Published on August 16th, 2024 by Bob Ciura

Different investors may have different interpretations of the term “blue chip,” but in general, it refers to companies that are considered the leaders in their respective industries.

For us, a stock earns the title of “blue chip” when it features at least a decade of consistent dividend growth. It’s not a small accomplishment, as it demonstrates that the company’s business model is likely to withstand tough economic times while continuing to deliver steady growth.

As a result, we feel that blue chip stocks are among the safest dividend stocks investors can buy.

With all this in mind, we created a list of 400+ blue-chip stocks, which you can download by clicking below:

The tech sector isn’t typically known for dividend growth stocks, but these companies have demonstrated a commitment to growing shareholder cash returns.

To highlight these industry leaders, we’ve compiled a list of the top 10 tech sector blue chip stocks. Each of these tech stocks have raised their dividends for at least 10 consecutive years.

In addition, the 10 tech stocks below have Dividend Risk scores of ‘C’ or better, indicating that their payouts are secure.

The stocks are ranked in order of five-year expected annual returns, from lowest to highest.

Table of Contents

- Blue Chip Tech Stock #10: Skyworks Solutions (SWKS)

- Blue Chip Tech Stock #9: HP Inc. (HPQ)

- Blue Chip Tech Stock #8: Oracle Corp. (ORCL)

- Blue Chip Tech Stock #7: Microsoft Corporation (MSFT)

- Blue Chip Tech Stock #6: Intuit Inc. (INTU)

- Blue Chip Tech Stock #5: Analog Devices, Inc. (ADI)

- Blue Chip Tech Stock #4: QUALCOMM Incorporated (QCOM)

- Blue Chip Tech Stock #3: Littelfuse, Inc. (LFUS)

- Blue Chip Tech Stock #2: Broadridge Financial Solutions (BR)

- Blue Chip Tech Stock #1: Cisco Systems, Inc. (CSCO)

Blue Chip Tech Stock #10: Skyworks Solutions (SWKS)

- Years of Dividend Growth: 11

- 5-Year Expected Annual Returns: 2.0%

Skyworks Solutions is a semiconductor company that designs, develops, and markets proprietary semiconductor products worldwide. Its products include antenna tuners, amplifiers, converters, modulators, receivers, and switches.

Skyworks’ products are used in diverse industries, including automotive, connected home, industrial, medical, smartphones, and defense.

On July 30th, 2024, Skyworks reported third-quarter results for Fiscal Year (FY)2024. The company posted revenue of $906 million. The company achieved a GAAP diluted earnings per share (EPS) of $0.75 and a non-GAAP diluted EPS of $1.21.

The year-to-date operating cash flow stands at $1.35 billion, with a free cash flow of $1.27 billion, reflecting strong cash flow margins of 43% and 40%, respectively. These results underscore Skyworks’ profitability and consistent performance in line with its guidance.

Click here to download our most recent Sure Analysis report on SWKS (preview of page 1 of 3 shown below):

Blue Chip Tech Stock #9: HP Inc. (HPQ)

- Years of Dividend Growth: 13

- 5-Year Expected Annual Returns: 3.7%

HP Inc. has centered its business activities around two main segments: its product portfolio of printers, and its range of personal systems, which includes computers and mobile devices. HP reported its second quarter (fiscal 2024) results on May 30.

The company reported revenue of $12.8 billion for the quarter, which beat the analyst consensus estimate, and which was down 1% from the previous year’s quarter. This was slightly better than the revenue decline that HP experienced during the previous quarter, when revenues were down by 5% on a year-over-year basis.

Non-GAAP earnings-per-share totaled $0.82 during the second quarter, which was ahead of the analyst consensus estimate. HP Inc. saw its operating margin improve over the last year.

The company currently forecasts earnings-per-share in a range of $0.78 to $0.92 for the third quarter, which would mean a better result versus the most recent quarter at the midpoint of the guidance range. For the current year, HP forecasts earnings-per-share of around $3.45.

Click here to download our most recent Sure Analysis report on HPQ (preview of page 1 of 3 shown below):

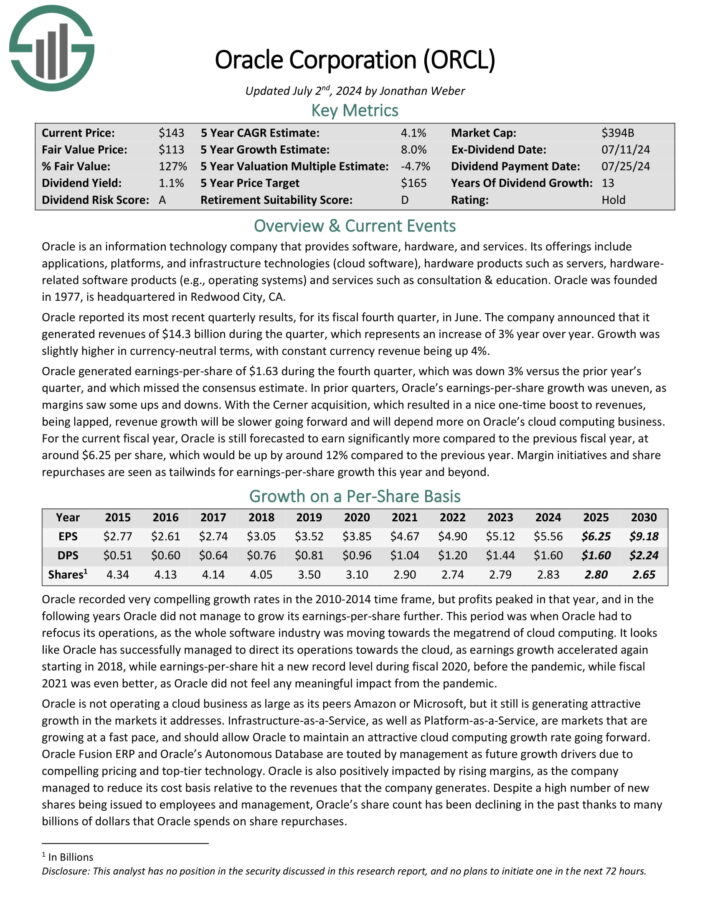

Blue Chip Tech Stock #8: Oracle Corporation (ORCL)

- Years of Dividend Growth: 13

- 5-Year Expected Annual Returns: 5.1%

Oracle is an information technology company that provides software, hardware, and services. Its offerings include applications, platforms, and infrastructure technologies (cloud software), hardware products such as servers, hardware-related software products (e.g., operating systems), and services such as consultation & education.

Oracle reported its most recent quarterly results, for its fiscal fourth quarter, in June. The company announced that it generated revenues of $14.3 billion during the quarter, which represents an increase of 3% year over year. Growth was slightly higher in currency-neutral terms, with constant currency revenue being up 4%.

Oracle generated earnings-per-share of $1.63 during the fourth quarter, which was down 3% versus the prior year’s quarter, and which missed the consensus estimate. In prior quarters, Oracle’s earnings-per-share growth was uneven as margins saw some ups and downs.

Click here to download our most recent Sure Analysis report on ORCL (preview of page 1 of 3 shown below):

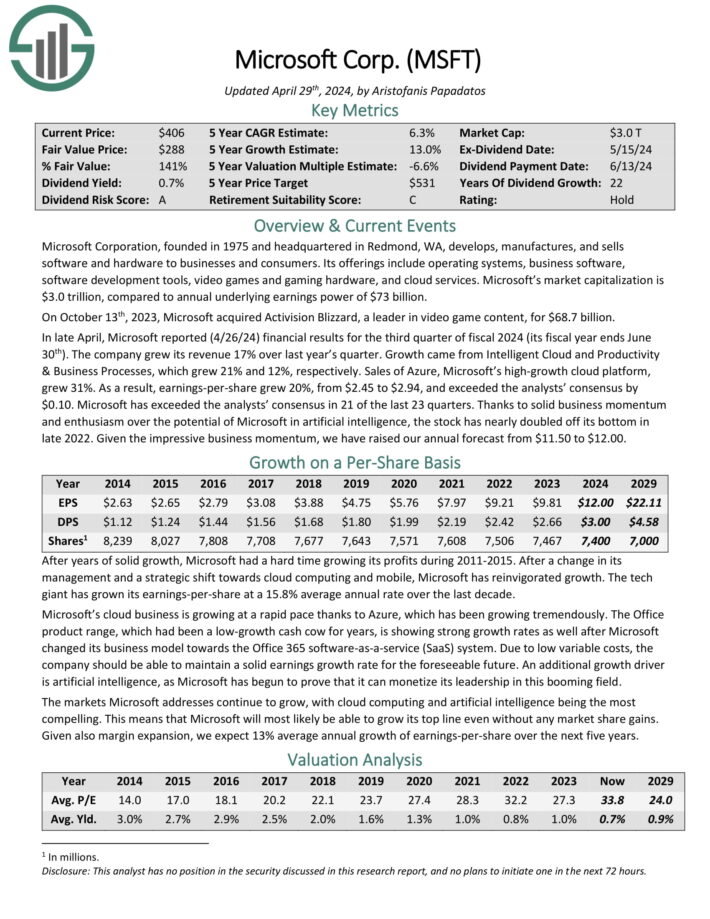

Blue Chip Tech Stock #7: Microsoft Corporation (MSFT)

- Years of Dividend Growth: 22

- 5-Year Expected Annual Returns: 5.5%

Microsoft Corporation, founded in 1975 and headquartered in Redmond, WA, develops, manufactures, and sells software and hardware to businesses and consumers.

Its offerings include operating systems, business software, software development tools, video games and gaming hardware, and cloud services. Microsoft’s market capitalization is ~$3.0 trillion, compared to annual underlying earnings power of $73 billion.

In late April, Microsoft reported (4/26/24) financial results for the third quarter of fiscal 2024 (its fiscal year ends June 30th). The company grew its revenue 17% over last year’s quarter.

Growth came from Intelligent Cloud and Productivity & Business Processes, which grew 21% and 12%, respectively.

Microsoft’s cloud business is growing at a rapid pace thanks to Azure. The Office product range, which had been a low-growth cash cow for years, is showing strong growth rates as well after Microsoft changed its business model towards the Office 365 software-as-a-service (SaaS) system.

Click here to download our most recent Sure Analysis report on MSFT (preview of page 1 of 3 shown below):

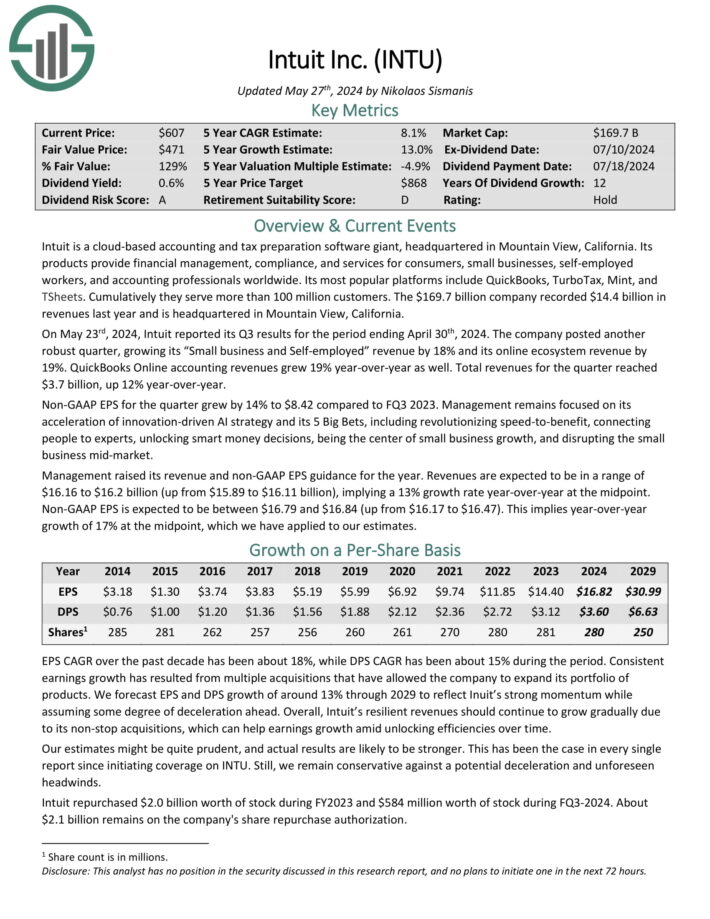

Blue Chip Tech Stock #6: Intuit Inc. (INTU)

- Years of Dividend Growth: 12

- 5-Year Expected Annual Returns: 6.5%

Intuit is a cloud-based accounting and tax preparation software giant. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide.

Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers.

On May 23rd, 2024, Intuit reported its Q3 results for the period ending April 30th, 2024. The company posted another robust quarter, growing its “Small business and Self-employed” revenue by 18% and its online ecosystem revenue by 19%.

QuickBooks Online accounting revenues grew 19% year-over-year as well. Total revenues for the quarter reached $3.7 billion, up 12% year-over-year. Non-GAAP EPS for the quarter grew by 14% to $8.42 compared to FQ3 2023.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

Blue Chip Tech Stock #5: Analog Devices, Inc. (ADI)

- Years of Dividend Growth: 20

- 5-Year Expected Annual Returns: 6.7%

Analog Devices makes integrated circuits that are sold to OEMs (original equipment manufacturers) to be incorporated into equipment and systems for communications, computer, instrumentation, industrial, military/aerospace, and consumer electronics applications.

The company is changing to meet the needs of new markets with its $10 billion investment in Research and Development over the past 10 years, and their previous acquisitions of companies like Maxim Integrated, Linear Technology, and Hittite.

On February 20th, 2024, Analog Devices announced a 7% dividend increase to $0.92 per share quarterly.

On May 22nd, 2024, Analog Devices reported second quarter 2024 results for the period ending May 4th, 2024. For the quarter, the company reported revenue of $2.16 billion, down 34% compared to the prior year’s quarter, which beat analysts’ estimates by $50 million. The company saw adjusted earnings-per-share of $1.40, which also beat analysts’ estimates by 13 cents but represented a 51% decline in EPS compared to the year-ago quarter.

During the quarter, Analog Devices repurchased $222 million of its shares, and paid $456 million in dividends.

Click here to download our most recent Sure Analysis report on ADI (preview of page 1 of 3 shown below):

