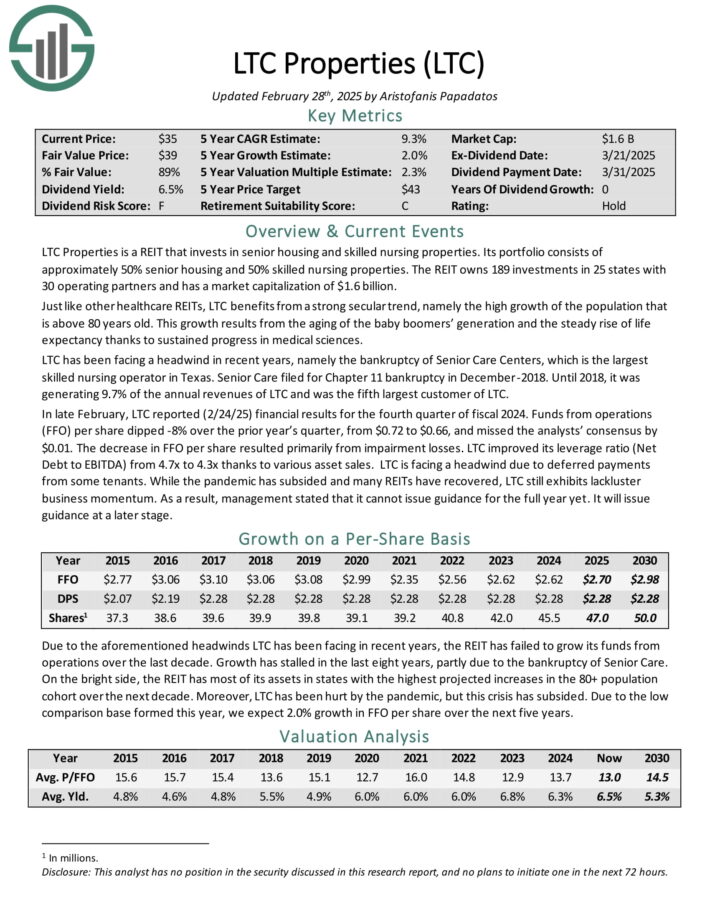

LTC Properties is a REIT that invests in senior housing and skilled nursing properties. Its portfolio consists of approximately 50% senior housing and 50% skilled nursing properties.

The REIT owns 194 investments in 26 states, with 31 operating partners.

Source: Investor Presentation

In late February, LTC reported (2/24/25) financial results for the fourth quarter of fiscal 2024. Funds from operations (FFO) per share dipped -8% over the prior year’s quarter, from $0.72 to $0.66, and missed the analysts’ consensus by $0.01.

The decrease in FFO per share resulted primarily from impairment losses. LTC improved its leverage ratio (Net Debt to EBITDA) from 4.7x to 4.3x thanks to various asset sales.

Click here to download our most recent Sure Analysis report on LTC (preview of page 1 of 3 shown below):

Monthly Dividend Stock #8: PennantPark Floating Rate Capital (PFLT)

- 5-Year Expected Total Return: 9.7%

- Dividend Yield: 11.1%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

PennantPark Floating Rate Capital (PFLT) reported its Q1 2025 results on February 11, 2025, highlighting stable financial performance and continued investment activity.

For the quarter ended December 31, the company posted GAAP net investment income of $0.37 per share and core net investment income of $0.33 per share.

PFLT’s portfolio grew 11% from the previous quarter to $2.2 billion, driven by $607 million in investments across 11 new and 58 existing portfolio companies at a weighted average yield of 10.3%.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

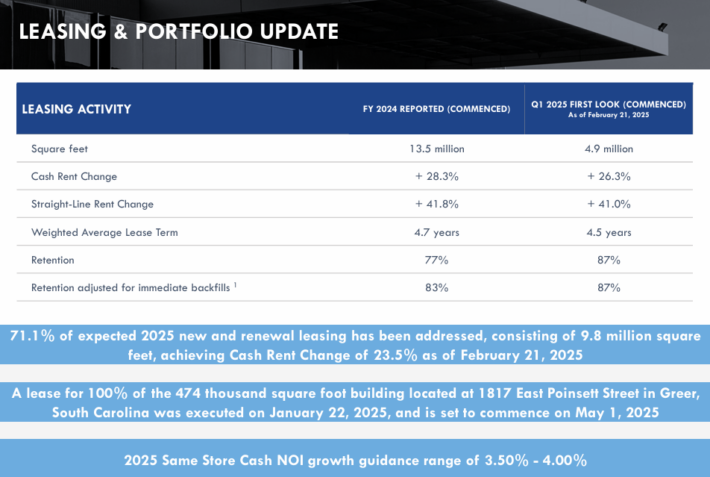

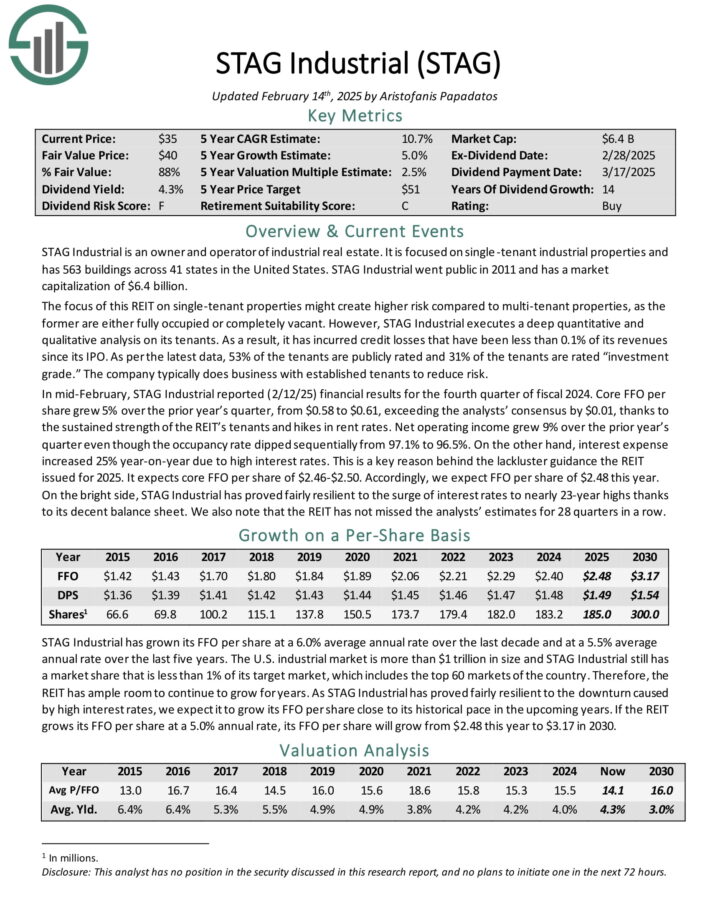

Monthly Dividend Stock #7: STAG Industrial (STAG)

- 5-Year Expected Total Return: 10.1%

- Dividend Yield: 4.1%

STAG Industrial is an owner and operator of industrial real estate. It is focused on single-tenant industrial properties and has ~560 buildings across 41 states in the United States.

The focus of this REIT on single-tenant properties might create higher risk compared to multi-tenant properties, as the former are either fully occupied or completely vacant.

Source: Investor Presentation

In mid-February, STAG Industrial reported (2/12/25) financial results for the fourth quarter of fiscal 2024. Core FFO-per-share grew 5% over the prior year’s quarter, from $0.58 to $0.61, exceeding the analysts’ consensus by $0.01, thanks to hikes in rent rates.

Net operating income grew 9% over the prior year’s quarter even though the occupancy rate dipped sequentially from 97.1% to 96.5%. On the other hand, interest expense increased 25% year-on-year due to high interest rates.

STAG expects core FFO per share of $2.46-$2.50 for 2025.

Click here to download our most recent Sure Analysis report on STAG Industrial Inc. (STAG) (preview of page 1 of 3 shown below):

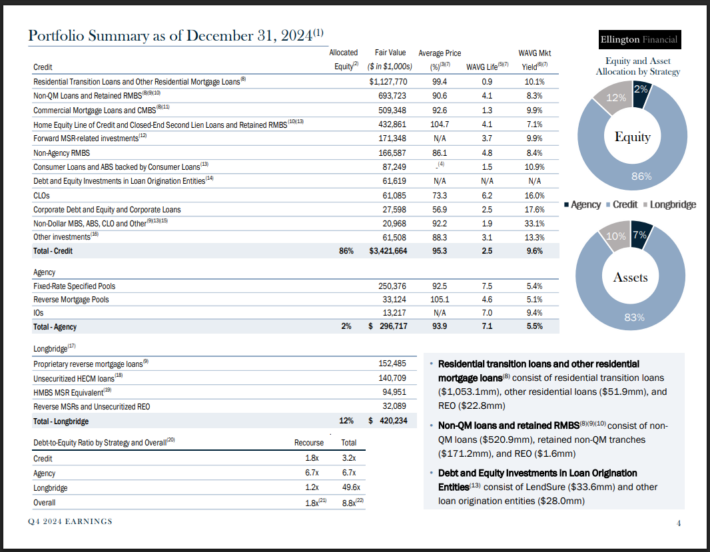

Monthly Dividend Stock #6: Ellington Financial (EFC)

- 5-Year Expected Total Return: 10.4%

- Dividend Yield: 11.8%

Ellington Financial Inc. acquires and manages mortgage, consumer, corporate, and other related financial assets in the United States.

The company acquires and manages residential mortgage–backed securities (RMBS) backed by prime jumbo, Alt–A, manufactured housing, and subprime residential mortgage loans.

Additionally, it manages RMBS, for which the U.S. government guarantees the principal and interest payments. It also provides collateralized loan obligations, mortgage–related and non–mortgage–related derivatives, equity investments in mortgage originators and other strategic investments.

You can see a snapshot of Ellington’s investment portfolio in the image below:

Source: Investor Presentation

On February 27th, 2025, Ellington Financial reported its Q4 results for the period ending December 31st, 2024. As with previous quarters, the company reported only income, not revenues. Gross interest income totaled $108.0 million, a notable increase from Q3, driven by higher contribution from Longbridge and expansion in several credit verticals.

Adjusted EPS (or “Adjusted Distributable Earnings per share”) came in at $0.45, up five cents sequentially. The increase was led by strong originations and securitization-related gains at Longbridge, which continues to be a major earnings engine.

The Agency strategy remained a drag on performance, reporting a net loss of $0.04 per share, as hedging gains couldn’t fully offset RMBS losses in the rising rate environment.

Click here to download our most recent Sure Analysis report on Ellington Financial (EFC) (preview of page 1 of 3 shown below):

Monthly Dividend Stock #5: AGNC Investment Corp. (AGNC)

- 5-Year Expected Total Return: 10.9%

- Dividend Yield: 15.1%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

In the fourth quarter of 2024, AGNC Investment Corp. reported a comprehensive loss per common share of $0.99, a reversal from the comprehensive income of $0.93 per share recorded in the previous quarter.

Despite this, the company achieved a positive economic return of 13.2% for the full year, driven by its consistent monthly dividend totaling $1.44 per common share.

The company’s net spread and dollar roll income, excluding catch-up premium amortization, was $0.65 per common share for the quarter, down from $0.67 per share in the prior quarter.

AGNC’s tangible net book value per common share stood at $9.08 as of December 31, 2024, reflecting a decrease from $9.84 at the end of the third quarter.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

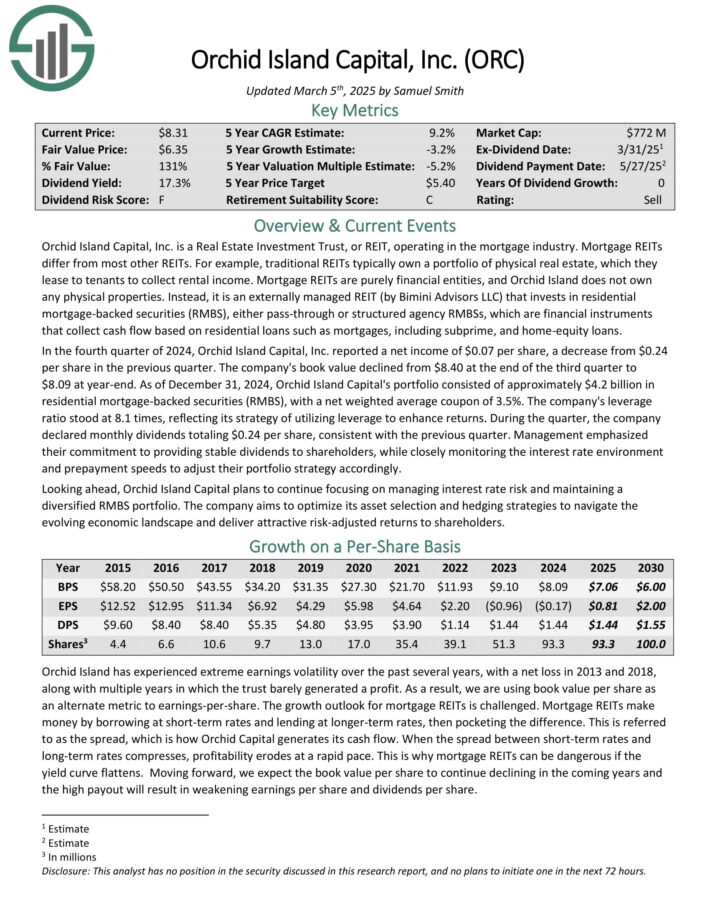

Monthly Dividend Stock #4: Orchid Island Capital (ORC)

