Updated on September 25th, 2024 by Bob Ciura

Spreadsheet data updated daily

Mega-cap stocks are companies with market capitalizations in excess of $200 billion. The total number of mega cap stocks varies depending upon market conditions. Right now there are over 50 mega-cap stocks, so there are plenty to choose from for investors.

These are the largest stocks in the market today and tend to have recognizable products and brands, in addition to fairly steady revenue, earnings, and in many cases dividends.

As a result, mega cap stocks tend to appeal to a wide variety of investors, as they typically see less volatility than small-cap stocks, with more predictable future returns.

You can download a free spreadsheet of all 50+ mega cap stocks right now (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

This article includes a spreadsheet and table of all mega cap stocks, as well as detailed analysis on our Top 10 mega cap stocks today.

Keep reading to see the 10 best mega cap stocks analyzed in detail.

The 10 Best Mega Cap Stocks Today

Now that we’ve defined what a mega cap stock is, let’s take a look at the 10 best mega cap stocks, as defined by our Sure Analysis Research Database.

The database ranks total expected annual returns, combining current yield, forecast earnings growth and any change in price from the valuation.

Note: The Sure Analysis Research Database is focused on income producing securities. As a result, we do not track or rank securities that don’t pay dividends. Mega caps that don’t pay dividends were excluded from the Top 10 rankings below.

We’ve screened the mega cap stocks with the highest 5-year expected returns and have provided them below, ranked from lowest to highest. You can instantly jump to any individual stock analysis by using the links below:

- Mega Cap Stock #10: Toyota Motor Corp. (TM)

- Mega Cap Stock #9: Bank of America (BAC)

- Mega Cap Stock #8: Johnson & Johnson (JNJ)

- Mega Cap Stock #7: Mastercard Inc. (MA)

- Mega Cap Stock #6: Visa Inc. (V)

- Mega Cap Stock #5: PepsiCo Inc. (PEP)

- Mega Cap Stock #4: UnitedHealth Group (UNH)

- Mega Cap Stock #3: Eli Lilly & Co. (LLY)

- Mega Cap Stock #2: ASML Holding N.V. (ASML)

- Mega Cap Stock #1: Alphabet Inc. (GOOGL)

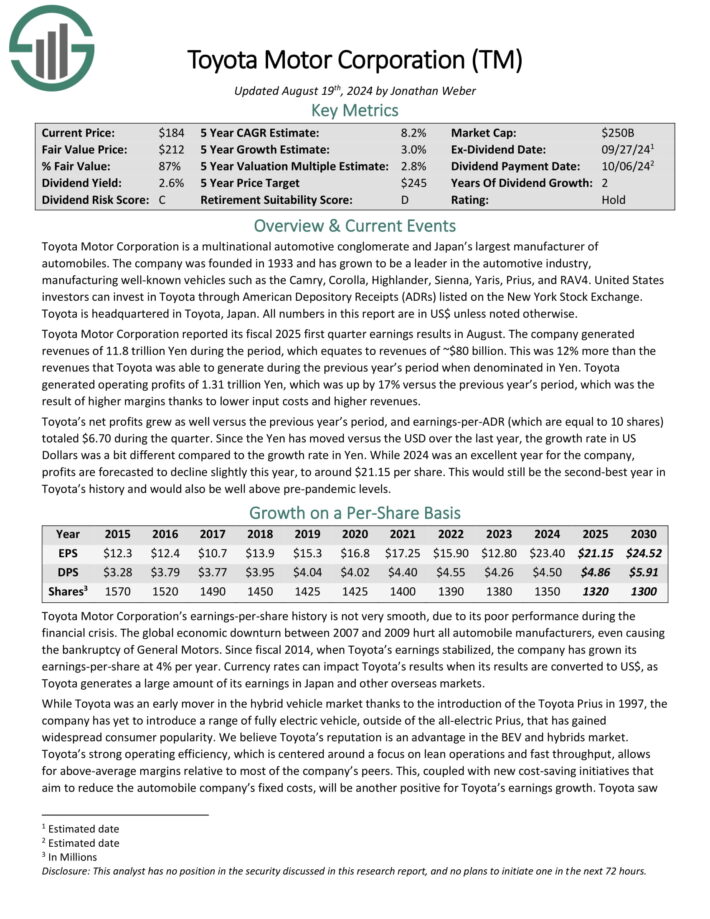

Mega Cap Stock #10: Toyota Motor Corp. (TM)

- 5-year expected annual returns: 8.3%

Toyota Motor Corporation is a multinational automotive conglomerate and Japan’s largest manufacturer of automobiles.

