Updated on November 4th, 2024 by Aristofanis Papadatos

The Dividend Kings are an illustrious group of companies. These companies stand apart from the vast majority of the market as they have raised dividends for at least 50 consecutive years.

We believe that investors should view the Dividend Kings as the most high-quality dividend growth stocks to buy for the long term.

With this in mind, we created a full list of all the Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

This group is so exclusive that there are just 53 companies that qualify as a Dividend King. United Bankshares (UBSI) raised its dividend for the 50th consecutive year in 2023, joining the list of Dividend Kings.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

United Bankshares was formed in 1982 and since that time, has acquired more than 30 separate banking institutions.

This focus on acquisitions, in addition to organic growth, has allowed United to expand into a regional powerhouse in the Mid-Atlantic with about $30 billion in total assets, and annual revenue of about $1 billion.

United posted third quarter earnings on October 24th, 2024, and results were decent. Earnings-per-share edged down marginally, from $0.71 in the prior year’s quarter to $0.70, but exceeded the analysts’ estimates by $0.03.

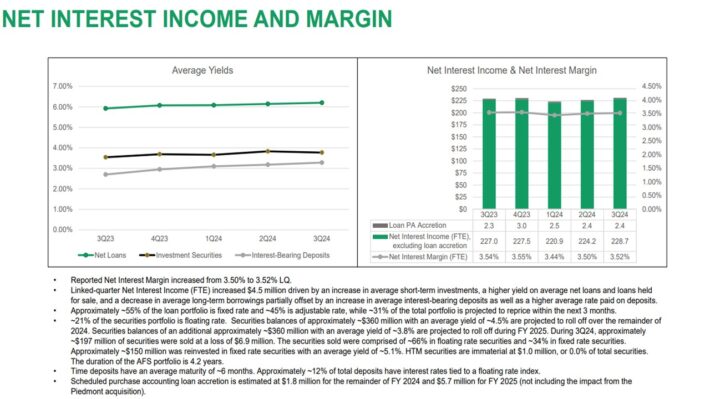

Net interest margin marginally expanded on a sequential basis, from 3.50% to 3.52%.

Source: Investor Presentation

As a result, net interest income grew 2% over the previous quarter. Q3 results benefited from higher average short-term investments and higher yields on loans, which were partly offset by higher deposit costs.

While net interest income edged up during the quarter, provisions for loan losses increased as well. As a result, earnings per share dipped 1%. We expect earnings per share of $2.75 in the full year, which will mark a 1.5% increase vs. 2023.

Growth Prospects

United has failed to grow its earnings per share over the last four years, as the company has struggled with translating asset and loan growth into profits.

The primary reason behind the stagnation of the bank is the surge of interest rates to 23-year highs, which have exerted pressure on the net interest margin of the bank via high deposit costs amid intense competition among banks for deposits.

On the bright side, as inflation has finally moderated, the Fed has just begun to reduce interest rates. As a result, the net interest margin of United is likely to improve in the upcoming years.

United has always grown through acquisitions, and we do not believe that will change. Overall, thanks to acquisitions and an expected improvement in net interest margin, we expect United to grow its earnings per share by 3% per year on average over the next five years.

This growth rate is lower than the 3.9% average annual growth rate of the bank over the last decade but we prefer to be somewhat conservative, given the stagnation in recent years.

Competitive Advantages & Recession Performance

United’s competitive advantage is in its strong market position in the areas it serves. It is headquartered in West Virginia where competition is relatively light, and it is expanding into more densely populated areas like northern Virginia.

That does not make it immune from recessions, but its performance in 2008 and 2009 was exemplary, and held up in very challenging conditions in 2020, while the bank thrived in 2021.

Below are the company’s earnings-per-share results during, and after, the Great Recession:

- 2007 earnings-per-share: $1.32

- 2008 earnings-per-share: $1.52 (15% increase)

- 2009 earnings-per-share: $1.51 (~1% decrease)

- 2010 earnings-per-share: $1.81 (20% increase)

The company grew its diluted earnings-per-share in 2008, followed by just a minor decline in 2009, which was the worst year of the recession. United Bankshares then quickly rebounded with 20% earnings growth in 2010.

Valuation & Expected Total Returns

We expect United Bankshares to generate earnings-per-share of $2.72 in 2024. At the current share price, UBSI stock trades for a price-to-earnings ratio of 13.7.

We see fair value at 12 times earnings, given where peer valuations are at present. We see increased risk for United given the relatively weak performance historically of the company’s net interest margin and we think investors will pay slightly less for the stock as a result. Shares are somewhat overvalued at the moment.

A contracting P/E multiple could reduce annual returns by -2.6% over the next five years. Dividends will also boost shareholder returns. UBSI stock is yielding 3.9% right now.

Given also expected 3.0% average annual growth of earnings per share, UBSI is expected to return 4.2% per year through 2029. This is a relatively weak expected rate of return, which renders UBSI stock a hold.

Final Thoughts

United is now expected to produce 4.2% annual returns in the upcoming years. The yield is attractive at 3.9% and should remain safe for years to come, so United could be worth a look for income investors.

However, the stock appears somewhat overvalued around its current price. As a result, we advise investors to wait for a significantly lower entry point before considering to purchase this stock.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks