Updated on January 23rd, 2024

At Sure Dividend, we believe that the best investment strategy is to identify high-quality companies with strong business models that have paid dividends for long periods of time. A good example of such names is those that have earned the title of Dividend Aristocrat, which are those S&P 500 companies with at least 25 years of dividend growth.

You can download our full list of the 68 Dividend Aristocrats, along with important metrics such as dividend yields and market capitalization, by clicking on the link below.

The Dividend Aristocrats have successfully navigated multiple recessions while growing their dividends at the same time. Dividend growth during economic expansions is one thing, but raising payments during a downturn is a sign of a company that has goods or services that customers need even in a recession.

Owning stocks of this type for long periods of time while reinvesting the dividends to acquire more shares is our preferred way to acquire wealth.

While we typically follow a long-term investment strategy, we believe it is important to consider various other paths that can lead to financial freedom.

This article will examine the dividend capture strategy, the advantages, and risks of the strategy, and provide a few examples of stocks that could be a good way for the investor to utilize this strategy.

Dividend Capture Strategy – The Basics

The first item that investors interested in the dividend capture strategy need to know is that this investment philosophy centers around the dates associated with the dividend, including the declaration date, the ex-dividend date, the date of record, and the pay date.

Most investors are already familiar with these dates, but a quick review can be helpful in the discussion of the dividend capture strategy.

- The declaration date is the date that the board of directors announces that a dividend will be paid. The other dates important to the dividend and the amount paid are also stated.

- The ex-dividend is the date that the stock trades without the dividend being paid. Investors need to own the stock prior to this date to be entitled to the next dividend payment. The dividend to be paid is also reflected in the share price as it is accordingly reduced by the amount of the dividend on this date.

- Date of record is the day that the company records the shareholders that are eligible to receive the dividend.

- Pay date is the day that shareholders receive their dividends.

Of these dates, the most important to those using the dividend capture strategy is the ex-dividend date. The basis of the entire dividend capture strategy is that the stock must be purchased before this date, or the dividend will not be paid to that investor.

The security can then be sold on the ex-dividend or after, and the investor will still receive the dividend on the pay date.

In theory, the price of the security should fall by the amount of the dividend on the ex-dividend date, as those investors will not receive the payment. For example, the investor purchases shares of company ABC at $50, and the next dividend payment is $1.00. This should result in the share price opening at $49 for ABC.

But this is not always the case in real-time. Suppose the investor waits to see the market’s reaction to the stock, and shares eventually rally to $49.50. The investor then sells their position. When the dividend is distributed a few weeks later, the investor has a total profit of $0.50 per share as the $0.50 loss per share from selling only partially offsets the $1 dividend.

Advantages of the Dividend Capture Strategy

Because the dividend capture strategy is based primarily on the ex-dividend date, one of the chief advantages of the strategy is that it is very simple. Dividend capture can be done with any stock that pays a dividend, providing, in theory, almost limitless ways to secure dividend income.

The investor can simply make a list of stocks that pay a dividend and the upcoming ex-dividend. This can provide a road map of what securities to buy, what day to make the purchase, and the sale.

And because the position is sold on the ex-dividend date or shortly thereafter, the number of dividends to be received can lead to sizeable income levels. The investor doesn’t have to wait every three months to receive their next payment as they would normally do if they were a long-term owner of the position.

In this case, dividend capture can mean multiple dividend payments almost any day the market is open. Those dividends can then be added to the investment sum, which can purchase more shares and, thus, more dividend income.

The dividend capture strategy can be successful even if the investor has limited investment funds. Admittedly, long-term dividend growth investing can take years, if not decades, and large amounts of capital to be successful. Dividend capture can generate high levels of income using minimum amounts of capital as the investor has more opportunities to receive payments.

Because investors are focusing on just the next dividend payment, there is very limited risk associated with a potential dividend cut. Even if the company cuts its next dividend, the stock is owned only before and after the ex-dividend date. Shareholders are entitled to the full dividend payment that was declared.

While we stress knowing what you’re buying before doing so, this strategy can limit the amount of time needed to research potential investments or wait for a perfect entry point. Investors would instead focus their energy on creating a list of stocks to own and knowing the upcoming ex-dividend date.

Valuation isn’t as important as the holding period is likely a few days instead of months or years, and therefore the risk of buying a security at elevated levels is less of a concern. The fear of buying a stock at its absolute peak isn’t a risk that dividend capture investors need to be focused on.

Finally, let’s return to our example of company ABC. Let’s say that ABC had some positive news that coincided with the ex-dividend date say an analyst’s upgrade or a company announcement that it was making a significant acquisition. The stock price could rally further. If the share price at the time of selling were above the purchase price, then the investor would see the profits from that as well as the dividend when it was paid a few weeks later.

Risks of the Dividend Capture Strategy

While the advantages of dividend capture appear to be great, there are also some clear risks associated with the strategy.

