Published on December 30th, 2024 by Bob Ciura

Investing doesn’t get much simpler than buying and holding high quality dividend growth stocks for the long run.

“Everything should be made as simple as possible, but not simpler.”

– Often attributed to Albert Einstein

Long-term dividend growth stock investing combines the primary reason most people invest – passive income – with the tried-and-true wisdom that underlies successful investing.

For a company to pay rising dividends year-after-year for decades, it must have favorable long-term economic characteristics and a reasonably competent and honest management team.

With this in mind, we created a downloadable list of over 130 Dividend Champions, which have raised their dividends for over 25 consecutive years.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

In addition, we have ranked the top 10 high quality dividend growth stocks for the long run.

All of the 10 stocks below are Dividend Champions, that have increased their payouts for over 25 years. They are ranked in order of 5-year growth rate, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

- Quality Dividend Stock For The Long Run: A.O. Smith Corp. (AOS)

- Quality Dividend Stock For The Long Run: PPG Industries (PPG)

- Quality Dividend Stock For The Long Run: Donaldson Co. (DCI)

- Quality Dividend Stock For The Long Run: Brown & Brown, Inc. (BRO)

- Quality Dividend Stock For The Long Run: Jack Henry & Associates (JKHY)

- Quality Dividend Stock For The Long Run: Lowe’s Cos. (LOW)

- Quality Dividend Stock For The Long Run: Sherwin-Williams Co. (SHW)

- Quality Dividend Stock For The Long Run: Cintas Corporation (CTAS)

- Quality Dividend Stock For The Long Run: Nordson Corp. (NDSN)

- Quality Dividend Stock For The Long Run: Roper Technologies (ROP)

Quality Dividend Stock For The Long Run: A.O. Smith Corp. (AOS)

- 5-year dividend growth: 8.0%

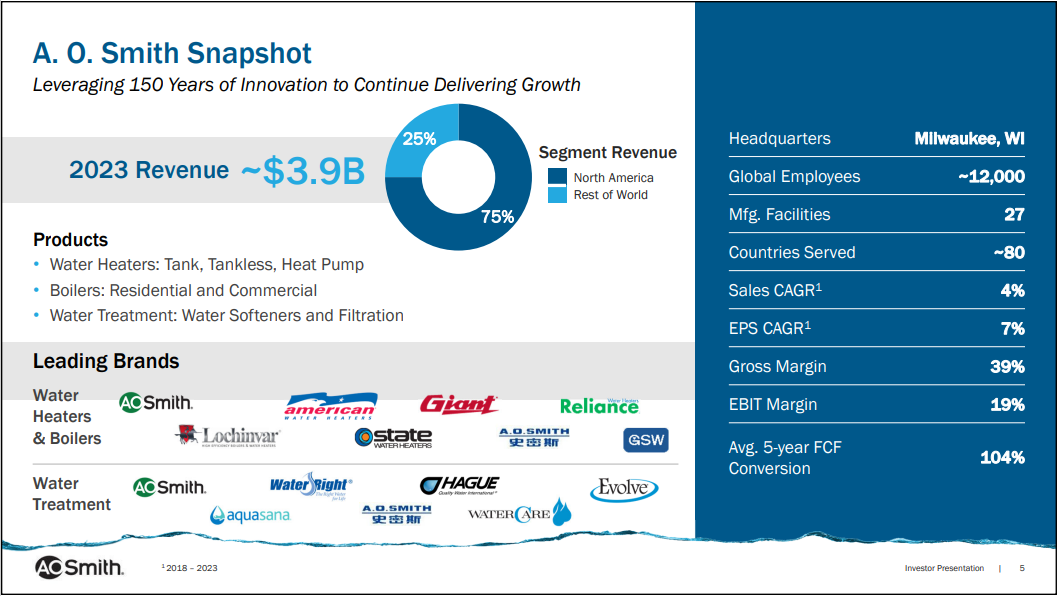

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment

products. It generates two-thirds of its sales in North America, and most of the rest in China.

A.O. Smith has raised its dividend for 30 years in a row, making the company a Dividend Aristocrat. The company was founded in 1874 and is headquartered in Milwaukee, WI.

A.O. Smith reported its third quarter earnings results on October 22. The company generated revenues of $903 million during the quarter, which represents a decline of 4% compared to the prior year’s quarter.

