Updated on June 25th, 2024 by Bob Ciura

High-yield stocks can be very helpful to shore up income after retirement.

For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Kohl’s Corporation (KSS) is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we’ll take a look at Kohl’s prospects as a potential investment today, including some of the significant risks it is facing.

Business Overview

Kohl’s operates as a department store-style retailer that covers a wide variety of categories. Its primary offerings are apparel, footwear, accessories, beauty, home goods, electronics, toys, and more.

The company sells a long slate of brands, but much of its apparel offerings are private label, developed in-house to drive better margins. The company also has numerous partnerships with celebrities and other brands.

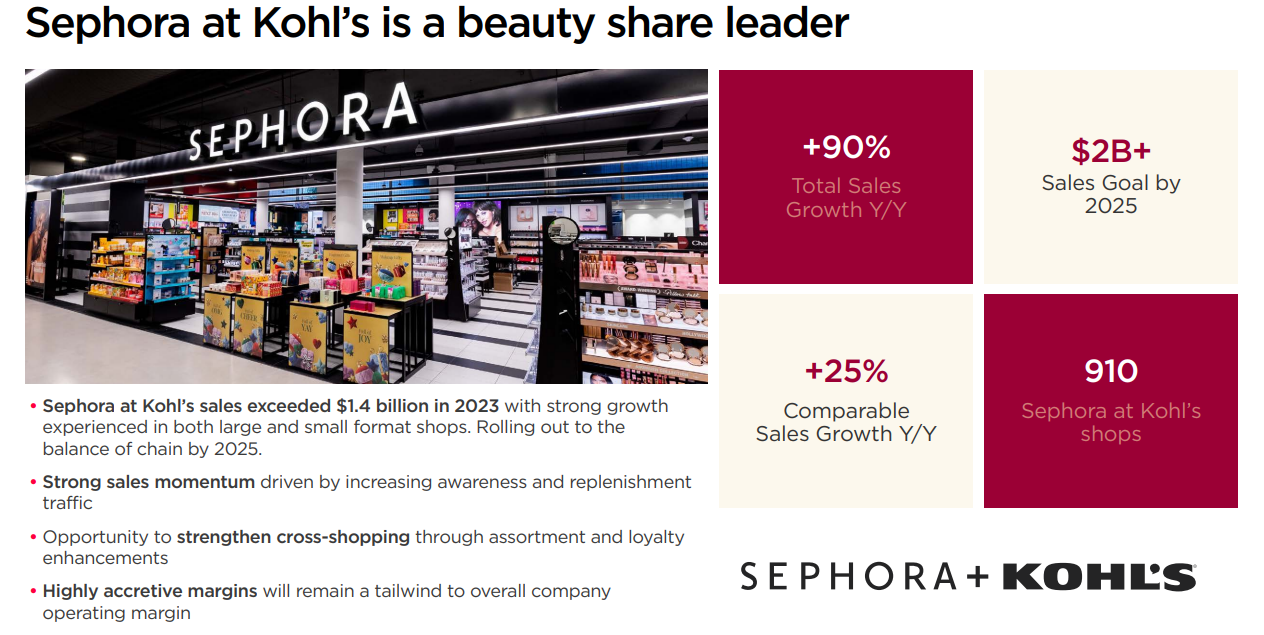

More recently, Kohl’s has rolled out a collaboration with beauty brand Sephora, and Kohl’s is well on its way to having a Sephora shop-in-shop in all of its stores.

Kohl’s has gone through some tumultuous times in recent years, and that resulted in a slight shrinking of the store base, which now stands at just over 1,100.

Source: Investor Presentation

Kohl’s reported first-quarter results on May 30th, 2024, and results were very weak, including a guidance cut. The company posted a loss of $0.24 per share, which was well below analyst estimates, which called for a profit of six cents per share.

Revenue declined over 5% year-over-year to $3.38 billion, which was marginally ahead of estimates. Comparable sales fell 4.4% year-over-year, and operating income fell by more than half.

The company noted comparable sales were negatively impacted by more than 600 basis points compared to the year-ago period from a lack of clearance sales. Management said regular price sales were up, however, and Sephora continues to be a source of strength.

Kohl’s now expects full-year revenue to decline between 2% and 4% for the full year, with comparable sales down 1% to 3%. Operating margin is now expected to be between 3.0% and 3.5% of revenue, and earnings-per-share are expected in a range of $1.25 and $1.85.

Growth Prospects

Kohl’s has a history of inconsistent earnings growth in the past decade. The company has experienced what amounted to boom and bust cycles in earnings over many years.

This not only makes it very difficult to maintain a dividend payment, but also for investors to have some sort of reasonable expectation of what the company might earn in a given year.

For instance, the company lost $1.21 per share in 2020, earned $7.33 in 2021, and is expected to earn $1.55 at the midpoint of management guidance for 2024.

That sort of volatility in earnings is difficult to reconcile for investors, but we think Kohl’s can grow earnings at 8% annually, on average, from its 2024 base.

One key initiative is the company’s partnership with Sephora, which is driving customers to stores and boosting traffic. Kohl’s expects Sephora sales to reach $2 billion by 2025, with comparable sales growth above 25% per year.

Source: Investor Presentation

The company believes it can achieve $2 billion in annual revenue with Sephora, which it says is “highly accretive” to profit margins. This is, in our view, the best chance Kohl’s has to achieve meaningful earnings growth in the years to come.

However, Kohl’s has struggled to maintain comparable sales in recent quarters, and has excess inventory at the moment.

We expect slow revenue growth, but we also note the company’s management team seems confident in their ability to boost operating margins to 7%-8%.

Competitive Advantages

Kohl’s operates in an extremely competitive field, as most goods sold at department stores are widely available to consumers from many other sources, most of which will ship clothing directly to their door.

Kohl’s has attempted to combat this with its off-mall store footprint, as well as its large suite of private label brands.

Compared to other retailers, we believe Kohl’s has a competitive advantage in the way of a well-entrenched store footprint outside of large malls, private-label brands, a large loyalty program, and an Amazon return service.

This is offset somewhat by the competitive nature of the business, but it still allows Kohl’s to stand out.

We believe the Sephora partnership gives Kohl’s its best shot at a sustainable competitive advantage, and early indications are that it is working as intended to drive traffic to stores.

Dividend Analysis

Kohl’s stock currently pays an annualized dividend of $2.00 per share. This equates to a current dividend yield of 8.2% at recent share prices.

Earnings are expected to be $1.55 per share this year at the midpoint of guidance, meaning the dividend payout is underwater when compared to projected earnings.

Kohl’s has competing priorities in terms of capex to build out the Sephora expansion and store remodels, in addition to the company’s stated goals of long-term debt reduction and the cost of the dividend.

If earnings do not increase fairly substantially, Kohl’s will need to make hard choices in terms of how to allocate capital. Share buybacks have already been paused, as management is committed to the dividend.

However, with a forecasted dividend payout ratio significantly above 100% for 2024, the current payout ratio is unsustainable. Either EPS needs to increase, or the dividend will need to be reduced at some point.

Final Thoughts

Kohl’s stock has an attractive high dividend yield above 8%. This is very appealing for income investors, so long as the company can continue to maintain the dividend payout going forward.

However, we note the company is in the midst of a transition, and the company is paying out a higher dividend than it currently generates in EPS.

As a result, shareholders should be aware of the increased execution risk of the turnaround plan, particularly as it pertains to the dividend.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more