Published January 17th, 2023 by Jonathan Weber

The Williams Companies, Inc. (WMB) is an American energy midstream company that offers a high dividend yield of more than 5% at current prices. Shares aren’t ultra-cheap, but the recession resilience of Williams’ business model makes the company suitable for investors looking for a lower-risk choice.

It is one of the high-yield stocks in our database.

Williams is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of The Williams Companies, Inc.

Business Overview

The Williams Companies, Inc. was founded more than 100 years ago, in 1908. The energy midstream company is headquartered in Tulsa, Oklahoma.

Williams is a natural gas pipeline-focused energy infrastructure company that owns and operates more than 30,000 miles of pipelines. On top of that, Williams also owns adjacent assets, such as natural gas processing facilities, fractionation facilities, natural gas liquid storage facilities, and so on.

Natural gas demand is not very cyclical, as the commodity is primarily used for heating homes, cooking, electricity generation, and some industrial use cases such as fertilizer production. Since heating and cooking aren’t dependent on the strength of the economy, and since electricity demand is also not moving up and down a lot dependent on economic conditions, annual natural gas demand is relatively resilient versus macro shocks.

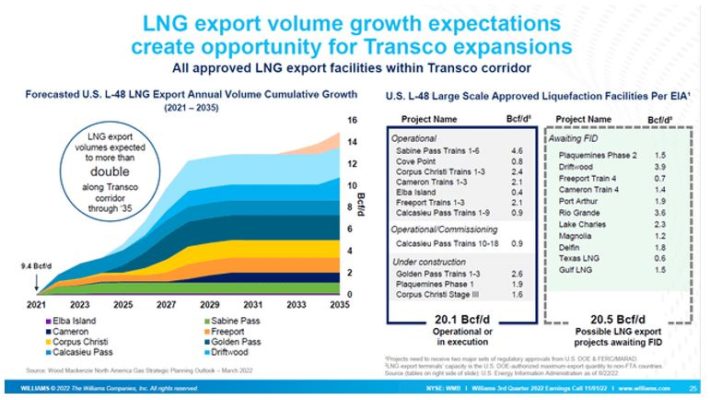

In North America, natural gas demand is in a longer-term growth trend. While the growth rate isn’t especially high, coal-to-gas shifting in electricity generation provides long-term growth potential for natural gas demand. Natural gas demand in North America is also driven by growing LNG (liquified natural gas) export volumes:

Source: Investor Presentation

Countries in Asia and Europe increase their LNG imports, especially since the war in Ukraine started, which made European countries reduce their natural gas imports from Russia. LNG suppliers such as the US will be meeting this additional LNG demand, resulting in higher production volumes in North America. Since this gas has to be exported to the coasts where LNG terminals are located, Williams should be able to fill its pipes with natural gas for a long time.

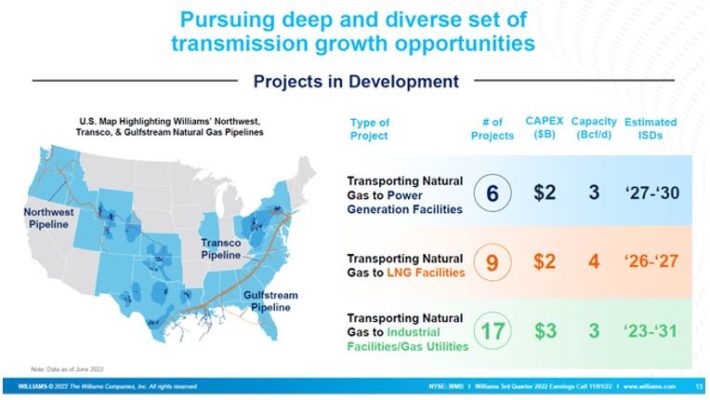

Williams has a large asset footprint in the United States, owning major pipeline assets such as the Gulfstream Pipeline and the Transco Pipeline:

Source: Investor Presentation

The company also owns pipelines connecting the Pacific Northwest to other markets. Recently, Williams expanded its asset footprint further by acquiring MountainWest Natural Gas Transmission from Southwest Gas Holdings in a deal that values the asset at $1.1 billion. This deal, which was announced in December, will expand Williams’ footprint in the Rockies by connecting to Salt Lake City and other markets in that region.

Growth Prospects

The energy midstream industry isn’t growing very quickly. But energy infrastructure companies such as Williams will nevertheless be able to generate some growth going forward, via several measures.

First, Williams can create cash flow growth by investing in new assets. Building out new major pipelines isn’t easy due to tough regulations, but the company is expanding its natural gas gathering and processing footprint, where regulations aren’t as complicated and where approval processes aren’t as time-consuming, relative to (interstate) pipelines.

Williams continues to invest in new gathering facilities in the Haynesville shale play, for example, which is located in Texas and Louisiana. Throughout 2023, Williams’ gathering capacity in the area will grow by around 20%, relative to 2022, which should result in a meaningful revenue uptick this year.

Other investment areas include the Marcellus play in the Appalachia region and a couple of deepwater expansion projects in the Gulf of Mexico where Williams is working for major energy companies such as Chevron.

Williams is also investing in adjacent businesses such as CO2 capturing and natural gas storage facilities. Via these growth investments and regular tuck-in acquisitions such as the aforementioned MountainWest takeover, Williams should be able to generate a solid mid-single digits profit and cash flow-per-share growth rate going forward, we believe.

Competitive Advantages

Energy midstream companies with existing asset footprints benefit from the very harsh regulatory environment today. Getting approvals for new pipelines is a highly complicated and very time-consuming task, which makes these endeavors risky. New major pipeline projects that are comparable to Williams’ Transco Pipeline, for example, are thus not really pursued any longer nowadays. That makes existing pipelines very valuable and hard (or even impossible) to replace. There is thus very little disruption risk for Williams’ pipeline segment.

The gathering and processing business isn’t quite as insulated by regulation, but due to Williams’ established business relationships with customers and due to Williams’ size and scale, it is in an advantaged position versus smaller and newer players nevertheless. Overall, business disruption risks are thus small.

Dividend Analysis

The Williams Companies increased its dividend for the last five years in a row, after cutting the payout in 2016, when a range of energy midstream companies did so as they moved towards a self-funded model.

Williams is currently paying out $1.70 per share, which means that its shares offer a dividend yield of 5.2% at current prices. That’s not among the highest dividend yields in the energy midstream space, but this nevertheless represents a high dividend yield in absolute terms.

On top of that, Williams has delivered compelling dividend growth in recent years. Between 2017 and 2022, Williams increased its payout by 42%, which equates to an annual dividend growth rate of a little more than 7%. In combination with a dividend yield of more than 5%, that is attractive.

Eventually, dividend growth should slow down to the mid-single digits to be more in line with our estimate for Williams’ future earnings and cash flow growth. But even that would still be far from bad, as a 5.2%-yielding dividend that grows by 4% to 5% per year is attractive for dividend growth investors.

At the current level, the dividend is well-covered by Williams’ cash flows. The cash flow payout ratio, based on the expected cash flow-per-share of $3.95 for 2022 (Q4 results have not yet been released), is rather low, at 43%. Williams could thus continue to grow its dividend at a rate that is higher than its business growth for a while.

On top of that, Williams’ dividend looks sufficiently safe for the foreseeable future, based on the not-at-all elevated cash flow payout ratio.

Final Thoughts

The Williams Companies is one of the largest natural gas-focused energy infrastructure players in the United States. It owns some large and more or less irreplaceable pipelines and a steadily growing natural gas gathering and processing business on top of that.

Thanks to a combination of hedges and fee-based contracts, Williams’ results are resilient versus macro shocks, and the company was able to grow its dividend during the pandemic years, despite weak energy markets. The dividend yield is compelling, at a little more than 5%, and future dividend growth can be expected.

On the other hand, Williams has seen its shares climb meaningfully over the last year, unlike some other midstream names, which is why its shares have become more expensive. At around 11x 2022’s cash flows, Williams is not really expensive, but not a bargain, either.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more