Updated on July 25th, 2024 by Bob Ciura

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. stocks.

Small-cap stocks have historically outperformed their larger counterparts. Accordingly, the Russell 2000 Index can be an intriguing place to look for new investment opportunities.

You can download your free Excel list of Russell 2000 stocks, along with relevant financial metrics like dividend yields and P/E ratios, by clicking on the link below:

We typically rank stocks based on their five-year expected annual returns, as stated in the Sure Analysis Research Database.

But for investors primarily interested in income, it is also useful to rank small-cap stocks according to their dividend yields.

This article will rank the 20 highest-yielding small cap stocks in our coverage universe (excluding REITs, MLPs, BDCs, and royalty trusts).

Table of Contents

- Why Invest In Small-Cap Stocks?

- High Yield Small Cap #20: Bank of Marin Bancorp (BMRC)

- High Yield Small Cap #19: Douglas Dynamics Inc. (PLOW)

- High Yield Small Cap #18: Northwest Natural Holding (NWN)

- High Yield Small Cap #17: Compass Minerals International (CMP)

- High Yield Small Cap #16: Donegal Group Inc. (DGICA)

- High Yield Small Cap #15: Premier Financial Corp. (PFC)

- High Yield Small Cap #14: Financial Institutions Inc. (FISI)

- High Yield Small Cap #13: Ames National Corp. (ATLO)

- High-Yield Small Cap #12: First Bancorp Inc. (FNLC)

- High-Yield Small Cap #11: Ethan Allen Interiors (ETD)

- High-Yield Small Cap #10: Auburn National Bancorp (AUBN)

- High-Yield Small Cap #9: Northwest Bancshares Inc. (NWBI)

- High-Yield Small Cap #8: Universal Corporation (UVV)

- High-Yield Small Cap #7: Kronos Worldwide (KRO)

- High-Yield Small Cap #6: Vector Group (VGR)

- High-Yield Small Cap #5: First of Long Island Corp. (FLIC)

- High-Yield Small Cap #4: Washington Trust Bancorp (WASH)

- High-Yield Small Cap #3: Xerox Holdings (XRX)

- High-Yield Small Cap #2: B&G Foods (BGS)

- High-Yield Small Cap #1: Fortitude Gold Corp. (FTCO)

Why Invest In Small-Cap Stocks?

The Russell 2000 Index contains the domestic U.S. stocks that rank 1,001 through 3,000 by descending market capitalization.

The Russell 2000 is an excellent benchmark for small-cap stocks. The average market capitalization within the Russell 2000 is ~currently $2.9 billion.

Why does this matter? There are a number of advantages to investing in small-cap stocks, which we explore in the following video:

Small-cap stocks have historically outperformed large-cap stocks for two reasons.

Firstly, small-cap stocks tend to grow more quickly than their larger counterparts. There is simply less competition and more room to grow when your market capitalization is, say, $1 billion when compared to mega-cap stocks with market caps above $200 billion.

Secondly, many small-cap securities are outside the investment universes of some larger institutional investment managers. This creates less demand for shares, which reduces their prices and creates better buying opportunities.

For this reason, there are typically more mispriced investment opportunities in a small-cap index like the Russell 2000 than a large-cap stock index like the S&P 500.

The following section ranks the 20 highest-yielding small-cap stocks in the U.S. that are covered in the Sure Analysis Research Database. The stocks are ranked in order of lowest dividend yield to highest.

High Yield Small Cap #20: Bank of Marin Bancorp (BMRC)

- Dividend Yield: 5.2%

Bank of Marin Bancorp operates as the holding company for Bank of Marin that provides a range of financial services primarily to small and medium-sized businesses, professionals, not-for-profit organizations, and individuals through its roughly 30 retail offices and eight commercial banking offices in California.

It offers commercial and retail deposit and lending programs, personal and business checking and savings accounts, and wealth management and trust services. The majority of its revenue comes from interest income, with total assets of $3.8 billion, and total interest-earning assets of $3.6 billion.

Source: Investor presentation

On April 29th, 2024, Bank of Marin Bancorp released first quarter 2024 results for the period ending March 31st, 2024. For the quarter, the company reported earnings of $2.9 million significantly down from $9.4 million in the first quarter of 2023, but up from $610,000 in the previous quarter.

Reported diluted earnings per share were $0.18 for the first quarter, compared to $0.04 for the prior quarter and $0.59 for the first quarter of 2023.

Click here to download our most recent Sure Analysis report on BMRC (preview of page 1 of 3 shown below):