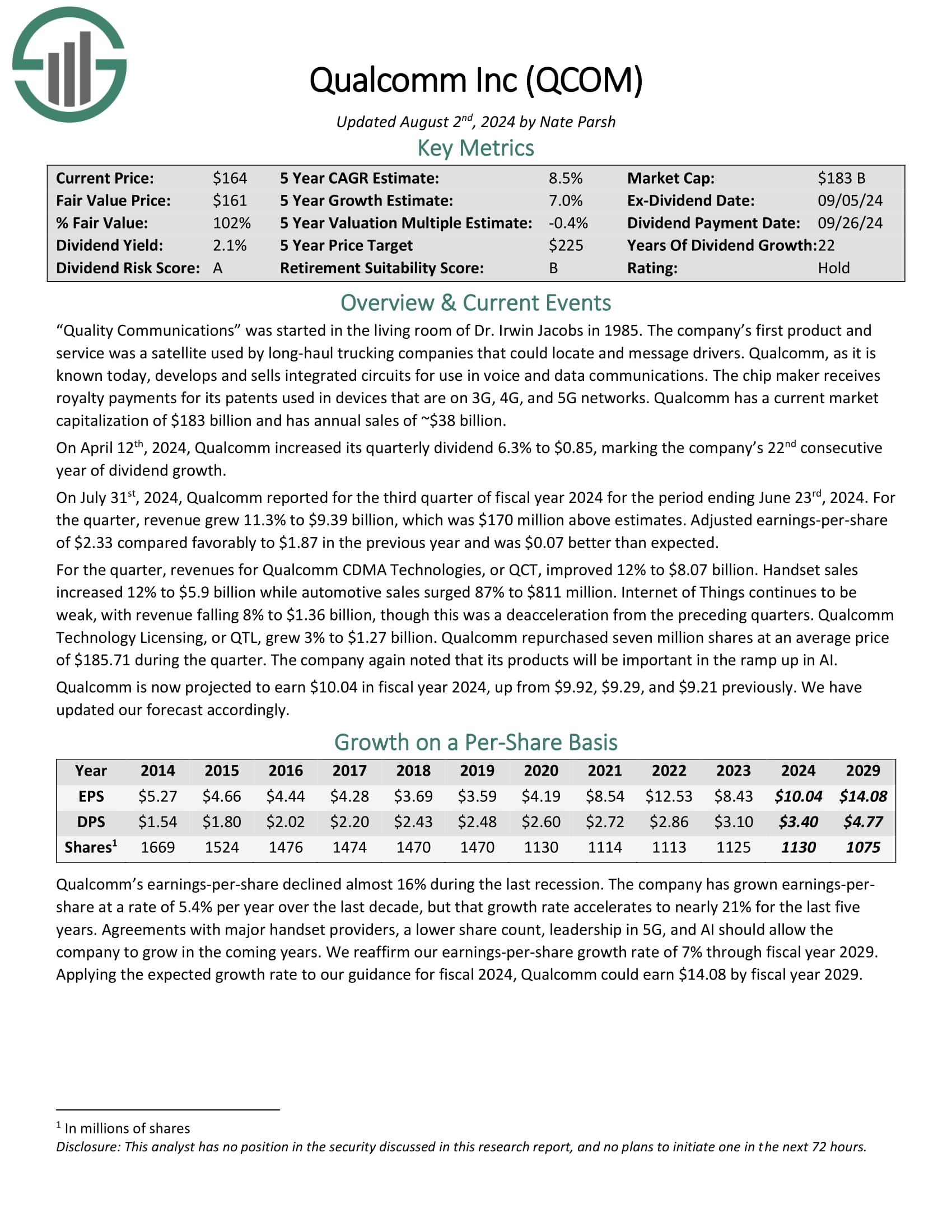

Blue Chip Tech Stock #4: QUALCOMM Incorporated (QCOM)

- Years of Dividend Growth: 22

- 5-Year Expected Annual Returns: 7.3%

Qualcomm has evolved into a leading developer and distributor of integrated circuits for both voice and data transmissions. Thanks to its extensive patent portfolio, Qualcomm receives royalties from devices operating on cutting-edge 5G networks.

On April 12th, 2024, Qualcomm increased its quarterly dividend 6.3% to $0.85, marking the company’s 22nd consecutive year of dividend growth.

On July 31st, 2024, Qualcomm reported for the third quarter of fiscal year 2024 for the period ending June 23rd, 2024. For the quarter, revenue grew 11.3% to $9.39 billion, which was $170 million above estimates. Adjusted earnings-per-share of $2.33 compared favorably to $1.87 in the previous year and was $0.07 better than expected.

For the quarter, revenues for Qualcomm CDMA Technologies, or QCT, improved 12% to $8.07 billion. Handset sales increased 12% to $5.9 billion while automotive sales surged 87% to $811 million.

Click here to download our most recent Sure Analysis report on Qualcomm (preview of page 1 of 3 shown below):

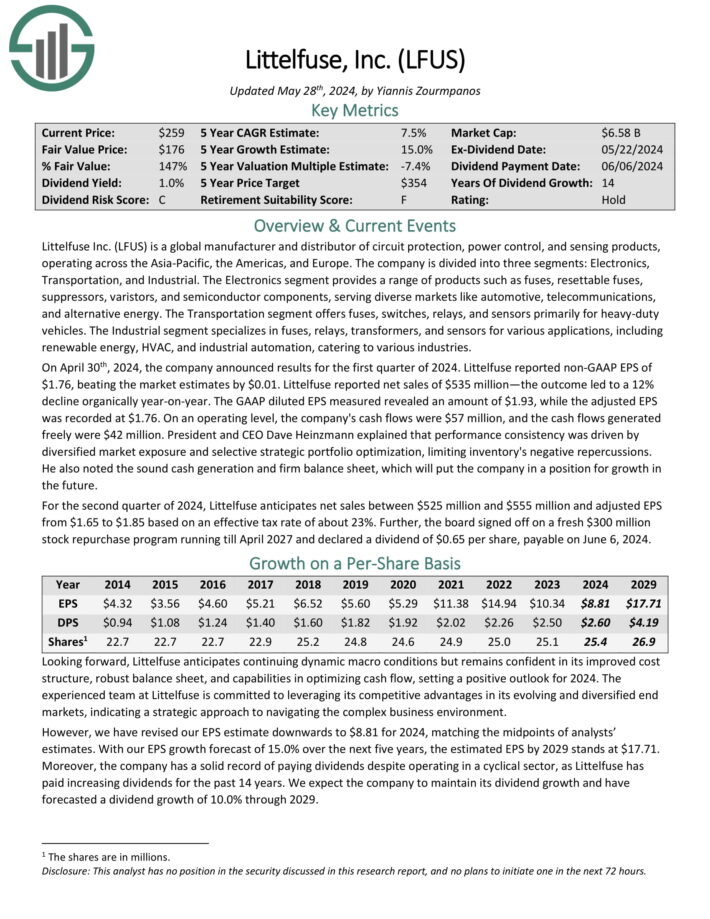

Blue Chip Tech Stock #3: Littelfuse, Inc. (LFUS)

