Updated on January 18th, 2023 by Nikolaos Sismanis

Vector Group Ltd. (VGR) is a high-yield dividend stock that had to cut its dividend during the COVID-19 pandemic in 2020. Because of that dividend cut, the dividend seems to have become safer now.

Vector Group is one of the stocks in our high-yield stocks database.

Vector is part of our ‘High Dividend 50‘ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

For the next high-yield stocks in this series, we will review a diversified holding company, Vector Group Ltd. (VGR), which currently has a dividend yield of 6.4%.

Business Overview

Vector Group Ltd. is a diversified holding company headquartered in Miami, Florida, with an executive office in Manhattan and tobacco operations in North Carolina. The company is a combination of a cigarette company and a real estate firm. The company owns and controls two tobacco companies: Liggett Group, LLC and Vector Tobacco, Inc. Vector Group also owns New Valley LLC, which is a real estate investment business. The company is also a constituent of the S&P SmallCap 600 Index and the Russell 2000 Index.

Vector Group’s tobacco segment primarily sells discount cigarette brands, including Eagle ’20s, Pyramid, Grand Prix, Liggett Select, and Eve. The company is the 4th largest cigarette manufacturer, in terms of volume, in the United States. The real estate segment New Valley has invested approximately $186 million, as of September 30, 2022, in a broad portfolio of real estate ventures.

Source: Investor Presentation

Vector Group recently reported its Q3 2022 results, with the numbers coming in strong. The company saw a whopping 26.6% increase in net revenue, bringing in $378.0 million compared to $297.9 million the previous year. While earnings per share did decrease to $0.25 from $0.31 due to the discontinued real estate operations, the company still holds strong with commercial real estate properties in its portfolio.

Revenue growth was supported by Vector’s wholesale shipments recording a significant boost, They rose 30.1% to 2.75 billion from 2.11 billion in the same period the previous year. This is even more impressive when you consider that the industry as a whole saw a decline of about -10.7% in shipments.

This led to Vector’s wholesale market share increasing to a solid 5.7%, up from 4.2% the previous year.

The company’s retail performance was just as impressive. Retail shipments saw a 22.78% increase, while the industry experienced a decline of (-8.5%). Thus, Vector’s retail market share also saw a boost, increasing to 5.4% from 4.2% the previous year.

This success can be attributed to the expanded distribution of Vector’s low-price Montego brand. While this investment has had an impact on overall profitability, it has certainly paid off in terms of revenue and market share growth.

Growth Prospects

Future growth prospects for the company will come from an increase in market share in the tobacco industry. This can be obtained through pricing its products more competitively. For example, VRG holds a significant advantage when compared to larger companies such as Altria (MO) and Philip Morris (PM). VGR can sell cigarettes at a discount due to the Master Settlement Agreement (MSA). Essentially, it gives VGR a $0.80 per pack advantage over the larger companies.

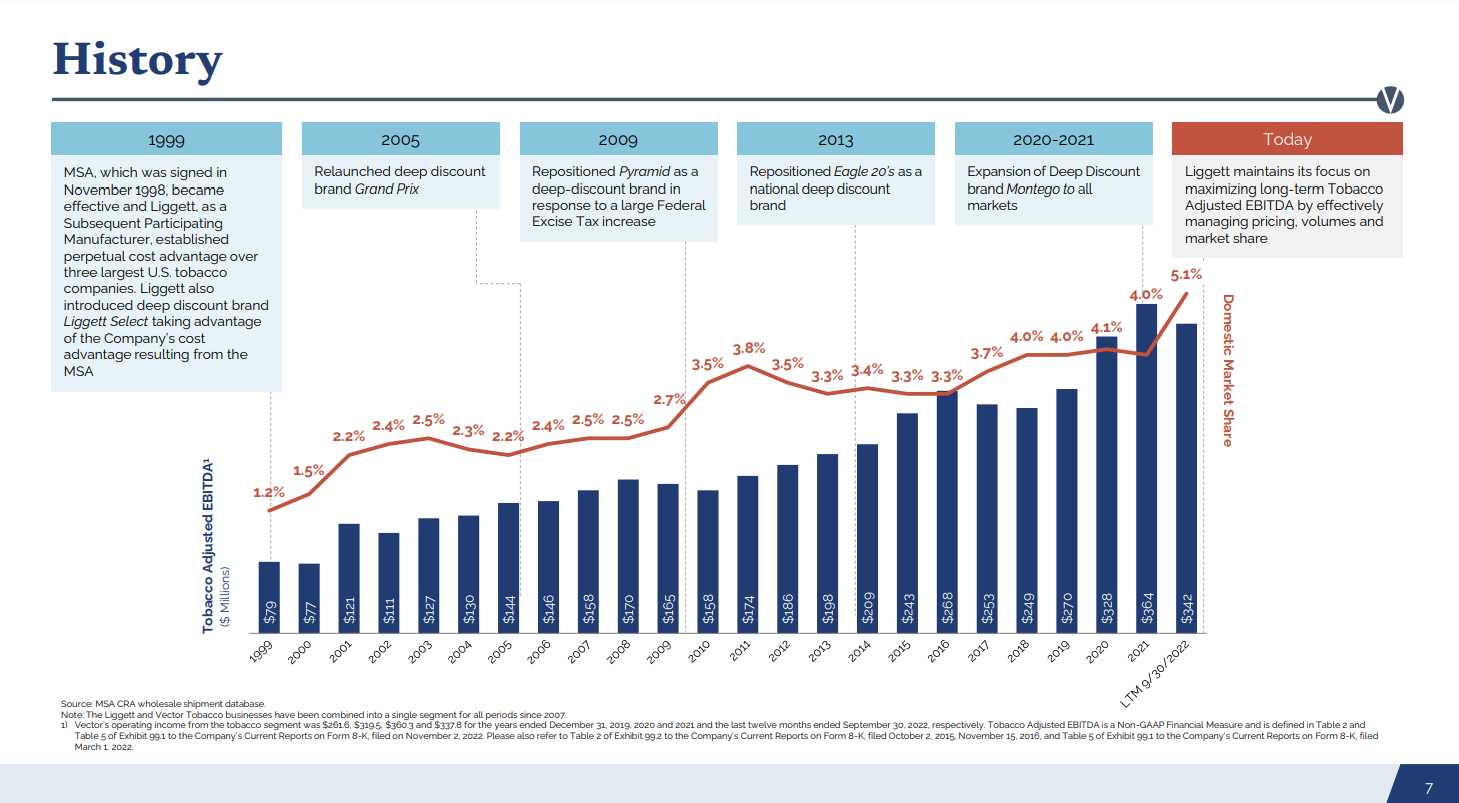

As the bar chart below illustrates, the tobacco segment’s adjusted EBITDA has been gradually growing in line with its market share gains.

Another growth driver would be a better marking campaign for its brands. This will help bring new customers to its cheaper products.

Source: Investor Presentation

Since the tobacco segment is the company’s biggest source of top and bottom line, acquiring more real estate will help drive growth for the company. As mentioned above, the company has approximately $185 million invested, as of September 30, 2022, in a broad portfolio of real estate ventures. This should help increase revenue and profit.

Competitive Advantages & Recession Performance

Vector Group’s main competitive advantage is the tobacco business, which tends to have stable cash flows. However, e-cigarettes represent a threat, and cigarette volumes are declining. Recent market share gains in both wholesale and retail are encouraging, but the company will certainly have a bumpy ride when it comes to maintaining/growing its profitability against the industry’s inherent headwinds.

The New Valley business does not have a competitive advantage as well. This is why it is important that the company continues to invest in new high-quality real estate properties to grow its portfolio.

As for recession performance, the company did fairly well during the 2008-2009 Great Recession.

VGR’s earnings-per-share throughout the Great Recession:

- 2007 earnings-per-share of $0.35

- 2008 earnings-per-share of $0.35 (flat)

- 2009 earnings-per-share of $0.31 (11% decrease)

- 2010 earnings-per-share of $0.37 (17% increase)

As you see, the company did reasonably well during the 2008-2009 Great Recession. Also, the dividend was not cut during this period.

During the COVID-19 pandemic, the company increased earnings from $0.50 per share in 2019 to $0.64 per share in 2020, but the dividend was cut in half to preserve some cash for future investments and improve coverage.

Dividend Analysis

The company pays out a hefty dividend yield of 6.4%. In this section of the article, we will determine if the dividend is safe for dividend and income focused investors. The company had previously raised its dividend from 2004 with a dividend growth rate of 5.4% compounded annually until 2020.

In 2020, as mentioned above, the company had to cut its dividend to allow for free cash flow to breathe easier and preserve some cash. They cut the dividend even though earnings were growing from 2018 to 2020. The regular dividend was cut in half from a quarterly rate of $0.80 to $0.40, while the stock dividend was completely suspended.

However, with the increase in earnings in recent years and because of the dividend cut, the current dividend looks to be a lot safer compared to a few years ago. For example, in 2019, the company earned $0.64 per share while paying a dividend of $0.57 for the year, implying an elevated payout ratio of 89%. In 2021, the dividend payout ratio was 71%, illustrating the result of the previous year’s cut.

We expect the company will make about $0.92 per share in 2022 with an earnings growth rate of 3% for the next five years. Thus, the dividend payout ratio for the year should be about 87%. While that’s not the most comfortable payout ratio on Earth, we think that the dividend should be fairly safe for the foreseeable future.

A threat to the dividend moving forward is the ongoing rise in interest rates, given the company is highly indebted. Interest payments are currently covered by about 3X the company’s operating income, which is not too great of a coverage ratio in case the company needs to refinance at higher rates in the future.

Also, the company has an S&P credit rating of B+, which is not an investment-grade credit rating.

Final Thoughts

Vector’s performance during 2022 has been rather bright, marked by market share gains and improved profitability in its most recent quarter results. With inflation gradually driving consumers to lower-priced brands, Vector’s cigarettes segment is likely to keep performing well in 2023.

That said, the company has failed to improve the balance sheet, which is heavily indebted, despite the recent dividend cut. The overall outlook in the tobacco industry moving forward is not favorable either.

The dividend looks safer than prior to the cut, and income-driven investors can likely benefit from the high dividend yield these days. Still, Vector’s dividend should not be blindly trusted.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more