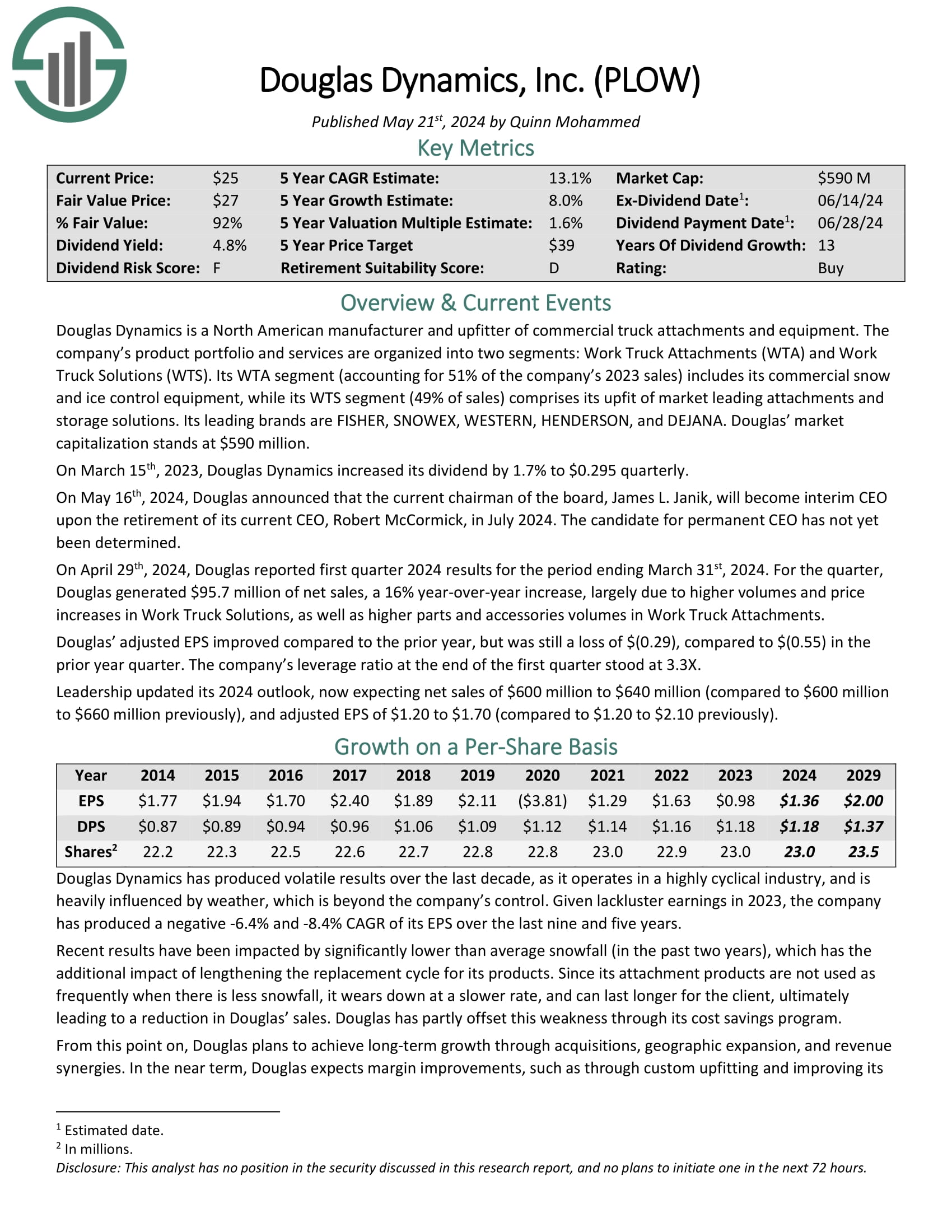

High Yield Small Cap #19: Douglas Dynamics, Inc. (PLOW)

- Dividend Yield: 4.8%

Douglas Dynamics is a North American manufacturer and upfitter of commercial truck attachments and equipment. The company’s product portfolio and services are organized into two segments: Work Truck Attachments (WTA) and Work Truck Solutions (WTS).

Its WTA segment (accounting for 51% of the company’s 2023 sales) includes its commercial snow and ice control equipment, while its WTS segment (49% of sales) comprises its upfit of market leading attachments and storage solutions. Its leading brands are FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA.

On April 29th, 2024, Douglas reported first quarter 2024 results for the period ending March 31st, 2024. For the quarter, Douglas generated $95.7 million of net sales, a 16% year-over-year increase, largely due to higher volumes and price increases in Work Truck Solutions, as well as higher parts and accessories volumes in Work Truck Attachments.

Douglas’ adjusted EPS improved compared to the prior year, but was still a loss of $(0.29), compared to $(0.55) in the prior year quarter. The company’s leverage ratio at the end of the first quarter stood at 3.3X.

Click here to download our most recent Sure Analysis report on PLOW (preview of page 1 of 3 shown below):

High Yield Small Cap #18: Northwest Natural Holding (NWN)

- Dividend Yield: 4.9%

NW Natural was founded in 1859 and has grown from a small utility to a large publicly traded utility today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

The company serves nearly 3 million people through its natural gas, water, and renewable energy businesses.

NWN stock trades with a market capitalization of $1.5 billion.

Source: Investor Presentation

Northwest Natural Holding reported its financial results for the first quarter of 2024, with net income reaching $63.8 million ($1.69 per share), a decrease from $71.7 million ($2.01 per share) in the same period of 2023.

Despite this decline, the company saw notable achievements, including adding nearly 15,000 gas and water utility connections in the last 12 months, driven mainly by robust water acquisitions, and providing bill credits totaling nearly $30 million to Oregon gas customers in early 2024.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

High Yield Small Cap #17: Compass Minerals International (CMP)

- Dividend Yield: 4.9%

Compass Minerals International produces and sells salt, and specialty plant nutrition, and chemical products internationally. Its various chloride and salt variants (~55% of sales), such as solar-evaporated salt, are applied as deicers for roadways, human, animal nutrition, and various other industrial uses.

Its plant nutrition segment (~45% of sales) offers specialty fertilizers in various grades and other agricultural solutions. The company generates nearly $1.2 billion in revenues annually and is based in Overland Park, Kansas.

On May 7th, 2024, Compass Minerals posted its fiscal Q2 results for the period ending March 31st, 2024. For the quarter, revenues fell by 11.5% to $364.0 million. This was due to the 5% revenue growth from the plant nutrition segment not being able to offset the 14% decline in salt revenues.

Click here to download our most recent Sure Analysis report on CMP (preview of page 1 of 3 shown below):

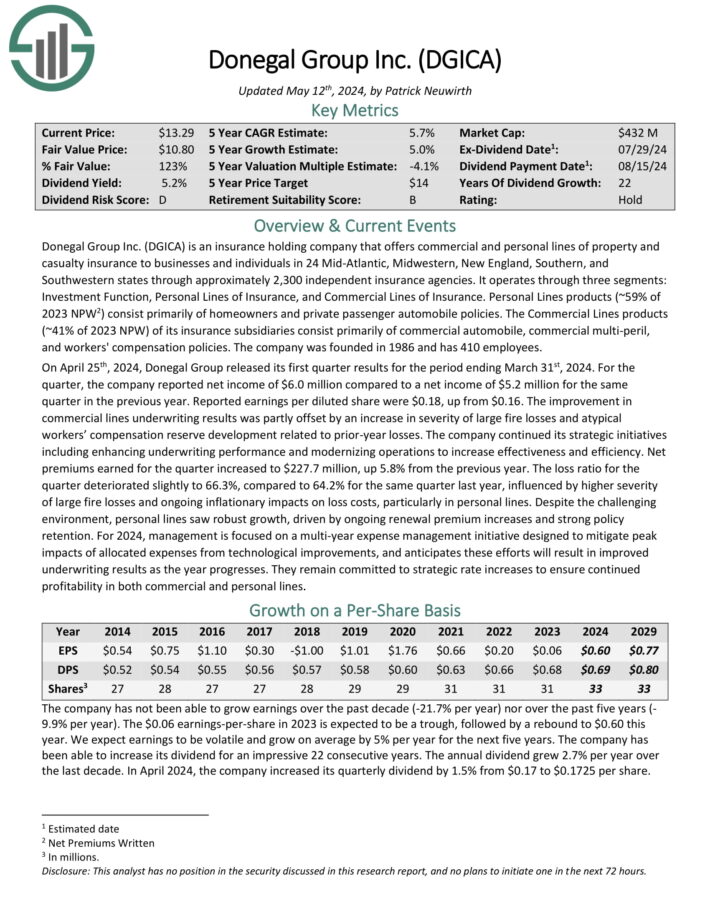

High Yield Small Cap #16: Donegal Group (DGICA)

- Dividend Yield: 4.9%

Donegal Group is an insurance holding company that offers commercial and personal lines of property and casualty insurance to businesses and individuals in 24 Mid-Atlantic, Midwestern, New England, Southern, and Southwestern states through approximately 2,300 independent insurance agencies.

It operates through three segments: Investment Function, Personal Lines of Insurance, and Commercial Lines of Insurance.

Source: Investor Presentation

Personal Lines products (~59% of 2023 NPW2) consist primarily of homeowners and private passenger automobile policies.

The Commercial Lines products (~41% of 2023 NPW) of its insurance subsidiaries consist primarily of commercial automobile, commercial multi-peril, and workers’ compensation policies. The company was founded in 1986 and has 410 employees.

On April 25th, 2024, Donegal Group released its first quarter results for the period ending March 31st, 2024. For the quarter, the company reported net income of $6.0 million compared to a net income of $5.2 million for the same quarter in the previous year.

Click here to download our most recent Sure Analysis report on DGICA (preview of page 1 of 3 shown below):

High Yield Small Cap #15: Premier Financial Corp. (PFC)

- Dividend Yield: 5.0%

Premier Financial, which is headquartered in Defiance, Ohio, is the holding company for Premier Bank, a community banking and financial services company that was founded in 1920.

Premier Bank is a regional bank with 73 branches and 9 loan production offices throughout northern Ohio, southeast Michigan, northeast Indiana and western Pennsylvania. Premier Financial has a market capitalization of ~$700 million.

In late April, Premier Financial reported (4/23/24) financial results for the first quarter of fiscal 2024. Deposits grew 2% during the first quarter but loans decreased -3%. Net interest margin contracted from 2.90% in last year’s quarter to 2.50% due to increased deposit costs amid heated competition among banks.

As a result, net interest income decreased -12%. Nevertheless, thanks to an increase in non-interest income and a decrease in non-interest expense, earnings-per-share declined just -2%, from $0.51 to $0.50, and exceeded the analysts’ consensus by $0.03.

Click here to download our most recent Sure Analysis report on PFC (preview of page 1 of 3 shown below):

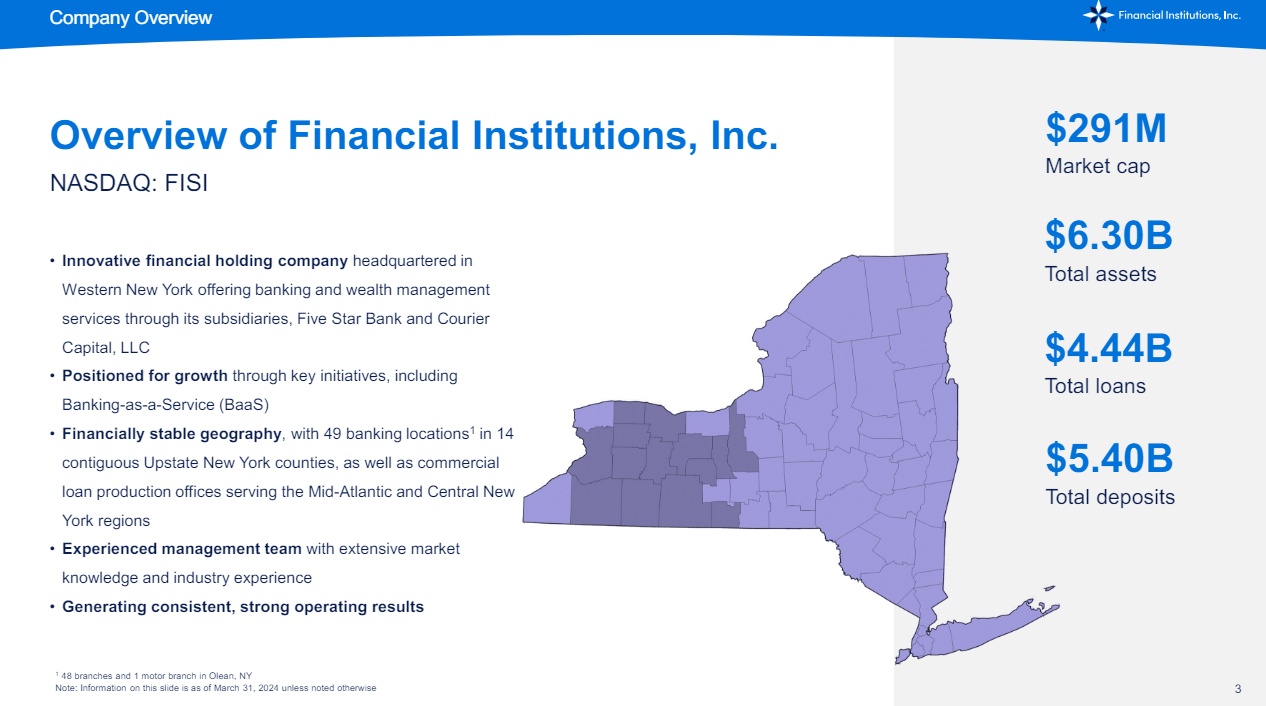

High Yield Small Cap #14: Financial Institutions Inc. (FISI)

- Dividend Yield: 5.1%

FISI is a holding company for Five Star Bank, which is a chartered community bank in New York.

It offers the typical mix of traditional banking products, including checking an savings accounts, certificates of deposit, retirement and qualified plan accounts, commercial and real estate lending, business loans, working capital loans, and more.

The bank was founded in 1817, and is headquartered in Warsaw, New York.

Source: Investor presentation

The bank has 49 offices in New York state, and has more than $6 billion in total assets. The bank’s loan-to-deposit ratio is 82% as of the most recent quarter.

FISI reported first quarter earnings on April 25th, 2024, and results were largely flat year-over-year, with the exception of a fraud event that cost the bank dearly during the quarter.

Loans and deposits were up about 5% year-over-year, but net interest income fell about 4%. Net interest margin fell sharply, ceding about 30 basis points from the year-ago period, which was attributable to the higher cost of deposits.

