Updated on October 31st, 2024 by Aristofanis Papadatos

The Dividend Kings are a selective group of stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks.

With this in mind, we created a full list of all the Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

A relatively new member to join this list is Nucor Corporation (NUE), an American steel giant. Nucor has successfully navigated the cyclicality facing the industry to consistently grow its dividend.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

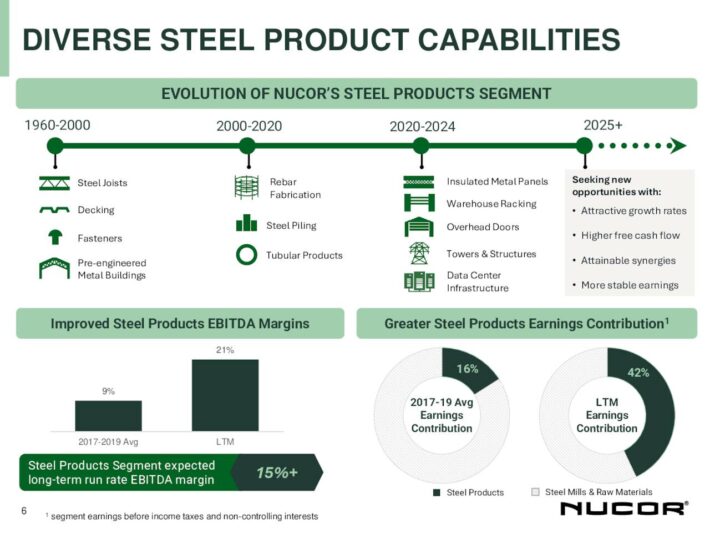

Nucor is headquartered in Charlotte, North Carolina and is a giant in the steel industry as the largest publicly traded US-based steel corporation based on its market capitalization. The company currently operates in three segments: Steel Mills (the largest segment by revenue), Steel Products, and Raw Materials.

The steel industry is notoriously cyclical, which makes Nucor’s streak of 51 consecutive years of dividend raises even more remarkable. The company faces challenges from international competitors. Some countries (including China), subsidize their steel industry, making steel exported to the United States artificially cheap.

Nucor manufactures a wide variety of material types, including sheet steel, steel bars, structural formations, steel plates, downstream products, and raw materials. The majority of the company’s production comes from a combination of sheet and bar steel, as has been the case for many years.

Source: Investor Presentation

Nucor has been successful over the long-term thanks to its focus on low-cost production. This allows the company to maintain profitability during downturns and produce significant operating leverage during better times.

In addition, it has worked to expand its product offerings to new markets while maintaining and growing its market leadership in existing channels.

On October 21st, 2024, Nucor Corporation released its third-quarter earnings report for 2024. Volumes edged down only 1% but average realized steel prices were 15% lower than those in the prior year’s period. As a result, revenue decreased 15% and earnings per share plunged 67%, from $4.57 to $1.49.

Even worse, in the latest conference call, Nucor stated that it expects its sales and earnings to decline further in the fourth quarter of the year due to a slowing global economy. As a result, the stock price plunged 6% on the day of the earnings release.

Growth Prospects

We believe that Nucor’s earnings per share are likely to decline by 0.9% per year on average over the next five years. Nucor’s earnings per share are highly sensitive to steel prices. The company’s previous all-time earnings-per-share high came in 2008, which coincided with the all-time high price of steel in the US.

The factors that drove the enormous earnings of 2021 and 2022, which involve pent-up demand after the pandemic and blowout steel prices amid supply chain restrictions, are simply unsustainable.

For the long-term, Nucor’s markets have a largely favorable growth outlook. Nucor’s diversification in terms of end markets also offers some relative stability when downturns strike. This helps the company perform well compared to other steel makers during recessions.

Nucor is also investing in growth initiatives that include harvesting new revenue synergies, improving operational and supply chain efficiencies, and expanding the businesses’ product offerings and geographic footprint.

Competitive Advantages & Recession Performance

Nucor is a manufacturer and distributor of steel, which – like the vast majority of raw materials businesses – is fundamentally a commodity product and therefore subject almost entirely to price as its sole differentiator.

Warren Buffett has the following to say about commodity businesses:

“Stocks of companies selling commodity-like products should come with a warning label: ‘Competition may prove hazardous to human wealth.’” – Warren Buffett

Certainly, commodity businesses are not the most defensive businesses due to their cyclicality. This can be seen by looking at Nucor’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $4.98

- 2008 adjusted earnings-per-share: $6.01

- 2009 adjusted earnings-per-share: net loss of ($0.94)

- 2010 adjusted earnings-per-share: $0.42

- 2011 adjusted earnings-per-share: $2.45

As a commodity producer, Nucor is highly vulnerable to fluctuations in the price of steel. Steel demand is tied to construction and the overall economy. During the Great Recession, the company saw earnings per share decline from $6.01 in 2008 to a loss per share of -$0.94 in 2009, and the stock lost two-thirds of its market capitalization in just six months.

Investors should be aware of the significant downside risk of Nucor, as the steel producer is likely to perform poorly in a protracted recession.

Valuation & Expected Total Returns

We assume a normalized earnings power-per-share of $13.60 for 2024, to smooth out the cyclicality of results. That puts the price-to-earnings power ratio at 10.5, which is below our fair value estimate of 12.0. For steel producers we remain more cautious than the general market, in no small part due to the volatility of commodity prices.

As a result of our modeling assumptions, Nucor is slightly undervalued today. An expanding valuation multiple could boost annual returns by 2.7% over the next five years.

In addition, the stock has a current dividend yield of 1.5%. Finally, we expect Nucor’s earnings per share to decline by 0.9% per year. As a result, total returns are expected to be only 3.2% per year on average over the next five years. Due to its low expected return, the stock has a sell rating around its current price.

Final Thoughts

Nucor’s status as a Dividend King helps it stand out among the highly volatile materials sector. There are very few raw materials businesses that have multi-decade track records of compounding their dividends and adjusted earnings per share.

Nucor has a low dividend yield when compared to the broader stock market, but the company has a long history of annual dividend raises. Nucor also has a strong industry position and a healthy balance sheet.

However, the stock does not merit a buy recommendation at the current price, given its negative expected returns. For investors who are looking for exposure to raw materials, we recommend waiting for a better opportunity to acquire shares of Nucor.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 NASDAQ stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks