Published on January 10th, 2023 by Josh Arnold

Generally, stocks that haven’t been public for very long tend not to have the best dividend yields. After all, newly public companies are often unprofitable, or early in their growth plan and are, therefore, unable or unwilling to return cash to shareholders via dividends. However, not all relatively recent additions to the stock market are created equal.

One example of a company that has only been public for a handful of years, but has a tremendously high yield, is RV retailer Camping World (CWH). The company went public in 2016, but has aggressively raised its dividend in recent years. Today, it has a yield of a staggering 10%, which is roughly six times that of the S&P 500.

Camping World’s dividend increase streak stands at just three years, but few stocks can match its double-digit payout to shareholders. That massive yield is more than good enough to land Camping world on our list of high-yield stocks.

Camping World is part of our ‘High Dividend 50‘ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

This list contains about 200 stocks with yields of at least 5%, meaning they all yield at least three times that of the S&P 500.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we’ll take a deep look at Camping World’s prospects as an investment today, including that highly attractive yield.

Business Overview

Camping World is a retailer of recreational vehicles, related products, and various RV services. It operates in two segments: Good Sam Services and Plans, and RV and Outdoor Retail. Through these segments, the company offers a deep and wide portfolio of services, protection plans, and other resources related to RVs. In addition it offers products like vehicle service contracts, roadside assistance, insurance programs, magazines, and of course, new and used RV vehicle sales. Camping World has a network of dealers and retail locations in 40 states in the U.S.

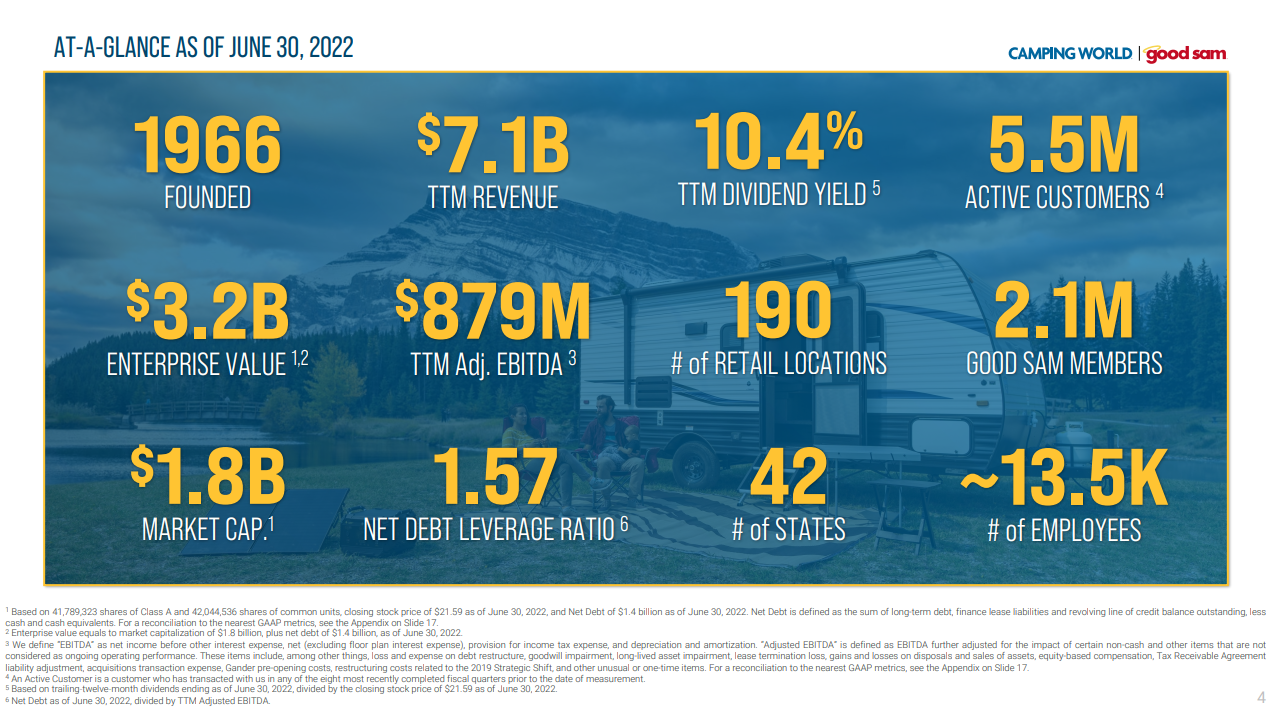

The company has a market cap of $2.1 billion, generates about $7 billion in annual revenue, and traces its roots to 1966.

Source: Investor presentation, page 4

The company boasts over 2 million members in its Good Sam business, which provide high-margin, recurring revenue to help compliment its more cyclical RV business.

Camping World reported its most recent earnings on November 1st, 2022. Adjusted earnings came in below expectations, while revenue was better than expected. Revenue was $1.9 billion for the third quarter, a decline of $61 million, or 3.2% year-over-year, which was driven by a $46 million reduction in product revenue. This was largely from product categories the company exited in 2021, with fishing, hunting, and apparel among them.

Used vehicle revenue was $526 million, a record for the third quarter, and up 1.2%, or $6.4 million. New vehicle revenue was off $30 million, or 3.5%, year-over-year. Used vehicle unit sales were 14,460 for the third quarter, an increase of more than 6% year-over-year. Same store used vehicle unit sales were up 2%, while same store new vehicle unit sales were down 7.2%.

Gross profit was $594 million, down about 14% year-over-year, as gross margin declined 408 basis points to 32% of revenue. This was driven primarily by the higher cost of new vehicles. Used vehicle gross margin declined less than new vehicle margins.

Adjusted EBITDA was $173 million, a decline of about 40% from the year-ago period. Net income was $103 million, a 46% reduction from the year-ago period. On a per-share basis, earnings were $1.07, down from $1.98 a year ago.

New and used vehicle inventories were $1.6 billion, an increase of $491 million year-over-year. The company attributed this inventory growth to restocking to normalized levels of new vehicles, as well as the strategic growth of the used vehicle business.

Following Q3 results, we see $5.00 in earnings-per-share for this year.

Growth Prospects

Camping World has experienced very choppy earnings in its short history as a public company, as one would probably expect from an RV dealer. RV sales tend to be extremely cyclical, as they are a luxury and not a need.

However, Camping World had a blockbuster earnings performance into the COVID recession, posting record earnings in 2020, and then nearly doubling that in 2021. We see 2022 final results as somewhat lower than 2021’s, as we estimate $5.00 for 2022 against $6.07 in 2021.

Looking forward, the company has high levels of inventory, and margins on new RVs are falling. However, Camping World has been focusing more heavily on the higher-margin used RV business in recent years, as well as exiting unprofitable business lines. These actions have helped preserve margins and we expect this margin optimization to continue for years to come.

However, with RV unit sales industrywide expected to fall by double-digits in 2023, we think Camping World will see -5% earnings contraction on average in the coming years.

Competitive Advantages

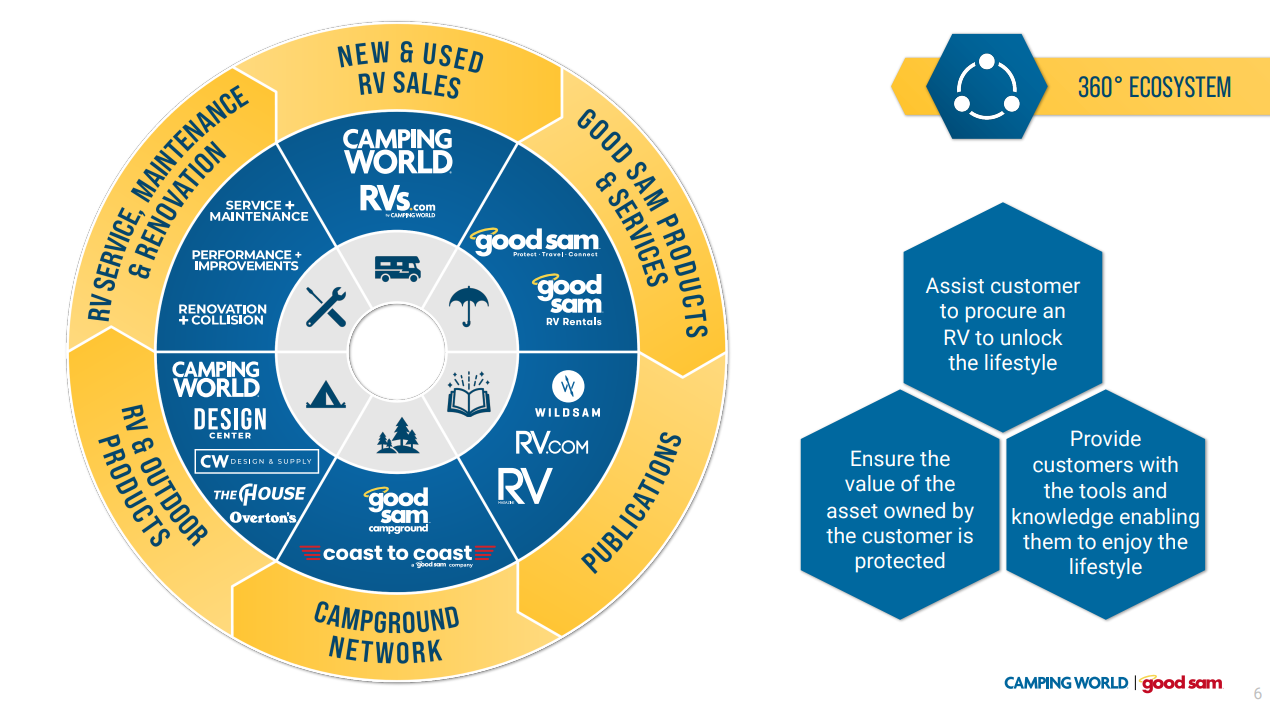

Camping World operates in a highly fragmented, and highly competitive sector of retail. The company sells largely the same vehicles as any other RV dealer. However, Camping World has built an ecosystem around the sale of RVs that has created a competitive advantage for it.

Source: Investor presentation, page 6

The company’s Good Sam business, and the retail shops and service bays attached to dealerships collectively provide just about any product or service an RV shopper could need. That’s the advantage Camping World has over other dealers; it is a true one-stop shopping experience for all things RV. The company continues to acquire brands that fit into its portfolio, and hone the branding of its portfolio to help drive revenue above and beyond the sale of vehicles.

