Updated on October 22nd, 2024 by Aristofanis Papadatos

Stepan Company (SCL) has a dividend track record that few companies can rival. The company currently sports a streak of 56 consecutive years of increasing dividends, making it one of just 53 stocks in the entire stock market with a dividend increase streak above 50 years.

That puts the company among the elite Dividend Kings, a small group of stocks that increased their payouts for at least 50 consecutive years. You can see the full list of all 53 Dividend Kings here.

We have created a full list of all 50 Dividend Kings, along with important financial metrics such as price-to-earnings ratios and dividend yields. You can access the spreadsheet by clicking on the link below:

Dividend Kings are the “best of the best” when it comes to rewarding shareholders with cash returns, and raising their dividend payouts every year.

This article will discuss Stepan’s dividend and valuation outlook.

Business Overview

Stepan traces its origins back to 1932 when it was founded by 23-year old Alfred C. Stepan Jr., and was known at the time as Chemical Distributors.

The fledgling enterprise’s first product was a chemical that controlled road dust on Illinois’ country thoroughfares, sold from a rented desk at Chicago’s North Pier Terminal. These humble beginnings were the start of what became a chemical powerhouse.

The company is still headquartered in Illinois and manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It expanded from that desk at the North Pier Terminal to a truly global reach with its 21 manufacturing sites in 12 countries throughout North and South America, Asia, and Europe.

Stepan also boasts global R&D centers, a worldwide distribution network and a broad portfolio of products to meet a diverse group of customer needs.

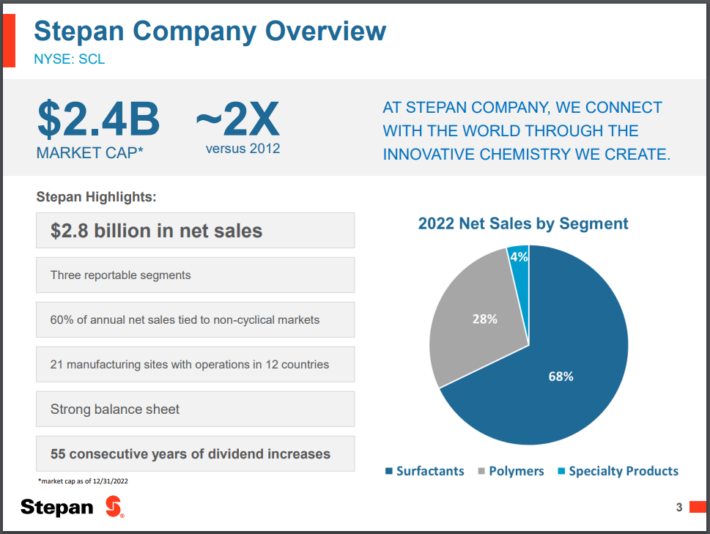

Stepan is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to a handful of industries; an important trait during an economic downturn.

Source: Investor presentation

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Surfactants are key ingredients in consumer and industrial cleaning compounds such as detergents, cleansing agents, emulsifiers, foaming or defoaming agents, viscosity builders, degreasers, and others.

Stepan offers a broad range of surfactant chemicals and creates custom surfactants and formulated blends to meet unique customer demands.

These surfactants are used in a wide variety of applications such as a foaming agent for shampoo, agents used in oil recovery and emulsifiers for agricultural insecticides.

The polymers business is Stepan’s second-largest by revenue, comprising about 28% of the company’s total revenue. The polymers division is further broken down into three segments: polyester polyols, powder coating resins, and phthalic anhydride. Polyester polyols are used in a wide variety of both polyurethane and polyisocyanurate applications.

Stepan produces a full range of aromatic and aliphatic polyester polyols for use in rigid foams, as well as many coatings, adhesives, sealants, and elastomers applications.

Polyester resins are designed with either hydroxyl or carboxyl functionality and combine with various curatives to form durable, attractive, environmentally friendly powder coatings. The company’s RUCOTE resins can enhance the quality, performance, and visual appeal of finishes on a wide variety of products.

Phthalic anhydride is an important part of Stepan’s polymers division. In addition to being used in polyester polyol chemistry, phthalic anhydride is a key raw material for plasticizers and unsaturated polyester resins.

The third division, specialty chemicals, is Stepan’s smallest by revenue, comprising only about 4% of the company’s total revenue. The segment produces science-based nutritional oils used in the food, nutrition, and pharmaceutical industries.

Its products are naturally derived ingredients that provide specific nutritional benefits in end markets like dietary supplements, beverages, nutritional powders, infant nutrition, and weight management.

Growth Prospects

Stepan reported second-quarter earnings on July 31st, 2024, with results coming in below estimates on both the top and bottom lines.

Revenue decreased 4% over the prior year’s quarter, from $580 million to $556 million, missing the analysts’ estimates by $25 million. Volume growth was more than offset by lower prices.

Earnings-per-share decreased 23%, from $0.53 to $0.41, missing the analysts’ estimates by a massive $0.26. The company has missed the analysts’ earnings-per-share estimates and revenue estimates in 5 of the last 6 quarters, indicating poor business momentum.

Second quarter earnings were significantly impacted by higher operational expenses at Millsdale site, start-up costs related to the new investment in Pasadena and a criminal social engineering event, which targeted one of the subsidiaries in Asia, leading to an unforeseeable expense in the quarter.

Stepan is actively investigating this fraud event with the assistance of outside counsel, and to date, it has not found any evidence of additional fraudulent activity.

Global demand has remained lackluster for the products of Stepan this year, leading to industry-wide destocking. Despite the relatively low comparison base formed in 2023, which was marked by a 67% decrease in earnings-per-share vs. 2022, we expect earnings-per-share to decline by another 3% this year, from $2.21 in 2023 to $2.15.

The company’s stated growth strategy includes R&D that develops a continuous stream of value-added applications, developing new processes for current products as well as refining existing processes.

Stepan also makes targeted acquisitions from time to time when appropriate, picking up manufacturing capacity or some other strategic advantage from its acquisitions.

It grows further by establishing manufacturing locations and sales offices where its customers are in the world, meaning it can more efficiently and effectively serve those varied customers.

Finally, it seeks to grow through strategic alliances via joint ventures where Stepan acts as a technical expert to complement the resources of a local partner with resources in the area.

This comprehensive growth strategy has worked for Stepan in the past and while it is not a true growth stock, over time it has produced meaningful revenue expansion using these strategies.

Stepan’s growth has been somewhat lumpy and volatile in the past, primarily due to the cycles of the demand for its products from manufacturers.

Due to the exceptionally low comparison base formed this year, we project earnings growth of 20% per year over the next five years, from $2.15 this year to $5.35 in 2029.

Even if the company achieves such a high growth rate, it will still fail to achieve the earnings it posted during 2020-2022.

Competitive Advantages & Recession Performance

Stepan’s competitive advantages include its customer base and end market diversity, its global supply chain and distribution network, as well as its technical expertise. Stepan is a true market leader in its niche and this has fueled its growth in the past 80+ years.

Stepan’s customers are extremely diverse, including end markets like agricultural products, construction, dietary supplements, cleaning products, personal care, laundry, oilfield services, pharmaceuticals and many more.

There are not many businesses in the world that serve such diverse end markets, and that offers Stepan exposure to lots of different industries. This creates lots of opportunities for growth as well as recession resistance.

In addition, the company operates around the world. This allows Stepan to have technical experts and sales professionals on the ground near its customers, developing products and solving problems more quickly and efficiently than if it were centralized in the U.S.

Adding in its vertical supply chain – which improves margins and reduces supplier risk – Stepan’s global footprint is a sizable asset.

Moreover, Stepan’s products are essential and not discretionary. As a result, the company fares very well during recessions.

During the Great Recession, it performed tremendously well; Stepan’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $0.75

- 2008 earnings-per-share of $1.20 (increase of 60%)

- 2009 earnings-per-share of $2.92 (increase of 143%)

- 2010 earnings-per-share of $2.95 (increase of 1.0%)

Revenue moved higher each year during this period except for 2009, but a tremendous amount of margin improvement during this period led Stepan to grow its earnings impressively, despite the economic malaise that had the world in its grips.

Operating margins were just 1.4%, in 2006 but peaked at 8.2% in 2009, driving the earnings growth Stepan enjoyed during this period.

Stepan is a very recession-resistant business, which is a significant advantage for the shareholders. The company again proved its resilience in 2020, as it continued to raise its dividend even in the challenging economic conditions caused by the pandemic.

Valuation & Expected Returns

With the current share price at ~$74, Stepan is trading at a price-to-earnings ratio of 34.4, well above our estimate of fair value at 19 times earnings.

Stepan stock appears to be richly valued right now, primarily due to the depressed earnings of the company this year. If the P/E multiple contracts from 34.4 to 19 over the next five years, valuation will reduce annual returns by 11.2% per year.

The company does use its capital to enhance its business through acquisitions, but Stepan, as a Dividend King, has been returning cash to shareholders for more than a half-century.

Source: Investor Presentation

Stepan has been trying to optimize its capital allocation, as it has many attractive endeavors to spend its capital on. It tries to grow its business with its large customers while it is also focused on achieving operational safety and cost savings.

In addition, the company has been growing its dividend for 56 consecutive years. It has grown its dividend by 7.8% per year on average over the last five years.

That’s very impressive but we don’t think that sort of growth rate can be sustained for the long-term, as the expected payout ratio for this year is 70%.

While the yield isn’t very impressive at just 2.0%, investors can sleep well at night knowing their payout is safe, and will likely remain on the rise for several more years.

The 2.0% yield and the 20% projected annual EPS growth are likely to be partly offset by an 11.2% headwind from multiple compression, resulting in an expected total annual return of 8.5% over the next five years.

Stepan receives a hold rating around its current stock price.

Final Thoughts

Due to its low dividend yield, Stepan doesn’t qualify as a high-income stock, despite its Dividend King status. However, the company raises its dividend year after year.

In addition, Stepan is a leader in its niche and has demonstrated that it is a strong business over the long run, with a growing dividend. Nevertheless, we believe that investors should wait for a more attractive entry point to buy the stock.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks