Published on February 11th, 2025 by Bob Ciura

All other things being equal, the higher the dividend yield, the better.

It’s true – in isolation, there’s no such thing as “too high” of a dividend yield. The greater the dividend yield, the more money you are paid for your investment. Getting a higher yield on your investment dollars is a good thing.

With this in mind, we compiled a list of high dividend stocks with dividend yields above 5%. You can download your free copy of the high dividend stocks list by clicking on the link below:

The problem is, however, that “all other things being equal” never seems to pan out in real life.

In the real world, a very high dividend yield can be a sign of distress; a red flag that requires further investigation. With this in mind, income investors should try to avoid dividend cuts or elimination as much as possible.

The following list represents the 10 riskiest high dividend stocks in the Sure Analysis Research Database.

The 10 dividend stocks below have dangerously high yields above 10%, and lack the fundamental strength to support their payouts over the long run.

The stocks all have Dividend Risk Scores of ‘D’ or ‘F’ (our lowest grades) in the Sure Analysis Research Database, with payout ratios above 70%, and either hold or sell ratings from Sure Dividend.

The list is sorted by current yield, from lowest to highest.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- Overly Risky High Dividend Stock #10: PennantPark Floating Rate Capital (PFLT)

- Overly Risky High Dividend Stock #9: Xerox Corporation (XRX)

- Overly Risky High Dividend Stock #8: Arbor Realty Trust (ABR)

- Overly Risky High Dividend Stock #7: Prospect Capital (PSEC)

- Overly Risky High Dividend Stock #6: New York Mortgage Trust (NYMT)

- Overly Risky High Dividend Stock #5: B&G Foods, Inc. (BGS)

- Overly Risky High Dividend Stock #4: ARMOUR Residential REIT (ARR)

- Overly Risky High Dividend Stock #3: Kohl’s Corporation (KSS)

- Overly Risky High Dividend Stock #2: Orchid Island Capital (ORC)

- Overly Risky High Dividend Stock #1: Icahn Enterprises LP (IEP)

Overly Risky High Dividend Stock #10: PennantPark Floating Rate Capital (PFLT)

- Dividend Yield: 11.0%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On November 26, 2024, PennantPark Floating Rate Capital reported strong results for the fourth fiscal quarter of 2024, with core net investment income of $0.32 per share. The portfolio grew 20% quarter-over-quarter, reaching $2 billion as the firm deployed $446 million across 10 new and 50 existing companies.

Investments carried an average yield of 11%, reflecting the continued strength of the middle market lending environment. After the quarter, PFLT remained active, investing an additional $330 million at a yield of 10.2%.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

Overly Risky High Dividend Stock #9: Xerox Corporation (XRX)

- Dividend Yield: 12.5%

Xerox Corporation traces its lineage back to 1906 when The Haloid Photographic Company began manufacturing photographic paper and equipment. Through a series of mergers and spinoffs, the Xerox we know today was formed.

Xerox spun off its business processing unit in 2017 (now called Conduent) and now focuses on design, development, and sales of document management systems.

Xerox reported third quarter earnings on October 29th, 2024, and results were awful, sending the stock spiraling lower. Revenue fell 7.3% year-on-year to $1.53 billion, missing estimates by $100 million. Adjusted earnings-per-share came to 25 cents, missing estimates by more than 50%, which had been set at 51 cents.

Unadjusted earnings included a non-cash after-tax goodwill impairment charge of $1 billion, or $8.16 per share, as well as a further $161 million, or $1.29 per share, that was related to the establishment of a valuation allowance.

Click here to download our most recent Sure Analysis report on XRX (preview of page 1 of 3 shown below):

Overly Risky High Dividend Stock #8: Arbor Realty Trust (ABR)

- Dividend Yield: 12.6%

Arbor Realty Trust is a nationwide mortgage real estate investment trust (REIT) that acts as a direct lender and operates in two reporting segments: Agency Business and Structured Business. The trust provides loan origination and servicing for multifamily, seniors housing, healthcare, and other diverse commercial real estate assets.

