Updated on February 25th, 2025 by Bob Ciura

The “Dogs of the Dow” investing strategy is a very simple way for investors to achieve diversification and income in their portfolios while remaining in the sphere of more conservative blue chip stocks.

The strategy consists of investing in the 10 highest-yielding stocks in the Dow Jones Industrial Average, an index of 30 U.S. stocks.

High dividend stocks are stocks with a dividend yield well in excess of the market average dividend yield of ~1.3%. With that in mind, we have created a free list of over 200 high dividend stocks with dividend yields above 5%.

You can download your copy of the high dividend stocks list below:

The “Dogs of the Dow” strategy produces above-average income and concentrates on stocks that typically trade at lower valuations relative to the rest of the DJIA.

Given that the DJIA represents some of the largest companies in the world, its “dogs” are typically companies with strong track records that have hit temporary problems.

This is a great and simple strategy for value investors looking to purchase good businesses that are currently out of favor.

To implement this strategy, take the amount of money you have to invest and then divide it equally among the 10 highest-yielding stocks in the DJIA.

Hold these stocks for a whole year and then at the end of 12 months, look at the 30 Dow stocks again and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the process. In addition to the simplicity and focus on quality, value, and income that this strategy generates, it also improves discipline by preventing excessive emotion-driven trading.

It also encourages investors to reap the tax benefits from holding positions for at least one year before selling, thereby being taxed at the long-term capital gains tax rate instead of the short-term rate.

The 2025 Dogs of the Dow

The list of the 2024 Dogs of the Dow is below, along with the current dividend yield of the top-ten yielding DJIA stocks. Click on a company’s name to jump directly to analysis on that company.

- Dog of the Dow #10: Procter & Gamble (PG)

- Dog of the Dow #9: Home Depot (HD)

- Dog of the Dow #8: International Business Machines (IBM)

- Dog of the Dow #7: Cisco Systems (CSCO)

- Dog of the Dow #6: Coca-Cola (KO)

- Dog of the Dow #5: Johnson & Johnson (JNJ)

- Dog of the Dow #4: Amgen Inc. (AMGN)

- Dog of the Dow #3: Merck & Company (MRK)

- Dog of the Dow #2: Chevron Corporation (CVX)

- Dog of the Dow #1: Verizon Communications (VZ)

- Final Thoughts

Dog of the Dow #10: Procter & Gamble (PG)

- Dividend Yield: 2.3%

Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and many more.

Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 68 consecutive years – one of the longest active streaks of any company.

In late January, Procter & Gamble reported (1/22/25) financial results for the second quarter of fiscal 2025 (its fiscal year ends June 30th).

Source: Investor Presentation

Sales and its organic sales grew 2% and 3%, respectively, over last year’s second quarter, primarily thanks to 2% volume growth. Core earnings-per-share grew 2%, from $1.84 to $1.88, beating the analysts’ consensus by $0.02.

Procter & Gamble reaffirmed its guidance for 3%-5% growth of organic sales and 5%-7% growth of earnings-per-share in fiscal 2025.

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

Dog of the Dow #9: Home Depot (HD)

- Dividend Yield: 2.3%

Home Depot was founded in 1978 and since that time has grown into a juggernaut home improvement retailer with over 2,300 stores in the US, Canada and Mexico that generate around $153 billion in annual revenue.

Home Depot reported third quarter 2024 results on November 12th, 2024. The company reported sales of $40.2 billion, up 6.6% year-over-year.

However, comparable sales in the quarter decreased 1.3%. Net earnings equaled $3.6 billion, or $3.67 per share, compared to $3.8 billion, or $3.81 per share in Q3 2023. Adjusted EPS was $3.78.

The company spent $649 million on common stock repurchases year-to-date, compared to $6.5 billion in the prior year. Average ticket declined 0.8% compared to last year, from $89.36 to $88.65.

Additionally, sales per retail square foot decreased 2.1% from $595.71 to $582.97.

Click here to download our most recent Sure Analysis report on HD (preview of page 1 of 3 shown below):

Dog of the Dow #8: International Business Machines (IBM)

- Dividend Yield: 2.5%

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services.

Its focus is running mission-critical systems for large, multi-national customers and governments. IBM typically provides end-to-end solutions.

The company now has four business segments: Software, Consulting, Infrastructure, and Financing.

IBM reported results for Q4 2024 on January 29th, 2025. Company-wide revenue rose 2% in constant currency while diluted adjusted earnings per share climbed 1% year-over-year.

Software revenue increased 11% year-over-year due to 12% growth in Hybrid Platform & Solutions and an 11% increase in Transaction Processing. Revenue was up 17% for RedHat, 16% for Automation, 5% for Data & AI, and 5% for Security.

Click here to download our most recent Sure Analysis report on International Business Machines (IBM) (preview of page 1 of 3 shown below):

Dog of the Dow #7: Cisco Systems (CSCO)

- Dividend Yield: 2.5%

Cisco Systems is the global leader in high performance computer networking systems. The company’s routers and switches allow networks around the world to connect to each other through the internet. Cisco also offers data center, cloud, and security products.

On February 12th, 2025, Cisco announced a 2.5% dividend increase in the quarterly payment to $0.41. That same day, Cisco announced results for the second quarter of fiscal year 2025 for the period ending January 25th, 2025.

For the quarter, revenue grew 9.4% to $13.99 billion, which beat estimates by $120 million. Adjusted earnings-per-share of $0.94 compared favorably to adjusted earnings-per-share of $0.87 in the prior year and was $0.03 ahead of expectations.

Excluding the company’s recent acquisition of Splunk, total revenue grew 11% for the quarter. Networking fell 3% while Security grew 117%, Observability was up 47%, and Collaboration improved 1%. By region, the Americas increased 9%, Europe/Middle East/Africa was higher by 11%, and Asia-Pacific/Japan/China was up 8%.

Click here to download our most recent Sure Analysis report on Cisco Systems (CSCO) (preview of page 1 of 3 shown below):

Dog of the Dow #6: Coca-Cola (KO)

- Dividend Yield: 2.9%

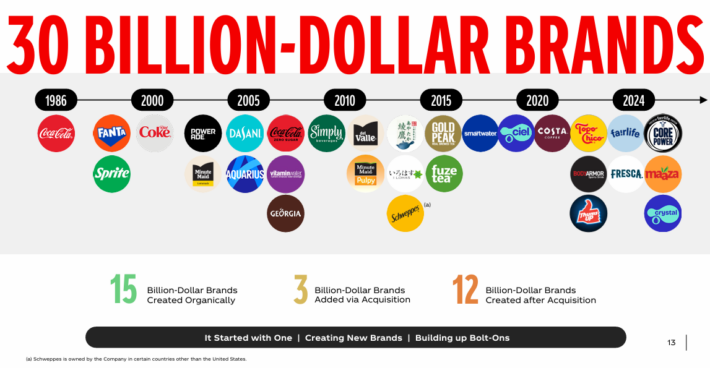

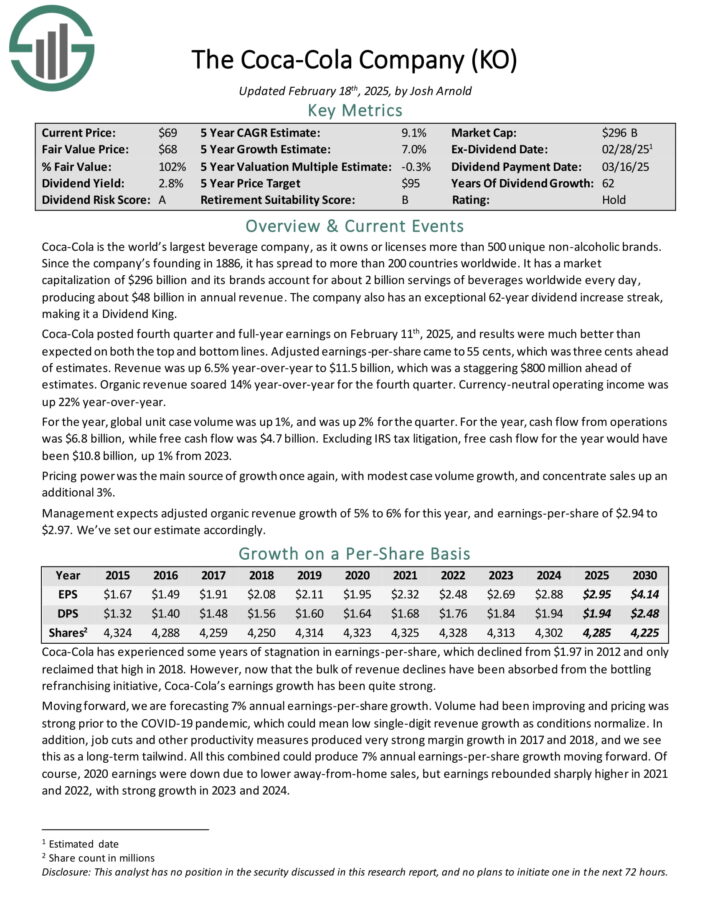

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Coca-Cola now has 30 billion-dollar brands in its portfolio, which each generate at least $1 billion in annual sales.

Source: Investor Presentation

Coca-Cola posted fourth quarter and full-year earnings on February 11th, 2025, and results were much better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 55 cents, which was three cents ahead of estimates.

Revenue was up 6.5% year-over-year to $11.5 billion, which was a staggering $800 million ahead of estimates. Organic revenue soared 14% year-over-year for the fourth quarter. Currency-neutral operating income was up 22% year-over-year.

For the year, global unit case volume was up 1%, and was up 2% for the quarter. Excluding IRS tax litigation, free cash flow for the year would have been $10.8 billion, up 1% from 2023.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

Dog of the Dow #5: Johnson & Johnson (JNJ)

