Updated on January 18th, 2023 by Nathan Parsh

Most investors hesitate to invest in high-yield stocks, fearing that a dividend cut may be just around the corner. Indeed, in some cases, a high yield signals that the dividend is at risk of being cut whenever the next downturn shows up.

However, some stocks offer a generous dividends with a wide margin of safety.

With this in mind, we created a complete list of high-dividend stocks.

Dow is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Dow Inc. (DOW) is currently offering a well-covered 4.8% dividend. This article will analyze Dow’s business, growth prospects, and dividend safety.

Business Overview

Dow Inc. is a standalone company that was spun off from its former parent, DowDuPont, in 2019. DowDuPont has broken into three publicly traded, standalone companies, with the former Materials Science business being the new Dow.

Due to its sensitivity to the underlying economic conditions, Dow was hurt by the coronavirus crisis in 2020 and saw its earnings per share plunge 52% in that year. However, thanks to the strong recovery of the global economy from the pandemic, Dow has fully recovered from the health crisis.

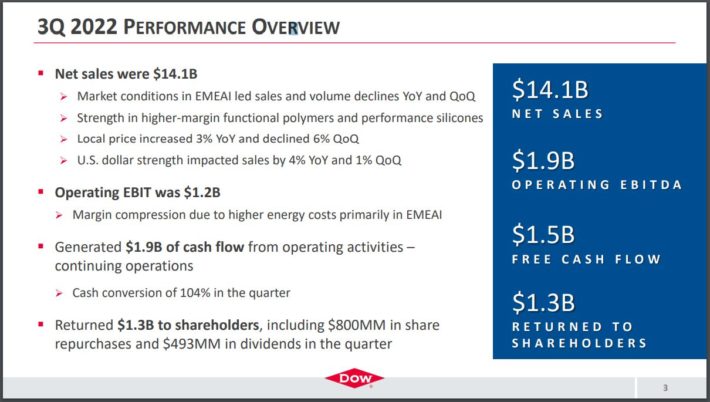

The company reported earnings results on October 20th, 2022.

Source: Investor Presentation

In the third quarter of 2022, revenue fell 5% to $14.1 billion but was $1.1 billion above expectations.

Revenue was down 5% year-over-year in the largest segment, Packaging and Specialty Plastics, as pricing gains in polymers were more than offset by lower polyethylene prices and reduced demand for packaging in Europe. Industrial Intermediates & Infrastructure revenue was 9% lower, due primarily to pricing declines and higher currency translation costs. Performance Materials & Coatings was up 5% year-over-year as local pricing gains more than offset declining demand.

Net income totaled $760 million, or $1.02 per share, but this was down sharply from $1.71 billion, or $2.23 per share, in the prior year. Earnings-per-share results were also slightly below estimates. Thanks to higher energy costs, gross margins fell to 12.3% from 21.7%.

Growth Prospects

Dow began trading as a standalone company only in 2019. As a result, it is challenging to forecast the company’s future results.

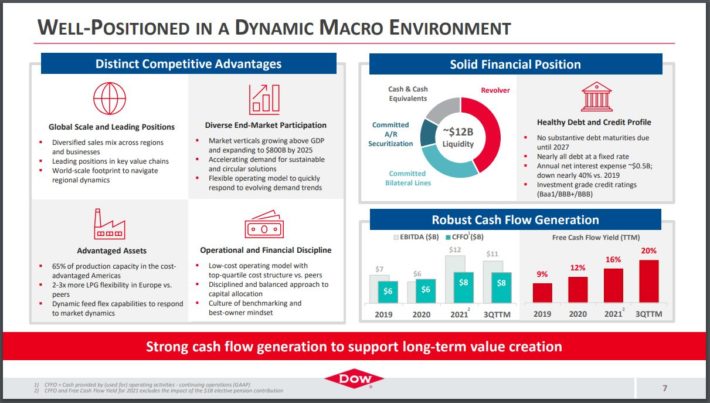

Dow expects the demand for its products to remain solid for the foreseeable future thanks to the strong financial condition of most consumers, who have accumulated cash during the pandemic, assisted by the immense fiscal stimulus packages offered by governments.

Source: Investor Presentation

The company also expects to benefit from increased investment in infrastructure and the secular growth of electric vehicles.

However, in 2021, Dow posted blowout earnings thanks to the strong recovery of the global economy from the pandemic, which resulted in pent-up demand, and the company implemented material price hikes.

Given these extraordinary tailwinds, we believe that Dow will not be able to match its performance in 2021 anytime soon. Demand for its products will likely remain robust for the foreseeable future, but the tailwind from pent-up demand will begin to fade at some point.

Moreover, the company is not likely to keep raising its prices in the near term. Therefore, given the non-recurring factors behind the stellar earnings per share of $8.98 in 2021, we expect the company to post earnings per share of around $6.40 this year.

Competitive Advantages

The long history of Dow as a component of DowDuPont has helped the company build almost unparalleled expertise in its business. This expertise, combined with the strong brand of Dow constitutes a significant competitive advantage.

On the other hand, due to its short history as a standalone company, Dow has hardly been tested under adverse economic conditions. The company proved highly vulnerable to the pandemic, as its earnings plunged 52% in 2020, but it is likely to prove somewhat more resilient to normal recessions, i.e., without the impact of lockdowns.

Nevertheless, investors should be aware that Dow is sensitive to the underlying economic growth and is not immune to recessions.

Dividend Analysis

Dow currently offers an above-average dividend yield of 4.8%, with a healthy payout ratio of 44%. In addition, the company has a solid balance sheet, with long-term debt of just $13 billion, which is only 32% of the market capitalization of the stock and about 3 times the earnings of the company expected this year. Therefore, the dividend of Dow has a solid margin of safety.

On the other hand, it is important to note that Dow has paid the same dividend for 15 consecutive quarters. In other words, Dow has not raised its dividend since its formation as a standalone company.

Given the stock’s high yield, management does not seem interested in raising the payout anytime soon. The absence of dividend growth is a red flag for income-oriented investors, particularly given the 40-year high inflation prevailing right now.

Overall, we believe that the dividend of Dow is safe for the foreseeable future, but income-oriented investors should probably wait for a modest correction of the stock to lock in a higher dividend yield and enhance their future returns.

Final Thoughts

Dow has recovered from the coronavirus crisis, but we believe the company will struggle to top its post-pandemic high for earnings-per-share. Inflationary pressures are also weighing on the company.

The stock is offering a nearly 5% dividend yield that looks to be quite safe. That said, some investors might see the absence of dividend growth since becoming an independent company as a concern.

In addition, the short history of Dow as a standalone company makes it challenging to forecast its future performance. As a result, we need a wider margin of safety to recommend purchasing this stock.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more