Published on July 1st, 2024 by Josh Arnold

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.3%, a product of record highs in stock indices so far in 2024.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is Horizon Bancorp, Inc. (HBNC).

Horizon has an eight-year dividend increase streak, which certainly isn’t the longest streak, but the bank has been able to put in some very strong dividend increases in those eight years.

Business Overview

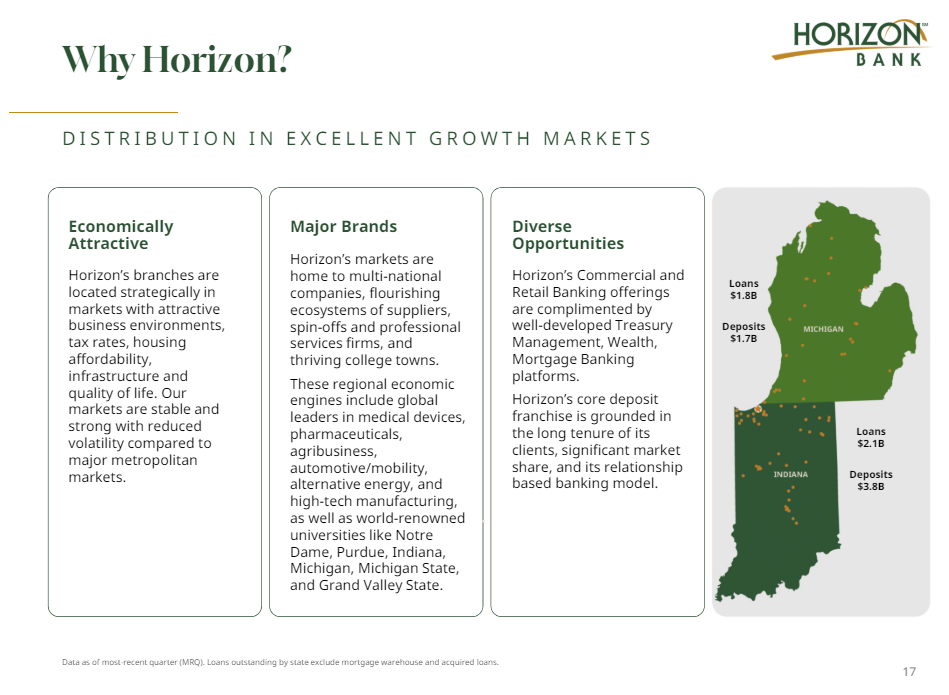

Horizon is a bank holding company for Horizon Bank, which engages in the typical mix of commercial and retail banking services and products.

It offers checking, saving, money market, certificate of deposit, retirement accounts, various types of consumer and commercial loans, insurance, and more.

Horizon operates in Indiana and Michigan, and was founded in 1873.

Source: Investor presentation

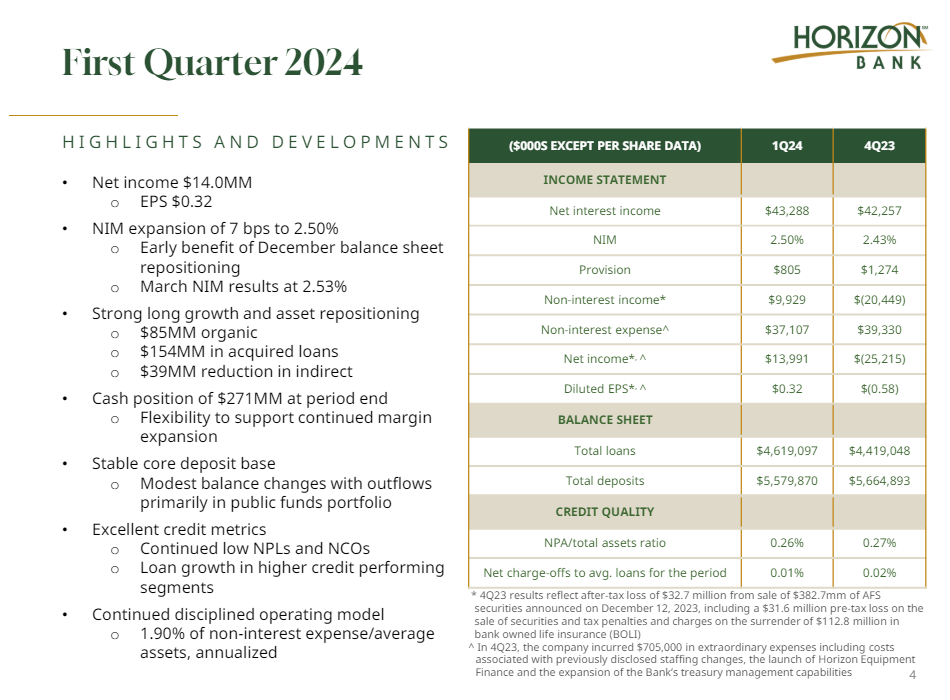

The bank reported first quarter earnings on April 24th, 2024, and results were greatly improved from the prior quarter.

Source: Investor presentation

Horizon saw 32 cents in earnings-per-share, up from a loss of 58 cents in the fourth quarter of 2023. Credit quality remains excellent with just 0.01% net charge-offs for the period, and non-performing assets totaled just 26 basis points of total assets.