The company was founded in 1933 and has grown to be a leader in the automotive industry, manufacturing well-known vehicles such as the Camry, Corolla, Highlander, Sienna, Yaris, Prius, and RAV4.

Toyota Motor Corporation reported its fiscal 2025 first quarter earnings results in August. The company generated revenues of 11.8 trillion Yen during the period, which equates to revenues of ~$80 billion. This was 12% more than the revenues that Toyota was able to generate during the previous year’s period when denominated in Yen.

Toyota’s operating profits grew by 17% versus the previous year’s quarter, which was the result of higher margins thanks to lower input costs, and higher revenues.

Toyota’s net profits grew as well versus the previous year’s period, and earnings-per-ADR (which are equal to 10 shares) totaled $6.70 during the quarter.

Click here to download our most recent Sure Analysis report on Toyota Motor Corp. (TM) (preview of page 1 of 3 shown below):

Mega Cap Stock #9: Bank of America (BAC)

- 5-year expected annual returns: 9.0%

Bank of America, headquartered in Charlotte, NC, provides traditional banking services, as well as non–banking financial services to customers all over the world. Its operations include Consumer Banking, Wealth & Investment Management and Global Banking & Markets.

Bank of America posted second quarter earnings on July 16th, 2024, and results were better than expected on both the top and bottom lines. Earnings-per-share came to 83 cents, which was three cents better than expected.

Revenue was up only fractionally from the year before, but at $25.4 billion, was $200 million ahead of expectations. Provisions for credit losses were $1.5 billion, up from $1.1 billion a year ago, and $1.3 billion in the first quarter.

Click here to download our most recent Sure Analysis report on Bank of America (preview of page 1 of 3 shown below):

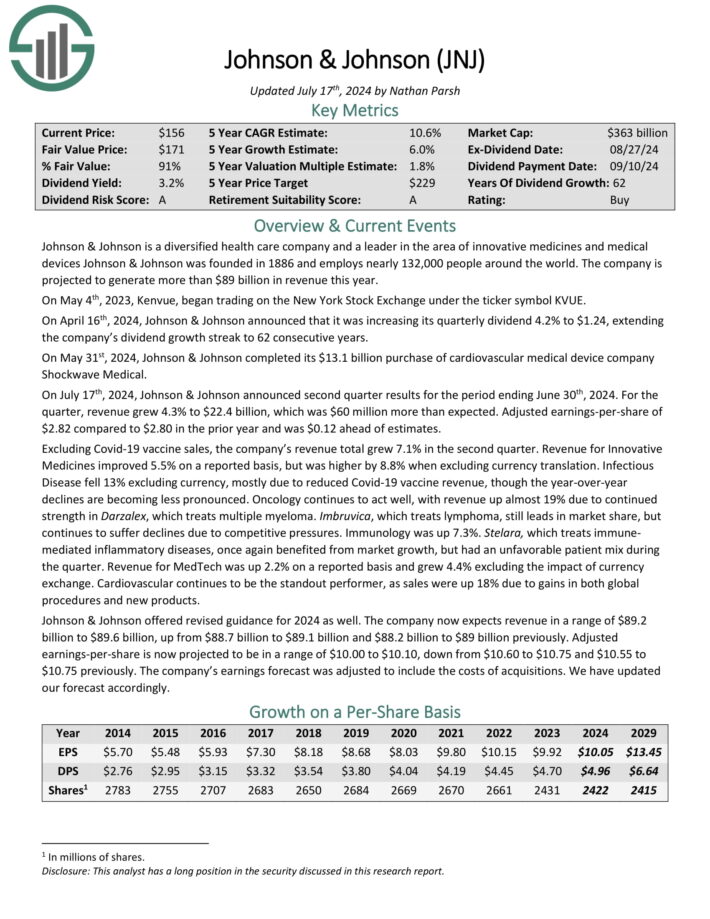

Mega Cap Stock #8: Johnson & Johnson (JNJ)

- 5-year expected annual returns: 9.7%

Johnson & Johnson is a global healthcare giant. The company currently operates three segments: Consumer, Pharmaceutical, and Medical Devices & Diagnostics. The corporation includes roughly 250 subsidiary companies with operations in 60 countries and products sold in over 175 countries.

On July 17th, 2024, Johnson & Johnson announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 4.3% to $22.4 billion, which was $60 million more than expected. Adjusted earnings-per-share of $2.82 compared to $2.80 in the prior year and was $0.12 ahead of estimates.

Excluding Covid-19 vaccine sales, the company’s revenue total grew 7.1% in the second quarter. Revenue for Innovative Medicines improved 5.5% on a reported basis, but was higher by 8.8% when excluding currency translation.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

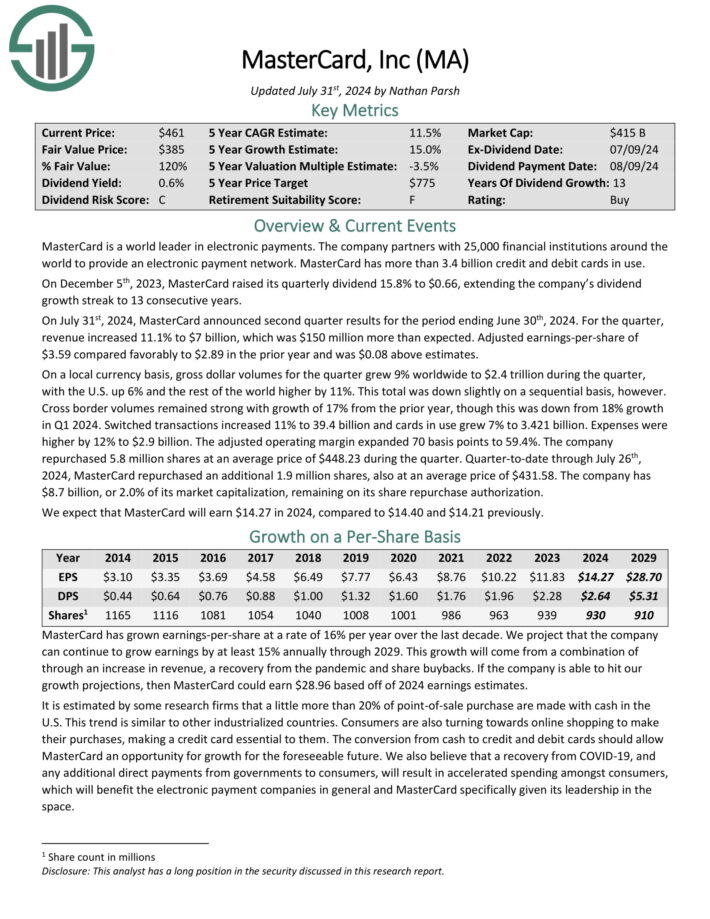

Mega Cap Stock #7: Mastercard Inc. (MA)

- 5-year expected annual returns: 10.3%

MasterCard is a world leader in electronic payments. The company partners with 25,000 financial institutions around the world to provide an electronic payment network. MasterCard has more than 3.1 billion credit and debit cards in use.

On July 31st, 2024, MasterCard announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue increased 11.1% to $7 billion, which was $150 million more than expected. Adjusted earnings-per-share of $3.59 compared favorably to $2.89 in the prior year and was $0.08 above estimates.

On a local currency basis, gross dollar volumes for the quarter grew 9% worldwide to $2.4 trillion during the quarter, with the U.S. up 6% and the rest of the world higher by 11%. This total was down slightly on a sequential basis, however. Cross border volumes remained strong with growth of 17% from the prior year.

Click here to download our most recent Sure Analysis report on Mastercard (preview of page 1 of 3 shown below):

Mega Cap Stock #6: Visa Inc. (V)

- 5-year expected annual returns: 10.6%

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second.

On July 23rd, 2024, Visa reported third quarter 2024 results for the period ending June 30th, 2023. (Visa’s fiscal year ends September 30th.) For the quarter, Visa generated revenue of $8.9 billion, adjusted net income of $4.9 billion and adjusted earnings-per-share of $2.42, marking increases of 10%, 9% and 12%, respectively.

These results were driven by a 7% gain in Payments Volume, a 14% gain in Cross-Border Volume and an 10% gain in Processed Transactions. Visa processed 59.3 billion transactions in the quarter.