- 5-Year Expected Total Return: 11.6%

- Dividend Yield: 19.3%

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

In the fourth quarter of 2024, Orchid Island Capital, Inc. reported a net income of $0.07 per share, a decrease from $0.24 per share in the previous quarter. The company’s book value declined from $8.40 at the end of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of approximately $4.2 billion in residential mortgage-backed securities (RMBS), with a net weighted average coupon of 3.5%. The company’s leverage ratio stood at 8.1 times, reflecting its strategy of utilizing leverage to enhance returns.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

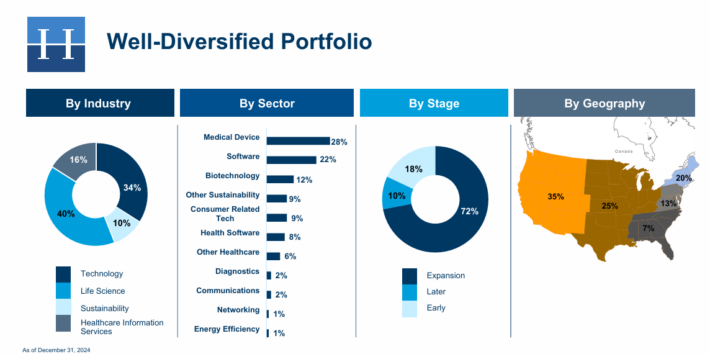

Monthly Dividend Stock #3: Horizon Technology Finance (HRZN)

- 5-Year Expected Total Return: 13.9%

- Dividend Yield: 12.6%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

Source: Investor Presentation

On March 4th, 2025, Horizon released its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, total investment income fell 16.7% year-over-year to $23.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q4 of 2024 and Q4 of 2023 was 14.9% and 16.8%, respectively.

Net investment income per share (IIS) fell to $0.27, down from $0.45 compared to Q4-2023. Net asset value (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

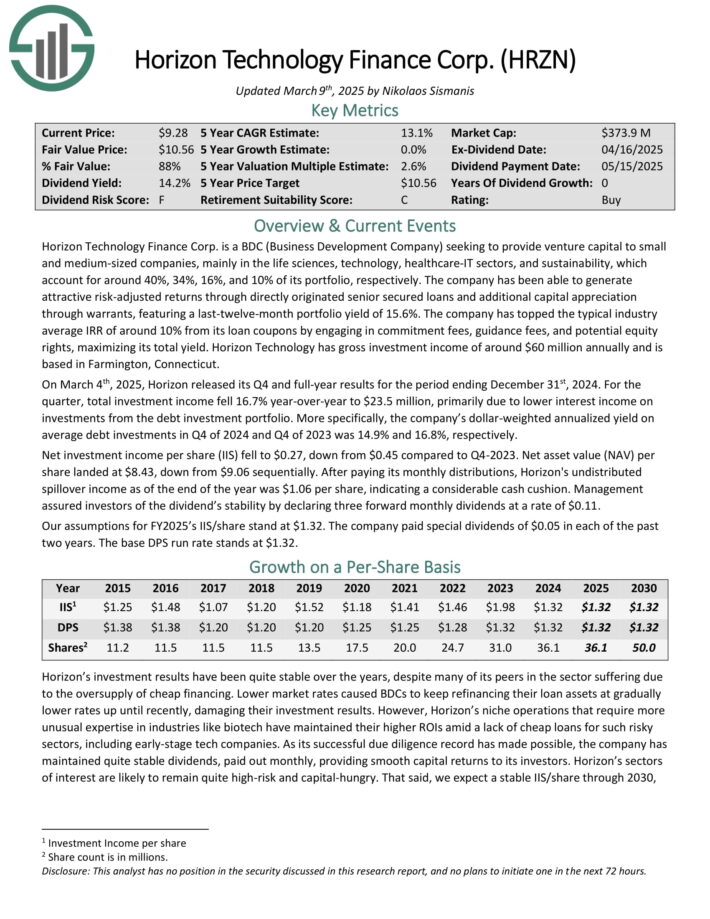

Monthly Dividend Stock #2: Itau Unibanco (ITUB)

- 5-Year Expected Total Return: 18.5%

- Dividend Yield: 9.0%

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

On February 6th, 2025, Itaú Unibanco reported fourth-quarter and full year results for 2024. The company reported recurring managerial result reached R$10.9 billion, up 2.0% from the previous quarter, with a 22.1% return on equity.