Revenue declined by 1% in North America, but the international business saw a wider decline, primarily due to lower sales in China, which has a troubled real estate market.

A.O. Smith generated earnings-per-share of $0.82 during the third quarter, which was down 9% on a year over year basis.

Click here to download our most recent Sure Analysis report on AOS (preview of page 1 of 3 shown below):

Quality Dividend Stock For The Long Run: PPG Industries (PPG)

- 5-year dividend growth: 8.0%

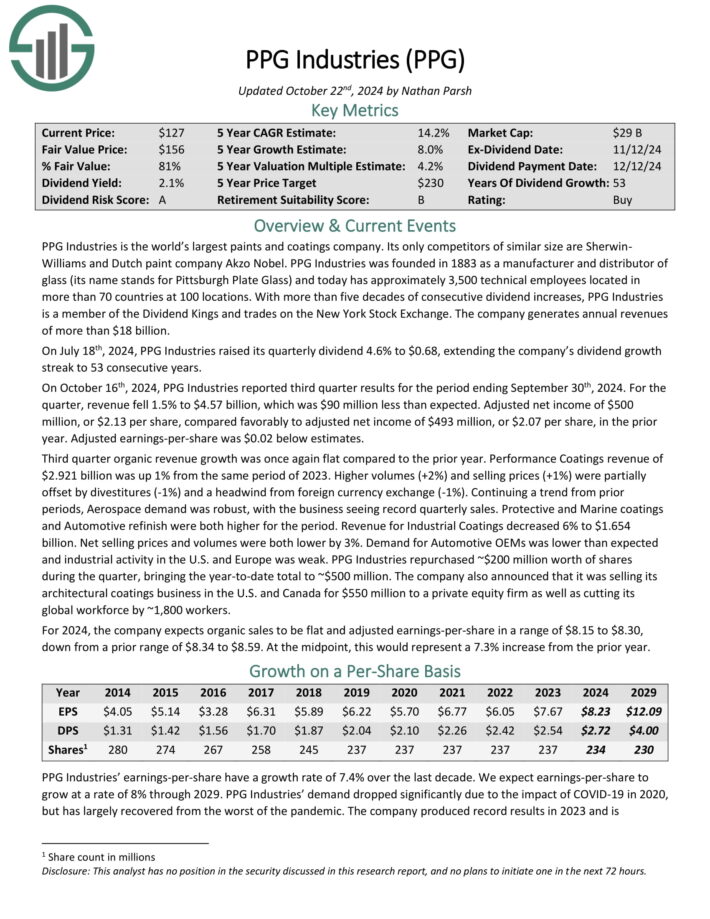

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023. Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

Quality Dividend Stock For The Long Run: Donaldson Co. (DCI)

- 5-year dividend growth: 8.2%

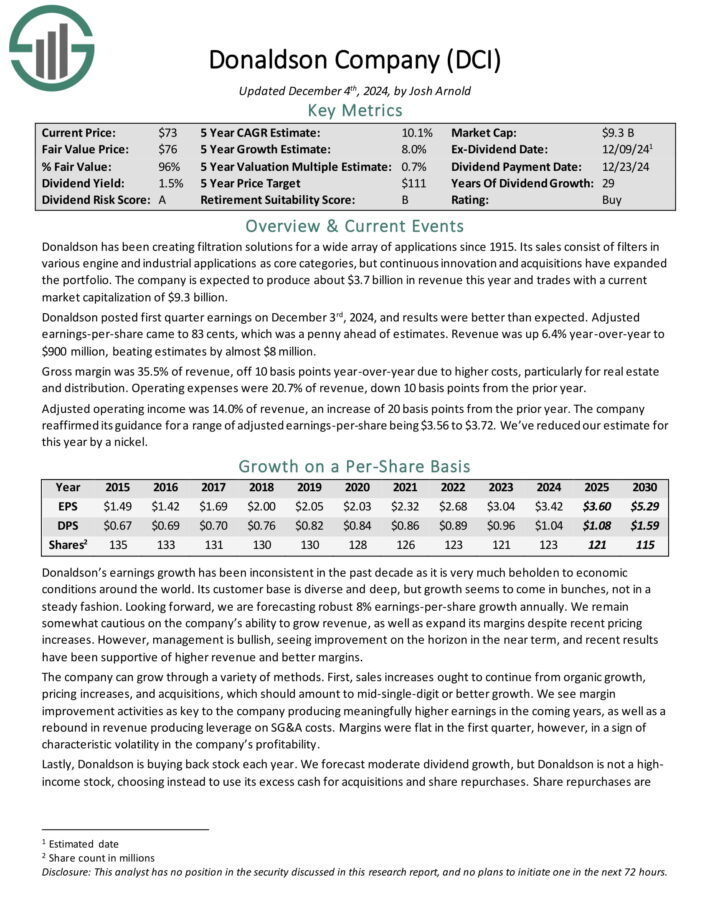

Donaldson has been creating filtration solutions for a wide array of applications since 1915. Its sales consist of filters in various engine and industrial applications as core categories. The company is expected to produce about $3.7 billion in revenue this year.

Donaldson posted first quarter earnings on December 3rd, 2024, and results were better than expected. Adjusted earnings-per-share came to 83 cents, which was a penny ahead of estimates. Revenue was up 6.4% year-over-year to $900 million, beating estimates by almost $8 million.

Gross margin was 35.5% of revenue, off 10 basis points year-over-year due to higher costs, particularly for real estate and distribution. Operating expenses were 20.7% of revenue, down 10 basis points from the prior year.

Adjusted operating income was 14.0% of revenue, an increase of 20 basis points from the prior year. The company reaffirmed its guidance for a range of adjusted earnings-per-share being $3.56 to $3.72.

Click here to download our most recent Sure Analysis report on DCI (preview of page 1 of 3 shown below):

Quality Dividend Stock For The Long Run: Brown & Brown (BRO)

- 5-year dividend growth: 8.9%

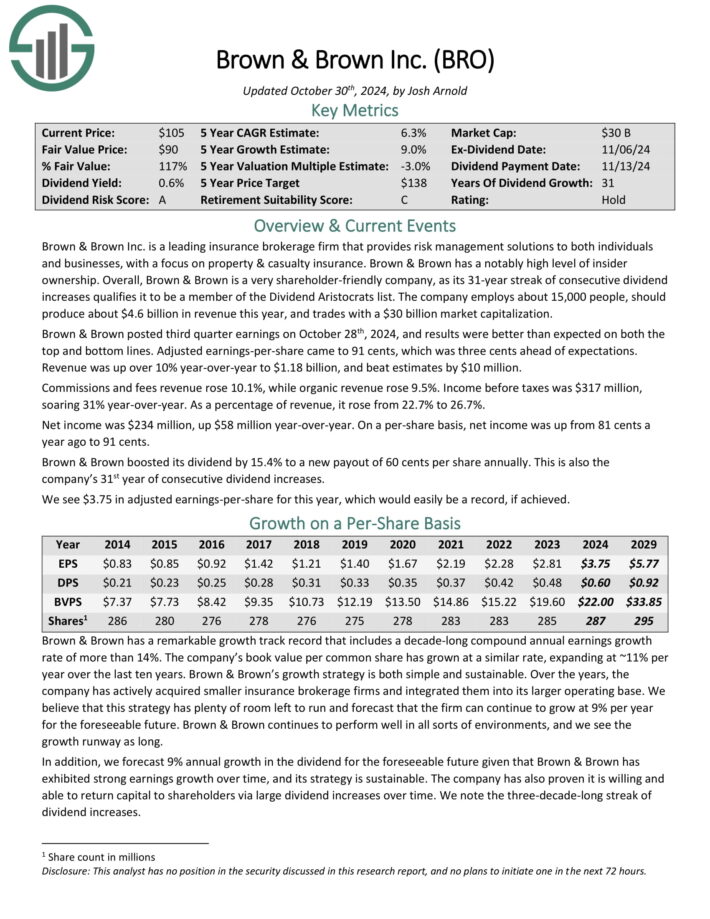

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted third quarter earnings on October 28th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 91 cents, which was three cents ahead of expectations.

Revenue was up over 10% year-over-year to $1.18 billion, and beat estimates by $10 million. Commissions and fees revenue rose 10.1%, while organic revenue rose 9.5%. Income before taxes was $317 million, soaring 31% year-over-year. As a percentage of revenue, it rose from 22.7% to 26.7%.