Click here to download our most recent Sure Analysis report on Visa (preview of page 1 of 3 shown below):

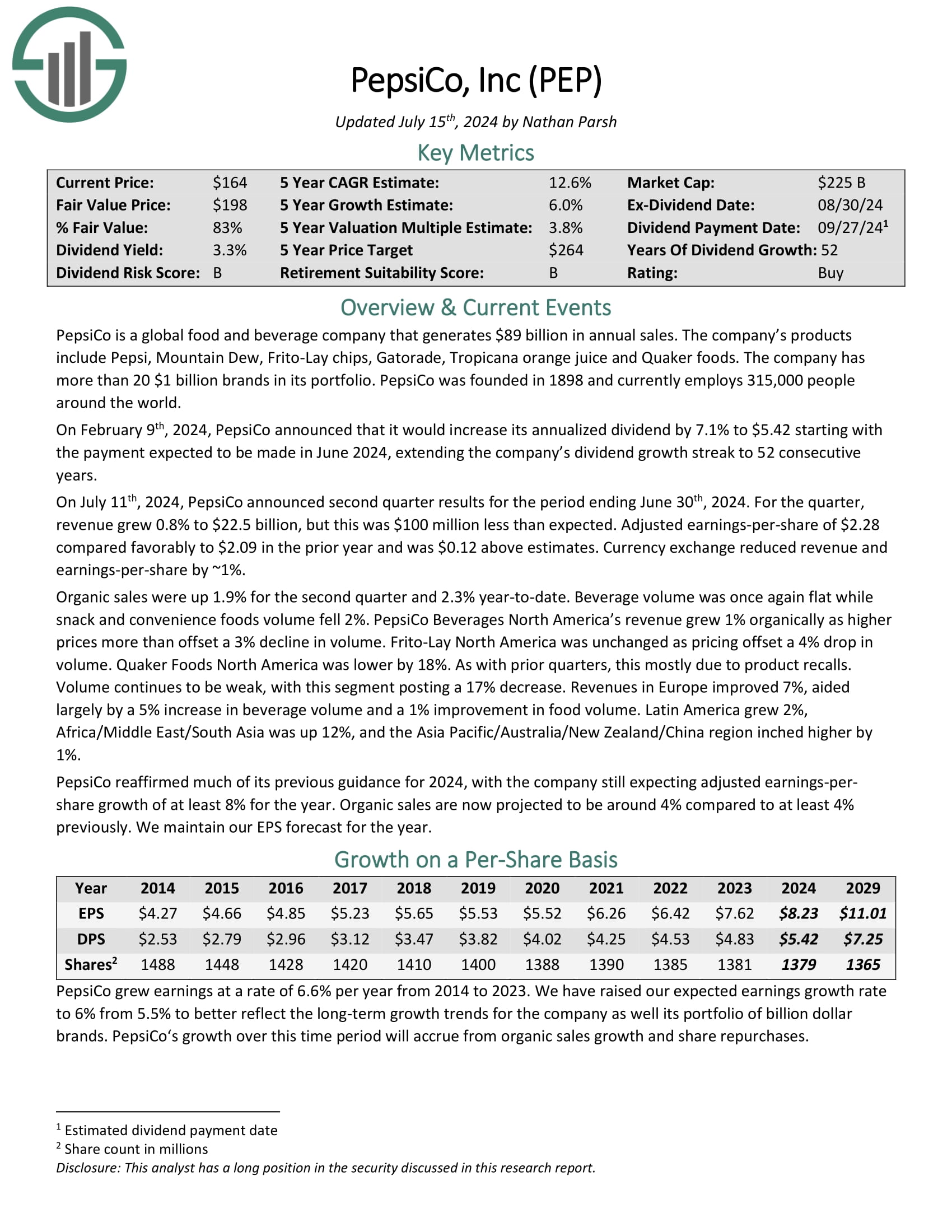

Mega Cap Stock #5: PepsiCo (PEP)

- 5-year expected annual returns: 11.8%

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods. The company has more than 20 $1 billion brands in its portfolio.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 11th, 2024, PepsiCo announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 0.8% to $22.5 billion, but this was $100 million less than expected. Adjusted earnings-per-share of $2.28 compared favorably to $2.09 in the prior year and was $0.12 above estimates. Currency exchange reduced revenue and earnings-per-share by ~1%.