The loan portfolio grew 6.3% overall and 5.8% in Brazil, driven by mortgage (+5.6%), vehicle financing (+1.8%), and credit card loans (+6.8%).

Small and medium-sized business loans rose 8.1% due to foreign exchange effects and government backed financing. Corporate lending increased 6.8%.

Higher lending and an improved liabilities margin led to a 3.7% rise in the financial margin with clients, while credit costs rose 4.8%. Nonperforming loans over 90 days (NPL 90) improved to 2.4%, with similar gains in short-term delinquency rates.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

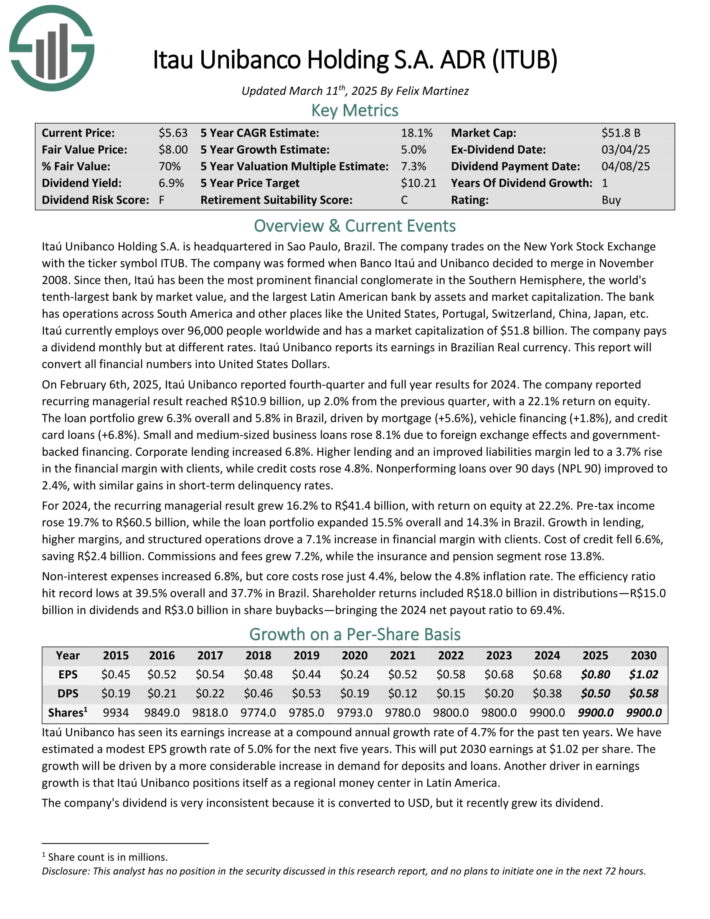

Monthly Dividend Stock #1: Ellington Credit Co. (EARN)

- 5-Year Expected Total Return: 17.4%

- Dividend Yield: 19.0%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On March 12th, 2025, Ellington Residential reported its fourth quarter results for the period ending December 31, 2024. The company generated a net loss of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million in the quarter, leading to adjusted earnings of $0.27 per share, which covered the dividend paid in the period.

Ellington’s net interest margin was 5.07% overall. At quarter end, Ellington had $31.8 million of cash and cash equivalents, and $79 million of other unencumbered assets.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

Other Monthly Dividend Stock Resources

Each separate monthly dividend stock has its own unique characteristics. The resources below will give you a better understanding of monthly dividend stock investing.

The following research reports will help you generate more monthly dividend stock investment ideas.

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Cheapest Monthly Dividend Stocks

- 10 Safest Monthly Dividend Stocks

Monthly Dividend Stock Performance

In March 2025, a basket of the monthly dividend stocks above generated negative returns of -0.58%. For comparison, the Russell 2000 ETF (IWM) generated negative returns of -6.8% for the month.