- Dividend Yield: 3.0%

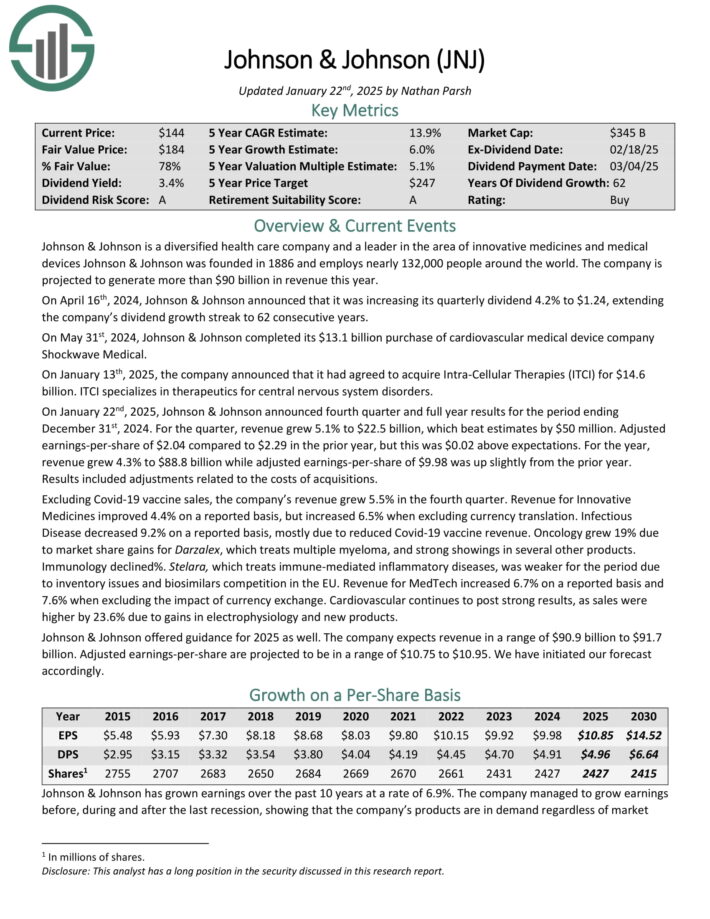

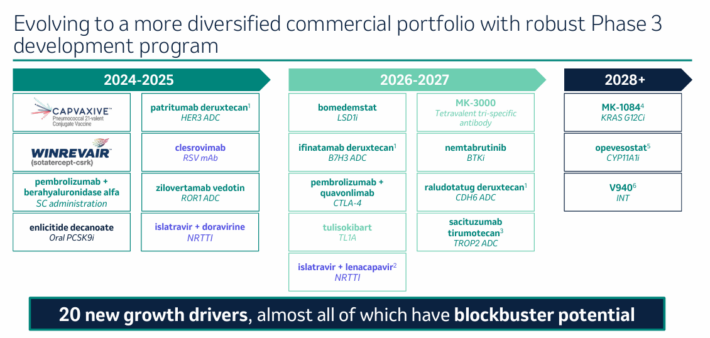

Johnson & Johnson is a diversified health care company and a leader in the area of innovative medicines and medical devices Johnson & Johnson was founded in 1886 and employs nearly 132,000 people around the world.

On January 22nd, 2025, Johnson & Johnson announced fourth quarter and full year results for the period ending December 31st, 2024.

Source: Investor Presentation

For the quarter, revenue grew 5.1% to $22.5 billion, which beat estimates by $50 million. Adjusted earnings-per-share of $2.04 compared to $2.29 in the prior year, but this was $0.02 above expectations.

For the year, revenue grew 4.3% to $88.8 billion while adjusted earnings-per-share of $9.98 was up slightly from the prior year. Results included adjustments related to the costs of acquisitions.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

Dog of the Dow #4: Amgen Inc. (AMGN)

- Dividend Yield: 3.2%

Amgen is the largest independent biotech company in the world. Amgen discovers, develops, manufactures, and sells medicines that treat serious illnesses.

The company focuses on six therapeutic areas: cardiovascular disease, oncology, bone health, neuroscience, nephrology, and inflammation.

Source: Investor Presentation

On February 4th, 2025, Amgen announced fourth quarter and full year earnings results. Revenue grew 11% to $9.1 billion, which was $230 million more than expected. Adjusted earnings-per-share of $5.31 compared favorably to $4.71 in the prior year and was $0.23 ahead of estimates.

For the year, revenue grew 19% to $33.4 billion while adjusted earnings-per-share of $19.84 compared to $18.65 in 2023.

Amgen had a successful 2024 as 21 products achieved record sales. For the quarter, growth was primarily due to a 14% increase in volumes. Excluding the addition of Horizon Therapeutics, product sales improved 10% and volume was up 15%.

Click here to download our most recent Sure Analysis report on Amgen Inc. (AMGN) (preview of page 1 of 3 shown below):

