Updated on August 26th, 2024 by Bob Ciura

Beer stocks, just like other beverage stocks, come in several different forms. Companies that are engaged in the beer industry offer direct exposure through manufacturing and distribution of beer, while other companies in adjacent industries offer indirect exposure through equity stakes in beer companies.

The beer industry is attractive for long-term income investors. Beer companies enjoy tremendous recession-resistance and consistent profits, which are used in large part to pay dividends to shareholders.

With this in mind, we created a downloadable spreadsheet that focuses on beer stocks. You can download our full Excel spreadsheet of beer stocks (with important financial metrics like dividend yields and payout ratios) by clicking the link below:

This article will discuss the top five beer stocks, each of which offer investors strong competitive advantages and decent long-term growth prospects.

As a result, they may fit well in the diversified long-term dividend growth portfolios.

The following stocks were selected according to the Sure Analysis Research Database. The five beer stocks are ranked according to their 5-year expected annual returns, in ascending order from lowest to highest.

Table Of Contents

You can use the following links to instantly jump to any specific stock:

- Beer Stock #5: Constellation Brands (STZ))

- Beer Stock #4: Anheuser-Busch InBev (BUD)

- Beer Stock #3: Altria Group (MO)

- Beer Stock #2: Molson Coors (TAP)

- Beer Stock #1: Diageo plc (DEO)

Beer Stock #5: Constellation Brands (STZ)

- 5-year expected annual returns: 2.5%

Constellation Brands was founded in 1945 and has grown into a global alcoholic beverage giant, producing and distributing over 100 brands of beer, wine, and spirits, including Corona, Modelo Especial, Modelo Negra, Pacifico, Ballast Point, Funky Buddha Brewery, SVEDKA Vodka, Casa Noble Tequila and High West Whiskey.

Constellation Brands declared a $1.01 quarterly dividend on April 10th, 2024, which represented a 13% increase.

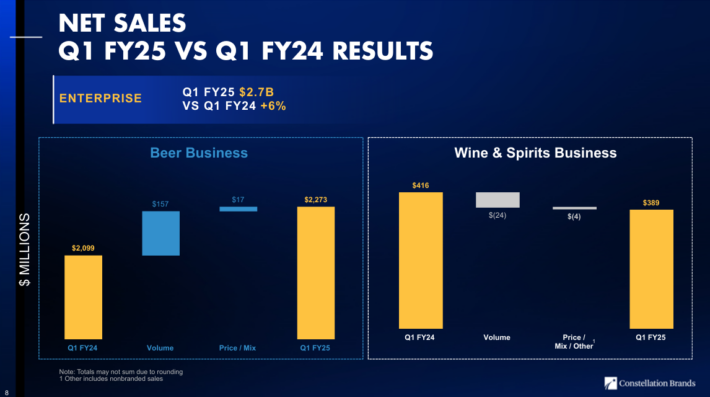

On July 3rd, 2024, Constellation Brands reported first quarter fiscal 2025 results for the period ending May 31st, 2024.

Source: Investor Presentation

For the first quarter, the company recorded $2.66 billion in net sales, a 6% increase compared to the same prior year period. Beer sales improved by 8% year-over-year, while wine and spirits sales declined by 7%.

Comparable earnings-per-share equaled $3.57 for the quarter, which was a 17% increase compared to Q1 2024, and 12 cents ahead of analyst estimates.

Click here to download our most recent Sure Analysis report on STZ (preview of page 1 of 3 shown below):

Beer Stock #4: Anheuser-Busch InBev SA/NV (BUD)

- 5-year expected annual returns: 6.2%

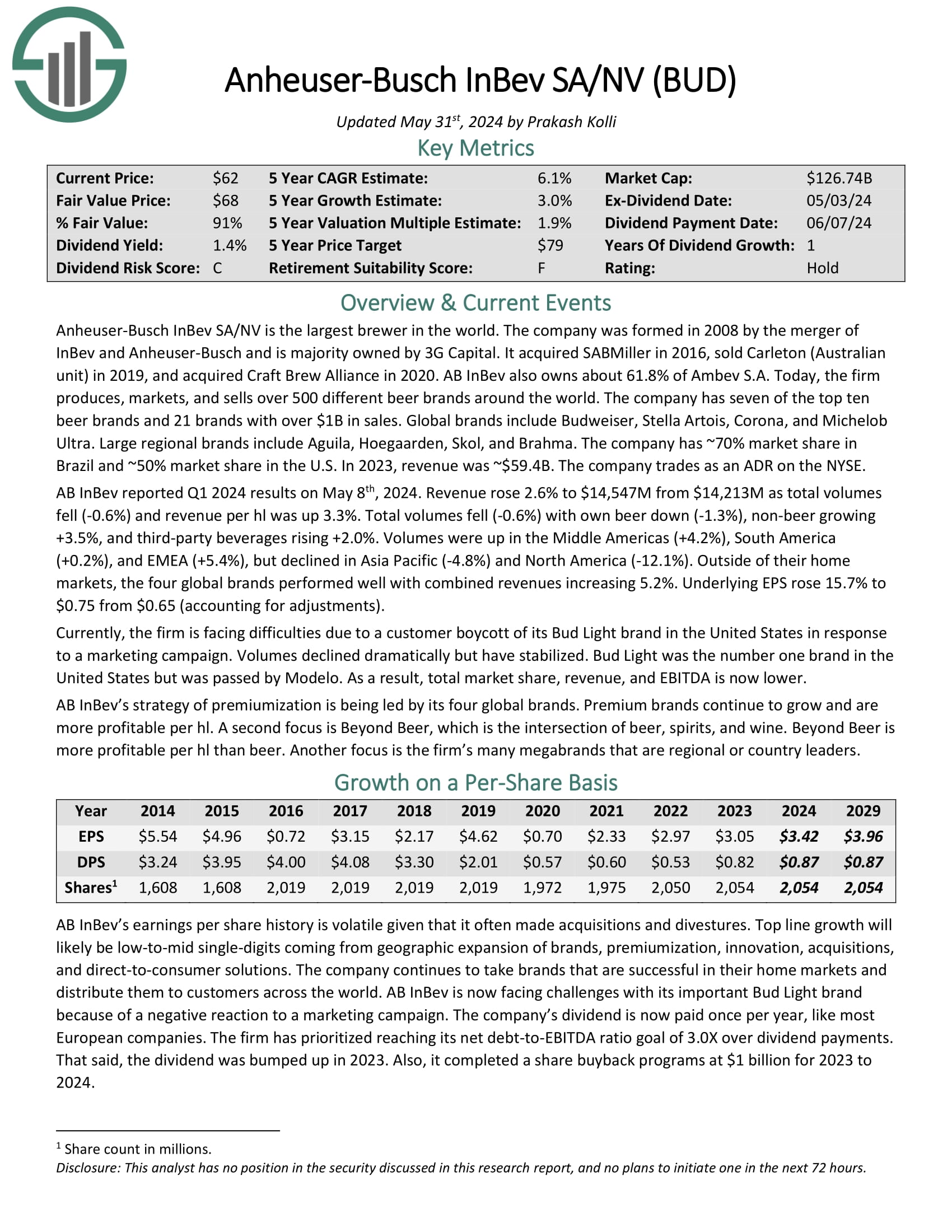

Anheuser-Busch InBev SA/NV is the largest brewer in the world thanks to the 2008 merger of InBev and Anheuser-Busch and the 2016 acquisition of SABMiller.

The company produces, markets and sells over 500 different beer brands around the world and owns five of the top ten beer brands. These include Budweiser, Stella Artois and Corona.

AB InBev reported Q1 2024 results on May 8th, 2024. Revenue rose 2.6% as total volumes fell 0.6% and revenue per hl was up 3.3%.

Source: Investor Presentation

Beer volumes declined -1.3% year-over-year, with non-beer volumes growing 3.5%, and third-party beverages rising 2.0%. Underlying EPS rose 15.7% to $0.75 from $0.65 (accounting for adjustments).

The company’s dividend is now paid once per year, like most European companies. The firm has prioritized reaching its net debt-to-EBITDA ratio goal of 3.0X over dividend increases. That said, the dividend was bumped up in 2023.

Click here to download our most recent Sure Analysis report on BUD (preview of page 1 of 3 shown below):

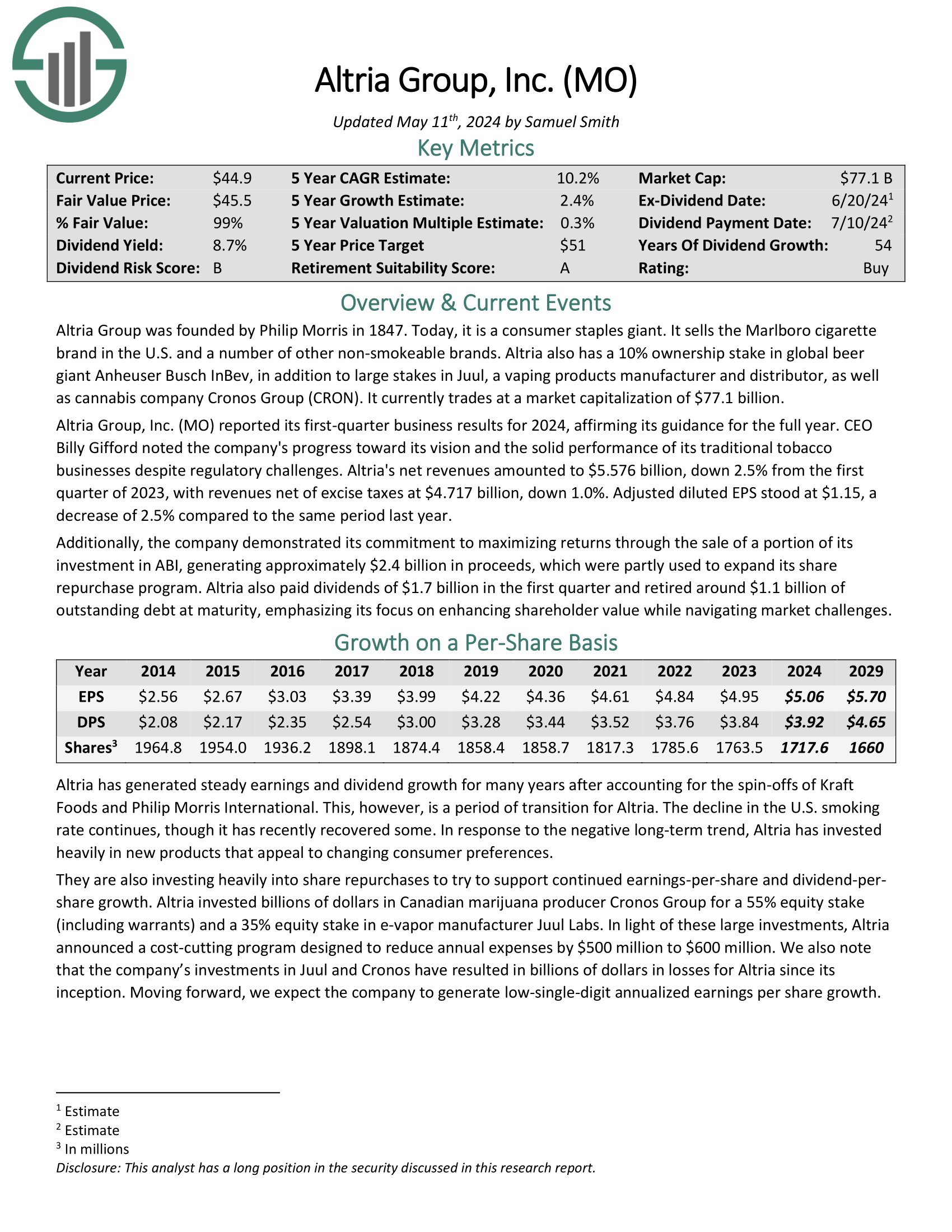

Beer Stock #3: Altria Group (MO)

- 5-year expected annual returns: 6.8%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

Altria has a sizeable investment in beer through its equity stake in Anheuser-Busch InBev. Altria owned roughly 10% of BUD, but recently announced it will sell a portion of its investment.

In the 2024 first quarter, Altria’s net revenue of $5.576 billion declined 2.5% from the first quarter of 2023, with revenue net of excise taxes at $4.717 billion, down 1.0%.

Adjusted diluted EPS stood at $1.15, a decrease of 2.5% compared to the same period last year.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Beer Stock #2: Molson Coors Brewing Company (TAP)

- 5-year expected annual returns: 11.1%

Molson Coors Brewing Company was founded all the way back in 1873 and has since grown into one of the largest U.S. brewers, with a variety of brands including Coors Light, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, as well as the Miller brands including Miller Lite.

On February 13th, 2024, the company announced an 8% increase to the quarterly dividend to $0.44 per share.

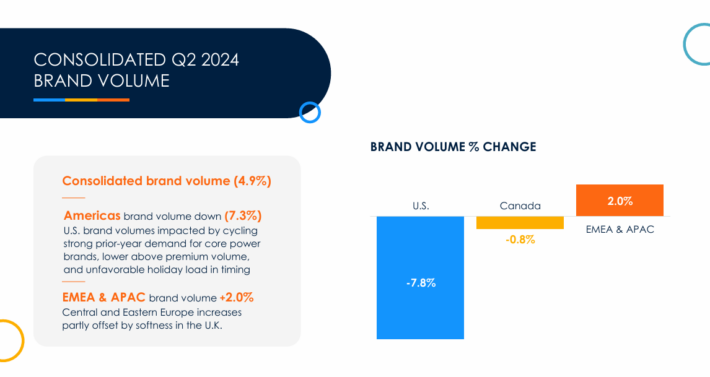

On August 6th, 2024, Molson Coors reported second quarter 2024 results for the period ending June 30th, 2024. For the quarter, the company generated net sales of $3.25 billion, a 0.4% decrease compared to Q2 2023.

Source: Investor Presentation

Net sales declined 1.7% in Americas, but improved 5.3% in Europe, the Middle East and Africa, and Asia-Pacific.

Reported net income equaled $560 million or $2.03 per share compared to $441 million or $1.57 per share in Q2 2023. On an adjusted basis, earnings-per-share equaled $1.92 versus $1.78 prior. The company repurchased $375 million of its shares in H1 2024.

Click here to download our most recent Sure Analysis report on Molson Coors (preview of page 1 of 3 shown below):

Beer Stock #1: Diageo (DEO)

- 5-year expected annual returns: 11.6%

Diageo is one of the oldest and largest alcoholic beverages companies. It dates all the way back to the 17th century and today owns 20 of the world’s top 100 spirits brands. Diageo manufacturers popular spirits and beer brands, such as Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and many more.

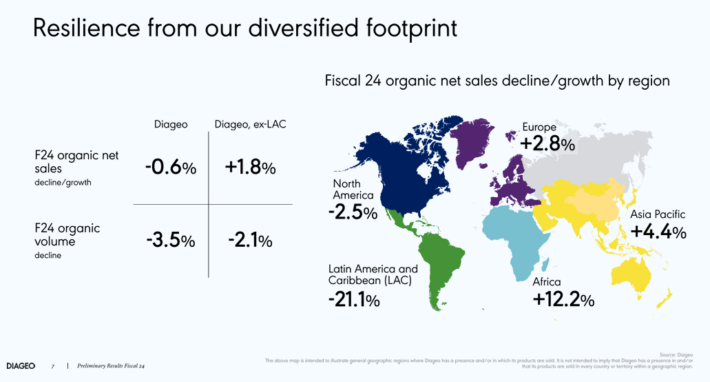

On July 30th, 2024, Diageo released earnings results for fiscal year 2024 for the period ending June 30th, 2023. For the year, the company earned $6.91 per share, which was 5% above the prior year’s result, but well below estimates. Net sales decreased 1.4% while organic growth was lower by 0.6%.

Source: Investor Presentation

A small benefit from pricing and mix was more than offset by a 3.5% decrease in volume. Most regions performed well. Organic revenue growth for Africa, Asia Pacific, and Europe totaled 12%, 4%, and 3%. North America was down 3% while Latin American and Caribbean was down 21%.

The decrease in North America was due to a cautious consumer market and tough comparable periods. Total market share grew or held steady in 75% of the portfolio, which compared to 70% in fiscal year 2023. Premium-plus brands accounted for the majority of net sales.

Click here to download our most recent Sure Analysis report on Diageo (preview of page 1 of 3 shown below):

Final Thoughts

The beer industry has numerous players with global diversification and strong competitive advantages. Each offers investors a unique angle on the market. Some focus heavily on individual geographies, such as Molson Coors in the U.S. market and Ambev in Latin America, while Altria offers indirect exposure to the beer industry through its stake in AB InBev.

Companies that operate in beer widely enjoy strong profit margins, and the ability to withstand even the deepest recessions. Beer should continue to see steady demand each year, and the largest beer stocks enjoy high profit margins thanks to their ability to raise prices over time.

These beer stocks have positive growth prospects and return cash to shareholders through hefty dividends. Risk-averse income investors looking for steady dividend payouts should take a closer look at beer stocks, particularly in uncertain economic times.

Further Reading

If you are interested in finding high-quality dividend growth stocks, and other income investing opportunities, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

- 10 Blue-Chip Tech Stocks For Growing Dividends

- Blue Chip Stocks: Kings, Aristocrats, and Achievers

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more