Updated on June 27th, 2024 by Bob Ciura

High-yield stocks with dividend yields above 5% are appealing to income investors. However, not all high-dividend stocks are created equally.

Some have secure dividend payouts, but others are in questionable financial condition, leaving shareholders vulnerable to a dividend cut in a downturn.

With this in mind, we created a complete list of high-dividend stocks.

Universal is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Universal Corporation (UVV) is a Dividend King with a very high dividend yield. But the decline of the U.S. cigarette industry poses long-term difficulty. Overall, Universal is a high-risk dividend stock.

Business Overview

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

It was founded in 1918 and today operates in two segments: Tobacco Operations and Ingredient Operations.

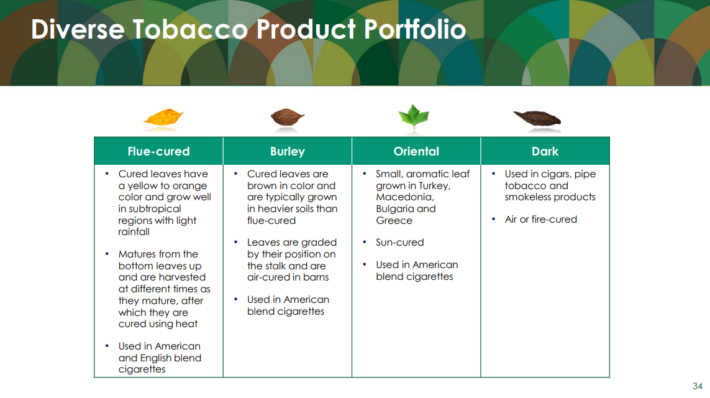

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its fourth-quarter earnings results at the end of May. The company generated revenues of $770 million during the quarter, which was 11% more than the revenues that Universal Corporation generated during the previous year’s period.

Revenues were positively impacted by product mix changes, and growth was weaker than during the previous quarter. Universal’s gross margin was up compared to the previous year’s period. This tailwind helped the company in growing its profits meaningfully compared to the previous year’s period.

Universal’s adjusted earnings-per-share totaled $1.79 during the quarter. The company has not provided guidance for the current fiscal year, but comments indicate that demand is healthy.

Growth Prospects

Universal’s primary business has been declining as a waning industry supplier for years. Cigarette sales declined from a peak of $635.6 billion in 1981 to $270 billion in 2023.

The combination of regulation and health concerns about cancer means it is unlikely the long-term decline will reverse, even though the global tobacco market grew in 2023.

Tobacco industry growth is being driven by underdeveloped markets, while the U.S. tobacco industry faces a continued decline.

Furthermore, e-cigarettes and smokeless products provide more competition and are increasing sales. In turn, they have accelerated the long-term decline of cigarette sales.

To that end, Universal’s earnings per share were lower in 2020 than in 2010.

The company is growing through acquisitions of fruit and vegetable suppliers. Universal acquired FruitSmart and Silva in 2020 and Shank’s Extracts in 2021.

The fruit and vegetable supply businesses are similar to the leaf tobacco business, but with better long-term prospects.

Competitive Advantages

As one of the leading players in a declining industry, Universal has little to worry about with new entrants. The company’s main competitors are Pyxus International and the cigarette manufacturers who can directly source leaf tobacco.

However, Universal has a long history of established relationships with farmers and cigarette manufacturers, which are difficult to replicate and result in entry barriers.

Furthermore, Universal adds value by checking the quality, blending, and testing the leaf tobacco before selling it to customers. This value-added function adds to the company’s competitive advantage.

Next, since the industry is declining, significant capital expenditures are not needed. As a result, tobacco companies like Universal typically generate strong free cash flow.

For example, Universal generated $186 million of free cash flow in 2023, and utilized $77 million for dividend payments.

The free cash flow can be also be used for acquisitions to expand the Ingredient Operations segment, and to pay down debt.

Dividend Analysis

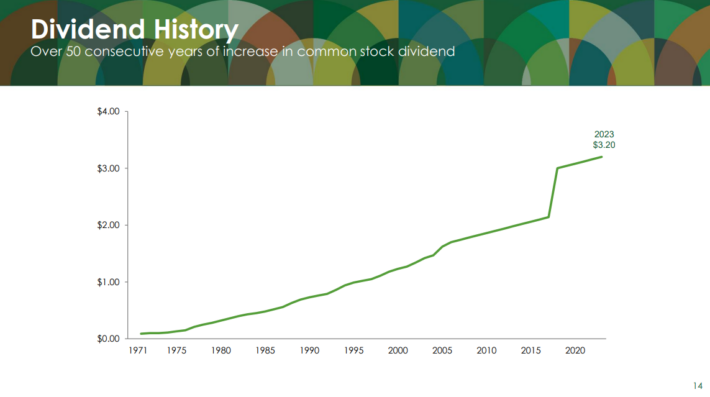

Universal has paid an increasing dividend for 53 years. This makes UVV one of only 53 Dividend Kings.

The forward dividend rate is $3.24 per share, giving the stock a high forward dividend yield of ~6.7%. This value is greater than the 5-year average yield.

Source: Investor Presentation

The payout ratio is approximately 68% expected for 2024. The payout ratio was roughly 50% of net profits for the past decade.

After completing a strategic review, Universal raised the dividend by 36% in 2019. Since then, the company has mostly approved annual dividend increases in the low single digit percentage range.

Final Thoughts

High-dividend stocks have instant appeal for income investors. But investors should carefully analyze each company before buying individual stocks, as there may be warning signs of potential challenges.

Universal’s major challenge going forward is that its industry is in secular decline. It is trying to grow in the fruit and vegetable market by acquiring smaller companies, but the tobacco operations still account for the majority of profit.

That said, the current dividend payout is covered by earnings and free cash flow. And, Universal has increased its dividend for over 50 years.

As a result, UVV stock could be attractive for income investors.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List