Net income was $234 million, up $58 million year-over-year. On a per-share basis, net income was up from 81 cents a year ago to 91 cents. Brown & Brown boosted its dividend by 15.4% to a new payout of 60 cents per share annually. This is also the company’s 31st year of consecutive dividend increases.

Its competitive advantage comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition strategy gives the company an enduring opportunity to continue growing its business for the foreseeable future.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

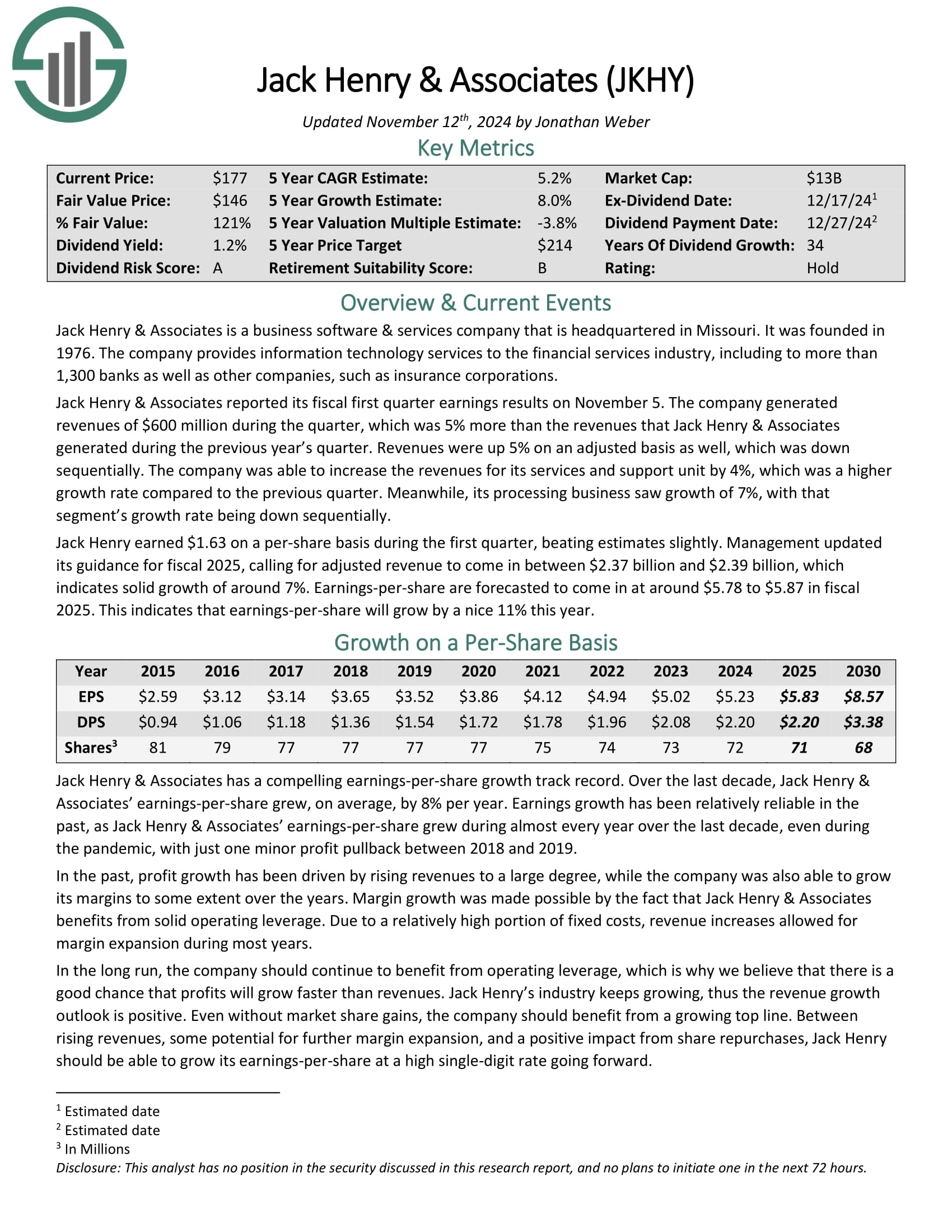

Quality Dividend Stock For The Long Run: Jack Henry & Associates (JKHY)

- 5-year dividend growth: 9.0%

Jack Henry & Associates is a business software & services company. It provides information technology services to the financial services industry, including to more than 1,300 banks as well as other companies, such as insurance corporations.

