Published on August 16th, 2024 by Bob Ciura

Inflation has come down significantly in the U.S. over the past few years, but still remains elevated. The Federal Reserve has hiked interest rates multiple times in response.

Inflation erodes investors’ purchasing power. To protect a portfolio against inflation, investors should focus on stocks that can raise their dividends above the rate of inflation.

A good place to start is blue-chip stocks, which we classify as those with at least 10 consecutive years of dividend increases.

With all this in mind, we created a list of 400+ blue-chip stocks, which you can download by clicking below:

In addition to the Excel spreadsheet above, this article covers our top 12 blue-chip dividend stocks to beat inflation, with the following criteria:

- Current dividend yield at or above the S&P average (1.3%)

- Expected future five-year compound annual dividend growth rate above the current rate of U.S. inflation (3%)

- At least 10 consecutive years of dividend increases

- Dividend Risk Scores of ‘C’ or better

Dividend growth and Dividend Risk Scores were derived using data from the Sure Analysis Research Database.

The stocks are ranked by dividend growth rate, from lowest to highest. The table of contents below allows for easy navigation.

Table of Contents

- Blue-Chip Stock #12: Silgan Holdings Inc. (SLGN)

- Blue-Chip Stock #11: Trinity Industries (TRN)

- Blue-Chip Stock #10: Westlake Corporation (WLK)

- Blue-Chip Stock #9: Federal Agriculture Mortgage Corp. (AGM)

- Blue-Chip Stock #8: Broadridge Financial Solutions (BR)

- Blue-Chip Stock #7: AGCO Corp. (AGCO)

- Blue-Chip Stock #6: International Bancshares Corp. (IBOC)

- Blue-Chip Stock #5: Nike Inc. (NKE)

- Blue-Chip Stock #4: CSX Corp. (CSX)

- Blue-Chip Stock #3: Dominos Pizza Inc. (DPZ)

- Blue-Chip Stock #2: Raymond James Financial Inc. (RJF)

- Blue-Chip Stock #1: UnitedHealth Group Inc. (UNH)

Blue-Chip Stock #12: Silgan Holdings Inc. (SLGN)

- Dividend History: 20 years of consecutive increases

- Dividend Yield: 1.5%

- 5-year Annualized Dividend Growth: 10.0%

Silgan Holdings manufactures and sells metal and plastic containers, as well as packaging closures. Its containers are found in everyday food consumables such as pet food, fruits and vegetables, and drinks, while its closures are applied to the beverage, garden, and personal care products.

On July 31st, 2024, Silgan reported its Q2 results for the period ending June 30th, 2024. Quarterly revenues fell 3.2% year-over-year to $1.38 billion.

Specifically, the metal containers segment’s sales fell 8% to $650.8 million mainly due to lower price/mix driven by the contractual pass through of lower raw material costs, which was partially offset by higher unit volume of 1%.

The dispensing & specialty closures segment posted somewhat improved results, with its sales rising by 1% year-over-year to $565.4 million.

Adjusted EPS came in at $0.88, which was above Q2-2023’s $0.83. For FY2024, Silgan reiterated its outlook, expecting adjusted EPS to land between $3.55 and $3.75.

Click here to download our most recent Sure Analysis report on SLGN (preview of page 1 of 3 shown below):

Blue-Chip Stock #11: Trinity Industries Inc. (TRN)

- Dividend History: 14 years of consecutive increases

- Dividend Yield: 3.5%

- 5-year Annualized Dividend Growth: 10.0%

Trinity Industries is a leading provider of rail transportation products and services in North America. The business of the company is classified primarily under two reporting segments: Railcar Leasing, which owns and operates a fleet of railcars and provides third-party fleet leasing, management, and administrative services; and the Rail Products Group, which manufactures and sells railcars and related parts and components and provides railcar maintenance and modification services.

On May 1st, 2024, the company announced results for the first quarter of 2024. Trinity reported Q1 non-GAAP EPS of $0.33, beating estimates by $0.11, and revenue of $809.6 million, which was up 26.2% year-over-year.

Trinity Industries continued to report a robust 97.5% utilization rate of their lease fleet, while the FLRD reported a positive 34.7% at the end of the quarter. During the quarter, 4,695 railcars were delivered, and new orders were received for close to $2.9 billion, indicating good demand and a pipeline for the company’s future business.

In cash flow, operating cash flow after investment and dividends and free cash flow attained $57 million and totaled $12 million, respectively. These figures reflect the company’s operational efficiency and strategic investments for future growth. Trinity Industries also issued guidance for 2024.

Click here to download our most recent Sure Analysis report on TRN (preview of page 1 of 3 shown below):

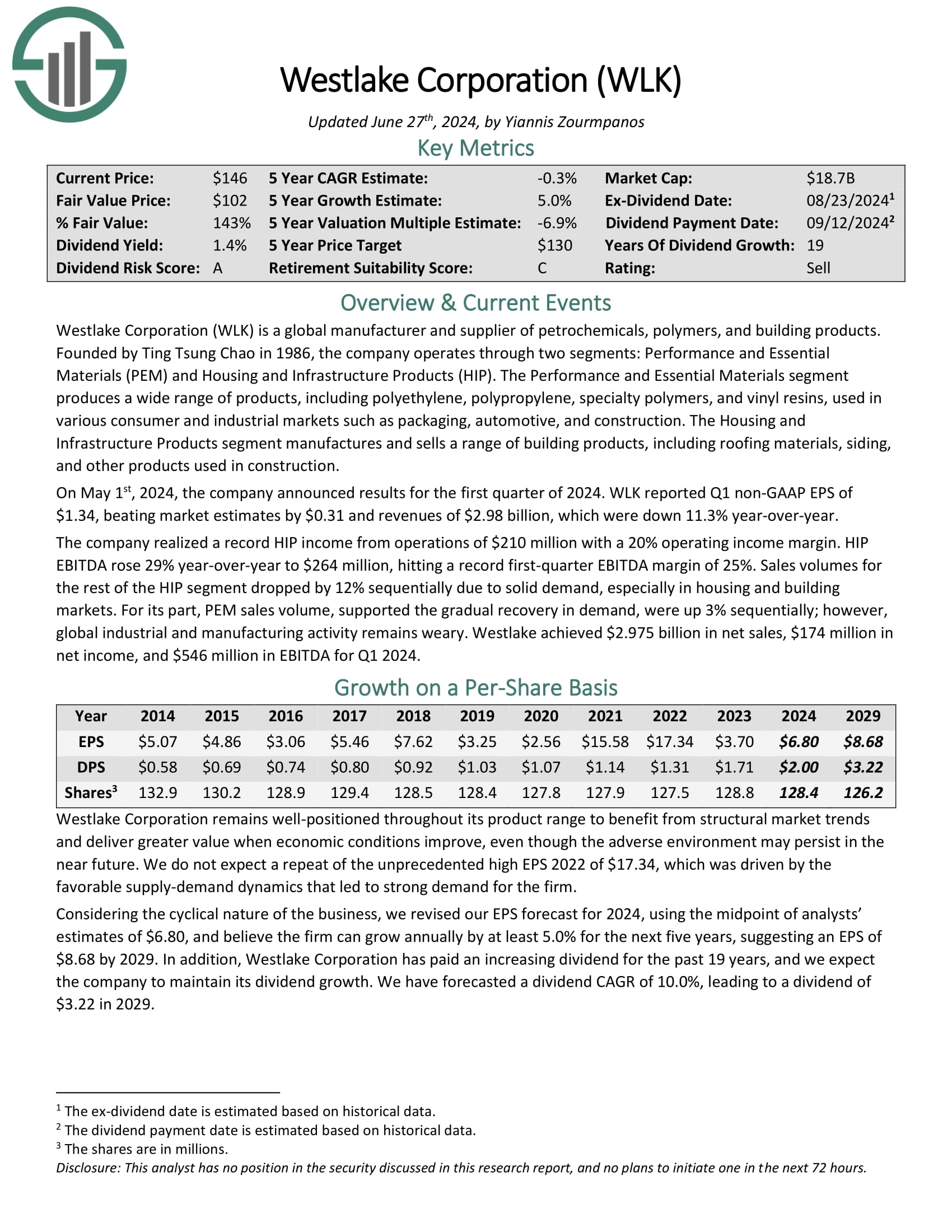

Blue-Chip Stock #10: Westlake Corporation (WLK)

- Dividend History: 19 years of consecutive increases

- Dividend Yield: 1.4%

- 5-year Annualized Dividend Growth: 10.0%

Westlake Corporation is a global manufacturer and supplier of petrochemicals, polymers, and building products. The company operates through two segments: Performance and Essential Materials (PEM) and Housing and Infrastructure Products (HIP).

The Performance and Essential Materials segment produces a wide range of products, including polyethylene, polypropylene, specialty polymers, and vinyl resins, used in various consumer and industrial markets such as packaging, automotive, and construction.

The Housing and Infrastructure Products segment manufactures and sells a range of building products, including roofing materials, siding, and other products used in construction.

On May 1st, 2024, the company announced results for the first quarter of 2024. WLK reported Q1 non-GAAP EPS of $1.34, beating market estimates by $0.31 and revenues of $2.98 billion, which were down 11.3% year-over-year.

The company realized a record HIP income from operations of $210 million with a 20% operating income margin.

Click here to download our most recent Sure Analysis report on WLK (preview of page 1 of 3 shown below):

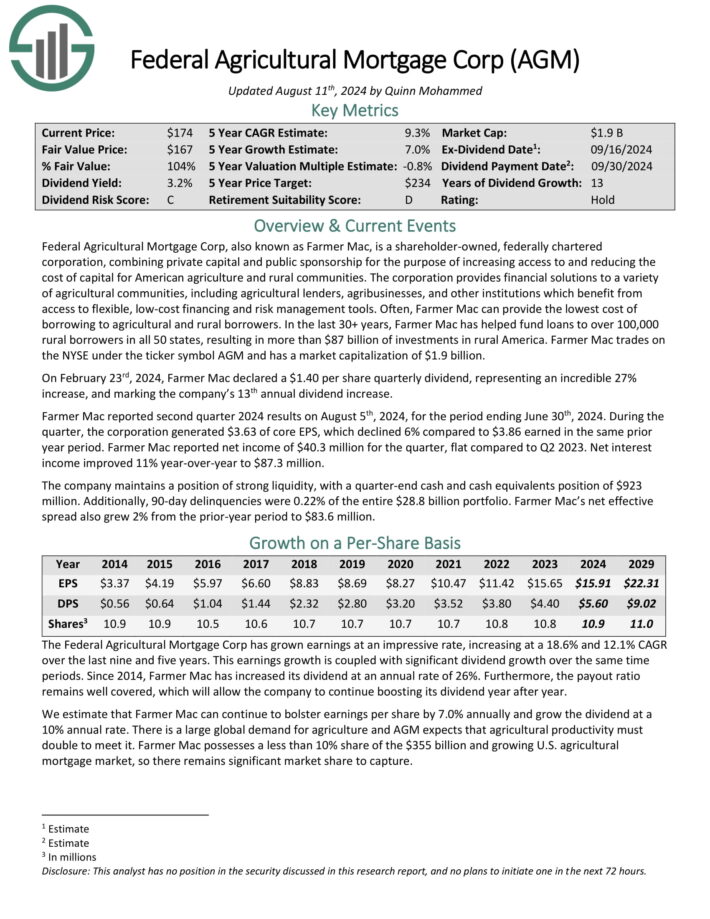

Blue-Chip Stock #9: Federal Agriculture Mortgage Corp. (AGM)

- Dividend History: 10 years of consecutive increases

- Dividend Yield: 3.1%

- 5-year Annualized Dividend Growth: 10.0%

Federal Agricultural Mortgage Corp, also known as Farmer Mac, is a shareholder-owned, federally chartered corporation, combining private capital and public sponsorship for the purpose of increasing access to and reducing the cost of capital for American agriculture and rural communities.

The corporation provides financial solutions to a variety of agricultural communities, including agricultural lenders, agribusinesses, and other institutions which benefit from access to flexible, low-cost financing and risk management tools.

Often, Farmer Mac can provide the lowest cost of borrowing to agricultural and rural borrowers. In the last 30+ years, Farmer Mac has helped fund loans to over 100,000 rural borrowers in all 50 states, resulting in more than $87 billion of investments in rural America.

On February 23rd, 2024, Farmer Mac declared a $1.40 per share quarterly dividend, representing an incredible 27% increase, and marking the company’s 13th annual dividend increase. Farmer Mac reported second quarter 2024 results on August 5th, 2024, for the period ending June 30th, 2024.

Click here to download our most recent Sure Analysis report on AGM (preview of page 1 of 3 shown below):

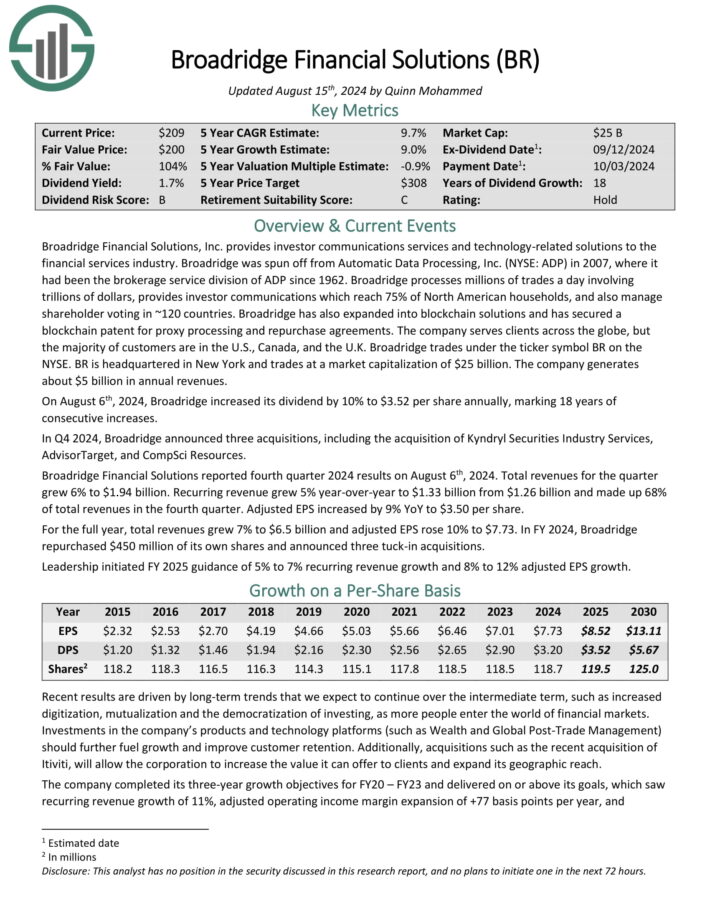

Blue-Chip Stock #8: Broadridge Financial (BR)

- Dividend History: 16 years of consecutive increases

- Dividend Yield: 2.0%

- 5-year Annualized Dividend Growth: 10.0%

Broadridge Financial Solutions, Inc. provides investor communications services and technology-related solutions to the financial services industry. Broadridge was spun off from Automatic Data Processing in 2007, where it had been the brokerage service division of ADP since 1962.

Broadridge processes millions of trades a day involving trillions of dollars, provides investor communications which reach 75% of North American households, and also manage shareholder voting in ~120 countries.

Broadridge has also expanded into blockchain solutions and has secured a blockchain patent for proxy processing and repurchase agreements. The company serves clients across the globe, but the majority of customers are in the U.S., Canada, and the U.K.

Broadridge Financial Solutions reported fourth quarter 2024 results on August 6th, 2024. Total revenues for the quarter grew 6% to $1.94 billion. Recurring revenue grew 5% year-over-year to $1.33 billion from $1.26 billion and made up 68% of total revenues in the fourth quarter. Adjusted EPS increased by 9% YoY to $3.50 per share.

For the full year, total revenues grew 7% to $6.5 billion and adjusted EPS rose 10% to $7.73. In FY 2024, Broadridge repurchased $450 million of its own shares and announced three tuck-in acquisitions.

Click here to download our most recent Sure Analysis report on Broadridge (preview of page 1 of 3 shown below):

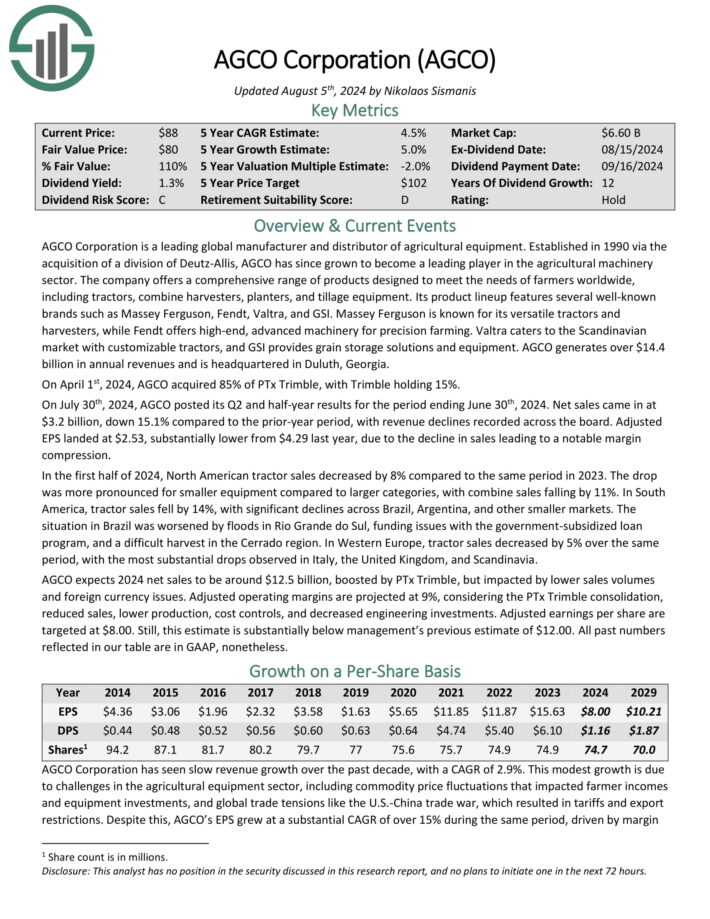

Blue-Chip Stock #7: AGCO Corp. (AGCO)

- Dividend History: 12 years of consecutive increases

- Dividend Yield: 1.3%

- 5-year Annualized Dividend Growth: 10.0%

AGCO Corporation is a leading global manufacturer and distributor of agricultural equipment. It has since grown to become a leading player in the agricultural machinery sector.

The company offers a comprehensive range of products designed to meet the needs of farmers worldwide, including tractors, combine harvesters, planters, and tillage equipment. Its product lineup features several well-known brands such as Massey Ferguson, Fendt, Valtra, and GSI.

Massey Ferguson is known for its versatile tractors and harvesters, while Fendt offers high-end, advanced machinery for precision farming. Valtra caters to the Scandinavian market with customizable tractors, and GSI provides grain storage solutions and equipment.

AGCO generates over $14.4 billion in annual revenues and is headquartered in Duluth, Georgia. On April 1st, 2024, AGCO acquired 85% of PTx Trimble, with Trimble holding 15%.

On July 30th, 2024, AGCO posted its Q2 and half-year results for the period ending June 30th, 2024. Net sales came in at $3.2 billion, down 15.1% compared to the prior-year period, with revenue declines recorded across the board.

Adjusted EPS landed at $2.53, substantially lower from $4.29 last year, due to the decline in sales leading to a notable margin compression.

Click here to download our most recent Sure Analysis report on AGCO (preview of page 1 of 3 shown below):

Blue-Chip Stock #6: International Bancshares Corp. (IBOC)

- Dividend History: 15 years of consecutive increases

- Dividend Yield: 2.2%

- 5-year Annualized Dividend Growth: 10.0%

International Bancshares Corporation is a financial holding company based in Laredo, Texas. It is a multi-bank financial holding company that provides banking and financial services through its subsidiary banks in Texas and Oklahoma.

International Bancshares has a diverse customer base, including individuals, small businesses, and large corporations. It operates in several revenue segments, including commercial and retail banking, wealth management, insurance, and international trade finance.

On May 3rd, 2024, the company announced results for the first quarter of 2024. IBOC reported Q1 non-GAAP EPS of $1.56 and a net income of $97.3 million for the quarter.

Higher interest income was noted on net investment and loan portfolios, supported by portfolio growth and higher rates resulting from the Fed’s rate hikes in 2022 and 2023 in the first quarter. Meanwhile, net interest income was pressurized downward by accelerating interest expenses on deposits.

Click here to download our most recent Sure Analysis report on IBOC (preview of page 1 of 3 shown below):

Blue-Chip Stock #5: Nike Inc. (NKE)

- Dividend History: 22 years of consecutive increases

- Dividend Yield: 1.8%

- 5-year Annualized Dividend Growth: 10.2%

Nike is the world’s largest athletic footwear, apparel and equipment maker. The namesake brand is one of the most valuable brands in the world. Nike’s offerings focus on six categories: running, basketball, the Jordan brand, football (soccer), training, and sportswear. Nike also owns Converse.

In late June, Nike released (6/27/24) results for the fourth quarter of fiscal year 2024 (Nike’s fiscal year ends on May 31st). Sales and direct sales decreased -2% and -8%, respectively, vs. the prior year’s quarter. Digital sales declined -10%.

Gross margin expanded from 43.6% to 44.7% thanks to price hikes and lower freight costs and earnings-per-share grew 53%, from $0.66 to $1.01, exceeding the analysts’ consensus by $0.17, but only thanks to depressed earnings in the prior year’s period.

Nike now expects a mid-single digit decrease in revenues in fiscal 2025 due to challenging macroeconomic conditions.

Click here to download our most recent Sure Analysis report on NKE (preview of page 1 of 3 shown below):

Blue-Chip Stock #4: CSX Corp. (CSX)

- Dividend History: 19 years of consecutive increases

- Dividend Yield: 1.4%

- 5-year Annualized Dividend Growth: 11.0%

CSX can trace its roots all the way back to 1827 when the B&O Railroad was first chartered. From just 13 miles of track, CSX has grown to cover 23 states and more than 20,000 route miles. CSX provides rail, rail-to-truck, and intermodal transport services.

CSX posted second quarter earnings on August 5th, 2024, and results were better than expected for the most part. Earnings-per-share came to 49 cents, which was a penny ahead of estimates.

Revenue was flat year-over-year at $3.7 billion, and met expectations. Merchandise pricing gains and growth in intermodal volume were offset by declines in export coal prices, and lower fuel surcharges.

Total volumes were up 2.1%, 50 basis points ahead of estimates, while pricing power was down 2%. Operating margin was 39.1% of revenue, off 50 basis points from a year ago.

However, this was a 280 basis point improvement from the first quarter. Gross margin was up 150 basis points to 52.3% of revenue, while adjusted EBITDA margin was unchanged at 50% of revenue.

Click here to download our most recent Sure Analysis report on CSX (preview of page 1 of 3 shown below):

Blue-Chip Stock #3: Dominos Pizza Inc. (DPZ)

- Dividend History: 11 years of consecutive increases

- Dividend Yield: 1.4%

- 5-year Annualized Dividend Growth: 11.1%

Domino’s Pizza was founded in 1960. It is the largest pizza company in the world based on global retail sales. The company operates more than 20,900 stores in more than 90 countries. It generates nearly half of its sales in the U.S. while 99% of its stores worldwide are owned by independent franchisees.

In mid-July, Domino’s reported (7/18/24) financial results for the second quarter of fiscal 2024. Its U.S. same-store sales grew 4.8% and its international same-store sales rose 2.1% over the prior year’s quarter.

Earnings-per-share grew 31%, from $3.08 to $4.03, but nearly all growth resulted from a gain in the value of the investment of the company in DPC Dash. Earnings-per-share of $4.03 exceeded the analysts’ consensus by $0.35.

Domino’s reiterated its bright 5-year outlook. It expects to open more than 1,100 stores per year and grow its global retail sales and its operating income by 7% and 8% per year, respectively, until the end of 2028.

Click here to download our most recent Sure Analysis report on DPZ (preview of page 1 of 3 shown below):

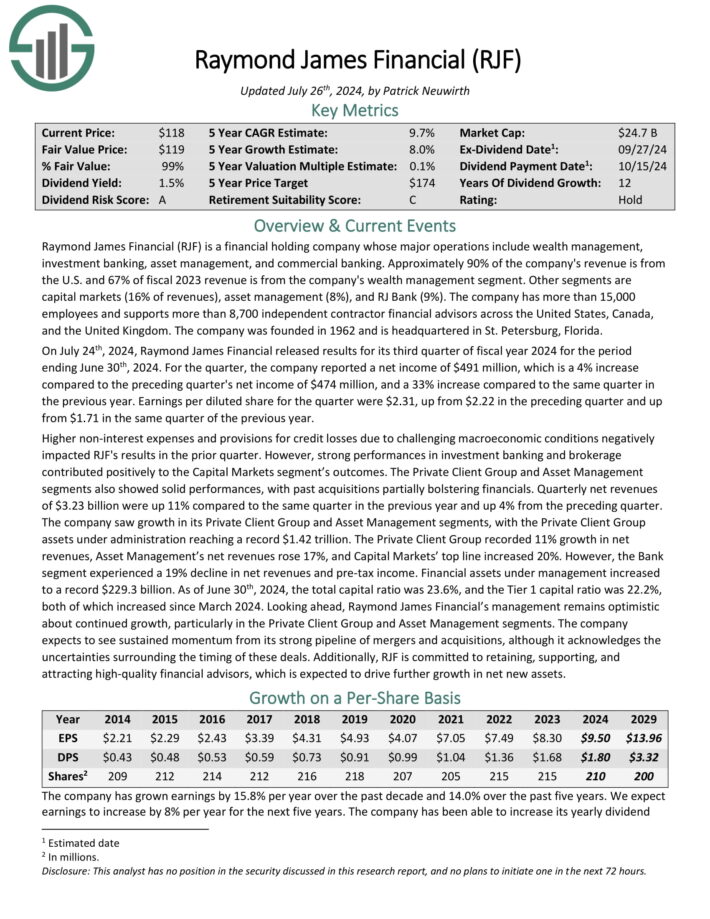

Blue-Chip Stock #2: Raymond James Financial (RJF)

- Dividend History: 12 years of consecutive increases

- Dividend Yield: 1.6%

- 5-year Annualized Dividend Growth: 13.0%

Raymond James Financial is a financial holding company whose major operations include wealth management, investment banking, asset management, and commercial banking. Approximately 90% of the company’s revenue is from the U.S. and 67% of fiscal 2023 revenue is from the company’s wealth management segment.

Other segments are capital markets (16% of revenues), asset management (8%), and RJ Bank (9%). The company has more than 15,000 employees and supports more than 8,700 independent contractor financial advisors across the United States, Canada, and the United Kingdom.

On July 24th, 2024, Raymond James Financial released results for its third quarter of fiscal year 2024 for the period ending June 30th, 2024.

For the quarter, the company reported a net income of $491 million, which is a 4% increase compared to the preceding quarter’s net income of $474 million, and a 33% increase compared to the same quarter in the previous year.

Earnings per diluted share for the quarter were $2.31, up from $2.22 in the preceding quarter and up from $1.71 in the same quarter of the previous year.

Click here to download our most recent Sure Analysis report on RJF (preview of page 1 of 3 shown below):

Blue-Chip Stock #1: UnitedHealth Group Inc. (UNH)

- Dividend History: 15 years of consecutive increases

- Dividend Yield: 1.4%

- 5-year Annualized Dividend Growth: 14.0%

UnitedHealth offers global healthcare services to tens of millions of people via a wide array of products. The company has two major reporting segments: UnitedHealth and Optum.

UnitedHealth provides global healthcare benefits to individuals, employers, and Medicare/Medicaid beneficiaries. The Optum segment is a services business that seeks to lower healthcare costs and optimize outcomes for its customers.

UnitedHealth posted second quarter earnings on July 16th, 2024, and results were better than expected on the top line. Adjusted earnings-per-share came to $6.80, which was 17 cents ahead of estimates. Revenue was up 6.4% year-over year at $98.9 billion, but that only met estimates. UnitedHealthcare revenue was up 5% year-over-year, while Optum once again led the way with 12% growth.

UnitedHealth noted cash flow from operations were $6.7 billion, or a staggering 1.5 times net income, implying outstanding free cash flow conversion. The company’s medical care ratio was 85.1%, which was worse than the 83.2% a year ago, and 84.3% from the first quarter.

Click here to download our most recent Sure Analysis report on UNH (preview of page 1 of 3 shown below):

Additional Resources

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more