Returning to our example of company ABC, there could be news on or around the intended time of selling, either to the market in general or the stock especially, that causes a negative market reaction. Instead of declining by just the $1.00 dividend on the ex-dividend date, ABC could fall much more than that.

If the investor sold the stock at $45, then the loss would be $4.00 per share after adding the dividend payment, which would mean a reduction in available funds to invest for the next purchase. Assuming the available capital for investment is already limited, this would be a major setback.

While researching the company’s fundamentals might not be a major priority, successful implementation of the dividend capture strategy requires curating a list of investments that would take time and planning. A date to buy and sell would need to be established to make the next purchase.

In essence, this strategy requires the investor to be a day trader, which can be difficult under normal conditions, but especially painful on days when stocks are down significantly. Veering from the planned buying and selling dates can lead to missing ex-dividend dates and future payments.

Dividend capture removes many of the tax breaks that long-term holders of stock enjoy. This doesn’t apply to tax-deferred accounts but does to taxable accounts. For a dividend to be known as a qualified dividend, the underlying stock must be held for at least 60 days during the 121 days before the ex-dividend date. The tax rate of a qualified dividend is 15%.

Since few dividends received under this strategy will be considered qualified, they are taxed at the investor’s normal income tax rate. In all likelihood, the non-qualified dividend will be taxed at a higher rate regardless of the tax bracket.

Examples of the Dividend Capture Strategy in Action

There are plenty of options to choose from as many companies pay dividends, but those with low yields would likely not be ideal candidates as the income received wouldn’t justify the risk.

Same with the lower-yielding but higher growth stocks, such as Apple Inc. (AAPL) or Microsoft Corporation (MSFT). These types of stocks don’t offer much in the way of dividend income, so investors would need to be sure that the share price would rally on the ex-dividend date to profit from these names. That is a significant risk as high-growth stocks tend to have more downside potential when markets fall.

Therefore, investors wishing to follow this philosophy probably need to consider higher-yielding stocks. Of course, with higher yields often come higher risks. While dividend capture does limit the impact of dividend cuts, higher-risking securities can also have outsized moves to the downside, putting the entire strategy at risk of failing.

In order to limit overall risk, we believe that those following this strategy target high-quality names with strong business models and decades of dividend growth, as they are typically seen as the more stable of investments.

Identifying names with a low beta would also be important. There might not be as much upside potential in the stock on the ex-dividend date, but this could also limit a steep reduction in the share price even if the market has a severe down day at the planned time of selling.

One example that meets all of these criteria is AbbVie Inc. (ABBV). AbbVie was spun off from parent company Abbott Laboratories in 2013. Since then, the company has produced very strong results, speaking to the strength of its business.

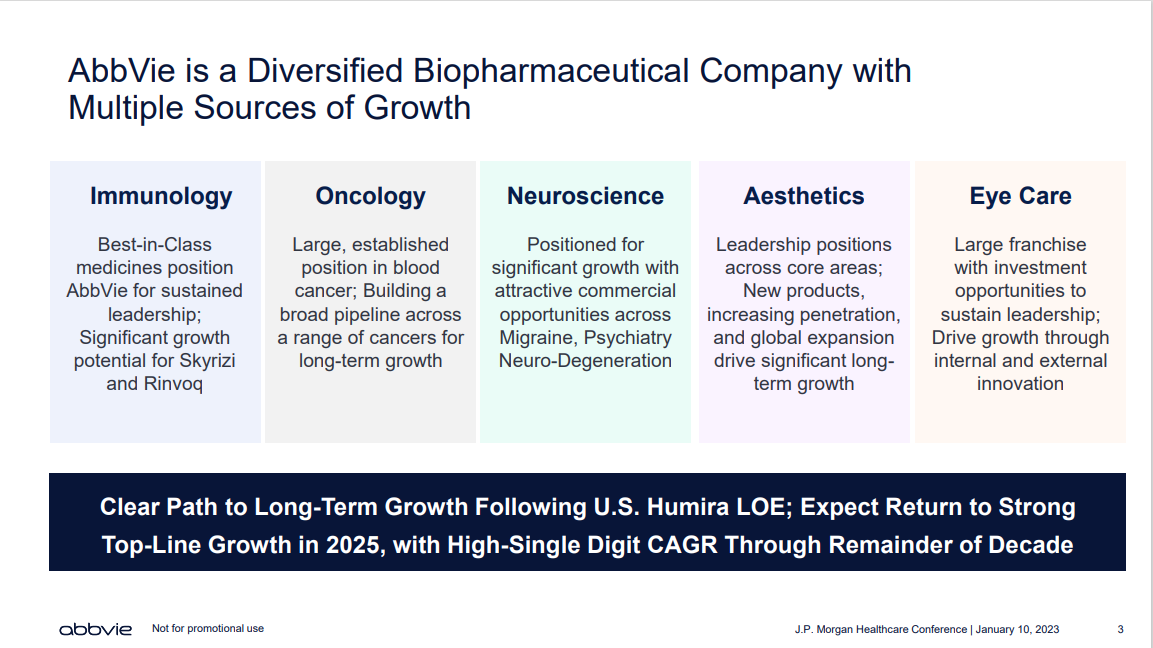

Today, AbbVie focuses on one main business segment—pharmaceuticals. It focuses on a few key treatment areas, including immunology, hematologic oncology, neuroscience, and more.

Source: Investor Presentation

Including the time it was part of Abbott Laboratories, AbbVie has raised its dividend for 51 consecutive years, making the company a Dividend King.

AbbVie is also in the healthcare sector, which is usually one of the more stable areas of the economy. This sector is usually in favor even during periods of economic distress, which can provide stability in a recession.

Real estate investment trusts, or REITs, could be good candidates for the dividend capture strategy as they are required by law to pay out at least 90% of income in the form of dividends to investors. As a result, stocks in this sector often have elevated yields.

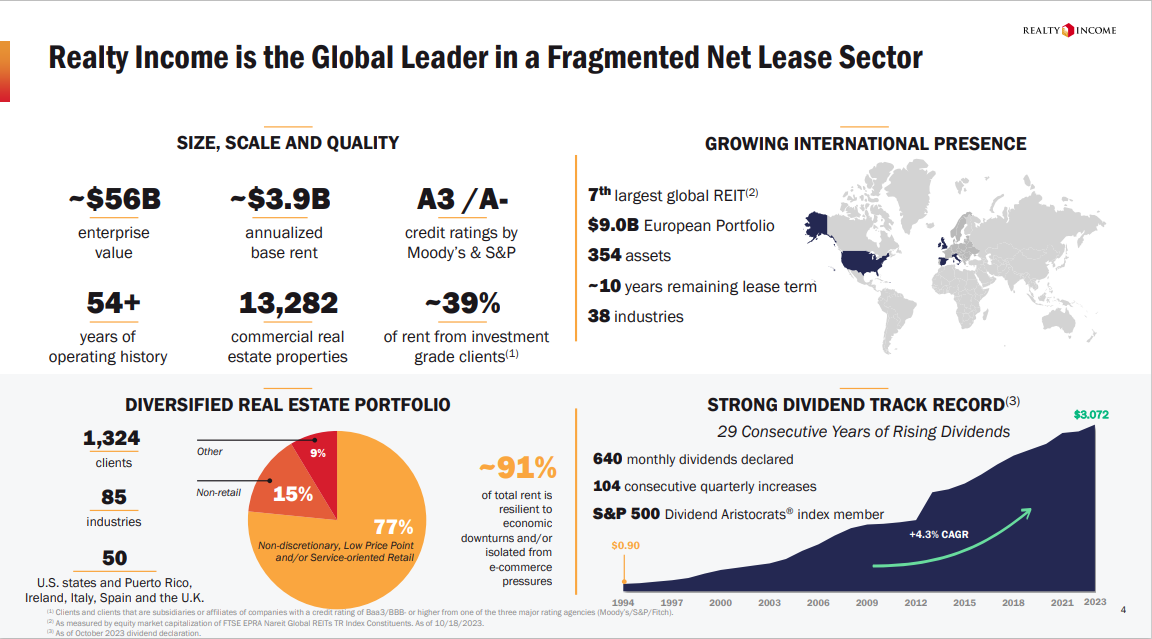

Take Realty Income (O), for example. The stock yields 6.1%, which is more than three times the average yield of 1.7% for the S&P 500 Index. Realty Income has raised its dividend for over 25 years, which makes it a Dividend Aristocrat.

Source: Investor Presentation

And while most companies pay their dividend quarterly, Realty Income pays dividends each month.

A dividend capture strategy might work best with a company that distributes monthly payments, as the ex-dividend dates are usually similar month to month. There are roughly 80 monthly dividend-paying stocks, so the choices are limited.

Realty Income has earned the nickname The Monthly Dividend Company due to its more than a quarter century of making monthly payments.

Shareholders have received more than 600 monthly payments, and the trust has raised its dividend over 100 times since Realty Income went public in 1994.

Final Thoughts

Long-term dividend growth investing is the most popular income-focused strategy, but the dividend capture strategy does have its positives. This strategy can provide a higher frequency of dividend payments and can be a useful tool for those with limited investment capital to create income.

That said, this strategy requires great attention to the important dates associated with the dividend, particularly the ex-dividend date. An investor would have to be very disciplined when buying and selling securities to maximize dividend capture chances of success. This involves the risk of a loss and forfeits any tax benefits related to the long-term holding of securities.

Finally, if the investor were to pursue this strategy, we would stress that they focus on high-quality companies, the same that we suggest long-term investors purchase. For this reason, plus the risks involved with dividend capture, we firmly believe that long-term dividend growth investing is the best to build wealth.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Best DRIP Stocks: The top 15 Dividend Champions with no-fee dividend reinvestment plans.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks