Updated on June 28th, 2024 by Bob Ciura

After a 36-year streak of dividend increases, AT&T cut its dividend by nearly half in 2022, following the spinoff of its media business.

Still, despite the dividend cut in 2022, the stock has a high dividend yield of 5.9% at its recent share price.

As a result, AT&T is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the telecom giant AT&T Inc. (T).

Business Overview

AT&T is a leading telecommunications company, providing a wide range of services, including wireless, broadband, and television. The company serves more than 100 million U.S. customers.

In 2023, AT&T generated total revenue of $122 billion.

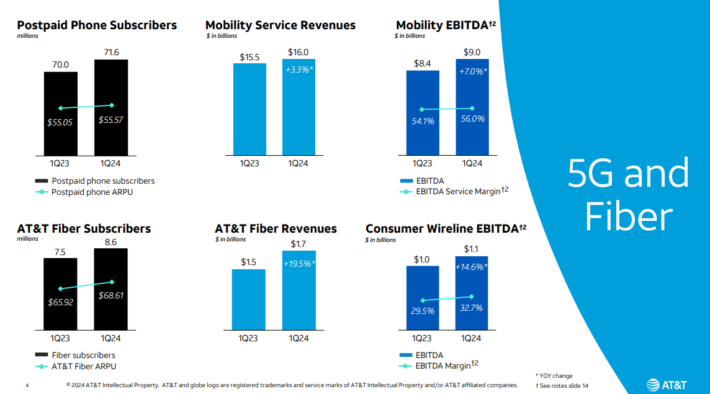

In late April, AT&T reported (4/24/24) financial results for the first quarter of fiscal 2024. While the company posted decent customer additions across its growing 5G wireless and fiber networks, revenue remained essentially flat vs. last year’s quarter.

Source: Investor Presentation

AT&T is investing in the expansion of its 5G and fiber networks at an almost record pace. It posted 252,000 fiber net additions and thus it has posted more than 200,000 additions per quarter for 17 consecutive quarters.

It also posted 349,000 postpaid phone net additions. Adjusted earnings-per-share dipped -8%, from $0.60 to $0.55, but free cash flow grew from $1.0 billion to $3.1 billion. AT&T needs excessive free cash flow to maintain its generous dividend and reduce its debt.

Earnings-per-share exceeded the analysts’ estimates by $0.02. AT&T has beaten the analysts’ estimates in 13 of the last 14 quarters. Management reaffirmed its guidance for earnings-per-share of $2.15 $2.25 in 2024

Growth Prospects

AT&T is a massive business, and as a mature U.S. telecom, the company grows very slowly. After purchasing DIRECT-TV in 2015 and Time Warner in 2018, AT&T reversed course in 2021, deciding to spin off both businesses along with other assets.

Now the company is focusing on its roots and has growth opportunities in 5G and fiber networks. We expect AT&T to grow its earnings-per-share at a 3% average annual rate over the next five years.

Source: Investor Presentation

The company will strengthen the balance sheet by reducing its net debt with its free cash flow after dividends. AT&T has reduced its net debt by ~$6 billion from the same time last year.

It remains on track to reach a net debt-to-adjusted EBITDA ratio in the 2.5x range in the first half of 2025.

AT&T’s renewed focus on telecom will benefit from the fact that it no longer needs to invest in wireless network infrastructure and media assets at the same time.

Competitive Advantages & Recession Performance

AT&T has a competitive advantage with its entrenched position in various important industries. The company also operates a recession-resistant business.

AT&T enjoys steady demand, as most consumers require their broadband and wireless service, even during recessions.

AT&T’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $2.76

- 2008 earnings-per-share: $2.16

- 2009 earnings-per-share: $2.12

- 2010 earnings-per-share: $2.29

AT&T experienced some earnings decline during the Great Recession, but the company remained highly profitable. This allowed it to continue growing its dividend throughout the time period and beyond.

AT&T eclipsed its pre-recession earnings level, but it took until 2016.

In the COVID-19 pandemic year of 2020, the held up quite well. While many businesses faced tremendous challenges due to the pandemic, AT&T generated strong cash flow and had a payout ratio below 70%.

In the current economic downturn as a result of high inflation and increasing interest rates, AT&T’s dividend appears to be secure.

Dividend Analysis

After 36 years of consecutive dividend increases, AT&T kept its dividend steady and lost its Dividend Aristocrat status in 2021. Then in 2022, AT&T utilized the spinoff as a way to reduce its dividend payment to shareholders.

This afforded the company the funds for its massive capital investment plans.

AT&T’s current annual dividend is $1.11 per share. At the recent share price, AT&T is yielding about 5.9%. Based on the expected adjusted EPS of $2.20 at the midpoint of 2024 guidance, the stock has a 50% expected payout ratio for this year.

Final Thoughts

AT&T should benefit from its renewed focus on its main telecom business following the spin off its media assets and its reduced dividend.

Its slimmed down business and improved efficiency should allow it to improve the balance sheet, and continue to make capital investments in its expansion of 5G and fiber.

AT&T stock has a high dividend yield of 5.7% today. Furthermore, this dividend appears to be secure with a modest dividend payout ratio.

We view AT&T stock as attractive for income investors looking for high yields.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List