Published on June 25th, 2024 by Josh Arnold

High-yield stocks pay out dividends that are significantly more than market average dividends. As a reference point for how to define high-yield, the S&P 500 is yielding about 1.3%.

We generally see high-yield as stocks with dividend yields of at least 5%, or more than three times that of the broader market.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is Clearway Energy, Inc (CWEN).

Clearway has a 5-year dividend increase streak, which isn’t particularly long, due to a cut that was made in 2019.

However, the dividend has doubled just since 2019, so growth has been excellent. In addition, its yield is about five times that of the S&P 500.

Business Overview

Clearway operates a renewable energy business in the US, with about 6,000 megawatts of installed wind, solar, and other energy generation projects.

In addition, it has a conventional business that contains about 2,500 megawatts of natural gas power generation.

The company was created in 2012, and it produces about $1.4 billion in annual revenue, and the stock trades with a market cap of just over $5 billion.

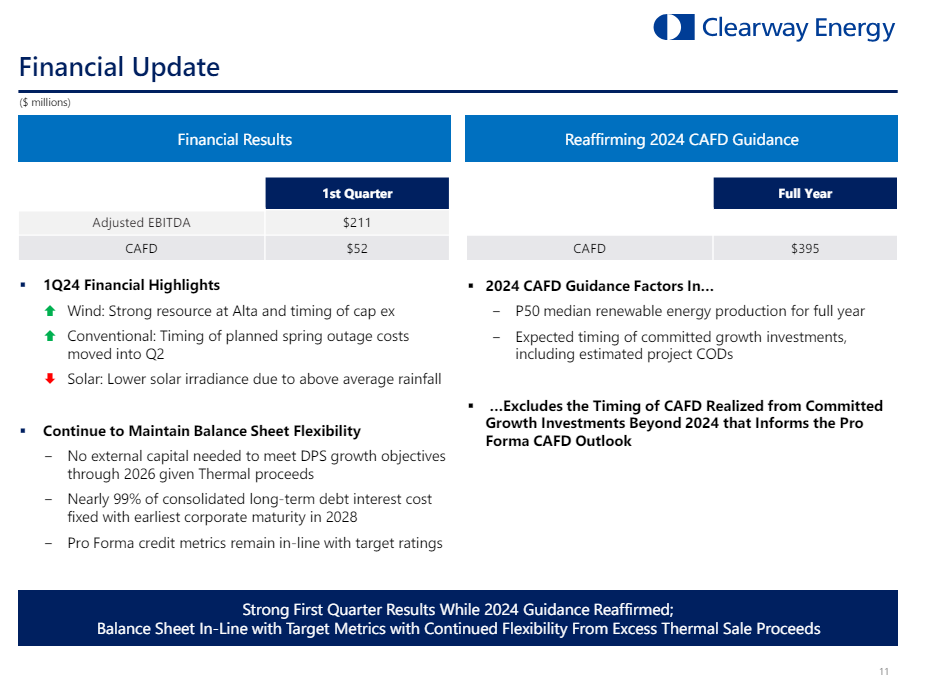

The company posted first quarter earnings on May 9th 2024, with results coming in slightly worse than expected.

Source: Investor presentation

Still, the company reaffirmed its guidance for the full-year of nearly $400 million in cash flow.

Adjusted EBITDA finished the quarter at $211 million, which was down slightly from estimates of $218 million. After Q1 results, we see $3.38 per share in CAFD for this year.

Growth Prospects

Growth for Clearway has been spotty at times, but in general, has moved higher. There is an inherently volatile nature to earnings for a renewable energy business, so Clearway suffers a bit from that.

The natural gas generation business helps to stabilize some, but the renewable business is more than twice the size of the conventional business.

We see 3% growth looking forward, which is quite good given 2024 estimates are for record earnings.

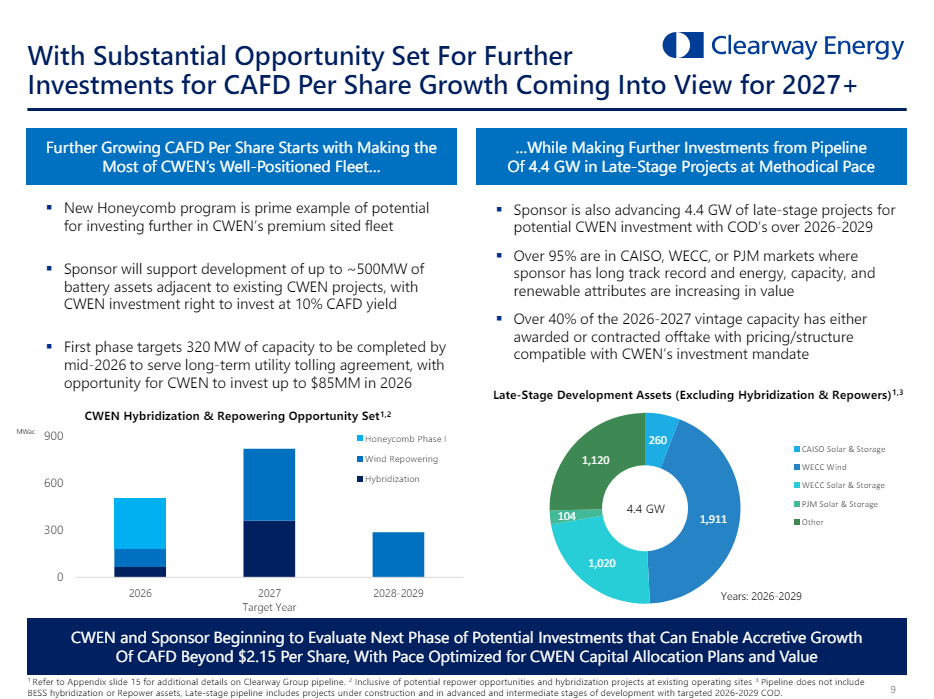

Source: Investor presentation

We see the approximately 30 gigawatts of development in the pipeline as the major driver of growth, in addition to rate increases and M&A activity.

Clearway does grow its share count over time, which will be a headwind to CAFD per-share, but the company has proven it can outpace share count expansion with strong earnings from new projects and acquisitions.

Growth is likely to be choppy, and Clearway may continue to see years of lower earnings going forward.

Competitive Advantages & Recession Performance

In general terms, Clearway doesn’t really have any meaningful competitive advantages. It generates energy and sells it, just like any other utility-type business.

Therefore, scale is the primary way to improve margins over time, which is why the company has so aggressively pursued acquisitions and growth projects over the years, even at the expense of a rising share count.

On the plus side, one other characteristic of energy businesses is that they tend to be quite recession resilient, mainly because discretionary usage of energy is quite low.

While that caps growth on the upside, it can help protect against downside during tough periods.

Clearway wasn’t around during the Great Recession, but CAFD per-share held up quite nicely during the COVID recession.

Here is the company’s CAFD performance during that tough period as an illustration:

- 2019 CAFD per-share: $2.70

- 2020 CAFD per-share: $2.54

- 2021 CAFD per-share: $2.87

We see this performance as reiterating the company’s inherent recession resilience and believe that when the next recession strikes, Clearway will be well positioned.

The need for dividend cuts going forward should be minimal, in part due to this recession resilience.

Dividend Analysis

The company’s current payout is $1.64 per share annually, and on today’s share price, that’s good for a yield of about 6.5%. In a low interest rate environment, yields such as this make Clearway extremely attractive as an income stock.

Given we see $3.38 in CAFD per-share for this year, we believe the dividend is quite safe, with a projected payout ratio of just under half of CAFD.

That should provide sufficient cushion should earnings decline for whatever reason, as well as provide the ability for management to raise the payout for years to come.

One potential headwind for the dividend is the rising share count over time, as that effectively makes the dividend more expensive to pay.

But as we mentioned above, we believe the company’s ability to generate earnings outweighs this headwind.

Final Thoughts

Clearway has boosted its payout for only five years, so its dividend growth longevity could be better.

However, dividend growth has been exemplary in the past five years and we believe there’s ample room to continue to raise the payout in the years to come.

We note some volatility in the renewable energy business is to be expected, but the base of earnings for 2024 is quite high, and there’s the stabilizing factor of the natural gas business.

Overall, we see Clearway as a stock with modest growth prospects, but a very high and sustainable dividend yield.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more