Published on December 27th, 2024 by Bob Ciura

Intergenerational wealth is created when one’s investments provide not only for themselves, but for their children, grandchildren, and beyond.

Unfortunately, the skills that it takes to build and maintain a growing investment portfolio are typically not transferred with an inheritance.

Time estimates that 70% of rich families lose their wealth by the 2nd generation, and 90% by the third generation.

Building lasting intergenerational wealth requires an investing plan that is both effective and relatively easy to implement.

And that’s what makes buy and hold forever investing in high quality dividend growth stocks so appealing for creating intergenerational wealth.

When it comes to quality dividend growth stocks, we recommend investors take a closer look at the Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

The Dividend Aristocrats broadly have durable competitive advantages, and long-term growth.

The following 10 dividend growth stocks are on the Dividend Aristocrats list, have current yields above 2%, and Dividend Risk Scores of A or B in the Sure Analysis Research Database.

This makes them ideal candidates for investors looking to create intergenerational wealth.

The top 10 list is ranked according to dividend yield, from lowest to highest.

Table of Contents

- Dividend Stock For Intergenerational Wealth: Abbott Laboratories (ABT)

- Dividend Stock For Intergenerational Wealth: Automatic Data Processing (ADP)

- Dividend Stock For Intergenerational Wealth: General Dynamics (GD)

- Dividend Stock For Intergenerational Wealth: PPG Industries (PPG)

- Dividend Stock For Intergenerational Wealth: McCormick & Co. (MKC)

- Dividend Stock For Intergenerational Wealth: Illinois Tool Works (ITW)

- Dividend Stock For Intergenerational Wealth: NextEra Energy (NEE)

- Dividend Stock For Intergenerational Wealth: S&P Global (SPGI)

- Dividend Stock For Intergenerational Wealth: The Coca-Cola Company (KO)

- Dividend Stock For Intergenerational Wealth: Johnson & Johnson (JNJ)

Dividend Stock For Intergenerational Wealth: Abbott Laboratories (ABT)

Abbott Laboratories, founded in 1888, is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices. Abbott

Laboratories generated $40 billion in sales and $8.3 billion in profit in 2023.

On October 16th, 2024, Abbott Laboratories reported third quarter results for the period ending September 30th, 2024.

For the quarter, the company produced $10.6 billion in sales (60.5% outside of the U.S.), which represented a 4.9% improvement compared to the third quarter of 2023 and was $90 million more than expected. Adjusted earnings-per share of $1.21 compared to $1.14 in the prior year and was $0.01 ahead of estimates.

U.S. sales grew 10.1% while international increased 1.7%. Currency exchange was a 2.5% headwind for the period. Companywide organic sales grew 7.6%. However, excluding Covid-19 testing products, organic growth was 8.2%.

Click here to download our most recent Sure Analysis report on ABT (preview of page 1 of 3 shown below):

