Updated on January 5th, 2023 by Nikolaos Sismanis

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only 1.5%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Altria is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is Altria Group (MO).

Altria has a 53-year dividend increase streak. It last raised its dividend by 4.4%. A large part of why Altria has been able to raise the dividend for so long is because of its multiple competitive advantages.

Altria currently has a tremendous dividend yield of 8.2%.

Business Overview

Altria sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others. The company also has a large 10% equity stake in Anheuser-Busch InBev (BUD), a 35% stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

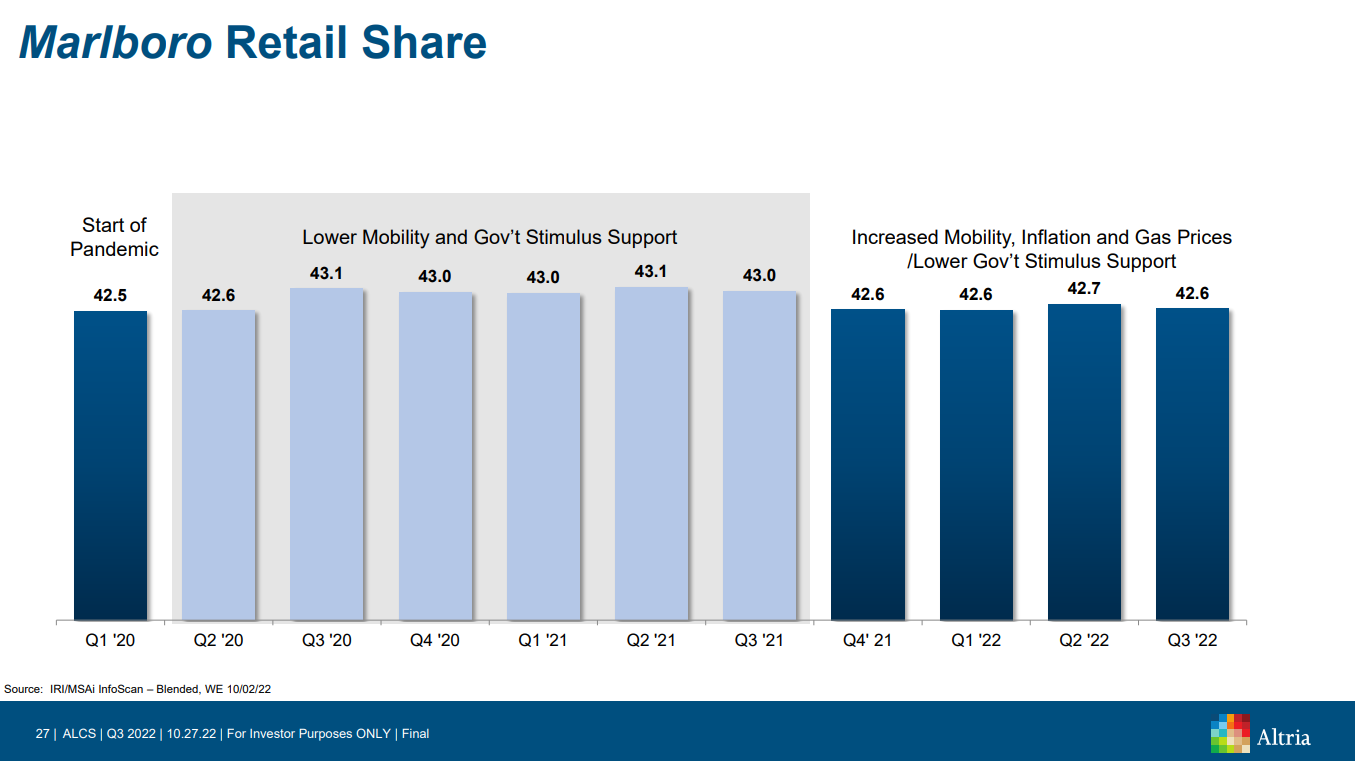

The majority of Altria’s revenue and profit is still made up of smokeable tobacco products. The Marlboro brand still enjoys the leading market share in the U.S. market.

Source: Investor Presentation

Over many decades, this has served the company (and its shareholders) very well. Altria has increased its dividend for 53 years in a row.

While high dividend yields are common with tobacco stocks, no other company in the industry has a dividend increase streak as long as Altria’s.