Organic sales were up 1.9% for the second quarter and 2.3% year-to-date. Beverage volume was once again flat while snack and convenience foods volume fell 2%. PepsiCo Beverages North America’s revenue grew 1% organically as higher prices more than offset a 3% decline in volume.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

Mega Cap Stock #4: UnitedHealth Group (UNH)

- 5-year expected annual returns: 12.6%

UnitedHealth dates back to 1974 when Charter Med was founded by a group of health care professionals looking for ways to expand healthcare options for consumers. The company has two major reporting segments: UnitedHealth and Optum.

The company posted second quarter earnings on July 16th, 2024, and results were better than expected on the top line. Adjusted earnings-per-share came to $6.80, which was 17 cents ahead of estimates. Revenue was up 6.4% year-over year at $98.9 billion, but that only met estimates. UnitedHealthcare revenue was up 5% year-over-year, while Optum once again led the way with 12% growth.

UnitedHealth noted cash flow from operations were $6.7 billion, or a staggering 1.5 times net income, implying outstanding free cash flow conversion.

Click here to download our most recent Sure Analysis report on UnitedHealth (preview of page 1 of 3 shown below):

Mega Cap Stock #3: Eli Lilly (LLY)

- 5-year expected annual returns: 15.0%

Eli Lilly develops, manufactures, and sells pharmaceuticals around the world, and has about 35,000 employees globally. Eli Lilly has annual revenues of about $34 billion.

On August 8th, 2024, Eli Lilly announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 36% to $11.3 billion, which topped estimates by $1.33 billion. Adjusted earnings-per-share of $3.92 compared very favorably to adjusted earnings-per-share of $2.11 in the prior year and was $1.16 more than expected.

Volumes companywide were up 27% for the quarter and pricing added 10%. U.S. revenue grew 42% to $7.84 billion, as volume was up 27% and higher prices added 15%. International revenues increased 25% to $3.47 billion due to a 27% increase in volume that was partially offset by a 3% decrease in net selling prices.

Revenue for Mounjaro, which helps patients with weight management and is the company’s top gross product, totaled $3.09 billion, compared to $979.7 million a year ago. Demand remains incredibly high for the product. Zepbound, which is also used to treat patients with obesity, had revenue of $1.24 billion for the quarter.

Click here to download our most recent Sure Analysis report on LLY (preview of page 1 of 3 shown below):

Mega Cap Stock #2: ASML Holding NV (ASML)

- 5-year expected annual returns: 16.3%

ASML Holding is one of the largest manufacturers of chip-making equipment in the world. The company’s customers include a wide variety of industries, and ASML is present in 16 countries with about 31,000 employees. The company is headquartered in the Netherlands and produces more than $30 billion in annual revenue.

ASML reports results in euro but unless otherwise noted, all figures in this report are in USD. ASML posted second quarter earnings on July 17th, 2024, and results were somewhat weak, sending the stock lower. Earnings-per-share came to $4.37, while revenue was off 10% year-over-year to $6.75 billion. Although net bookings soared 54% quarter-over-quarter, investors are concerned about the macro environment.

Click here to download our most recent Sure Analysis report on ASML (preview of page 1 of 3 shown below):

Mega Cap Stock #1: Alphabet Inc. (GOOGL)

- 5-year expected annual returns: 19.8%

Alphabet is a holding company. With a market capitalization that exceeds $2 trillion, Alphabet is a technology conglomerate that operates several businesses such as Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and many more. Alphabet is a leader in many of the areas of technology that it operates.

There are two classes of Alphabet stock, Class A shares, which has voting rights, and Class C shares, that do not have voting rights. This report will reference the Class A shares. On July 23rd, 2024, Alphabet declared its second ever quarterly dividend of $0.20 per share.

Also on July 23rd, 2024, Alphabet announced second quarter results for the period ending June 30th, 2024. As had been the case for several quarters, the company delivered better than expected results.

Revenue improved 13.6% to $84.7 billion for the period, topping analysts’ estimates by $450 million. Adjusted earnings-per-share of $1.89 compared very favorably to $1.44 in the prior year and was $0.04 more than expected.

Click here to download our most recent Sure Analysis report on GOOGL (preview of page 1 of 3 shown below):

Final Thoughts

Mega cap stocks offer investors access to the largest and generally most profitable companies in the world. The group tends to hold up better during downturns and offer investors steady streams of revenue and earnings.

Many of the stocks on this list offer investors generous dividend yields as well, but all of them have high expected total returns. These 10 stocks, we believe, collectively offer investors an attractive blend of growth, value and yield.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 66 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.