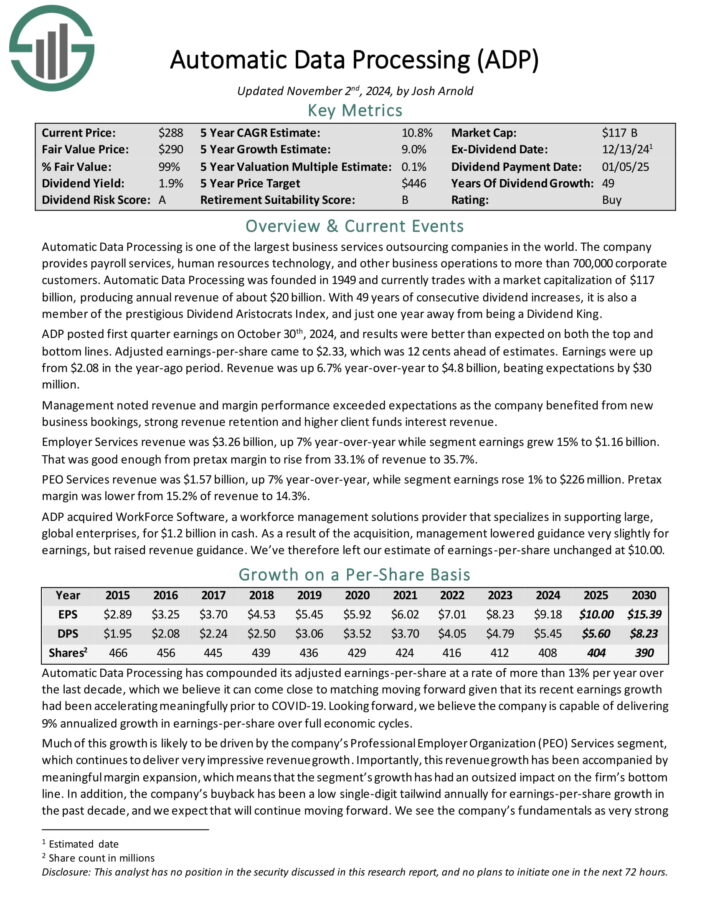

Dividend Stock For Intergenerational Wealth: Automatic Data Processing (ADP)

Automatic Data Processing is one of the largest business services outsourcing companies in the world. The company provides payroll services, human resources technology, and other business operations to more than 700,000 corporate customers.

ADP posted first quarter earnings on October 30th, 2024, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.33, which was 12 cents ahead of estimates.

Earnings were up from $2.08 in the year-ago period. Revenue was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.

Management noted revenue and margin performance exceeded expectations as the company benefited from new business bookings, strong revenue retention and higher client funds interest revenue.

Employer Services revenue was $3.26 billion, up 7% year-over-year while segment earnings grew 15% to $1.16 billion. That was good enough from pretax margin to rise from 33.1% of revenue to 35.7%.

Click here to download our most recent Sure Analysis report on ADP (preview of page 1 of 3 shown below):

Dividend Stock For Intergenerational Wealth: General Dynamics (GD)

General Dynamics is a US aerospace & defense company that now operates in four business segments: Aerospace (21% of sales), Combat Systems (19%), Marine Systems (26%), and Technologies (33%). General Dynamics combined the IT and Mission Systems segments in 2020.

The company’s Aerospace segment is focused on business jets and services while the remainder of the company is defense. The company makes the well-known M1 Abrams tank, Stryker vehicle, Virginia-class submarine, Columbia-class submarine, and Gulfstream business jets.

General Dynamics had revenue of approximately $42.3B in 2023.

General Dynamics reported poor Q3 2024 results on October 23rd, 2024, missing estimates on higher costs and taxes. Revenue rose 10.4% and diluted earnings per share increased 10.2% to $3.35 from $3.04 on a year-over-year basis. Aerospace revenue rose 22% while Gulfstream’s book-to-bill ratio was 1.0X.

Revenue for Marine Systems increased 20% to $3,599M from $3,002M on the strength of the Columbia and Virginia class submarine programs.

Click here to download our most recent Sure Analysis report on GD (preview of page 1 of 3 shown below):

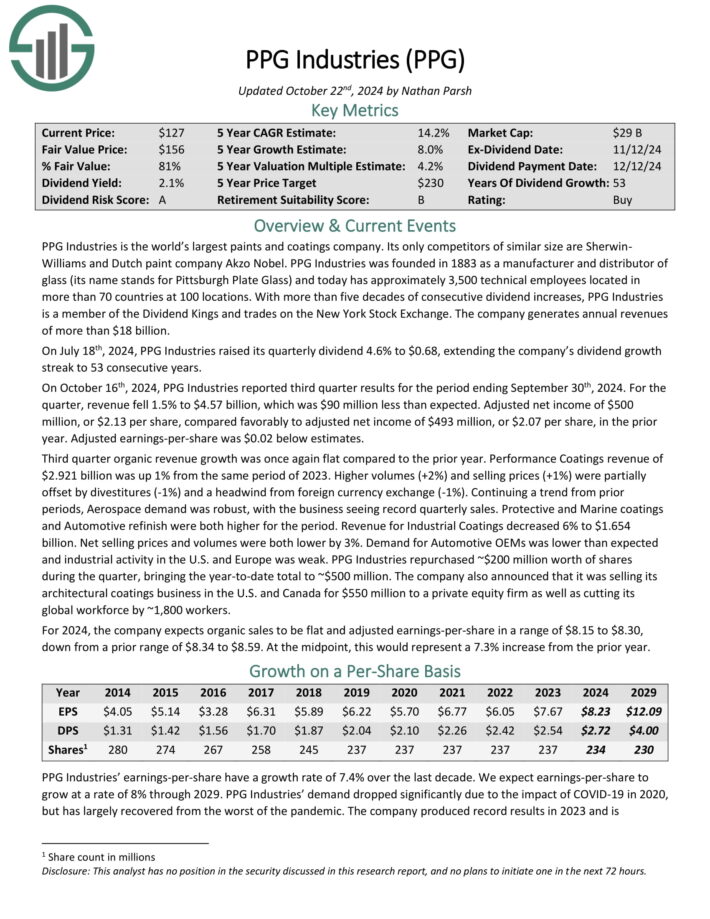

Dividend Stock For Intergenerational Wealth: PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings company. Its only competitors of similar size are Sherwin-Williams and Dutch paint company Akzo Nobel.

On October 16th, 2024, PPG Industries reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue fell 1.5% to $4.57 billion, which was $90 million less than expected.

The company generates annual revenue of about $18.2 billion.

Source: Investor Presentation

Adjusted net income of $500 million, or $2.13 per share, compared favorably to adjusted net income of $493 million, or $2.07 per share, in the prior year. Adjusted earnings-per-share was $0.02 below estimates.

Third quarter organic revenue growth was once again flat compared to the prior year. Performance Coatings revenue of $2.921 billion was up 1% from the same period of 2023.

Higher volumes (+2%) and selling prices (+1%) were partially offset by divestitures (-1%) and a headwind from foreign currency exchange (-1%).

Click here to download our most recent Sure Analysis report on PPG (preview of page 1 of 3 shown below):

Dividend Stock For Intergenerational Wealth: McCormick & Co. (MKC)

McCormick & Company produces, markets, and distributes seasoning mixes, spices, condiments and other products to customers in the food industry. McCormick was founded in 1889 by Willoughby M. McCormick and controls ~20% of the global seasoning and spice market.

On October 1st, 2024, McCormick announced third quarter results for the period ending August 31st, 2024. For the quarter, revenue was stable at $1.68 billion, but this beat estimates by $10 million. Adjusted earnings-per-share of $0.83 compared favorably to $0.65 in the prior year and was $0.10 more than expected.

For the quarter, volume and mix improved 0.6%. This was offset by a 0.2% decline in price, a 0.3% decrease related to acquisitions and divestitures, and a 0.4% headwind from currency translation. The Consumer segment was flat for the period. Volume and mix (+1.0) were offset by lower pricing (-0.8%) and currency exchange (-0.2%).

The Americas were down 0.4% as pricing offset volume and mix improvements. EMEA continues to perform well, with sales higher by 2.9% as volume and mix added 3.5%.

Click here to download our most recent Sure Analysis report on MKC (preview of page 1 of 3 shown below):

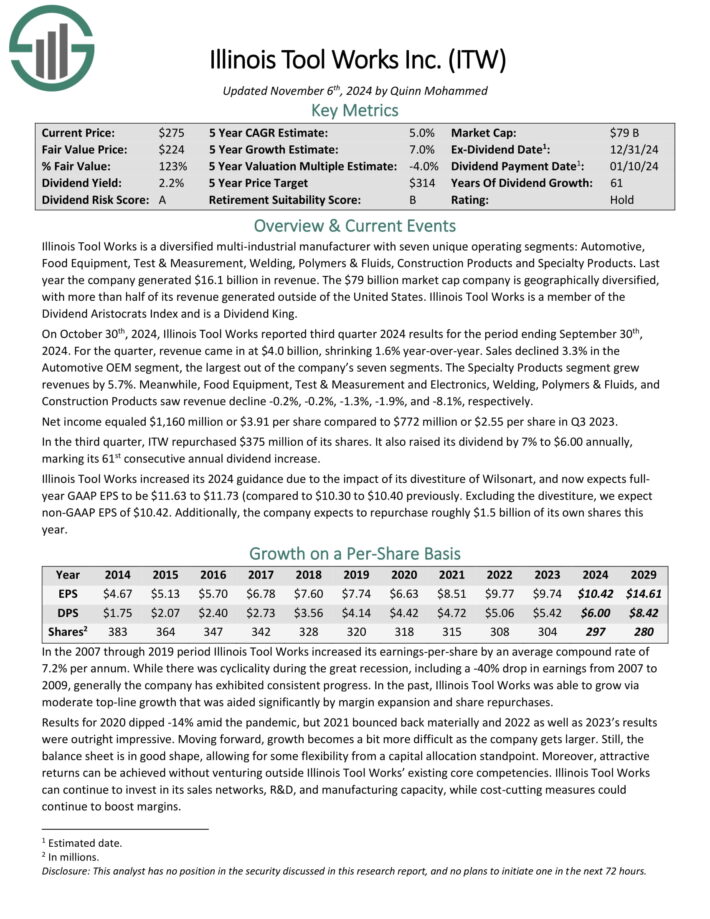

Dividend Stock For Intergenerational Wealth: Illinois Tool Works (ITW)

Illinois Tool Works is a diversified multi-industrial manufacturer with seven unique operating segments: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products and Specialty Products. Last year the company generated $16.1 billion in revenue.

On October 30th, 2024, Illinois Tool Works reported third quarter 2024 results for the period ending September 30th, 2024. For the quarter, revenue came in at $4.0 billion, shrinking 1.6% year-over-year. Sales declined 3.3% in the Automotive OEM segment, the largest out of the company’s seven segments.

The Specialty Products segment grew revenues by 5.7%. Meanwhile, Food Equipment, Test & Measurement and Electronics, Welding, Polymers & Fluids and

Construction Products saw revenue decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Net income equaled $1,160 million or $3.91 per share compared to $772 million or $2.55 per share in Q3 2023. In the third quarter, ITW repurchased $375 million of its shares. It also raised its dividend by 7% to $6.00 annually, marking its 61st consecutive annual dividend increase.

Click here to download our most recent Sure Analysis report on ITW (preview of page 1 of 3 shown below):

Dividend Stock For Intergenerational Wealth: NextEra Energy (NEE)

NextEra Energy is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers.

The rate-regulated electric utility serves about 5.9 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE was founded in 1925. NEE generates roughly 80% of its revenues from FPL.

NextEra Energy reported its Q3 2024 financial results on 10/23/24. For the quarter, the company reported revenues of $7.6 billion (up 5.5% year over year), translating to adjusted earnings of $2.1 billion (up 11% year over year). On a per share basis, adjusted earnings climbed 10% to $1.03.

The utility added ~3 GW of new renewables and storage projects to its backlog, including ~1.4 GW of solar and ~1.4 GW of battery storage, bringing its backlog to over 24 GW.

Year to date, it generated operating revenue of $19.4 billion (down 8.8% year over year), adjusted earnings of $6.0 billion (up 11%), and adjusted earnings per share (“EPS”) of $2.90 (up 9%).

Click here to download our most recent Sure Analysis report on NEE (preview of page 1 of 3 shown below):

Dividend Stock For Intergenerational Wealth: S&P Global (SPGI)

S&P Global is a worldwide provider of financial services and business information and revenue of over $13 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 51 consecutive years.

S&P Global posted third quarter earnings on October 24th, 2024, and results were quite strong once again. Adjusted earnings-per-share came to $3.89, which was 25 cents ahead of estimates. Earnings were down from $4.04 in Q2, but much higher than $3.21 in the year-ago period.

Revenue soared 16% higher year-on-year to $3.58 billion, which also beat estimates by $150 million. Growth in the Ratings and Indices segment led the top line higher in Q3, although strength was broad.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

Dividend Stock For Intergenerational Wealth: The Coca-Cola Company (KO)

Coca-Cola was founded in 1892. Today, it is the world’s largest non-alcoholic beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages.

Its brands account for about 2 billion servings of beverages worldwide every day, producing more than $45 billion in annual revenue.

The sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more.

The still beverage portfolio includes water, juices, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Source: Investor Presentation

Coca-Cola dominates sparkling soft drinks, but the company is attempting to maintain and even improve this dominant position with product extensions of existing popular brands, including reduced and zero-sugar versions of brands like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October 23rd, 2024, and results were better than expected on both revenue and profits. The company saw adjusted earnings-per-share of 77 cents, which was two cents better than estimates.

Revenue was off fractionally year-over-year to $11.9 billion, but did beat estimates by $290 million. Organic revenues were up by 9%. That included 10% growth in price and mix, a 2% decline in concentrate sales, and a 1% gain in case volumes.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

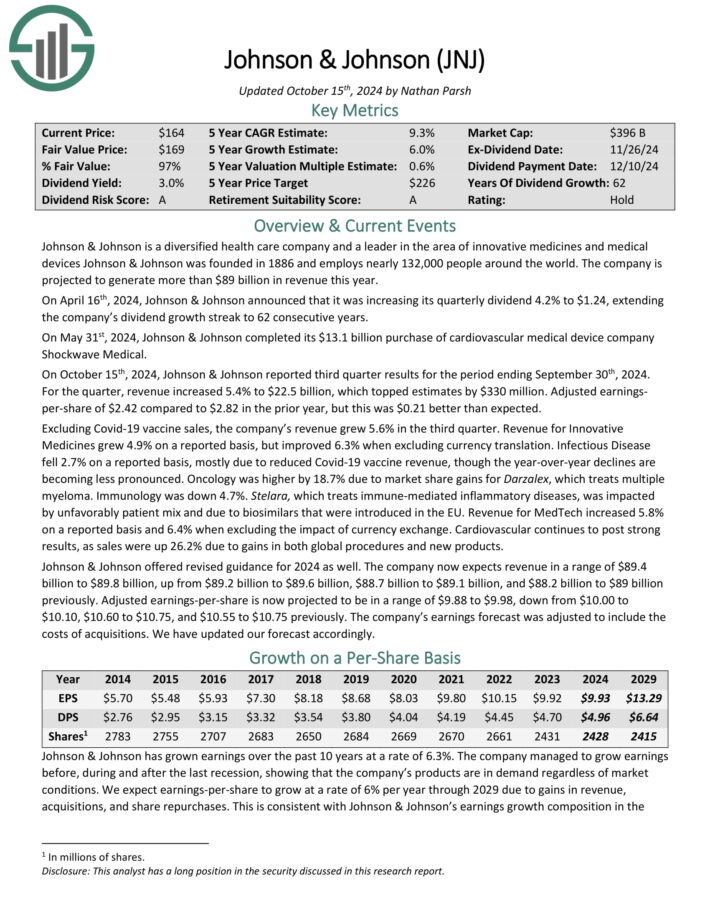

Dividend Stock For Intergenerational Wealth: Johnson & Johnson (JNJ)

Johnson & Johnson was founded in 1886 and has transformed into one of the largest companies in the world. Johnson & Johnson is a mega-cap stock. The company generates annual sales above $99 billion.

Johnson & Johnson operates a diversified business model, allowing it to appeal to a wide variety of customers within the healthcare sector. J&J now operates two segments, pharmaceuticals and medical devices, after spinning off its consumer health franchises.

Johnson & Johnson reported third-quarter 2024 sales growth of 5.2%, reaching $22.5 billion, with operational growth of 6.3%.

Source: Investor Presentation

However, earnings per share (EPS) decreased by 34.3%, largely due to a one-time special charge and acquired in-process research and development (IPR&D).

Adjusted EPS fell 9.0% to $2.42, driven by the same IPR&D impact. The company made significant advancements, including approvals for treatments like TREMFYA and RYBREVANT, and the submission of a new general surgery robotic system, OTTAVA.

Click here to download our most recent Sure Analysis report on JNJ (preview of page 1 of 3 shown below):

Additional Reading

The following databases of dividend growth stocks may also be useful for income investors:

- The Dividend Aristocrats List: dividend stocks with 25+ years of consecutive dividend increases

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 53 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.