Arbor Realty’s specific focus is government-sponsored enterprise products, although its platform also includes commercial mortgage backed securities (CMBS), bridge and mezzanine loans, and preferred equity issuances.

Arbor Realty Trust, Inc. (ABR) reported third-quarter 2024 results with net income of $0.31 per diluted common share, matching expectations, and distributable earnings of $0.43 per share. Revenue reached $88.81 million, a 17.23% year-over-year decrease but still beating estimates by $3.10 million.

The company declared a cash dividend of $0.43 per share and announced agency loan originations totaling $1.1 billion, supporting a $33.01 billion servicing portfolio, which grew 10% year-over-year. Structured loan originations reached $258.5 million, contributing to a $11.57 billion portfolio.

Click here to download our most recent Sure Analysis report on ABR (preview of page 1 of 3 shown below):

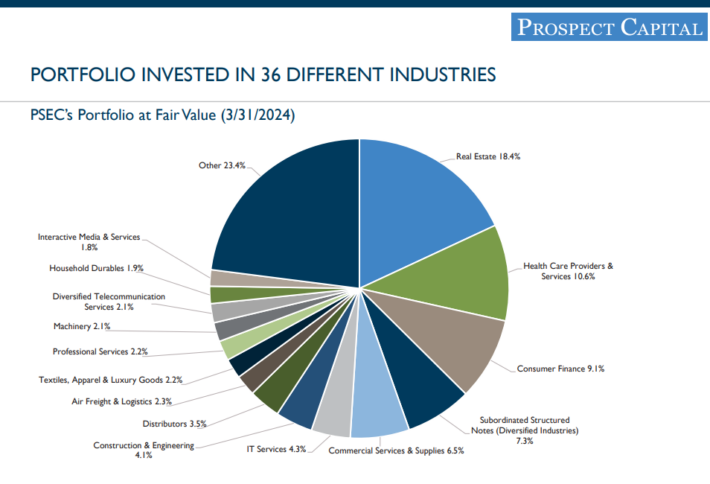

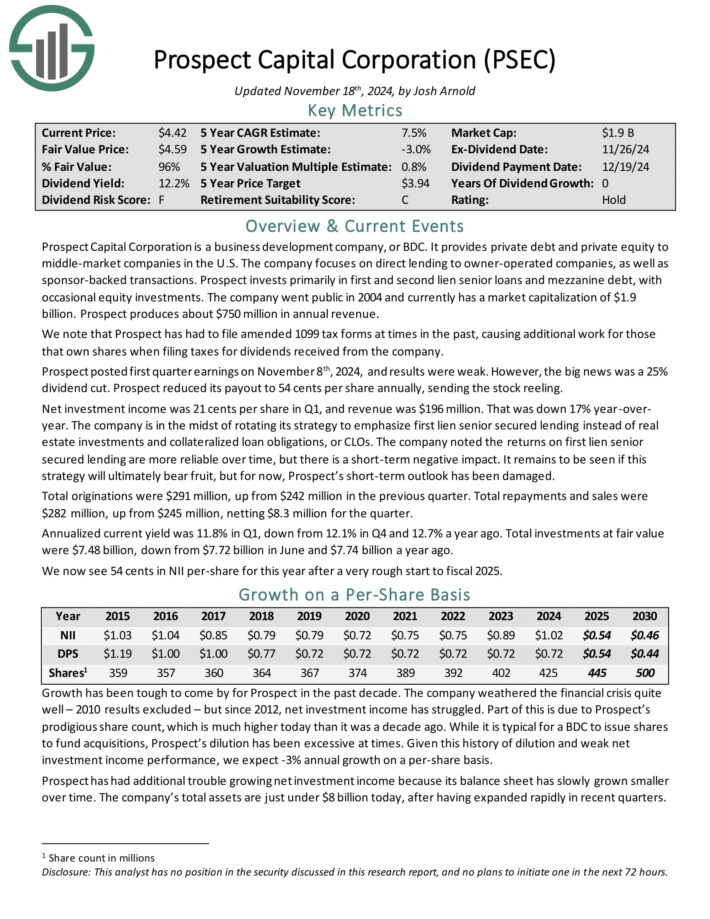

Overly Risky High Dividend Stock #7: Prospect Capital (PSEC)

- Dividend Yield: 12.9%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Source: Investor Presentation

Prospect posted first quarter earnings on November 8th, 2024, and results were weak. However, the big news was a 25% dividend cut. Prospect reduced its payout to 54 cents per share annually, sending the stock reeling.