Jack Henry & Associates reported its fiscal first quarter earnings results on November 5. The company generated revenues of $600 million during the quarter, which was up 5% year-over-year.

Jack Henry earned $1.63 on a per-share basis during the first quarter, beating estimates slightly. Management updated its guidance for fiscal 2025, calling for adjusted revenue to come in between $2.37 billion and $2.39 billion, which indicates solid growth of around 7%.

Earnings-per-share are forecasted to come in at around $5.78 to $5.87 in fiscal 2025. This indicates that earnings-per-share will grow by a nice 11% this year.

Click here to download our most recent Sure Analysis report on JKHY (preview of page 1 of 3 shown below):

Quality Dividend Stock For The Long Run: Lowe’s Cos. (LOW)

- 5-year dividend growth: 9.0%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). It operates or services more than 1,700 home improvement and hardware stores in the U.S.

Lowe’s reported third quarter 2024 results on November 19th, 2024. Total sales came in at $20.2 billion compared to $20.5 billion in the same quarter a year ago.

Comparable sales decreased by 1.1%, while net earnings-per-share of $2.99 compared to $3.06 in third quarter 2023.

Adjusted EPS was even lower at $2.89. The company continues to be negatively impacted from a reduction in DIY discretionary spending.

The company repurchased 2.9 million shares in the quarter for $758 million. Additionally, it paid out $654 million in dividends.

The company narrowed its fiscal 2024 outlook and now expects to earn adjusted diluted EPS of $11.80 to $11.90 (from $11.70 to $11.90 previously) on total sales of $83.0 to $83.5 billion.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

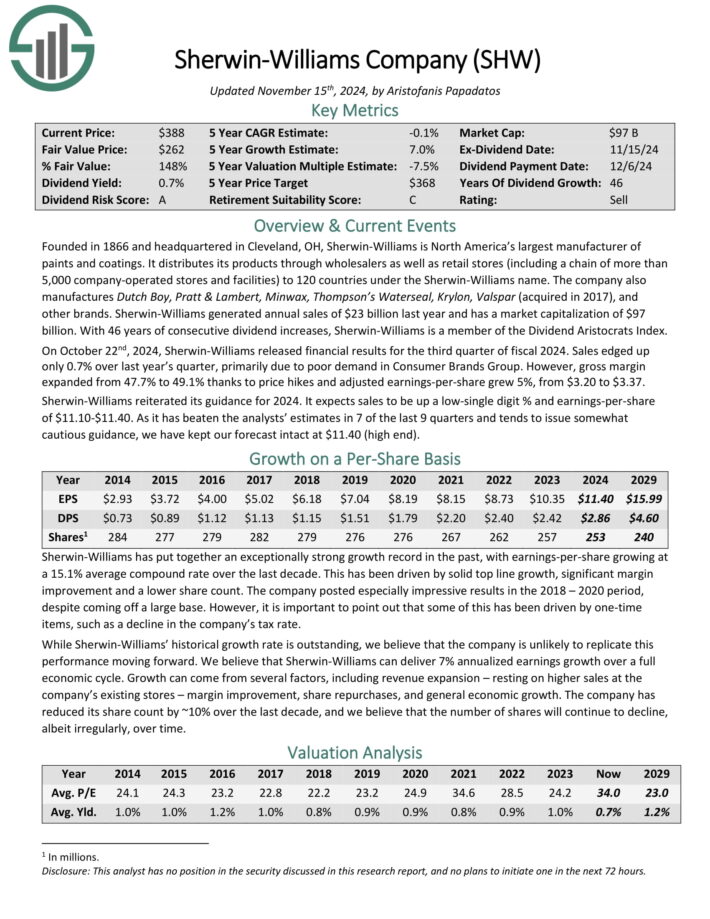

Quality Dividend Stock For The Long Run: Sherwin-Williams Co. (SHW)

- 5-year dividend growth: 10.0%

Sherwin-Williams, founded in 1866, is North America’s largest manufacturer of paints and coatings.

The company distributes its products through wholesalers as well as retail stores (including a chain of more than 4,900 company-operated stores and facilities) to 120 countries under the Sherwin-Williams name.

The company also manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and other brands.

On October 22nd, 2024, Sherwin-Williams released financial results for the third quarter of fiscal 2024. Sales edged up only 0.7% over last year’s quarter, primarily due to poor demand in Consumer Brands Group.

