Published on June 28th, 2024 by Bob Ciura

Pfizer Inc. (PFE) registered record earnings in 2022, due to a windfall of profits from its coronavirus vaccine and therapies.

But the company’s earnings fell over 70% in 2023. While Pfizer expects earnings to rebound somewhat in 2024, the market remains pessimistic.

Pfizer stock has declined 23% in the past 12 months. The result is that Pfizer stock now has a high dividend yield of 6%.

It is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Big Pharma giant Pfizer.

Business Overview

Pfizer Inc. is a global pharmaceutical company focusing on prescription drugs and vaccines. Its top seven products are Eliquis, Ibrance, Prevnar family, Vyndaqel family, Abrysvo, Xeljanz, and Comirnaty.

Pfizer had revenue of $58.5 billion in 2023.

Pfizer reported Q1 2024 results on May 1st, 2024. Company-wide revenue fell (-19%) to $14.6 billion, and adjusted diluted earnings per share declined 33% to $0.82 versus $1.23 on a year-over-year basis, mostly due to declining COVID-19 related sales.

Source: Investor Presentation

Total sales increased for multiple core products:

- Vyndaqel/ Vyndamax: +66%

- Lobrena: +49%

- Nurtec/Vydura: +7%

- Oxbryta: +18%

- Zavicefta: +8%

- Zithromax: +38%

- Prevnar: +7%

- Xtandi: +23%

- Eliquis: +10%

Additionally, Padcev, Abrysvo, and Tukysa are growing rapidly after their launch.

Pfizer kept revenue guidance at $58.5B – $61.5B and raised adjusted diluted EPS guidance to $2.15 – $2.35 for 2024.

Growth Prospects

As expected, sales of Pfizer’s COVID-19 vaccine (Comirnaty) and the anti-viral drug (Paxlovid) continue to trend downward.

But since 2021, the company has used its COVID cash flow to make pipeline investments. Future growth will come from increasing sales for approved indications, product extensions, research and development, and bolt-on acquisitions.

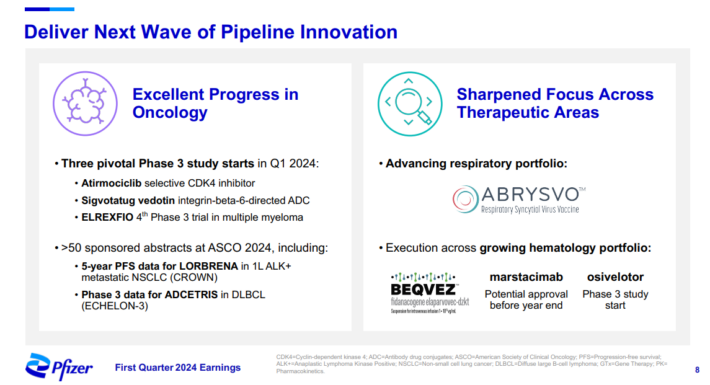

Pfizer has a strong pipeline in oncology, inflammation & immunology, rare diseases, and vaccines.

Source: Investor Presentation

Recent acquisitions include Trillium for its cancer drug candidates, Arena for its autoimmune candidate, ReViral for its RSV programs, Biohaven for its CGRP assets (migraines), GBT for its sickle cell disease treatments, and Seagen for its ADC technology.

At the same time, growth will be mitigated by loss of exclusivity for Eliquis, Ibrance, and other drugs, which will cumulatively weigh on earnings between 2025 and 2028.

Overall, we expect 5% earnings per share growth out to 2029 besides declines from the COVID-19 vaccine and anti-viral therapies.

Competitive Advantages

Pfizer is one of the largest pharmaceutical companies in the world. As such, it has scale in R&D, manufacturing, regulatory affairs, distribution, and marketing around the world.

This gives Pfizer the ability to bring new therapies to market, partner with smaller companies, or acquire entire companies outright. The current pipeline is robust, and some will likely be blockbuster drugs even after attrition.

As a pharmaceutical company, Pfizer is thought to be recession resistant.

Dividend Analysis

Pfizer currently pays a quarterly dividend of $0.42, for an annualized rate of $1.68 per share. This equates to a current dividend yield of 6% for Pfizer stock.

The elevated dividend yield for Pfizer is due primarily to its falling share price. Pfizer has increased its dividend for 15 consecutive years, although annual hikes have been in the 2%-3% range for several years.

While Pfizer is a high yield stock, it is not a high growth stock when it comes to the dividend payout. Still, the dividend payout is covered by underlying earnings.

Based on expected EPS of $2.25 per share for 2024, Pfizer should have a dividend payout ratio near 75% for the year. This is a high payout ratio which does not leave much room for earnings to decline. However, the payout appears secure for now.

Final Thoughts

Pfizer is in a transition phase. COVID-related revenue is declining quickly, and the firm has taken charges and write downs.

As a result, 2023 was a difficult year, but Pfizer’s non-COVID business is growing, and acquisitions should help top line growth.

The company will need to accelerate its earnings growth and pay down debt before it can more aggressively raise the dividend. But in the meantime, Pfizer has a high dividend yield of 6% which makes it an attractive stock for income investors.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Kings: 50+ years of rising dividends

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List