Net investment income was 21 cents per share in Q1, and revenue was $196 million. That was down 17% year-over-year.

The company is in the midst of rotating its strategy to emphasize first lien senior secured lending instead of real estate investments and collateralized loan obligations, or CLOs.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

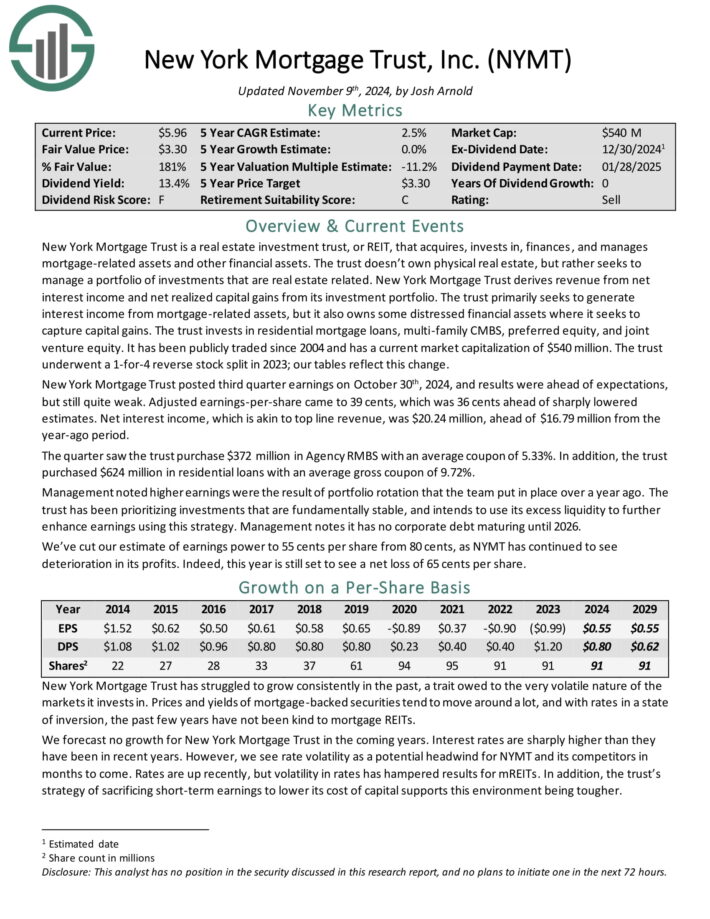

Overly Risky High Dividend Stock #6: New York Mortgage Trust (NYMT)

- Dividend Yield: 13.0%

New York Mortgage Trust acquires, invests in, finances, and manages mortgage-related assets and other financial assets. The trust doesn’t own physical real estate, but rather seeks to manage a portfolio of investments that are real estate related.

The trust invests in residential mortgage loans, multi family CMBS, preferred equity, and joint venture equity.

New York Mortgage Trust posted third quarter earnings on October 30th, 2024, and results were ahead of expectations, but still quite weak.

Adjusted earnings-per-share came to 39 cents, which was 36 cents ahead of sharply lowered estimates. Net interest income, which is akin to top line revenue, was $20.24 million, ahead of $16.79 million from the year-ago period.

The quarter saw the trust purchase $372 million in Agency RMBS with an average coupon of 5.33%. In addition, the trust purchased $624 million in residential loans with an average gross coupon of 9.72%.

