Published on July 5th, 2024 by Josh Arnold

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only about 1.3%, as prices have risen more quickly than dividends in recent months.

High-yield stocks can be very helpful to shore up income after retirement.

For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Avista Corporation (AVA) is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is Avista Corporation (AVA).

Avista has a 21-year dividend increase streak, which is quite impressive by any measure, even among utilities.

The company has been able to boost its payout for two decades because of predictable and stable cash flows, and we believe there are likely many years of increases to come.

Business Overview

Avista is an electric and natural gas utility company that was founded in 1889. The company operates two segments: Avista Utilities and AEL&P.

The Avista Utilities segment provides electric distribution and transmission, as well as natural gas distribution services in Washington and Idaho, as well as parts of Oregon and Montana.

The AEL&P segment offers electric services in Juneau, Alaska, generating power through hydroelectric, thermal, wind, and solar generation facilities.

In total Avista has about 800,000 customer connections, generating just over 200 megawatts of power.

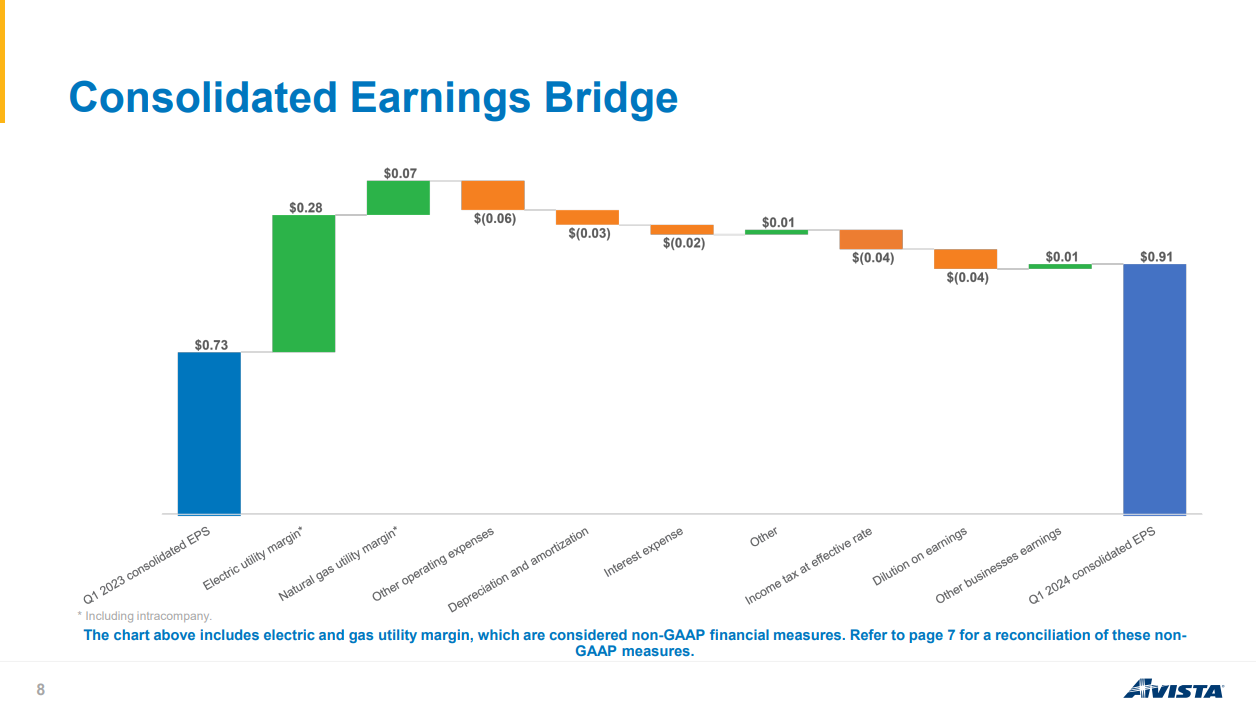

Avista’s first quarter earnings showed strong profitability growth, particularly in the electric utility segment.

Source: Investor presentation

The company was able to boost margins in both electric and natural gas distribution, which was partially offset by higher taxes and operating expenses, among others.

Still, growth in earnings from 73 cents per share to 91 cents year-over-year was a terrific start to the year.

We see $2.36 in full-year earnings for 2024, representing about 5% growth from 2023 should that come to fruition.

Growth Prospects

Given that Avista is a utility, its only growth levers are largely out of its control. First, Avista can grow its customer base or see existing customers use more electricity or natural gas.

Customer growth is largely due to population growth, so it’s a slow and steady way to grow, and with electricity demand largely dependent upon weather, there’s not a huge amount Avista can do to influence.

