Updated on March 18th, 2025 by Bob Ciura

Over the past decade, many technology stocks such as Apple, Inc. (AAPL), Cisco Systems (CSCO), and more have initiated dividend payments to shareholders.

While the technology industry has widely embraced dividends, not all tech companies pay dividends. One lingering holdout to paying dividends to shareholders is e-commerce giant Amazon.com Inc. (AMZN).

Rather than return cash to shareholders, Amazon continues to plow its cash flow back into the business.

The decision whether or not a company should pay a dividend depends on many factors. Thousands of stocks pay dividends to shareholders, and an elite few have maintained long histories of raising their dividends every year.

For example, the Dividend Aristocrats are a group of 69 stocks in the S&P 500 that have raised their dividends for 25+ years in a row.

You can download an Excel spreadsheet of all Dividend Aristocrats (with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

Amazon’s lack of a dividend certainly has not hurt investors to this point, as Amazon has been a premier tech stock.

Over the past 10 years, Amazon stock generated total returns of over 900%.

But for income investors, Amazon may not be an attractive option due to the lack of a dividend payment.

This article will discuss the chances of Amazon ever paying a dividend.

Business Overview

Amazon is an online retailer that operates a massive e-commerce platform where consumers can buy virtually anything with their computers or smartphones.

Amazon is a mega-cap stock with a market cap of more than $2 trillion. It operates through the following segments:

- North America

- International

- Amazon Web Services

The North America and International segments include the global retail platform of consumer products through the company’s websites.

The Amazon Web Services segment sells subscriptions for cloud computing and storage services to consumers, start-ups, enterprises, government agencies, and academic institutions.

Amazon’s e-commerce operations fueled its massive revenue growth over the past decade. The company saw continued growth in the most recent quarter.

Related: Which is the better investment, dividend stocks or growth stocks?

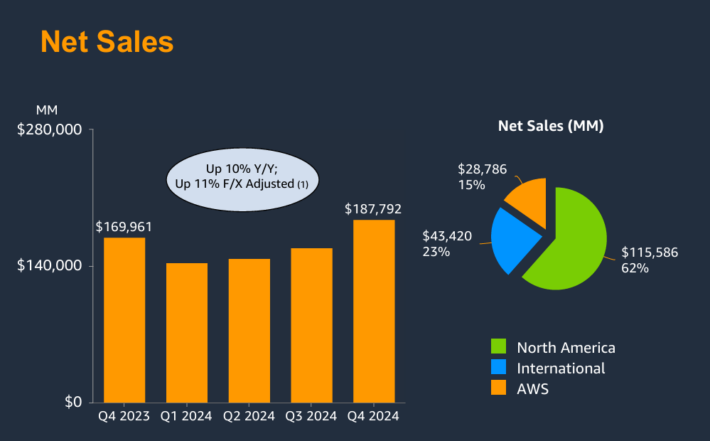

In the 2024 fourth quarter, revenue of $187.7 billion increased 10% year-over-year, and beat analyst estimates by $563 million.

By segment, North America sales increased 10% year-over-year to $115.6 billion. International sales rose 9% excluding foreign currency translation, while AWS sales rose 19% year-over-year.

Source: Investor Presentation

While the retail business still operates at low gross margins, it continues to generate strong revenue growth.

Separately, the AWS segment is highly profitable, and is largely the reason for Amazon’s impressive earnings growth. Such strong earnings growth improves Amazon’s chances of paying a dividend at some point in the future.

That said, the company still plans to invest heavily in growth, which makes for uneven earnings-per-share from one quarter to the next.

Growth Prospects

As is typical with many technology companies, growth investment is Amazon’s top strategic priority. This is partly out of necessity.

Things move extremely fast in technology, which is a highly competitive industry. Technology firms need to invest large amounts to stay ahead of the pack.

Amazon is no different—it is making major investments to continue building its online retail platform. Amazon continues to grow its retail business.

It also acquired natural and organic grocer Whole Foods for nearly $14 billion. This gave Amazon the brick-and-mortar footprint it desired to further expand its reach in groceries.

Amazon isn’t stopping there. In addition to the retail industry, it aims to spread its tentacles into other industries as well, including media and healthcare.

Amazon has built a sizable media platform in which it distributes content to its Amazon Prime members.

Making original content is another highly capital-intensive endeavor, which will require huge sums in order for Amazon to compete with the likes of streaming giants Netflix (NFLX) and Hulu, as well as other television and movie studios.

Its media ambitions were augmented by its 2022 acquisition of MGM for $8.5 billion.

Now that Amazon dominates retail and media content, it is readying a bigger move into the healthcare industry.

In 2022 Amazon acquired One Medical in a $3.9 billion all-cash transaction, including One Medical’s debt. One Medical is a national primary care company.

These investments will fuel Amazon’s revenue growth, which is what the company’s investors are primarily concerned with. Nevertheless, such aggressive spending will limit Amazon’s ability to pay dividends to shareholders, at least for some time.

For the 2025 first quarter, Amazon expects net sales in a range of $151.0 billion and $155.5 billion, for 5%-9% year-over-year growth.

Operating income is expected to be between $14.0 billion and $18.0 billion, compared with $15.3 billion in the first quarter of 2024.

Will Amazon Ever Pay A Dividend?

Amazon has joined the ranks of profitable tech companies like Apple, Microsoft, and Cisco, all of which generate high earnings-per-share. Apple, Microsoft, and Cisco are now blue-chip tech dividend payers.

In theory, Amazon could pay a dividend, as the company should be profitable in fiscal 2025. Amazon’s earnings-per-share are forecast to be $6.32 for fiscal 2025.

The company can use its profits for a number of purposes, including debt repayment, reinvestment in future growth initiatives, paying dividends, or share buybacks.

If Amazon chose to, it could distribute a dividend to shareholders, although any announced dividend payout would likely be small, in terms of the dividend yield.

For example, even if Amazon maintained a dividend payout ratio of 25%, which would be appropriate for a growth-oriented tech company, the dividend of $1.58 per share would represent just a ~0.8% yield.

This would still be an unappealing yield for many income investors.

Final Thoughts

Amazon has been one of the most impressive growth companies in history. It now dominates the online retail industry. It is also a massive cloud services provider, as well as a movie studio and content streaming giant.

Ultimately, a company has to make the decision to initiate a dividend payment. This is often done when future growth no longer requires such heavy investment.

For Amazon, the company still has many new avenues for future expansion in mind, including (but not limited to) media content, grocery stores, and health care.

Growth is still very much the top priority for Amazon. As a result, investors should not expect a dividend payment any time soon.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.