Click here to download our most recent Sure Analysis report on FISI (preview of page 1 of 3 shown below):

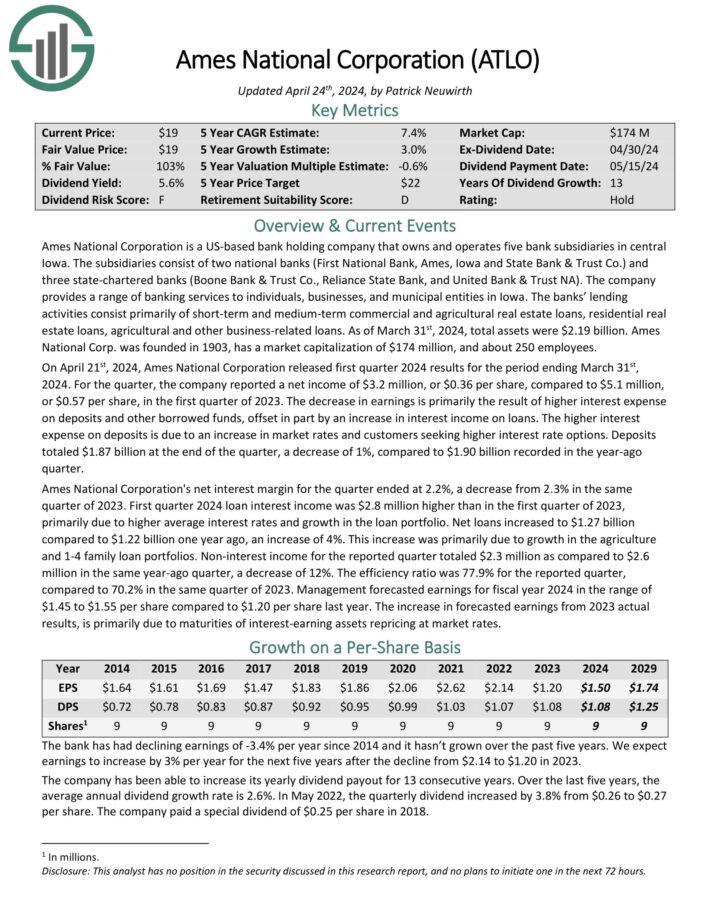

High Yield Small Cap #13: Ames National Corporation (ATLO)

- Dividend Yield: 5.1%

Ames National Corporation is a U.S.-based bank holding company that owns and operates five bank subsidiaries in central Iowa.

The subsidiaries include two national banks, First National Bank, Ames, Iowa, and State Bank & Trust Co., and three state-charted banks, Boone Bank & Trust Co., Reliance State Bank, and Iowa State Savings Bank.

The last three years have been difficult for the bank.

Source: Investor Relations

Ames National Corporation reported earnings results for the first quarter of 2024 on March 31st, 2024. Net income of $3.2 million, or $0.36 per share, compared unfavorably to net income of $5.1 million, or $0.57 per share, in the prior year.

The decrease in earnings is primarily the result of higher interest expense on deposits and other borrowed funds. This was partially offset by an increase in interest income on loans.

Click here to download our most recent Sure Analysis report on ATLO (preview of page 1 of 3 shown below):

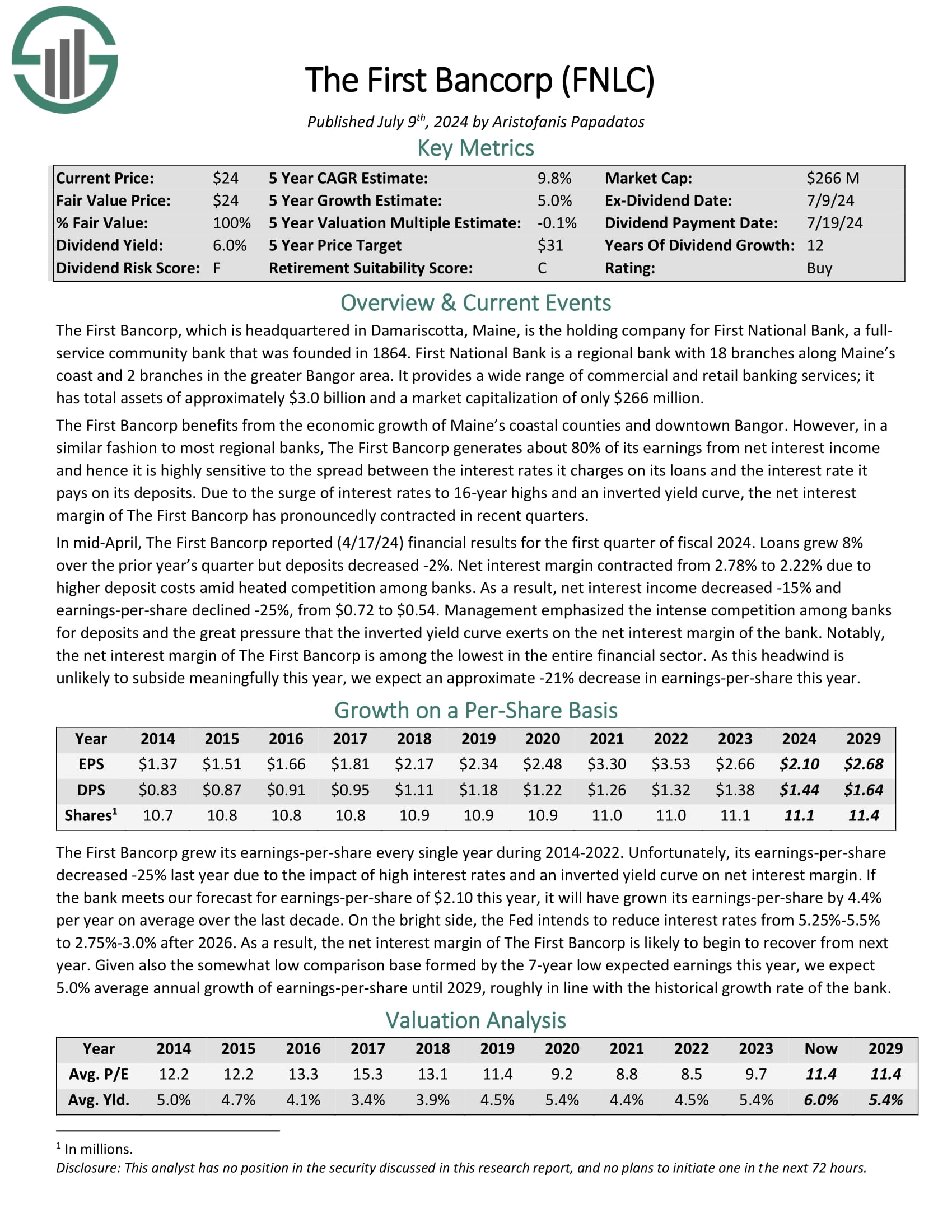

High Yield Small Cap #12: First Bancorp Inc. (FNLC)

- Dividend Yield: 5.2%

The First Bancorp is the holding company for First National Bank, a full service community bank that was founded in 1864. First National Bank is a regional bank with 18 branches along Maine’s coast and 2 branches in the greater Bangor area. It provides a wide range of commercial and retail banking services; it has total assets of approximately $3.0 billion.

Net income was $6.2 million, or $0.55 per diluted share, for the three months ended June 30, 2024. EPS grew slightly for the quarter from $0.54 per share in the year-ago period.

Net interest income was $15.1 million for the three months ended June 30, 2024, an increase of 1.3% from the first quarter of 2024. Net interest margin was 2.21% for the second quarter of 2024, down slightly from 2.22% in the previous quarter.

Click here to download our most recent Sure Analysis report on FNLC (preview of page 1 of 3 shown below):

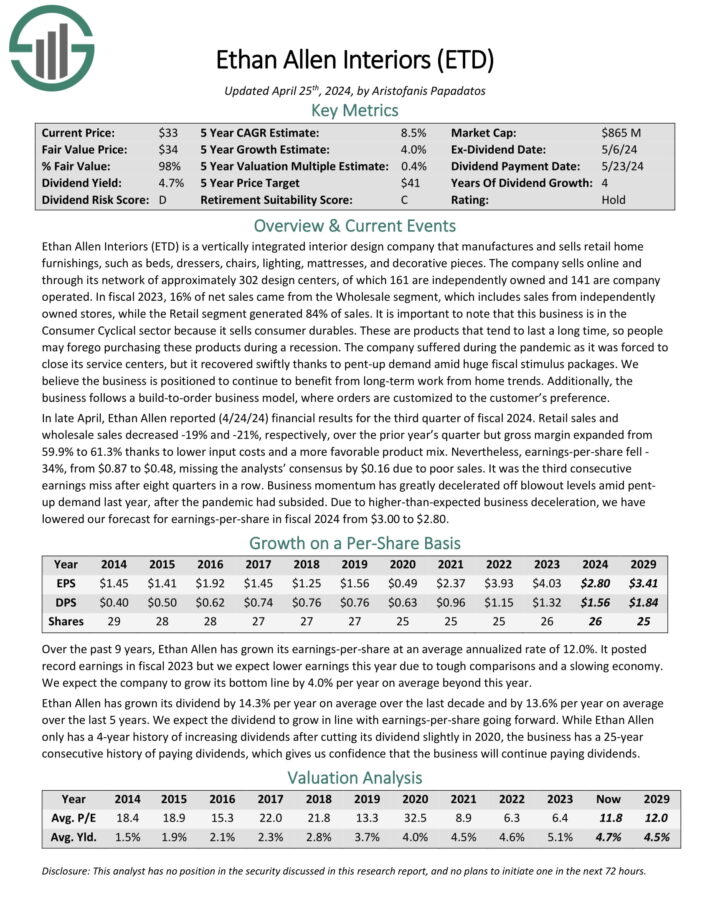

High Yield Small Cap #11: Ethan Allen Interiors (ETD)

- Dividend Yield: 5.4%

Ethan Allen Interiors is a vertically integrated interior design company that manufactures and sells retail home furnishings, such as beds, dressers, chairs, lighting, mattresses, and decorative pieces.

The company sells online and through its network of approximately 302 design centers, where 161 are independently owned and 141 are company operated.

In the fiscal 2024 third quarter, Ethan Allen Interiors Inc. reported consolidated net sales of $146.4 million, marking a 21.4% decrease from the previous year.

Retail net sales dropped by 18.8% to $122.6 million, while wholesale net sales fell by 21.3% to $89.8 million. The company’s retail and wholesale written orders also saw declines of 8.6% and 14.6%, respectively.

Click here to download our most recent Sure Analysis report on Ethan Allen (preview of page 1 of 3 shown below):

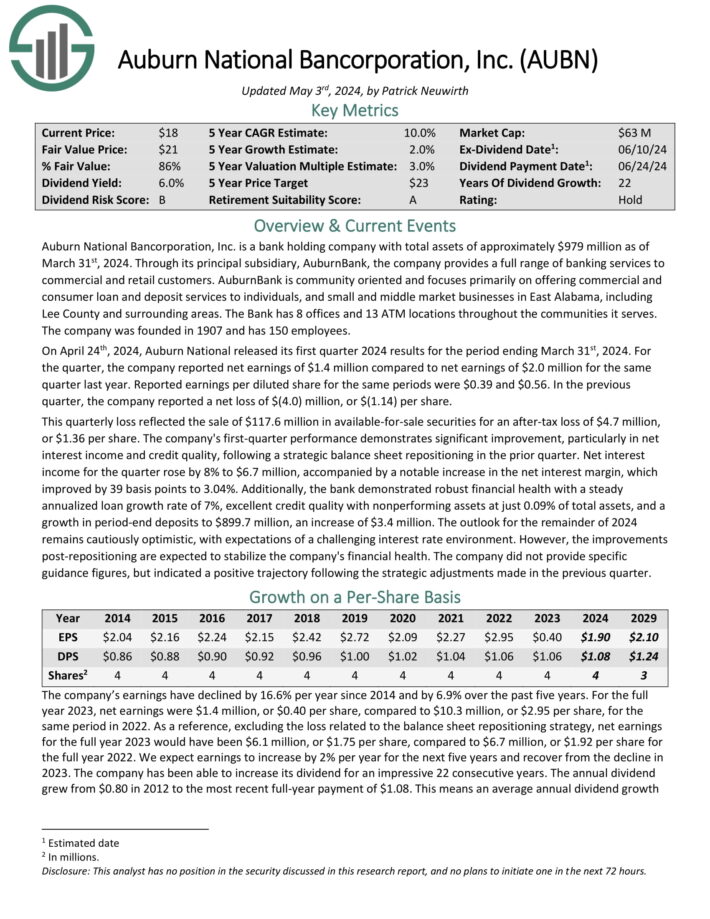

High Yield Small Cap #10: Auburn National Bancorporation (AUBN)

- Dividend Yield: 5.7%

Auburn National Bancorporation is a bank holding company. Through its principal subsidiary, AuburnBank, the company provides a full range of banking services to commercial and retail customers.

AuburnBank is community oriented and focuses primarily on offering commercial and consumer loan and deposit services to individuals, and small and middle market businesses in East Alabama, including Lee County and surrounding areas.

Auburn National Bancorporation announced its first quarter 2024 financial results, reporting a net income of $1.4 million, or $0.39 per share.

This marked a significant recovery from the fourth quarter of 2023, which saw a net loss of $(4.0) million, or $(1.14) per share, largely due to strategic balance sheet adjustments involving the sale of low-yielding securities.

Excluding this one-time loss, net earnings for the fourth quarter of 2023 would have been $0.7 million, or $0.21 per share.

Click here to download our most recent Sure Analysis report on AUBN (preview of page 1 of 3 shown below):

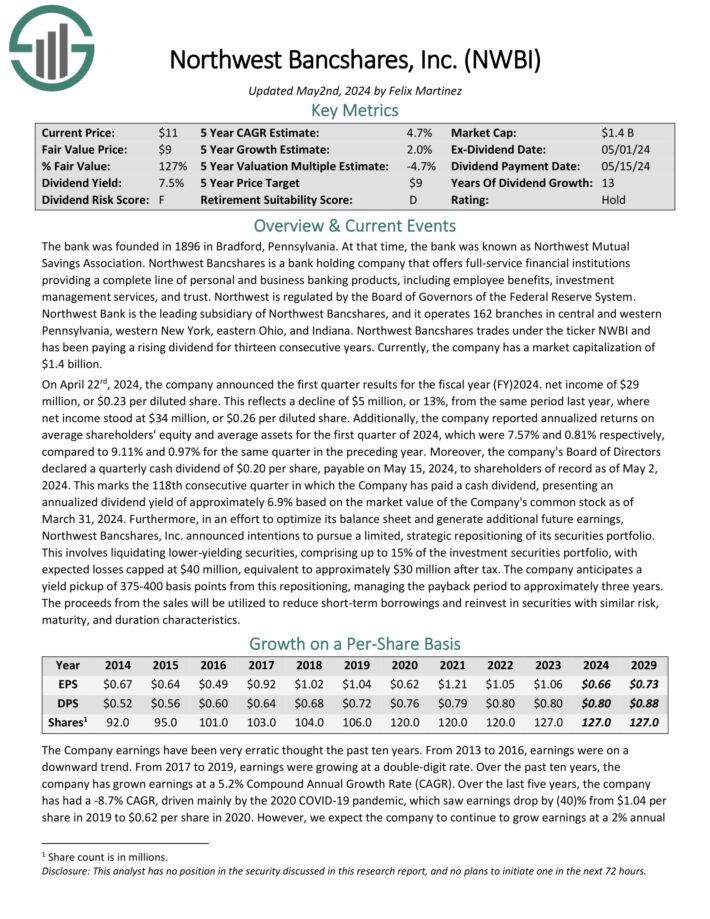

High Yield Small Cap #9: Northwest Bancshares (NWBI)

- Dividend Yield: 5.8%

Northwest Bancshares is a 100+ year-old bank founded in Pennsylvania and headquartered in Columbus, Ohio. Today, the bank has about 142 branches and eight drive-through locations in Ohio, Pennsylvania, Western New York, and Indiana.

Northwest takes in deposits and loans out money to consumers and small-to-medium-sized businesses like most community banks. Besides loans, the bank invests deposits in cash and cash equivalents.

The bank offers consumers checking and savings accounts, mortgages, auto loans, personal loans, and credit cards. For small businesses, the bank offers business checking and savings, credit cards, loans, payables and receivables, retirement plans, etc.

In addition, Northwest provides wealth management, offering mutual funds, insurance, and annuities.

The company announced first-quarter results on April 22nd, 2024. Net interest income fell more than 8% for the quarter, from $112.5 million in the same prior year period to $103.3 million in the most recent period. This decline was a result of a 154% surge in interest expense that more than offset a 19% gain in interest income.

Click here to download our most recent Sure Analysis report on NWBI (preview of page 1 of 3 shown below):

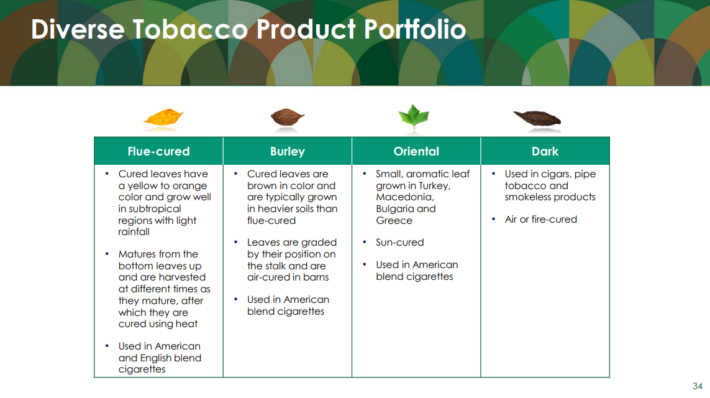

High Yield Small Cap #8: Universal Corporation (UVV)

- Dividend Yield: 6.2%

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its fourth-quarter earnings results at the end of May. The company generated revenues of $770 million during the quarter, which was 11% more than the revenues that Universal Corporation generated during the previous year’s period.

Revenues were positively impacted by product mix changes, and growth was weaker than during the previous quarter. Universal’s gross margin was up compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

High Yield Small Cap #7: Kronos Worldwide (KRO)

- Dividend Yield: 6.4%

Kronos Worldwide is a company that specializes in the production of titanium dioxide pigments, which are primarily used to enhance the color and brightness of products like paint, cosmetics, and plastics.

Kronos estimates it is the largest producer of TiO2 in Europe, with close to 50% of sales volumes attributable to markets in Europe.

The company’s most recent quarterly report showed a return to growth. Released on May 8th, 2024, revenue grew 12.3% to $479 million while earnings-per-share of $0.07 improved from a loss of $0.13 in the prior year.

Price for TiO2 were lower 11% for the quarter, but this was more than offset by a 28% surge in volume as demand improved.