Net interest margin was up seven basis points, boosting profitability, but we note that’s a very low NIM figure compared to the rest of our coverage universe in the banking sector.

After Q1 results, we estimate $1.32 in earnings-per-share for this year.

Growth Prospects

Horizon’s earnings growth has been choppy to say the least. The bank has managed to boost earnings over time, but in the past decade, there have been three years of declining earnings, including last year.

We expect to see 8% growth from this year’s base of $1.32, but we believe this is a reversion to the mean given the low base.

In other words, we don’t believe Horizon’s organic growth over the long-term is particularly strong, but we are looking for a return to mean levels nearer to $2 in earnings-per-share we’ve seen in recent years.

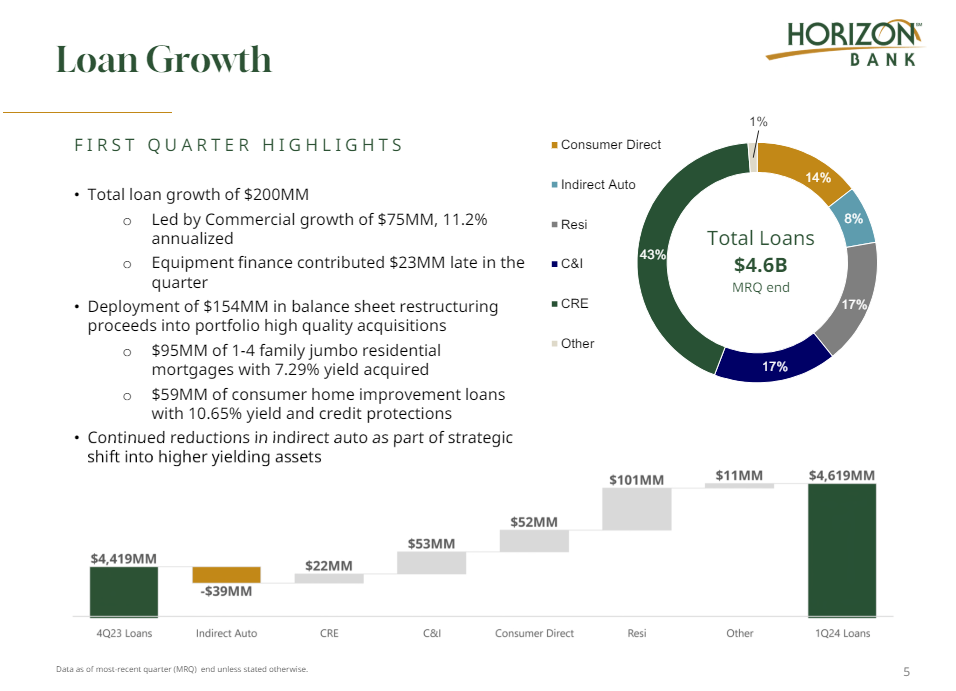

Source: Investor presentation

If this is going to happen, Horizon is likely to rely upon loan growth, which its been concentrating on in recent quarters.

In Q1, the bank grew loans by $200 million, led by commercial loan growth, as well as high-yield consumer loans. While these are riskier, the nearly-11% yield is quite enticing, particularly for a bank with very low NIM like Horizon.

Competitive Advantages & Recession Performance

Like other banks, Horizon really doesn’t have any competitive advantages. We note that all banks generally offer the same set of products and services, so small banks like Horizon rely upon brand loyalty and office location convenience for customer retention. However, we note that these are loose advantages at best, like other banks.

Also like other banks, Horizon is susceptible to recessionary periods, and we note that Horizon’s earnings are likely to suffer during the next period of economic weakness.

To its credit, the company performed relatively strongly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $0.54

- 2009 earnings-per-share: $0.47

- 2010 earnings-per-share: $0.54

Horizon’s excellent credit quality will serve it well during the next recession, but the fact remains that no bank has control over loan demand during recessions, or indeed borrowers that are unable to pay.

With Horizon struggling in recent years to grow earnings during what has been a very strong period of economic growth, we are cautious for the bank during the next recession.

Dividend Analysis

Horizon has managed to boost its dividend by an average of almost 11% annually in the past decade, which is extremely strong by the standards of the banking group.

Horizon’s dividend payout ratio was quite low a decade ago at about a quarter of earnings, but is double that now.

The current dividend of 64 cents per share annually is right at half of earnings, so we believe it’s safe for the foreseeable future. We do think that the ability for Horizon to raise the dividend is somewhat limited, but also believe small increases are in the cards in the coming years.

The yield is very strong at 5.2%, the product of that strong dividend growth, but also a relatively stagnant share price. Overall, we like the yield and the relative safety of the payout, but see the likelihood for large increases to be muted.

Final Thoughts

We see Horizon as a strong income stock, and one with a relatively safe dividend and space for small increases going forward. We note the lack of competitive advantages and recession susceptibility, but the latter is not an issue for the moment.

We encourage investors to watch net interest margin, as that’s a weak point for Horizon at the moment in terms of earnings, which obviously has a direct impact on its ability to raise the dividend.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs

- REITs: List of REITs

- BDCs: List of BDCs