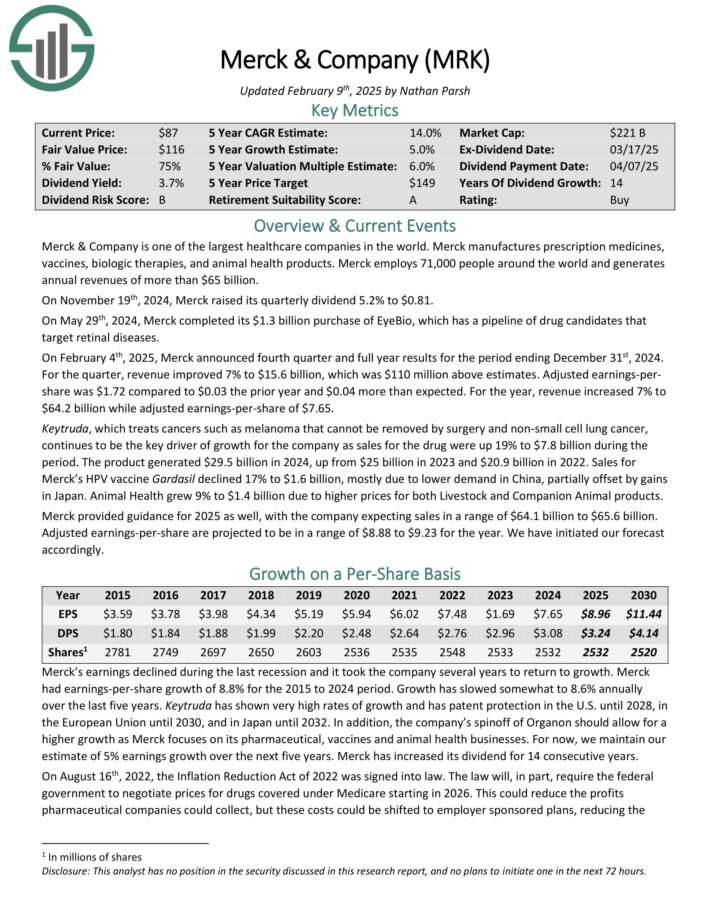

Dog of the Dow #3: Merck & Company (MRK)

- Dividend Yield: 3.6%

Merck & Company is one of the largest healthcare companies in the world. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal health products.

Merck employs 68,000 people around the world and generates annual revenues of more than $63 billion.

Source: Investor Presentation

On February 4th, 2025, Merck announced fourth quarter and full year results for the period ending December 31st, 2024.

For the quarter, revenue improved 7% to $15.6 billion, which was $110 million above estimates. Adjusted earnings-per-share was $1.72 compared to $0.03 the prior year and $0.04 more than expected.

For the year, revenue increased 7% to $64.2 billion while adjusted earnings-per-share of $7.65.

Keytruda, which treats cancers such as melanoma that cannot be removed by surgery and non-small cell lung cancer, continues to be the key driver of growth for the company as sales for the drug were up 19% to $7.8 billion during the period.

Click here to download our most recent Sure Analysis report on MRK (preview of page 1 of 3 shown below):

Dog of the Dow #2: Chevron Corporation (CVX)

- Dividend Yield: 4.4%

Chevron is one of the largest oil majors in the world. The company sees the bulk of its earnings from its upstream segment and has a higher crude oil and natural gas production ratio than most of its peers.

Chevron has increased its dividend for 38 consecutive years, placing it on the Dividend Aristocrats list.

In 2023, Chevron agreed to Acquire Hess (HES) for $53 billion in an all-stock deal. If the deal closes, Chevron will purchase the highly profitable Stabroek block in Guyana and Bakken assets and thus it will greatly enhance its output and free cash flow.

In late January, Chevron reported (1/31/25) results for the fourth quarter of 2024. Production dipped -1% over the prior year’s fourth quarter due to downtime in some fields, despite record Permian output after the acquisition of PDC Energy.

In addition, the price of oil decreased and refining margins plunged to normal levels after two years of blowout levels. As a result, earnings-per-share fell -40%, from $3.45 to $2.06, missing the analysts’ consensus by $0.05.

Click here to download our most recent Sure Analysis report on Chevron Corporation (CVX) (preview of page 1 of 3 shown below):

Dog of the Dow #1: Verizon Communications (VZ)

- Dividend Yield: 6.3%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is one of the largest wireless carriers in the country.

Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On January 24th, 2025, Verizon announced fourth quarter and full year results. For the quarter, revenue grew 1.7% to $35.7 billion, which beat estimates by $360 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.10 compared favorably to $1.08 in the prior year and was in-line with expectations. For the year, grew 0.6% to $134.8 billion while adjusted earnings-per-share $4.59 compared to $4.71 in 2023.

For the quarter, Verizon had postpaid phone net additions of 568K, which was better than the 449K net additions the company had in the same period last year. Retail postpaid net additions totaled 426K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 3.1% to $20.0 billion while the Consumer segment increased 2.2% to $27.6 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

Final Thoughts

Given the descriptions above, the Dogs of the Dow are clearly a very diverse group of blue-chip stocks that each enjoy significant competitive advantages and lengthy histories of paying rising dividends.

As a result, this investing strategy is a great, low-risk way for unsophisticated investors to approach dividend growth investing.

While it may not outperform the broader market every year, it is virtually guaranteed to provide investors with a combination of attractive current yield with steadily rising income over time.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Dividend Kings

- 20 Undervalued High-Dividend Stocks

- 20 Highest-Yielding Dividend Aristocrats

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 4 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- Blue Chip Stocks: Kings, Aristocrats, and Achievers

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more