However, gross margin expanded from 47.7% to 49.1% thanks to price hikes and adjusted earnings-per-share grew 5%, from $3.20 to $3.37.

Sherwin-Williams reiterated its guidance for 2024. It expects sales to be up a low-single digit % and earnings-per-share of $11.10-$11.40.

As it has beaten the analysts’ estimates in 7 of the last 9 quarters and tends to issue somewhat cautious guidance, we have kept our forecast intact at $11.40 (high end).

Click here to download our most recent Sure Analysis report on SHW (preview of page 1 of 3 shown below):

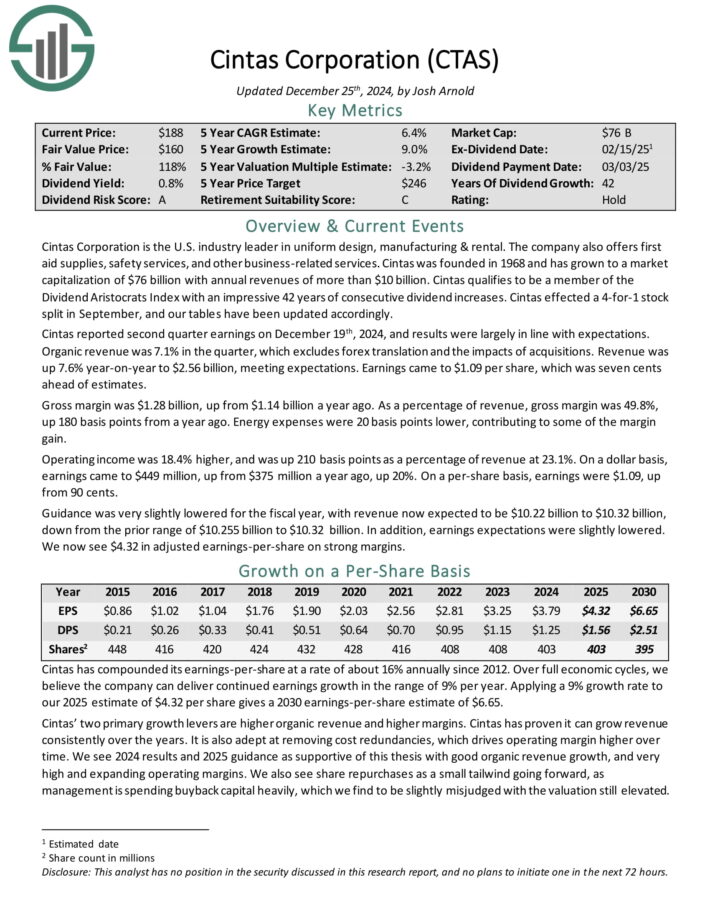

Quality Dividend Stock For The Long Run: Cintas Corporation (CTAS)

- 5-year dividend growth: 10.0%

Cintas Corporation is the U.S. industry leader in uniform design, manufacturing & rental. The company also offers first aid supplies, safety services, and other business-related services.

Cintas qualifies to be a member of the Dividend Champions with an impressive 42 years of consecutive dividend increases.

Cintas reported second quarter earnings on December 19th, 2024, and results were largely in line with expectations. Organic revenue was 7.1% in the quarter, which excludes forex translation and the impacts of acquisitions.

Revenue was up 7.6% year-on-year to $2.56 billion, meeting expectations. Earnings came to $1.09 per share, which was seven cents ahead of estimates.

Gross margin was $1.28 billion, up from $1.14 billion a year ago. As a percentage of revenue, gross margin was 49.8%, up 180 basis points from a year ago. Energy expenses were 20 basis points lower, contributing to some of the margin gain.

Operating income was 18.4% higher, and was up 210 basis points as a percentage of revenue at 23.1%. On a dollar basis, earnings came to $449 million, up from $375 million a year ago, up 20%. On a per-share basis, earnings were $1.09, up from 90 cents.

Click here to download our most recent Sure Analysis report on CTAS (preview of page 1 of 3 shown below):

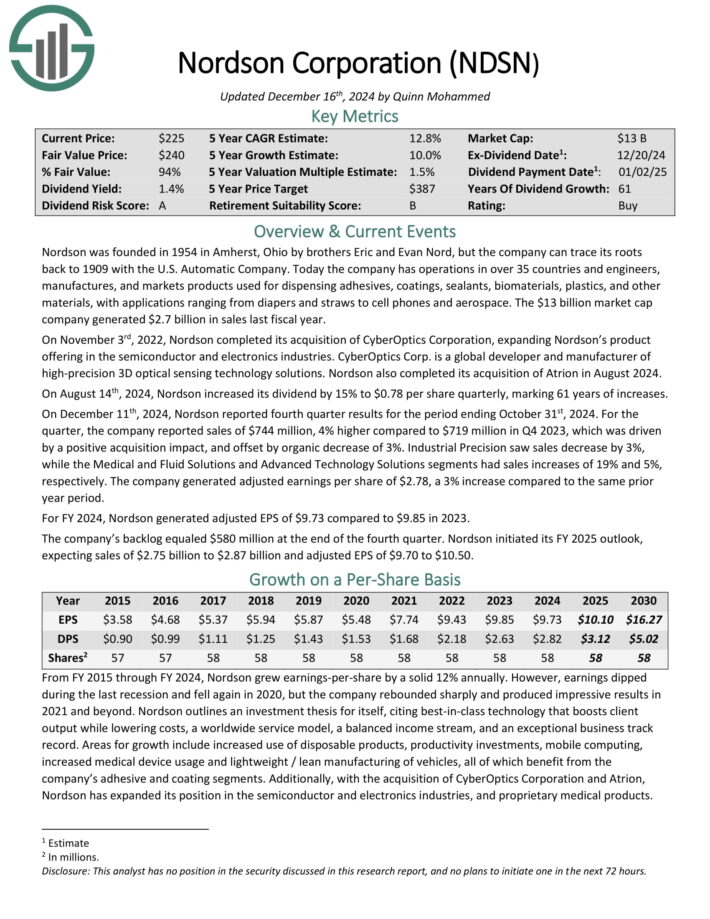

Quality Dividend Stock For The Long Run: Nordson Corp. (NDSN)

- 5-year dividend growth: 10.0%

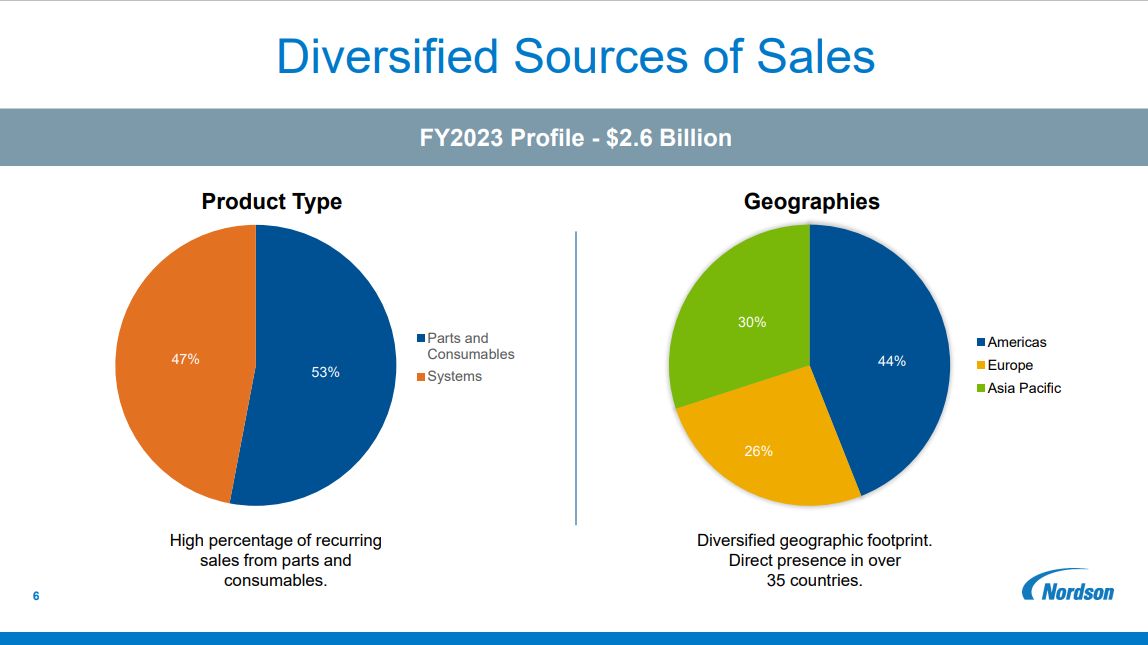

Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.

Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials.

Source: Investor Presentation

On August 14th, 2024, Nordson increased its dividend by 15% to $0.78 per share quarterly, marking 61 years of increases.

On December 11th, 2024, Nordson reported fourth quarter results for the period ending October 31st, 2024. For the quarter, the company reported sales of $744 million, 4% higher compared to $719 million in Q4 2023, which was driven by a positive acquisition impact, and offset by organic decrease of 3%.

Industrial Precision saw sales decrease by 3%, while the Medical and Fluid Solutions and Advanced Technology Solutions segments had sales increases of 19% and 5%, respectively.

The company generated adjusted earnings per share of $2.78, a 3% increase compared to the same quarter last year. For FY 2024, Nordson generated adjusted EPS of $9.73 compared to $9.85 in 2023.

Click here to download our most recent Sure Analysis report on NDSN (preview of page 1 of 3 shown below):

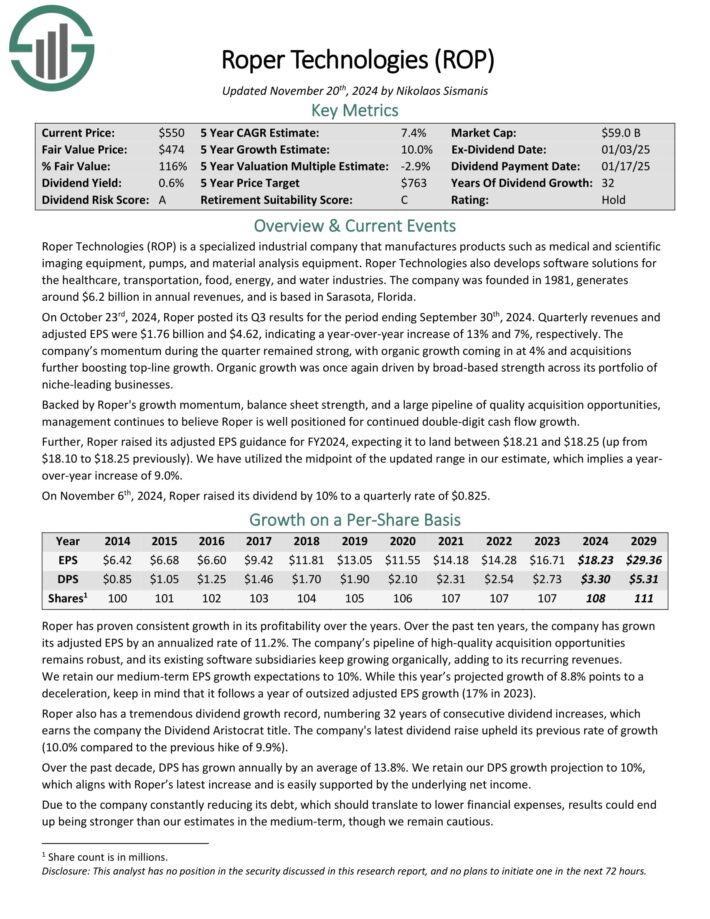

Quality Dividend Stock For The Long Run: Roper Technologies (ROP)

- 5-year dividend growth: 10.0%

Roper Technologies is a specialized industrial company that manufactures products such as medical and scientific imaging equipment, pumps, and material analysis equipment.

Roper Technologies also develops software solutions for the healthcare, transportation, food, energy, and water industries.

The company was founded in 1981, generates around $5.4 billion in annual revenues, and is based in Sarasota, Florida.

On October 23rd, 2024, Roper posted its Q3 results for the period ending September 30th, 2024. Quarterly revenues and adjusted EPS were $1.76 billion and $4.62, indicating a year-over-year increase of 13% and 7%, respectively.

The company’s momentum during the quarter remained strong, with organic growth coming in at 4% and acquisitions further boosting top-line growth.

Organic growth was once again driven by broad-based strength across its portfolio of niche-leading businesses.

Click here to download our most recent Sure Analysis report on ROP (preview of page 1 of 3 shown below):

Additional Reading

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.