Dividend Analysis

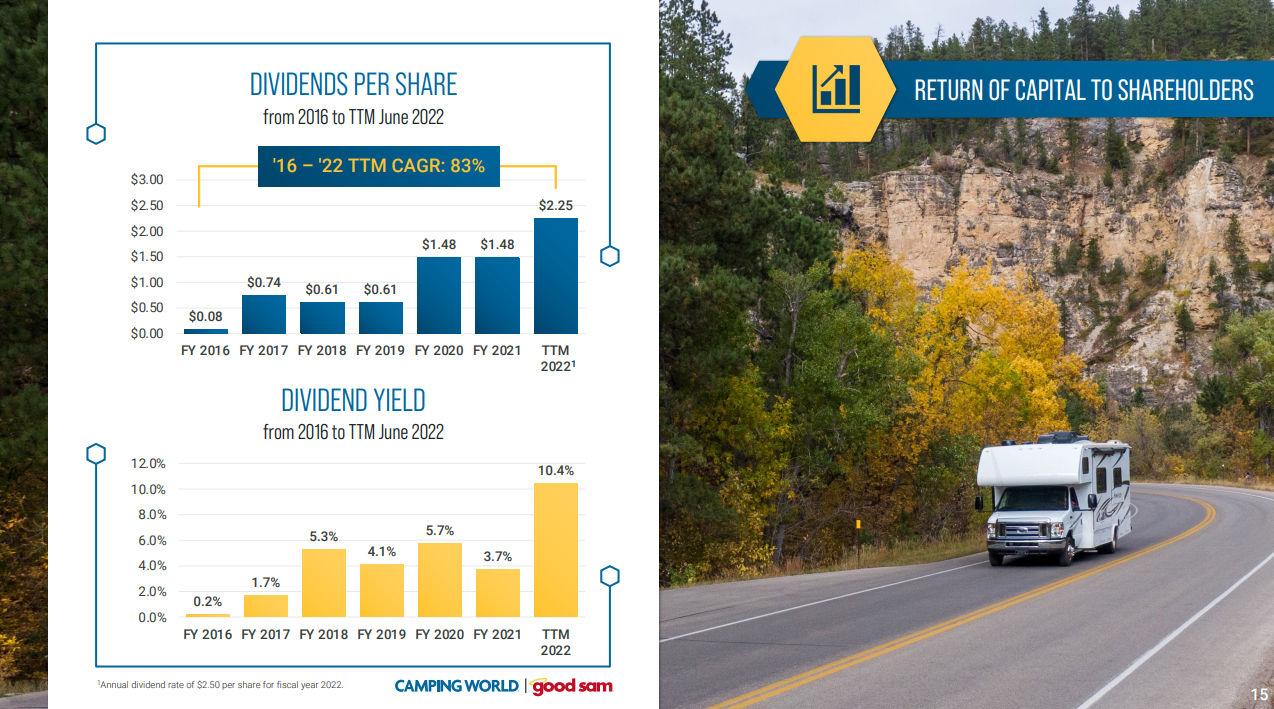

Camping World has paid dividends since shortly after it went public in 2016. The initial payment was eight cents, and that has been raised to the current value of 62.5 cents quarterly, good for a $2.50 annualized dividend payment today. That is extraordinary growth for such a short period of time, and we believe the dividend is reasonably safe today.

Source: Investor presentation, page 15

With earnings expected to be $5.00 this year, the payout ratio should be right at half of earnings. We are currently estimating a flat dividend from the current level for the foreseeable future, as we don’t believe there is room to raise it further. In addition, the yield is already 10%, so shareholders at this point are more concerned with sustaining the dividend rather than raising it.

We note Camping World does have $1.4 billion in long-term debt on the balance sheet. It pays about $100 million annually to service its debt, so the cost is significant. However, interest costs are well covered today, as is the dividend payment, so we do not anticipate a near-term dividend cut.

Final Thoughts

We see Camping World as having a tough road ahead in terms of earnings growth, but we note that is primarily from the bumper earnings produced in the past two years. The company has a reasonably high level of debt, but interest is well covered at the moment. The dividend is extraordinary at 10%, but is only half of earnings due to the extremely low valuation the stock has today. We believe the payout to be reasonably safe today.

Camping World’s share price has declined by 40% in the past five years, against a similarly-sized gain for the S&P 500. However, we see the stock as an attractive income stock today, noting that it is likely to continue to be quite volatile.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest-Yielding BDCs

- 20 Highest-Yielding MLPs

- 20 Highest Yielding Dividend Kings

- 20 Best Ultra High-Dividend Stocks

- 20 High-Dividend Stocks Under $10

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 20 Highest-Yielding Small Cap Dividend Stocks

- 20 Safe High Dividend Blue-Chip Stocks With Low Volatility

- 12 Long-Term High-Dividend Stocks To Buy And Hold For Decades

- 12 Consistently High Paying Dividend Stocks With Growth Potential

- 10 Super High Dividend REITs

- 10 Highest Yielding Dividend Champions

- 10 Highest Yielding Dow 30 Stocks | Dogs Of The Dow

- 10 High-Yield Dividend Stocks Trading Below Book Value

- 9 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stock: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more