Click here to download our most recent Sure Analysis report on KRO (preview of page 1 of 3 shown below):

High Yield Small Cap #6: Vector Group (VGR)

- Dividend Yield: 6.6%

Vector Group is a diversified holding company that is a combination of a cigarette manufacturer, and a real estate developer. The company owns and controls two tobacco companies: Liggett Group, LLC and Vector Tobacco, Inc.

Vector Group’s tobacco segment primarily sells discount cigarette brands, including Eagle ’20s, Pyramid, Grand Prix, Liggett Select, and Eve. The company is the 4th largest cigarette manufacturer, in terms of volume, in the United States.

Vector Group also owns New Valley LLC, which is a real estate investment business. The real estate segment New Valley has invested approximately $171 million, as of March 31st, 2024, in a broad portfolio of real estate ventures, including condominium and mixed-used developments, apartment buildings, hotels, and commercial properties.

Source: Investor Presentation

Vector Group recently reported its Q1 2024 results on May 1st, 2024, with the numbers coming in weaker than expected. The company saw a revenue decrease of 2.9% to $324.6 million. While earnings per share did decrease to $0.24 from $0.22 despite a decline in tobacco volume.

Click here to download our most recent Sure Analysis report on VGR (preview of page 1 of 3 shown below):

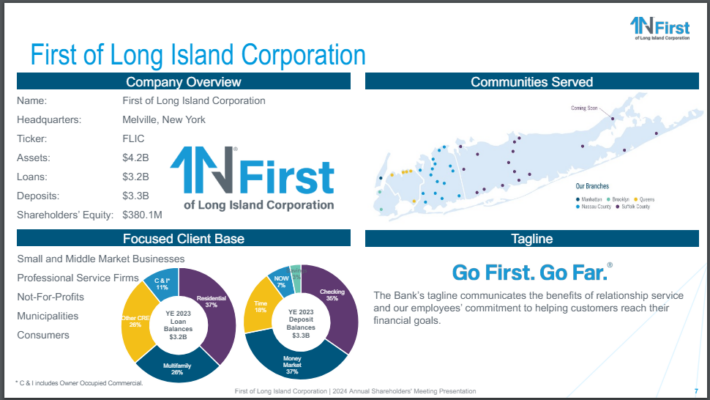

High Yield Small Cap #5: First of Long Island Corp. (FLIC)

- Dividend Yield: 6.8%

The First of Long Island is the holding company for The First National Bank of Long Island, which is a small-sized bank.

The First of Long Island provides a range of financial services to consumers and small to medium-sized businesses. These offerings include savings accounts, mortgages, and business and consumer loans, among others.

The First of Long Island has approximately 50 branches in two Long Island counties and several NYC burrows, including Brooklyn, Manhattan, and Queens.

Source: Investor Presentation

FLIC reported first quarter earnings results on April 25th, 2024, with results showing weakness for the period. Revenue fell 8% to $21 million while earnings-per-share of $0.20 compared unfavorably to $0.29 in the prior year.

Total deposits fell $162.6 million, or 4.7%, to $3.3 billion, but increased $55.5 million on a sequential basis. Total average loans declined 1.3% to $3.2 billion.

Click here to download our most recent Sure Analysis report on FLIC (preview of page 1 of 3 shown below):

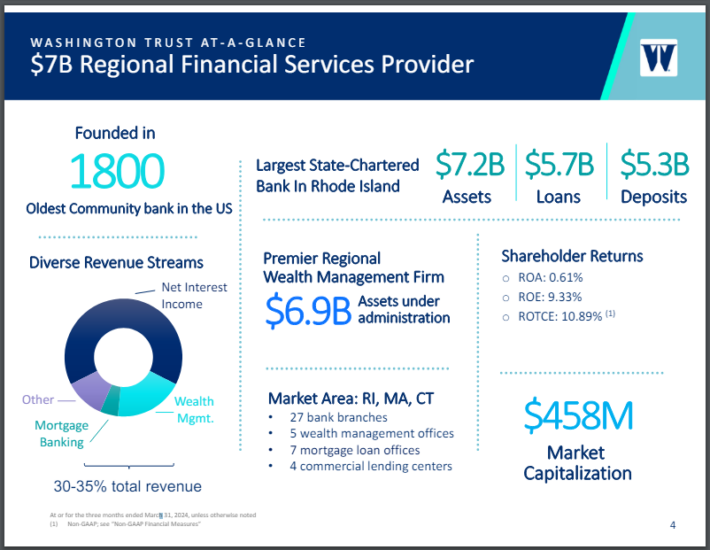

High Yield Small Cap #4: Washington Trust Bancorp (WASH)

- Dividend Yield: 7.2%

Washington Trust was founded in 1800, making it the oldest community bank in the U.S. The bank is the largest state-charted bank in Rhode Island and has small operations in Massachusetts and Connecticut.

Source: Investor Relations

Washington Trust operates as a holding company, with assets totaling more than $7 billion. The bank provides additional banking services, such as savings accounts, certificates of deposit, and money market accounts to its customers as well.

The bank also offers loans for residential, commercial, consumer, and construction customers, as well as reverse mortgages.

Finally, Washington Trust has nearly $7 billion in assets under management in its wealth management business, where it provides financial planning and advisory services.

Click here to download our most recent Sure Analysis report on WASH (preview of page 1 of 3 shown below):

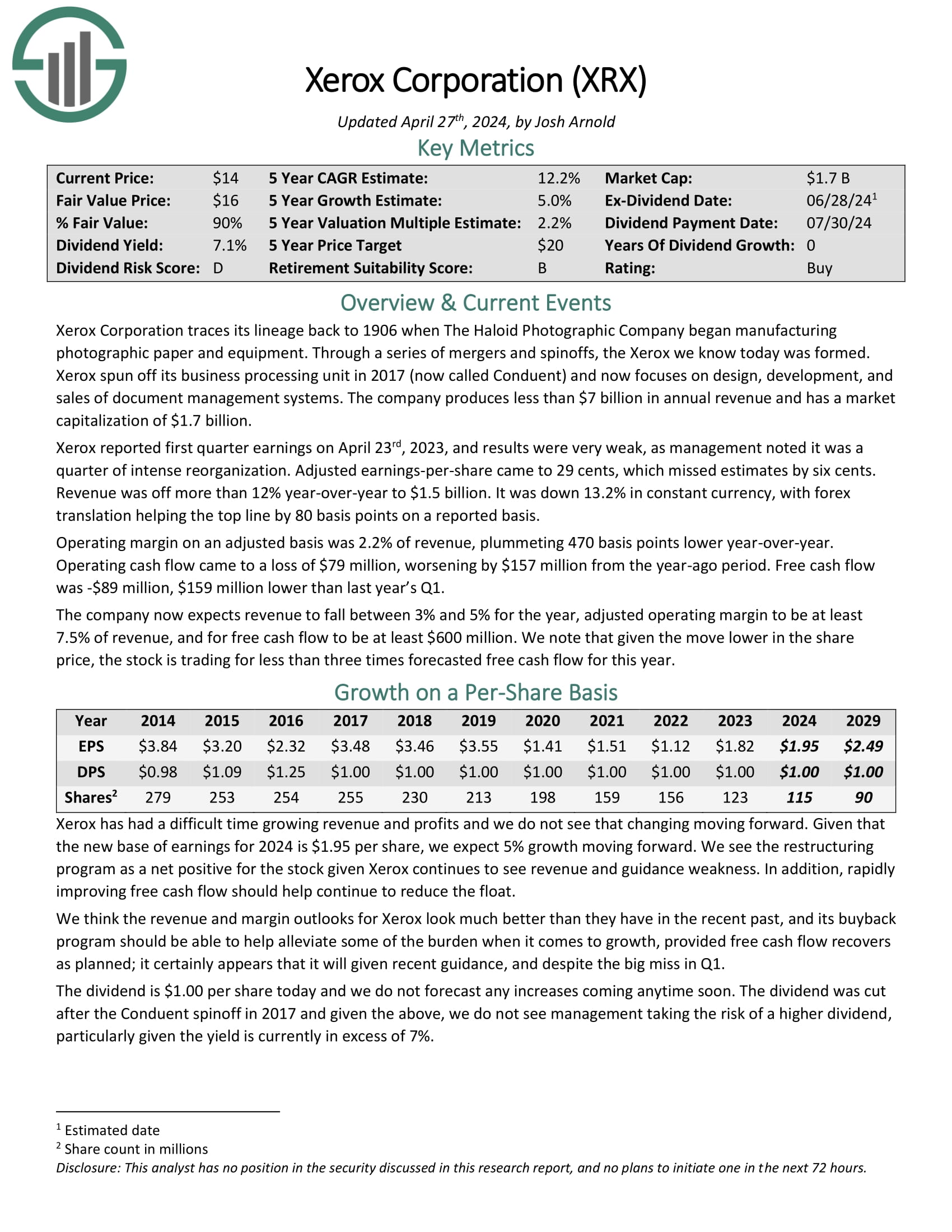

High Yield Small Cap #3: Xerox Holdings (XRX)

- Dividend Yield: 8.5%

Xerox is a technology company that designs, develops, and sells a wide range of business solutions in the United States and around the world.

Its offerings include color and multi-function printers, digital printing presses, digital services for workflow automation, content management solutions, and more.

From a relatively hardware-focused company, Xerox has developed into a more diversified enterprise over time, adding software and services segments via organic expansion and acquisitions.

As a result, non-equipment revenue contributes most of Xerox’s sales today:

Source: Investor Presentation

In the most recent quarter, Xerox reported revenues of $1.5 billion, which was a 12.4% decrease year-over-year and lower by 13.2% in constant currency. Foreign exchange translations helped the top-line by 80 basis points on a reported basis.

Click here to download our most recent Sure Analysis report on XRX (preview of page 1 of 3 shown below):

High Yield Small Cap #2: B&G Foods (BGS)

- Dividend Yield: 9.3%

B&G Foods was created in the late 1990s with the initial purpose of acquiring Bloch & Guggenheimer, who sold pickles, relish, and condiments. Bloch was founded in 1889. Last year, the company had just over $2 billion in sales.

Some of the company’s well-known brands include Green Giant, Ortega, Cream of Wheat, Mrs. Dash, and Back to Nature, with over 50 brands in total. The product portfolio focuses on shelf-stable, frozen and snack brands.

You can see an image of the company’s five-year financial performance below:

Source: 2023 Annual Report

B&G Foods reported first-quarter 2024 results on May 8th, 2024. Quarterly revenue of $475 million declined 7% year-over-year, due mostly to lower volume and the divestiture of the Green Giant U.S. shelf-stable product line.

Adjusted earnings-per-share declined 33% year-over-year, to $0.18 per share.

B&G Foods also reduced 2024 guidance, and now expects net sales in a range of $1.955 billion to $1.985 billion (from $1.975 billion to $2.020 billion previously), and adjusted EPS between $0.75 to $0.95 (from $0.80 to $1.00 previously).

Click here to download our most recent Sure Analysis report on BGS (preview of page 1 of 3 shown below):

High Yield Small Cap #1: Fortitude Gold Corporation (FTCO)

- Dividend Yield: 10.4%

Fortitude Gold is a gold producer, which is based in the U.S., generates 99% of its revenue from gold and targets projects with low operating costs, high returns on capital and wide margins.

Its Nevada Mining Unit consists of five high-grade gold properties located in the Walker Lane Mineral Belt. Nevada is one of the friendliest jurisdictions to miners in the world.

Fortitude Gold has grown its production at a fast pace in each of the last two years, primarily thanks to the major growth project of Isabella Pearl Mine.

Source: Investor Presentation

As shown in the above chart, the reserves of Isabella Pearl Mine will last until approximately 2025 and then they will probably be replenished by the additional reserves of the Golden Mile Project.

The chart depicts essentially flat production in the upcoming years. As a result, the earnings of Fortitude Gold will be essentially determined by the prevailing price of gold.

On the other hand, Fortitude Gold has some attractive features for dividend investors. It is offering a monthly dividend of $0.04, which corresponds to an annualized dividend yield of 7.3%.

Click here to download our most recent Sure Analysis report on FTCO (preview of page 1 of 3 shown below):

Final Thoughts

High yield dividend stocks have obvious appeal to income investors. The S&P 500 Index yields just ~1.3% right now on average, making high yield stocks even more attractive by comparison.

In addition, small-cap stocks could have stronger growth potential than larger competitors in their respective sectors.

Of course, investors should always do their research before buying individual stocks.

That said, the 20 stocks in this list have yields at least double the S&P 500 Index average, going all the way up to over 10%. As a result, income investors may find these 20 dividend stocks attractive.

Further Reading

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The 20 Highest Yielding Dividend Aristocrats

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Monthly Dividend Stocks List: contains stocks that pay dividends each month, for 12 payments per year.

- The 20 Highest Yielding Monthly Dividend Stocks