Notes: Data for performance is from Ycharts. Canadian company performance may be in the company’s home currency.

Monthly dividend stocks under-performed the Russell 2000 last month. We will update our performance section monthly to track future monthly dividend stock returns.

In February 2025, the 3 best-performing monthly dividend stocks (including dividends) were:

- Cross Timbers Royalty Trust (CRT), up 21.9%

- Peyto Exploration & Development (PEYUF) , up 15.9%

- Bank Bradesco (BBD), up 14.5%

The 3 worst-performing monthly dividend stocks (including dividends) in the month were:

- Ellington Credit Co. (EARN), down 15.2%

- Pine Cliff Energy Ltd. (PIFYF), down 13.7%

- Apple Hospitality REIT (APLE), down 12.3%

Why Monthly Dividends Matter

Monthly dividend payments are beneficial for one group of investors in particular; retirees who rely on dividend stocks for income.

With that said, monthly dividend stocks are better under all circumstances (everything else being equal), because they allow for returns to be compounded on a more frequent basis. More frequent compounding results in better total returns, particularly over long periods of time.

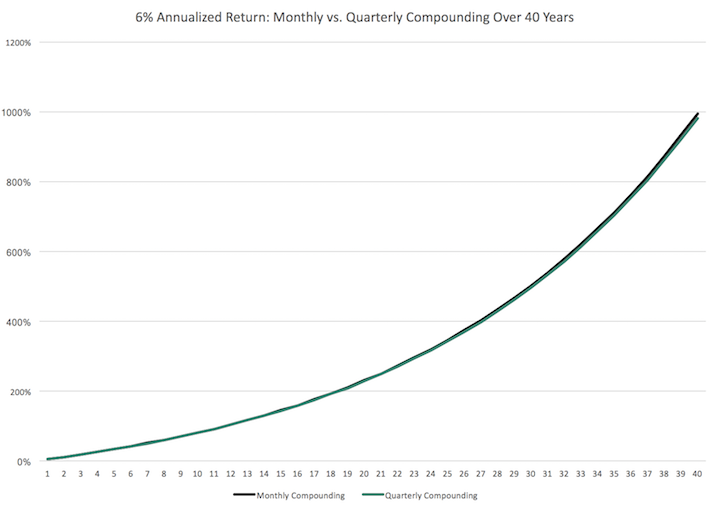

Consider the following performance comparison:

Over the long run, monthly compounding generates slightly higher returns over quarterly compounding. Every little bit helps.

With that said, it might not be practical to manually re-invest dividend payments on a monthly basis. It is more feasible to combine monthly dividend stocks with a dividend reinvestment plan to dollar cost average into your favorite dividend stocks.

The last benefit of monthly dividend stocks is that they allow investors to have – on average – more cash on hand to make opportunistic purchases. A monthly dividend payment is more likely to put cash in your account when you need it versus a quarterly dividend.

Case-in-point: Investors who bought a broad basket of stocks at the bottom of the 2008-2009 financial crisis are likely sitting on triple-digit total returns from those purchases today.

The Dangers of Investing In Monthly Dividend Stocks

Monthly dividend stocks have characteristics that make them appealing to do-it-yourself investors looking for a steady stream of income. Typically, these are retirees and people planning for retirement.

Investors should note many monthly dividend stocks are highly speculative. On average, monthly dividend stocks tend to have elevated payout ratios. An elevated payout ratio means there’s less margin for error to continue paying the dividend if business results suffer a temporary (or permanent) decline.

As a result, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession.

Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction.

With that said, there are a handful of high-quality monthly dividend payers around. Chief among them is Realty Income (O). Realty Income has paid increasing dividends (on an annual basis) every year since 1994.

The Realty Income example shows that there are high-quality monthly dividend payers around, but they are the exception rather than the norm. We suggest investors do ample due diligence before buying into any monthly dividend payer.

Final Thoughts & Other Income Investing Resources

Financial freedom is achieved when your passive investment income exceeds your expenses. But the sequence and timing of your passive income investment payments can matter.

Monthly payments make matching portfolio income with expenses easier. Most personal expenses recur monthly whereas most dividend stocks pay quarterly. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses.

Additionally, many monthly dividend payers offer investors high yields. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors.

But not all monthly dividend payers offer the safety that income investors need. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels.

Because of this, we advise investors to look for high-quality monthly dividend payers with reasonable payout ratios, trading at fair or better prices.

Additionally, see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- High Dividend Stocks: 5%+ dividend yields