Click here to download our most recent Sure Analysis report on NYMT (preview of page 1 of 3 shown below):

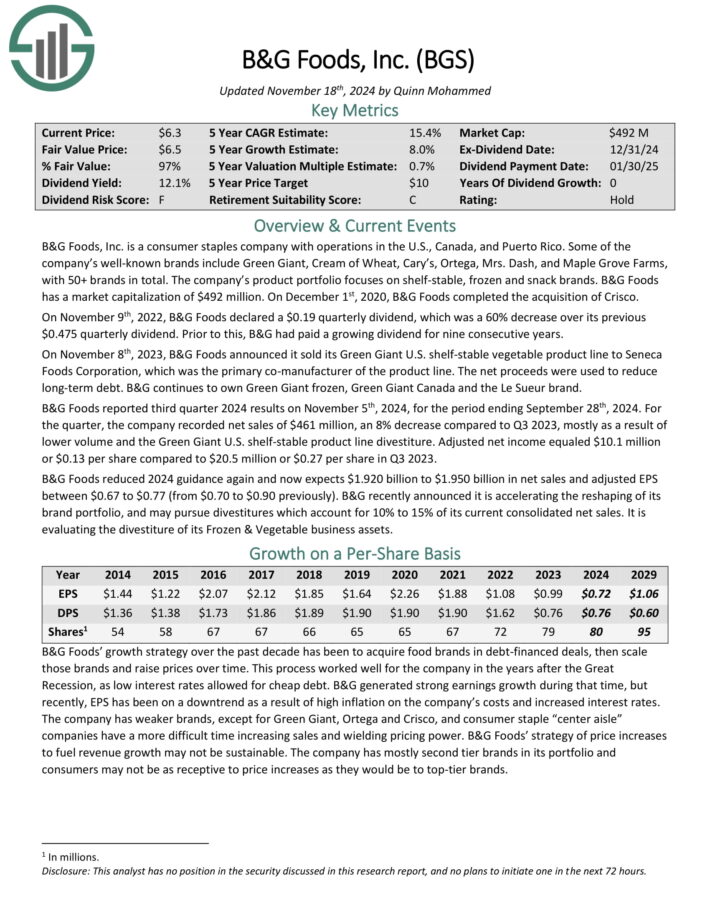

Overly Risky High Dividend Stock #5: B&G Foods, Inc. (BGS)

- Dividend Yield: 13.5%

B&G Foods, Inc. is a consumer staples company with operations in the U.S., Canada, and Puerto Rico. Some of the company’s well-known brands include Green Giant, Cream of Wheat, Cary’s, Ortega, Mrs. Dash, and Maple Grove Farms, with 50+ brands in total.

It product portfolio focuses on shelf-stable, frozen and snack brands. On December 1st, 2020, B&G Foods completed the acquisition of Crisco.

B&G Foods reported third quarter 2024 results on November 5th, 2024, for the period ending September 28th, 2024.

For the quarter, the company recorded net sales of $461 million, an 8% decrease compared to Q3 2023, mostly as a result of lower volume and the Green Giant U.S. shelf-stable product line divestiture. Adjusted net income equaled $10.1 million or $0.13 per share compared to $20.5 million or $0.27 per share in Q3 2023.

B&G Foods reduced 2024 guidance again and now expects $1.920 billion to $1.950 billion in net sales and adjusted EPS between $0.67 to $0.77 (from $0.70 to $0.90 previously).

Click here to download our most recent Sure Analysis report on BGS (preview of page 1 of 3 shown below):

Overly Risky High Dividend Stock #4: ARMOUR Residential REIT (ARR)

- Dividend Yield: 15.2%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor presentation

On October 23, 2024, ARMOUR Residential REIT announced its unaudited third-quarter 2024 financial results, reporting a GAAP net income available to common stockholders of $62.9 million, or $1.21 per common share. The company generated a net interest income of $1.8 million and distributable earnings of $52.0 million, equivalent to $1.00 per common share.

ARMOUR achieved an average interest income of 4.89% on interest-earning assets and an interest cost of 5.51% on average interest-bearing liabilities. The economic net interest spread stood at 2.00%, calculated from an economic interest income of 4.44% minus an economic interest expense of 2.44%.

During the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of common stock through an at-the-market offering program and paid common stock dividends of $0.72 per share for Q3.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

Overly Risky High Dividend Stock #3: Kohl’s Corporation (KSS)

- Dividend Yield: 16.9%

Kohl’s traces its roots back to a single store: Kohl’s Department Store in 1962. Since then, it has grown into a leader in the space – offering women’s, men’s and children’s apparel, housewares, accessories, and footwear in more than 1,100 stores in 49 states. The company should generate roughly $16 billion in sales this year.

From 2007 through 2018, Kohl’s was able to grow earnings-per-share by about 4.7% annually. However, it should be noted that this was driven by the company’s extensive share repurchase program. Over that period the share count was nearly halved, a reduction rate of -5.6% per year.

With the share repurchase program having been paused, we don’t see that as a tailwind for the time being. Fears of struggling margins have proven to be right, as the past few years have seen declining profitability. We note that 2021’s earnings has the potential to be the top for some time.

We forecast earnings-per-share at $1.85 this year as the company is seeing weakened demand come to fruition, and significant margin headwinds, along with much weaker sales.

Click here to download our most recent Sure Analysis report on KSS (preview of page 1 of 3 shown below):

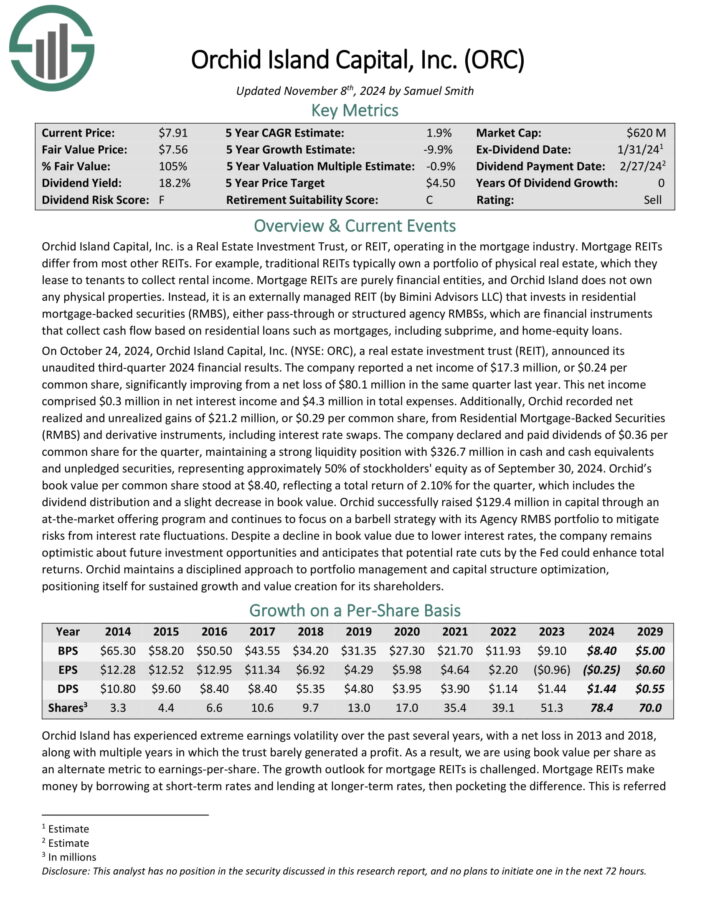

Overly Risky High Dividend Stock #2: Orchid Island Capital (ORC)

- Dividend Yield: 17.3%

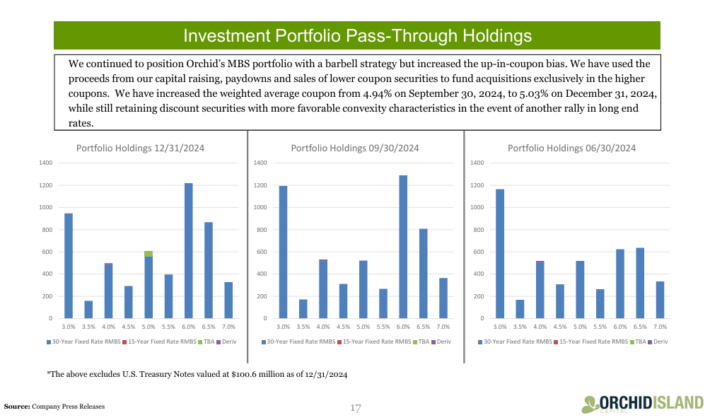

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

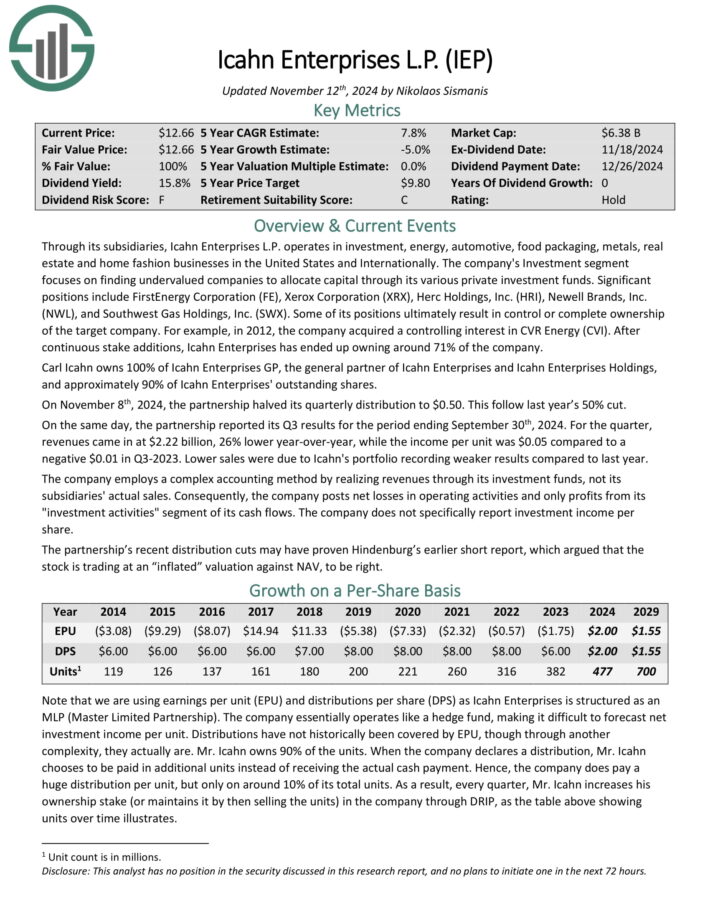

Overly Risky High Dividend Stock #1: Icahn Enterprises LP (IEP)

- Dividend Yield: 20.7%

Through its subsidiaries, Icahn Enterprises L.P. operates in investment, energy, automotive, food packaging, metals, real estate and home fashion businesses in the United States and Internationally.

The company’s Investment segment focuses on finding undervalued companies to allocate capital through its various private investment funds.

Significant positions include FirstEnergy Corporation (FE), Xerox Corporation (XRX), Herc Holdings, Inc. (HRI), Newell Brands, Inc. (NWL), and Southwest Gas Holdings, Inc. (SWX).

On November 8th, 2024, the partnership halved its quarterly distribution to $0.50. This follow last year’s 50% cut. On the same day, the partnership reported its Q3 results for the period ending September 30th, 2024.

For the quarter, revenues came in at $2.22 billion, 26% lower year-over-year, while the income per unit was $0.05 compared to a negative $0.01 in Q3-2023. Lower sales were due to Icahn’s portfolio recording weaker results compared to last year.

Click here to download our most recent Sure Analysis report on IEP (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

High dividend stocks are naturally appealing on the surface, due to their high dividend yields.

But income investors need to make sure they do not fall into a dividend ‘trap’, meaning purchasing a stock solely due to its high yield, only to see the company cut or eliminate the dividend payout.

While there is never a guarantee a stock will not cut its dividend, focusing on stocks with strong underlying fundamentals and modest payout ratios can go a long way.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Monthly Dividend Stocks: Individual securities that pay out every month