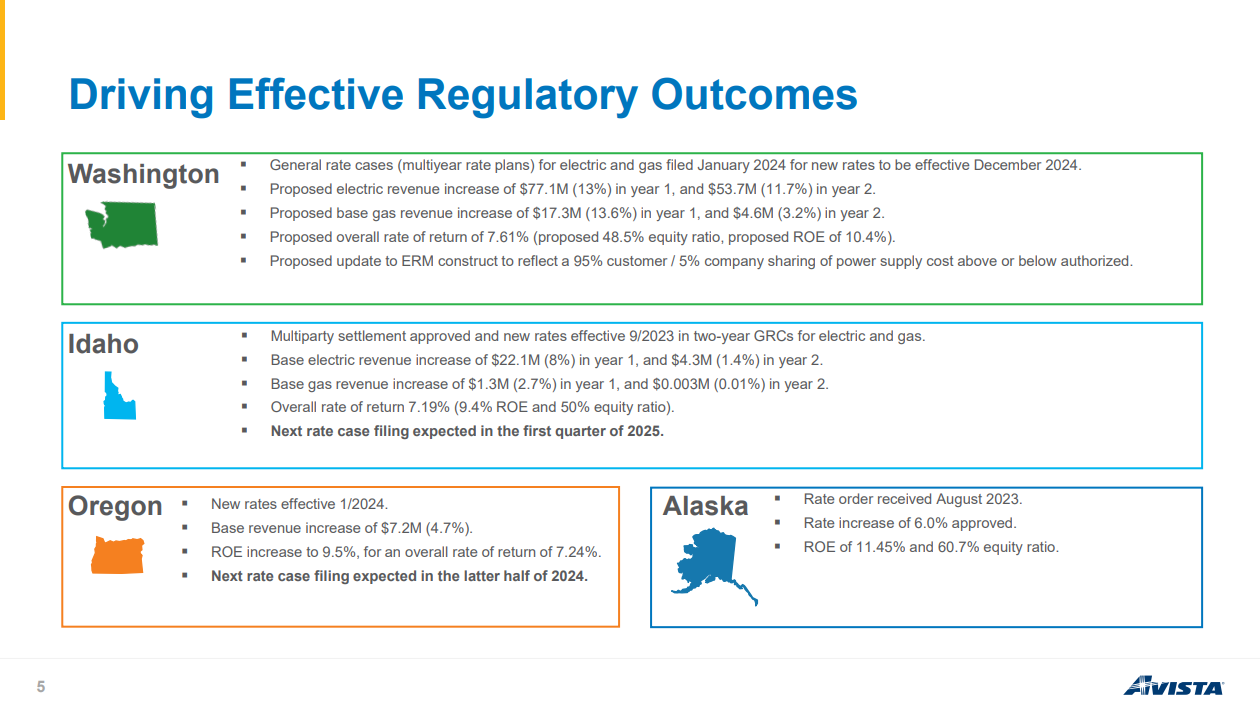

The other growth lever is rate case increases, which Avista is hard at work in securing.

Source: Investor presentation

There are numerous rate case increases in the pipeline in all of the states where the company operates, and assuming those come through, we should see Avista’s revenue – and potentially margins – continue to rise.

Like other utilities, the company has a history of successfully lobbying for rate increases, which accompany higher levels of capital expenditures.

Over time, we believe investors will see a steady rise in revenue and margins for Avista. In total, we estimate 3% annual earnings-per-share growth going forward.

Competitive Advantages & Recession Performance

Competitive advantages are also built in for regulated utilities, and Avista enjoys the virtual monopoly in its service area that regulated utilities are accustomed to.

Essentially, if someone wants power in the service area Avista operates in, that person has very few options but to use Avista.

This built-in competitive advantage makes revenue and cash flows very predictable, but also means growth is difficult to come by.

Another benefit of this model is recession resilience, and Avista should hold up quite nicely during the next recession.

The company performed strongly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.24

- 2009 earnings-per-share: $1.57

- 2010 earnings-per-share: $1.65

Avista actually managed to produce strong earnings growth during the Great Recession, which is not something the vast majority of companies can claim.

This is owed to the regulated nature of the utility, and we expect this to be the case during the next recession. Regulated utilities are defensive stocks, and Avista certainly fits that description.

Dividend Analysis

The current dividend of $1.90 per share annually represents a 5.6% yield on the current share price of about $34. That is roughly four times the S&P 500’s current yield, and is also well above Avista’s average yield in recent years.

The stock has been hammered in 2024 as defensive names have fallen out of favor, but that has given prospective investors an opportunity to buy Avista stock at an above-average dividend yield.

The payout ratio is about 80% of earnings, which is high. However, it is normal for regulated utilities to pay out most of their earnings to shareholders given highly stable and predictable cash flows, and the relative lack of investment opportunities for excess cash.

We therefore do not believe Avista’s dividend is at risk for the foreseeable future.

We see modest growth in the payout moving forward, commensurate with low levels of earnings growth. With the yield above 5%, Avista looks like a very strong income stock for the foreseeable future.

Final Thoughts

While investors are unlikely to get strong earnings and dividend growth from Avista in the future, we like the company’s long dividend increase streak, and its high dividend yield.

Avista should see very strong recession performance during the next downturn, and we see its prospects for further dividend growth as quite good.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more