Published on March 19th, 2025 by Bob Ciura

The Dividend Kings are a selective group of stocks that have increased their dividends for at least 50 years in a row.

We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

RLI Corp. (RLI) is the newest member of the Dividend King list, having announced its 50th consecutive annual dividend increase on February 13th.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

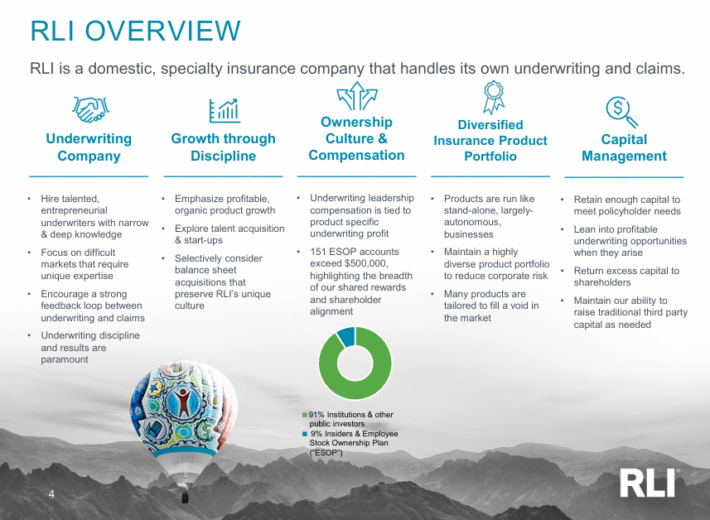

Business Overview

RLI Corp. is an insurance company that operates the following business units: Casualty (healthcare & transportation insurance), Property (fire, earthquake, difference in conditions, marine, etc.) and Surety (contract surety coverage, licenses, and bonds).

Source: Investor Presentation

RLI Corporation reported its fourth quarter earnings results on January 22. The company reported revenues of $440 million for the quarter, which was up 1% year-over-year. Net earned premiums rose by 15% year-over-year.

Realized gains were higher than during the previous year’s period, which had a positive impact on the company’s reported revenues, but net unrealized gains were lower compared to the previous year’s quarter, offset some of the revenue tailwinds.

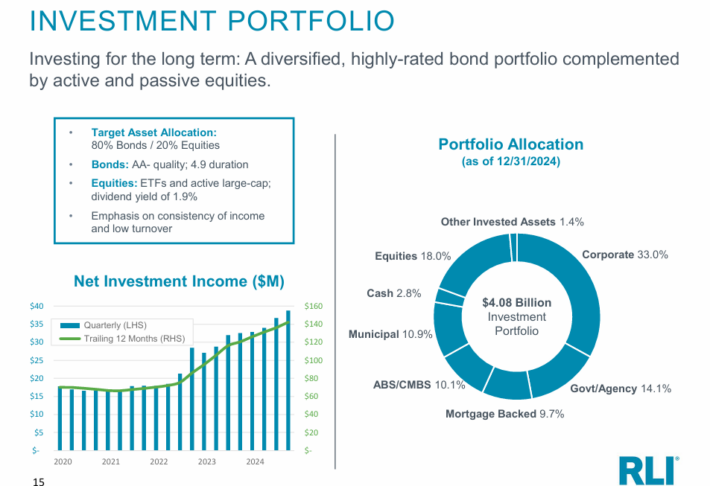

Higher net investment income, which was up 19% year over year, was a tailwind for RLI’s profitability during the quarter.

RLI Corporation earned $0.41 per share on a non-GAAP, or adjusted, basis during the quarter, which is where RLI backs out one-time items that can distort the picture when it comes to the company’s underlying earnings power.

RLI’s bottom line was lower than during the previous year’s period, but for the entire year of 2024, earnings were up. RLI Corp is forecasted to see its earnings-per-share grow nicely this year, to more than $3.00.

Growth Prospects

RLI Corp. has not been able to grow its profits very consistently in the past, as profits moved sideways for much of the last decade.

This is, in large part, because low interest rates reduced the income RLI can generate with its insurance float at times.

Since 2020, however, RLI Corp. has grown its earnings-per-share very nicely, with earnings-per-share rising by more than 100% between 2020 and 2024.

Higher interest rates allow RLI Corp. to deploy its insurance float in a more profitable way, thus a higher-rates environment is positive for the company, all else equal.

Source: Investor Presentation

RLI has grown its premiums in the recent past, and thanks to further premium growth, RLI should see its sales grow in the future.

We believe that 3% annual earnings-per-share growth is a realistic long-term estimate, factoring in the recent performance and the longer-term track record.

Competitive Advantages & Recession Performance

Many financial corporations, including some insurers, experienced significant difficulty during the Great Recession.

RLI remained profitable, and its earnings-per-share actually grew during the 2008-to-2010-time frame. We believe that RLI Corporation will be relatively stable during future recessions as well.

RLI Corporation has raised its regular dividend very steadily over the years, which was possible due to ongoing increases in the company’s payout ratio over many years.

More recently, the dividend payout ratio has come down again, and the dividend looks very sustainable for now.

During the Great Recession of 2008-2009, it steadily grew earnings-per-share each year in that time:

- 2008 earnings-per-share of $3.60

- 2009 earnings-per-share of $4.32 (20% increase)

- 2010 earnings-per-share of $6.00 (39 increase)

Valuation & Expected Total Returns

Based on expected 2025 earnings-per-share of $3.10, RLI stock trades for a forward P/E of 24.4. This is above our fair value estimate of 19, meaning shares appear overvalued.

RLI Corporation’s price to earnings multiple has been moving in a very wide range in the past. Shares were valued at a low double-digit price to earnings multiple shortly after the Great Recession, but the company’s valuation multiple has exploded upwards since then.

RLI’s valuation remains elevated. We believe that shares are trading above fair value and that multiple compression is likely going forward.

For example, if the P/E multiple declines from 24.4 to 19 over the next five years, it would reduce shareholder returns by -4.9% per year over that time frame.

Aside from changes in the P/E multiple, RLI should also generate returns from earnings growth and dividends. A projection of expected returns is below:

- 3% earnings-per-share growth

- 0.8% dividend yield

- -4.9% multiple reversion

RLI has a regular quarterly dividend, and periodically pays special dividends as well. For example, the company paid shareholders a special dividend of $4.00 per share in 2024, and a $2.00 special dividend in 2023.

However, since special dividends are irregular, we exclude them from our analysis and instead focus on the regular quarterly payouts.

In this scenario, RLI stock is projected to generate a negative total return of -1.1% per year over the next five years.

Final Thoughts

RLI Corporation is an insurance company which generated solid operating results in recent years, with written premiums and investment income rising at a nice pace.

Earnings will likely continue to grow during the next couple of years, but not at an overly fast pace.

RLI Corporation does not have a very strong long-term track record, even though results during recent years were strong, while the outlook for 2025 is compelling as well.

However, we believe that shares are overvalued today. Because of this, RLI Corporation earns a sell recommendation from Sure Dividend at the current valuation level.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks