Spreadsheet data updated daily

Updated on May 30th, 2024 by Bob Ciura

Individual products, businesses, and even entire industries (newspapers, typewriters, horse and buggy) go out of style and become obsolete.

Perhaps more than any other industry, agriculture is here to stay. Agriculture started around 14,000 years ago. It’s a safe bet we will be practicing agriculture far into the future.

And, the growth of the global population is tied to increasing agricultural efficiency. The agricultural revolution allowed greater population growth (and led to the industrial revolution).

As the global population grows, so does the need for improved agricultural production. This creates a long-term demand driver for agriculture stocks.

You can download the complete list of all 40+ agriculture stocks (along with important financial metrics such as price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the link below:

The agriculture stocks list was derived from two major exchange-traded funds. These are the AgTech & Food Innovation ETF (KROP) and the iShares Global Agriculture Index ETF (COW).

Investing in farm and agriculture stocks means investing in an industry that:

- Has stable long-term demand

- Has withstood the test of time, and is extremely likely to be around far into the future

- Benefits from advancing technology

This article analyzes 7 of the best agriculture stocks in detail. You can quickly navigate the article using the table of contents below.

Table of Contents

- Agriculture Stock #7: Scotts Miracle-Gro (SMG)

- Agriculture Stock #6: The Toro Company (TTC)

- Agriculture Stock #5: Federal Agriculture Mortgage Association (AGM)

- Agriculture Stock #4: CF Industries (CF)

- Agriculture Stock #3: Archer Daniels Midland Corporation (ADM)

- Agriculture Stock #2: Ingredion Inc. (INGR)

- Agriculture Stock #1: Lindsay Corporation (LNN)

- Final Thoughts

We have ranked our 7 favorite agriculture stocks below. The stocks are ranked according to expected returns over the next five years, in order of lowest to highest.

Even better, all 7 agriculture stocks pay dividends to shareholders, making them attractive for income investors. Interested investors should view this as a starting off point to more research.

Agriculture Stock #7: Scotts Miracle-Gro (SMG)

- 5-year expected annual returns: 9.1%

Scotts Miracle-Gro is one of the world’s leading marketers of branded consumer lawn and garden as well as hydroponic and indoor growing products. The company offers fertilizers, grass seed products, spreaders, outdoor cleaners, and any lawn-related weed, pest, and disease control products.

On May 1st, 2024, Scotts Miracle-Gro reported its Q2-2024 results for the period ending March 31st, 2024, with numbers showing signs of improvement from previous sales declines. The company posted sales of $1.53 billion, flat compared to Q2-2023. Despite a 28% sales decline in the Hawthorne division, a 2% growth in U.S. Consumer sales, a much larger division, offset that.

The company is currently being pressured by higher commodity prices that have led to a significant margin decline despite multiple pricing actions. Still, it posted an adjusted income-per-share of $3.69, not far from last year’s adjusted income-per-share of $3.78 in the same period of last year.

Click here to download our most recent Sure Analysis report on SMG (preview of page 1 of 3 shown below):

Agriculture Stock #6: The Toro Company (TTC)

- 5-year expected annual returns: 10.1%

The Toro Company was founded in 1914 as an engine manufacturer, providing power to early tractors. The company quickly shifted focus to mowers and in the century since, it has grown to generate $4.6 billion in annual revenue. Toro operates in North America as well as internationally, with three quarters of total revenue coming from the U.S.

Toro reported first quarter 2024 results on March 7th, 2024. Q1 net sales declined 13% year-over-year to $1.0 billion. Adjusted earnings per diluted share decreased 35% to $0.64 in Q1 2024 and adjusted operating margin for the quarter was 9.2% compared to 11.9% in the same prior-year period.

Leadership reaffirmed its fiscal 2024 outlook, guiding for low-single-digit total net sales growth, and adjusted EPS in the range of $4.25 to $4.35.

Click here to download our most recent Sure Analysis report on TTC (preview of page 1 of 3 shown below):

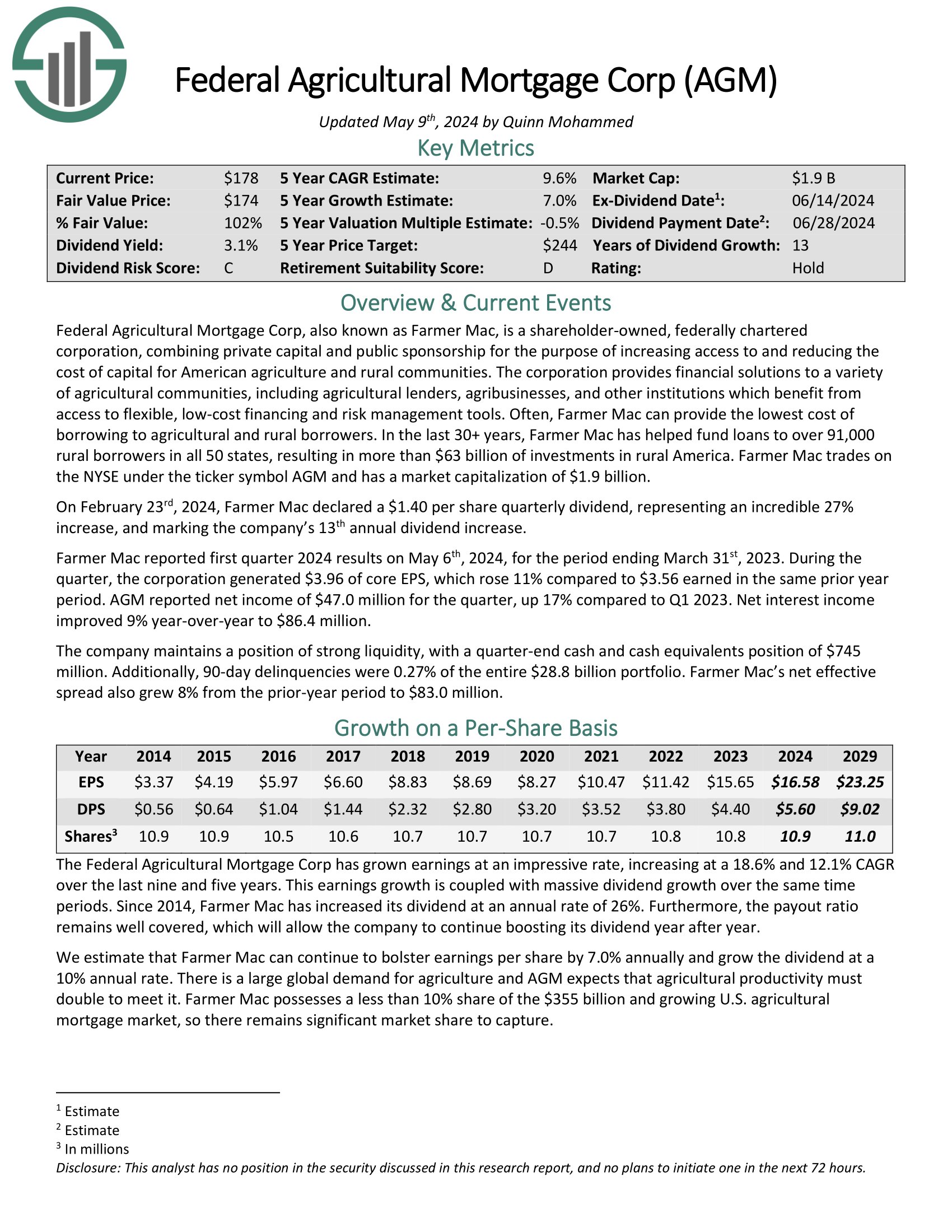

Agriculture Stock #5: Federal Agriculture Mortgage Corporation (AGM)

- 5-year expected annual returns: 10.4%

Federal Agricultural Mortgage Corp, also known as Farmer Mac, is a shareholder-owned, federally chartered corporation, combining private capital and public sponsorship for the purpose of increasing access to and reducing the cost of capital for American agriculture and rural communities.

The corporation provides financial solutions to a variety of agricultural communities, including agricultural lenders, agribusinesses, and other institutions which benefit from access to flexible, low-cost financing and risk management tools. Often, Farmer Mac can provide the lowest cost of borrowing to agricultural and rural borrowers.

Farmer Mac reported first quarter 2024 results on May 6th, 2024, for the period ending March 31st, 2023. During the quarter, the corporation generated $3.96 of core EPS, which rose 11% compared to $3.56 earned in the same prior year period. AGM reported net income of $47.0 million for the quarter, up 17% compared to Q1 2023. Net interest income improved 9% year-over-year to $86.4 million.

Click here to download our most recent Sure Analysis report on FMC (preview of page 1 of 3 shown below):

Agriculture Stock #4: CF Industries (CF)

- 5-year expected annual returns: 10.7%

CF Industries manufactures and distributes nitrogen fertilizer products worldwide. Its primary products include ammonium nitrate, urea ammonium nitrate solution, granular urea, and anhydrous ammonia.

It also offers non fertilizer products like diesel exhaust fluid, nitric acid, and urea liquor. CF Industries distributes its products through cooperatives, traders, wholesalers, farmers, and industrial customers.

CF posted fourth quarter and full-year earnings on February 14th, 2024. Fourth quarter earnings came to $1.44, which missed estimates for $1.60. Revenue was off a staggering 40% year-over-year to $1.57 billion, but was still $70 million ahead of expectations.

Average selling prices were lower than in the year-ago period as lower global energy costs reduced the global market clearing price required to meet global demand. Sales volume in the fourth quarter was actually higher than last year, but the decline in pricing was too big to overcome.

Click here to download our most recent Sure Analysis report on CF (preview of page 1 of 3 shown below):

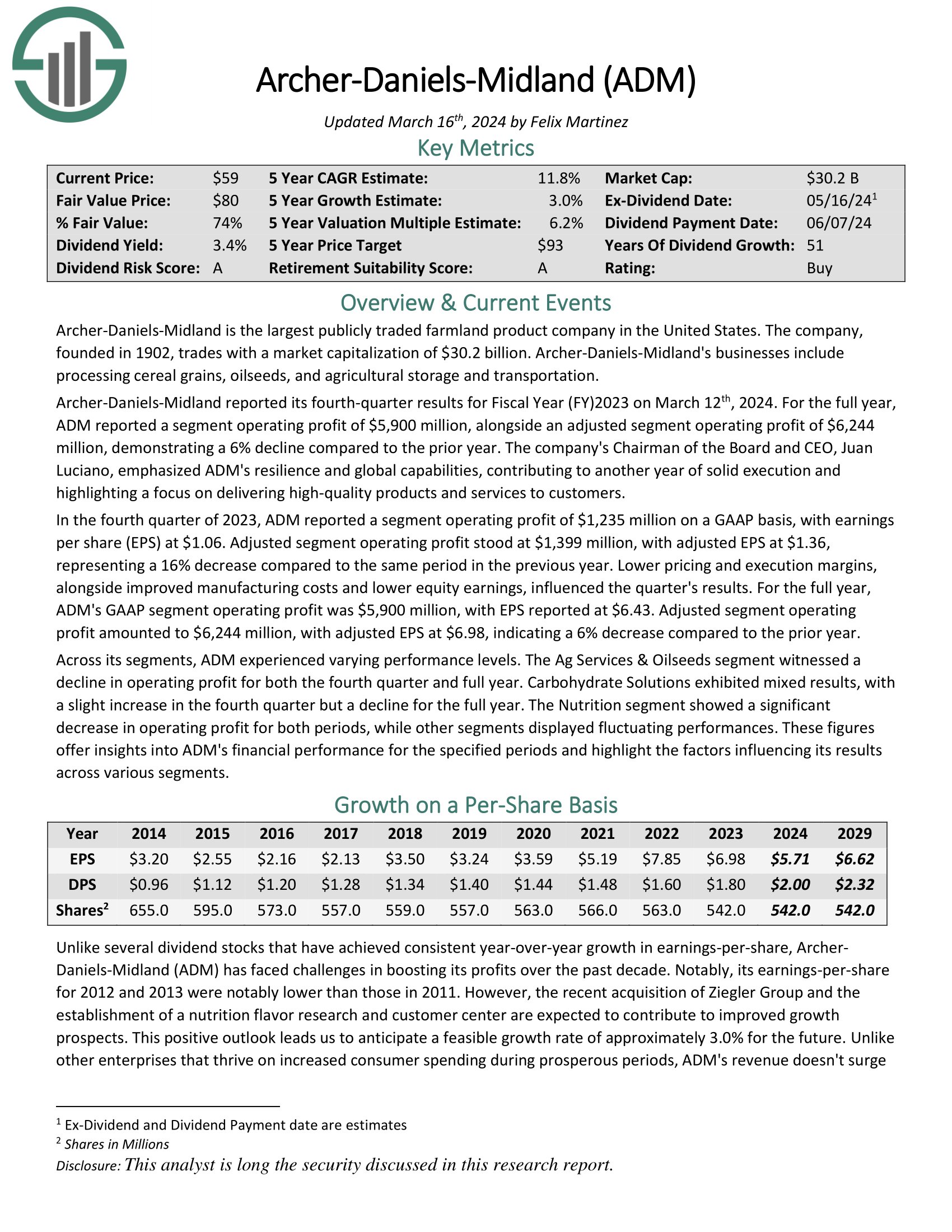

Agriculture Stock #3: Archer-Daniels-Midland (ADM)

- 5-year expected annual returns: 11.0%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. The company, founded in 1902, trades with a market capitalization of $38.6 billion. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its fourth-quarter results on March 12th, 2024. For the full year, ADM reported an adjusted segment operating profit of $6,244 million, demonstrating a 6% decline compared to the prior year. The company’s Chairman of the Board and CEO, Juan Luciano, emphasized ADM’s resilience and global capabilities, contributing to another year of solid execution and highlighting a focus on delivering high-quality products and services to customers.

In the fourth quarter of 2023, ADM reported adjusted EPS at $1.36, representing a 16% decrease compared to the same period in the previous year.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

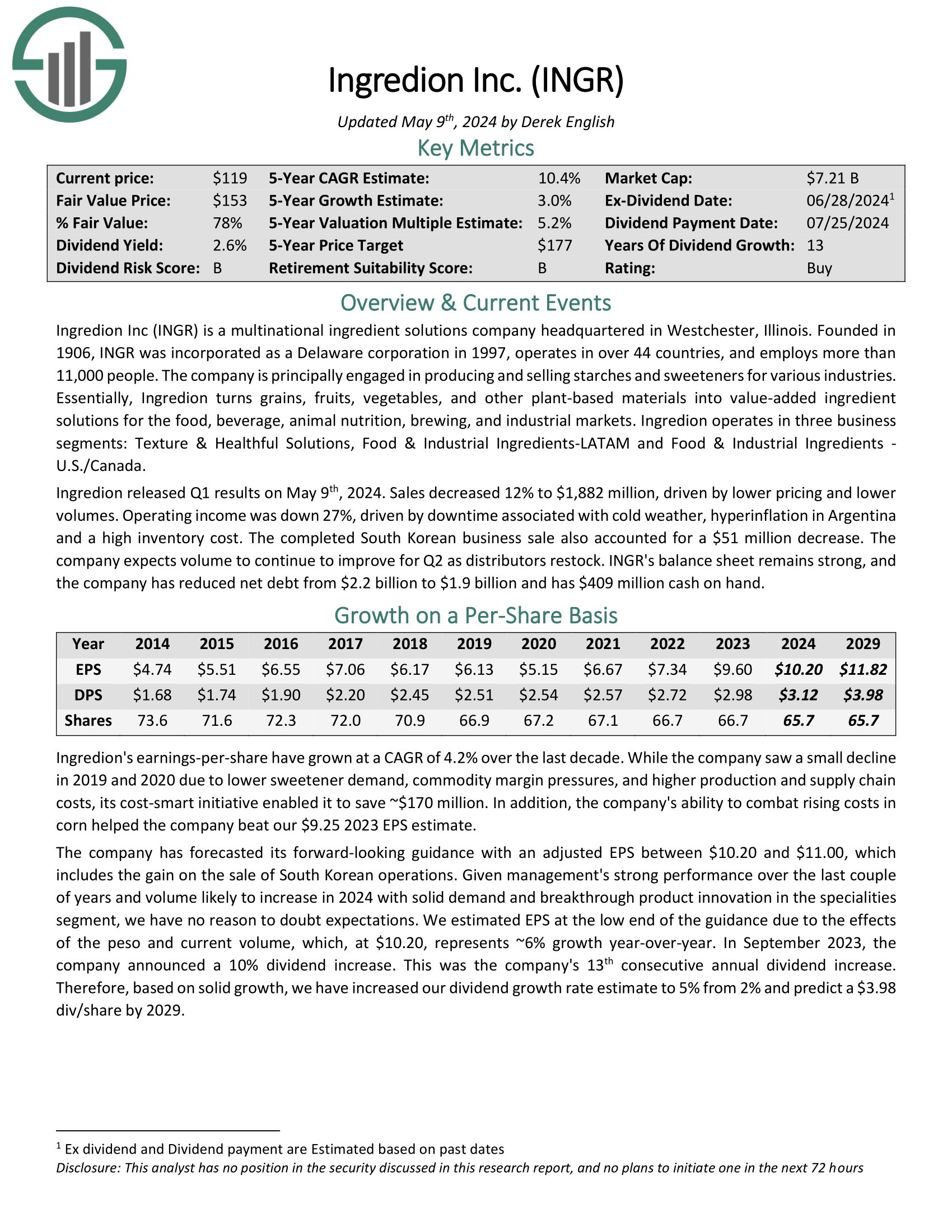

Agriculture Stock #2: Ingredion Inc. (INGR)

- 5-year expected annual returns: 11.1%

Ingredion Inc is a multinational ingredient solutions company engaged in producing and selling starches and sweeteners for various industries. Ingredion turns grains, fruits, vegetables, and other plant-based materials into value-added ingredient solutions for the food, beverage, animal nutrition, brewing, and industrial markets.

Ingredion operates in four business segments: North America, South America; Asia-Pacific; and Europe, Middle East, and Africa (“EMEA”).

Ingredion released Q1 results on May 9th, 2024. Sales decreased 12% to $1,882 million, driven by lower pricing and lower volumes. Operating income was down 27%, driven by downtime associated with cold weather, hyperinflation in Argentina and a high inventory cost. The completed South Korean business sale also accounted for a $51 million decrease. The company expects volume to continue to improve for Q2 as distributors restock.

INGR’s balance sheet remains strong, and the company has reduced net debt from $2.2 billion to $1.9 billion and has $409 million cash on hand.

Click here to download our most recent Sure Analysis report on INGR (preview of page 1 of 3 shown below):

Agriculture Stock #1: Lindsay Corporation (LNN)

- 5-year expected annual returns: 11.6%

Lindsay Corporation provides water management and road infrastructure services in the United States and internationally. The irrigation segment provides irrigation solutions for farmers and contributed 86% of sales in fiscal year 2022. The infrastructure segment helps with road and bridge repairs and contributed the other 14%.

On April 4th, 2024, Lindsay reported Q2 2024 results for the period ending February 29th, 2024. The business saw diluted earnings-per-share of $1.64 which rose slightly from the $1.63 reported the same quarter of last year. However, revenues declined 9% year-over-year to $152 million.

Though irrigation demand was steady in North America, the company cited significant decline in demand for its products in Brazil given weak pricing and agricultural activity in that market.

Click here to download our most recent Sure Analysis report on Lindsay (preview of page 1 of 3 shown below):

Final Thoughts

Agriculture stocks are a compelling place to look for long-term stock investments. That’s because the demand drivers of the industry make it extremely likely to be around far into the future.

We believe the 7 agriculture stocks examined in this article are the best within the industry.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 54 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.