Published on April 14th, 2023 by Jonathan Weber

3M Company (MMM) has increased its dividend for more than 60 years in a row, which makes for an exceptional dividend growth track record. Today, 3M’s dividend yield is at a level that is way higher than the historical norm, at around 5.7%.

The company’s shares have underperformed the broad market over the last year and over a multi-year time frame, primarily due to headwinds from lawsuits that 3M continues to battle.

3M Company is one of the high-yield stocks in our database.

It is also part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the outlook for 3M Company.

Business Overview

3M Company is a diversified industrial company that sells a very wide range of products, from adhesives to personal protection gear. Its product portfolio includes more than 60,000 different products, and the company is active in more than 200 countries around the globe.

This diversification across different product lines and different geographic markets has allowed 3M Company to be more resilient compared to many other industrial companies. 3M has more than 90,000 employees, was founded more than 100 years ago, in 1902, and is headquartered in St. Paul, Minnesota.

The company reported its most recent quarterly results on January 24. The company’s sales came in at $8.1 billion for the quarter, which was down 6% compared to the previous year’s quarter, which was pretty much in line with the Wall Street consensus estimate.

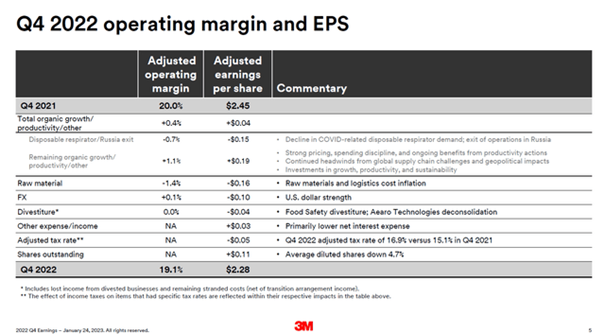

3M Company’s earnings-per-share for the period came in at $2.28, which was slightly less than expected, and which was down from the previous year’s quarter. A multitude of headwinds for economic growth and industrial activity, such as high inflation, rising interest rates, and an energy crisis in Europe, are responsible for the negative business growth that 3M has experienced during the period.

Source: Investor Presentation

Higher raw material prices were the main contributor to the margin decline 3M experienced during the period, while unfavorable currency rate movements also had a negative impact. The US Dollar strengthened versus most currencies in 2022, which made 3M’s ex-US revenue worth less once denominated in US Dollars.

Growth Prospects

3M Company has delivered solid earnings-per-share and business growth over the last decade. Between 2013 and 2022, its earnings-per-share rose from $6.72 to $10.10, which pencils out to an annual growth rate of 5%. That is not spectacular, but very solid for a reliable and established blue chip company such as 3M Company.

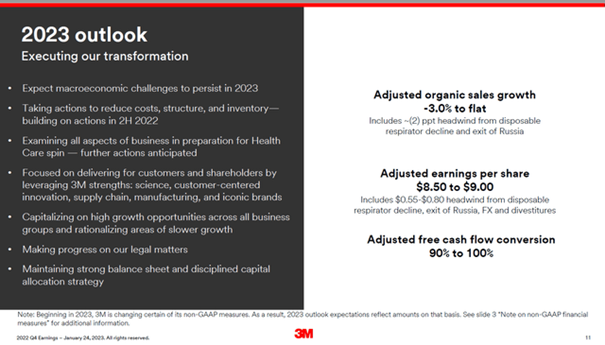

For the current year, 3M expects an earnings-per-share decline, mainly due to a weakening macro-economic environment and a potential recession:

Source: Investor Presentation

In the past, earnings-per-share growth rested on several contributing factors. The company was able to grow its sales volumes over time, by entering new markets and by introducing new products. Price increases also contributed to revenue growth, while 3M Company has also had a history of buying back its own shares.

These buybacks have reduced 3M’s share count over time, by around 20% over the last decade. A declining share count translates into a higher portion of the company’s overall net profit per each remaining share, thus buybacks add to 3M’s earnings-per-share growth in the long run.

In general, the same growth drivers should remain intact going forward, which is why we believe that 3M Company will be able to grow its earnings-per-share at a mid-single digit pace in the future, too. That being said, the lawsuits and their unknown impact of them add some uncertainty about 3M’s future profitability.

Competitive Advantages

3M’s competitive advantages are mostly centered around its product portfolio, patent portfolio, and successful research and development efforts.

The company’s product portfolio is very wide and diversified, which means that 3M is not very vulnerable to weaknesses in single end markets, as that can be balanced out by the results from other product categories.

3M invests a mid-single digit percentage of its annual sales into R&D, which has historically paid off. Around 30% of 3M’s sales have been made with products that didn’t exist 5 years ago, which showcases 3M’s success in developing and commercializing new products. There is no guarantee that this will continue in the future, but the R&D culture seems to be strong at 3M, which should be advantageous.

3M has not been invulnerable during recessions, but it has shown solid resilience, especially compared to many other industrial companies. The company remained profitable during the Great Recession and during the pandemic, when earnings-per-share declined by just 4% in the 2019-2020 time frame, before hitting a new record high in 2021. The above-average resilience during adverse economic environments should be maintained in the future, too.

Dividend Analysis

3M Company has an outstanding dividend growth track record, having raised its dividend for 64 years in a row. Over the last decade, dividend growth averaged 10% per year, which is pretty strong.

Due to the fact that 3M’s dividend growth rate was roughly twice as high as its earnings-per-share growth rate over the last decade, 3M’s dividend payout ratio has risen considerably in that time frame. Based on current earnings-per-share estimates, the 2023 dividend payout ratio is 68%, which is at the upper end of the historic range.

This will likely not cause a dividend cut, as the dividend is still covered easily, but 3M will likely not deliver a similar dividend growth rate compared to the past. Instead, it seems likely that 3M will try to bring down its dividend payout ratio over time, which is why dividend growth in the coming years could be subdued. Thanks to a high dividend yield of 5.7%, that will not be a disaster, however.

Final Thoughts

3M Company has been a bad performer on a share price and total return basis over the last year and the last five years. This was mostly the result of multiple compression, however, and not the result of declining profits or dividends.

Lawsuits related to so-called “forever chemicals” and (possibly) faulty hearing protection equipment have introduced uncertainties, which is why 3M has seen its valuation compress.

Today, 3M Company trades at a clear discount compared to how the company was valued in the past, which provides for some multiple expansion potential going forward.

We believe that the company could deliver double-digit annual returns over the next five years, thanks to a combination of a high dividend yield, some earnings growth potential, and some multiple expansion potential.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more