On October 27th, 2022, Altria reported Q3 results. Smokeable product revenue declined by 1.6% year-over-year. Q3 net revenue was down 3.5% to $6.6 billion, mainly due to the sale of Altria’s former Ste. Michelle wine business back in October 2021 and lower net revenues in the smokeable products segment. These declines were partially offset by higher net revenues in the oral tobacco products segment.

Third-quarter adjusted diluted earnings per share came in at $1.28, 4.9% higher than the same prior-year period.

Share repurchases also added to earnings-per-share growth. The company repurchased 8.5 million shares at an average price of $43.58, totaling $358 million in the most recent quarter. Altria provided full-year adjusted diluted EPS guidance and expects it to be between $4.81 and $4.89.

Growth Prospects

Altria’s future growth faces an uncertain future due to changing consumer habits.

As a major tobacco company, Altria has to face the reality of declining smoking rates in the United States. Each year, there are fewer cigarette smokers in the U.S. As a result, there are fewer customers for tobacco companies like Altria.

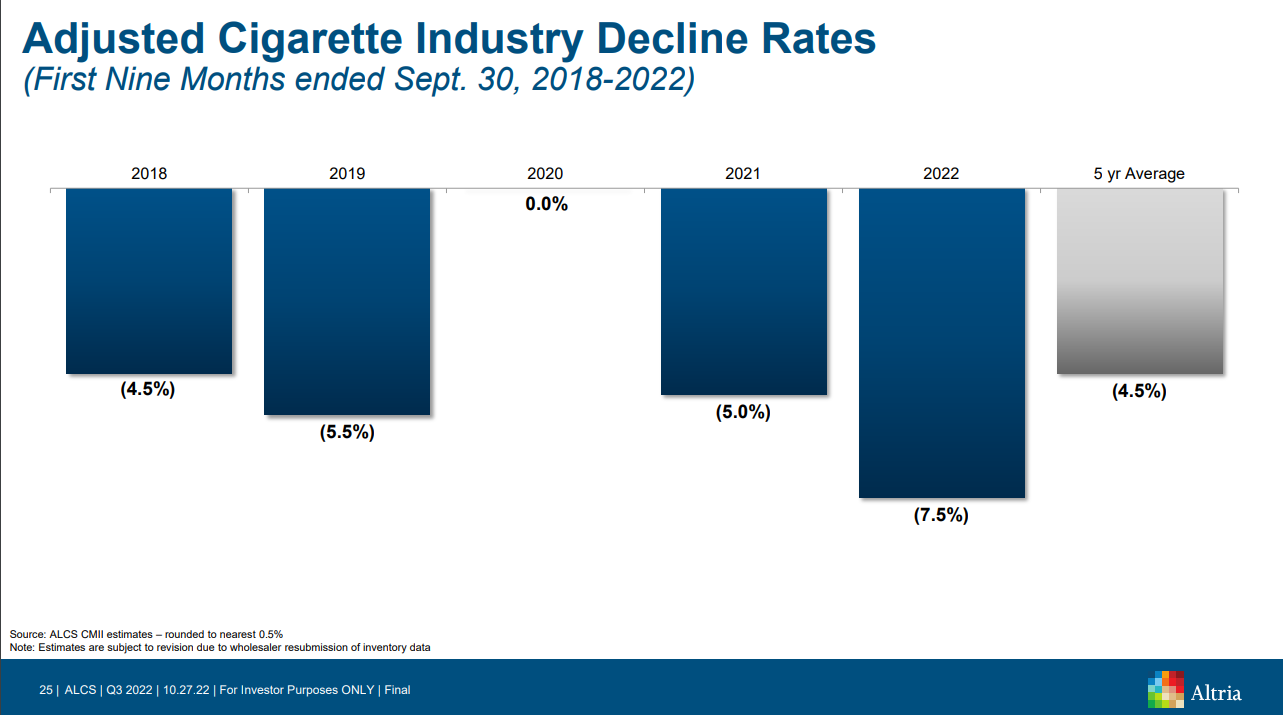

The total industry decline was 5.0% for the full year 2021 and 7.5% in the first nine months of 2022. Altria’s declines reflect the industry-wide challenges.

Source: Investor Presentation

Traditionally, tobacco manufacturers have compensated for falling smoking volumes with price increases. So far, this has worked to offset lost revenue. Altria will continue to raise prices in the years to come.

But still, tobacco companies must adapt to the new environment, and Altria is preparing for a post-cigarette world by investing in the development of non-combustible products.

Altria has invested heavily in non-combustible products, such as its $13 billion investment in e-cigarette leader JUUL and its $1.8 billion investment in Cronos. E-vapor and cannabis could be two major long-term growth catalysts going forward.

In fact, during Q4 2022, Altria entered into an agreement with Philip Morris International, under which the company is to receive $2.7 billion in cash exchange for assigning its exclusive U.S. Commercialization rights to the IQOS System at the end of April 2024.

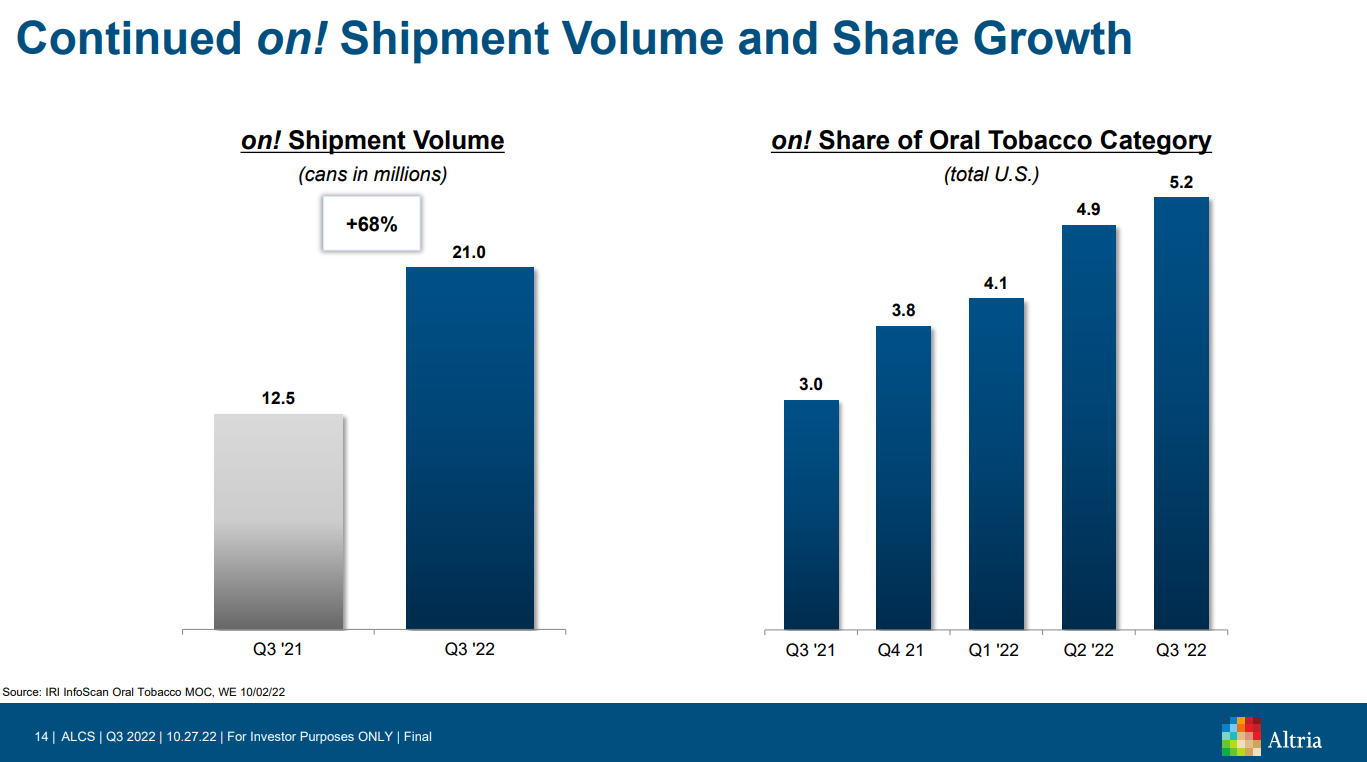

Altria has also acquired Swiss company Burger Söhne Group, to commercialize it’s on! oral nicotine pouches. Oral tobacco is a growth area for Altria, as consumers who have quit smoking increasingly shift to oral tobacco products.

Source: Investor Presentation

The company will also be able to generate earnings-per-share growth through cost reductions and share repurchases. Altria has reduced its share count by around 11.5% during the past decade. Share repurchases are particularly accretive to earnings-per-share these days, as the company is saving tons of cash on future dividends by buying back shares near their current yield levels.

All in all, we expect a ~0.3% compound annual decline in Altria’s earnings-per-share over the next five years. To note, Altria’s investments in Juul and Cronos have cost the company (and shareholders) billions of dollars of losses since the positions were initiated.

Competitive Advantages & Recession Performance

Altria benefits from a multitude of competitive advantages, which have allowed the company to generate steady growth over decades. First off, Altria has tremendous brand loyalty. Retail market share for the flagship Marlboro cigarette brand has remained at over 40% for many years. This allows the company to raise prices every year and still keep its customer base intact.

Also, tobacco manufacturers operate an advantageous business model which does not require intensive capital expenditures. Tobacco is not a capital-intensive business, thanks to economies of scale in production and distribution. This is why Altria generates strong free cash flow each year, even as revenue has stagnated from falling smoking rates.

Altria generated an operating cash flow of $8.3 billion during the past four quarters (Q4 2021 – Q3 2022). Meanwhile, the company spent just $214 million on capital expenditures over the same stretch, resulting in a free cash flow of $8.1 billion which represented 39% of revenues during this period. Such strong free cash flow leaves a great deal of cash available for shareholder returns, debt repayment, and investment in future growth initiatives.

Another benefit of Altria’s business model is that it is highly resistant to recessions. Cigarettes and alcohol sales hold up very well during recessions, which keeps Altria’s profitability and dividend growth intact. The company performed strongly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.66

- 2009 earnings-per-share: $1.76

- 2010 earnings-per-share: $1.87

Altria grew its adjusted earnings-per-share in each year of the Great Recession. This demonstrates the company’s ability to produce steady earnings growth, even when the broader economic environment becomes more challenging.

Earnings-per-share also grew during the pandemic, which is just another example showcasing the resilience of Altria’s business under various tough economic environments and uncertain trading conditions.

Given Altria’s exposure to recession-resistant products, it should hold up very well during the next downturn.

Dividend Analysis

Altria’s current annual dividend is $3.76 per share. With the company shares currently priced at $45.04, Altria has a high yield of 8.2%.

Given Altria’s outlook for 2022, diluted EPS is expected to be $4.80. As a result, the company is expected to pay out 78% of its EPS to shareholders in the form of dividends. Since the company has strong adjusted operating companies income (OCI) margins, low CAPEX, little competition, and a very wide moat, it can afford to pay out a large portion of earnings safely. Altria has a target payout ratio of about 80%, which it anticipates being under.

Altria is a Dividend King, which is an elite group of stocks that have each raised their dividend for 50 consecutive years or more. The company has raised its annual dividend for 53 years in a row. This dividend history exemplifies Altria’s dependability as a dividend growth stock.

The dividend appears to be sustainable, and we estimate the company will continue to grow the dividend at an annual growth rate of about 2% over the medium term.

Additionally, as the corporation repurchases and cancels its common shares (down about 1% per annum over the last nine years), the company as a whole will have fewer shares outstanding to pay the dividends to. This newly freed cash flow can be used to reinvest into the business, make acquisitions, or pay down debt.

The 8.2% yield is very attractive for investors who focus primarily on income. Some shareholders may be happy to hold the stock as long as the company continues to pay the dividend. In this case, most share price declines may be an opportunity to add. Currently, the company appears to be undervalued.

Final Thoughts

Altria’s long company history is a powerful conveyor of its dependability. It has increased its dividend each year for over five decades, a highly impressive performance.

The company faces uncertainty due to the continued decline in smoking rates, but Altria has made investments to deal with the changing consumer landscape by expanding into new products such as heated tobacco, e-vapor, and cannabis. The company will be relying on these segments to fuel continued growth in the years to come. The $2.7 billion deal with Philip Morris regarding the rights to the IQOS System lasting until the end of April 2024 should also help Altria.

Altria’s dividend is below its target payout ratio, and with 53 consecutive years of dividend increases, it is reasonable to expect these increases to continue. The high dividend yield of 8.2% is impressive for a company with Altria’s history, but declining smoking rates weigh on the share price. Still, the stock seems very attractive for income investors.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more