- Years of Dividend Growth: 14

- 5-Year Expected Annual Returns: 7.4%

Littelfuse Inc. is a global manufacturer and distributor of circuit protection, power control, and sensing products, operating across the Asia-Pacific, the Americas, and Europe.

The company is divided into three segments: Electronics, Transportation, and Industrial. The Electronics segment provides a range of products such as fuses, resettable fuses, suppressors, varistors, and semiconductor components, serving diverse markets like automotive, telecommunications, and alternative energy.

The Transportation segment offers fuses, switches, relays, and sensors primarily for heavy-duty vehicles. The Industrial segment specializes in fuses, relays, transformers, and sensors for various applications, including renewable energy, HVAC, and industrial automation, catering to various industries.

On April 30th, 2024, the company announced results for the first quarter of 2024. Littelfuse reported non-GAAP EPS of $1.76, beating the market estimates by $0.01. Littelfuse reported net sales of $535 million—a 12% decline organically year-on-year.

Click here to download our most recent Sure Analysis report on LFUS (preview of page 1 of 3 shown below):

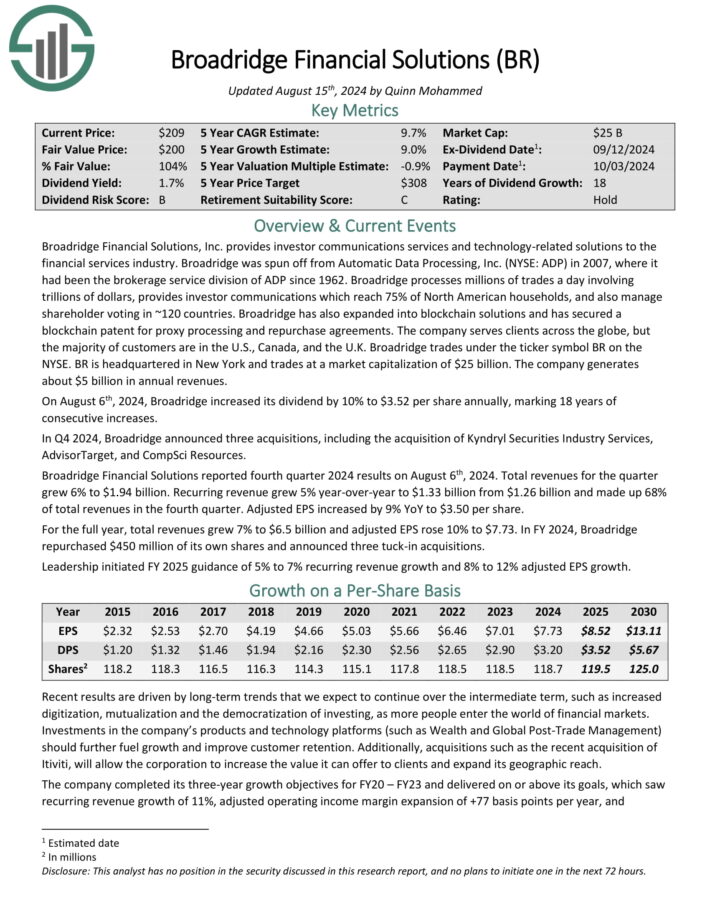

Blue Chip Tech Stock #2: Broadridge Financial Solutions, Inc. (BR)

- Years of Dividend Growth: 18

- 5-Year Expected Annual Returns: 9.6%

Broadridge Financial Solutions, Inc. provides investor communications services and technology-related solutions to the financial services industry. Broadridge was spun off from Automatic Data Processing in 2007, where it had been the brokerage service division of ADP since 1962.

Broadridge Financial Solutions reported fourth quarter 2024 results on August 6th, 2024. Total revenues for the quarter grew 6% to $1.94 billion. Recurring revenue grew 5% year-over-year to $1.33 billion from $1.26 billion and made up 68% of total revenues in the fourth quarter. Adjusted EPS increased by 9% YoY to $3.50 per share.

For the full year, total revenues grew 7% to $6.5 billion and adjusted EPS rose 10% to $7.73. In FY 2024, Broadridge repurchased $450 million of its own shares and announced three tuck-in acquisitions.

Click here to download our most recent Sure Analysis report on Broadridge (preview of page 1 of 3 shown below):

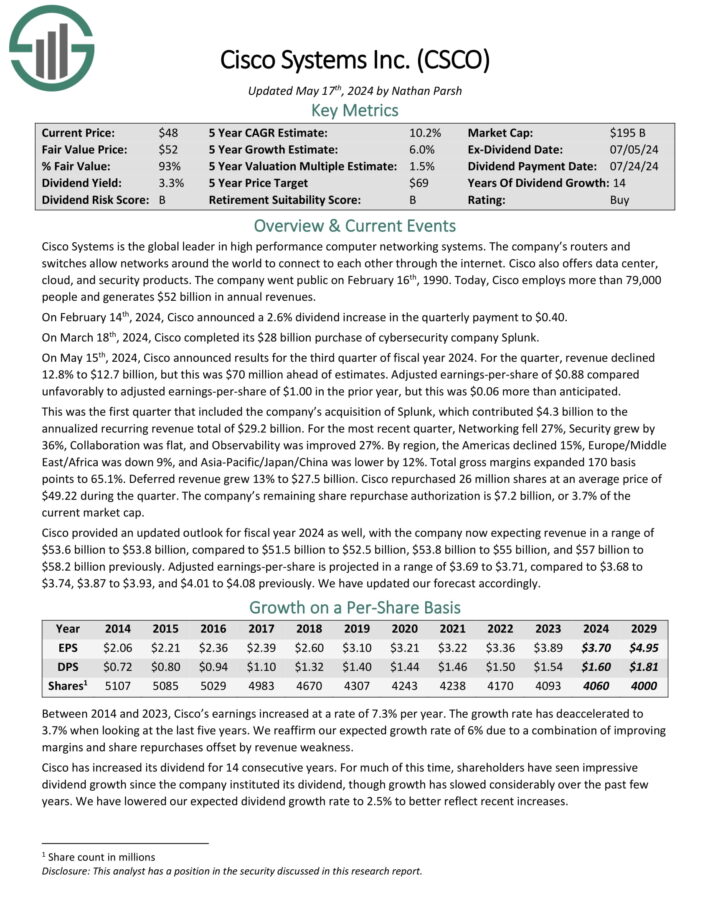

Blue Chip Tech Stock #1: Cisco Systems, Inc. (CSCO)

- Years of Dividend Growth: 14

- 5-Year Expected Annual Returns: 10.0%

Cisco Systems is the global leader in high performance computer networking systems. The company’s routers and switches allow networks around the world to connect to each other through the internet. Cisco also offers data center, cloud, and security products.

Cisco employs more than 79,000 people and generates $52 billion in annual revenues. On February 14th, 2024, Cisco announced a 2.6% dividend increase in the quarterly payment to $0.40.

On March 18th, 2024, Cisco completed its $28 billion purchase of cybersecurity company Splunk. On May 15th, 2024, Cisco announced results for the third quarter of fiscal year 2024.

For the quarter, revenue declined 12.8% to $12.7 billion, but this was $70 million ahead of estimates. Adjusted earnings-per-share of $0.88 compared unfavorably to adjusted earnings-per-share of $1.00 in the prior year, but this was $0.06 more than anticipated.

This was the first quarter that included the company’s acquisition of Splunk, which contributed $4.3 billion to the annualized recurring revenue total of $29.2 billion. For the most recent quarter, Networking fell 27%, Security grew by 36%, Collaboration was flat, and Observability was improved 27%.

Click here to download our most recent Sure Analysis report on CSCO (preview of page 1 of 3 shown below):

Final Thoughts

Overall, investors can find many investment opportunities among blue chip stocks, as these companies tend to feature a long history of financial stability and a strong market position.

The tech sector has not historically been known for dividends, but this has changed in the past several years. Many large, established tech stocks now pay dividends to shareholders.

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 4%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more