Published on June 28th, 2024 by Bob Ciura

Whirlpool Corporation (WHR) was a major beneficiary of low interest rates and a strong housing market for many years.

But recent years have been much more challenging for the company. Ongoing inflation and high interest rates have weighed significantly on Whirlpool’s earnings.

WHR stock has declined 30% in the past 12 months. As a result, WHR stock now yields 6.9%, making it one of the high-yield stocks in our database.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Whirlpool in greater detail.

Business Overview

Whirlpool Corporation was founded in 1955 and is now a leading home appliance company. Its major brands include Whirlpool, KitchenAid, and Maytag.

Roughly half of the company’s sales are in North America, but Whirlpool does business around the world under 12 principal brand names. The company generated nearly $20 billion in sales in 2023.

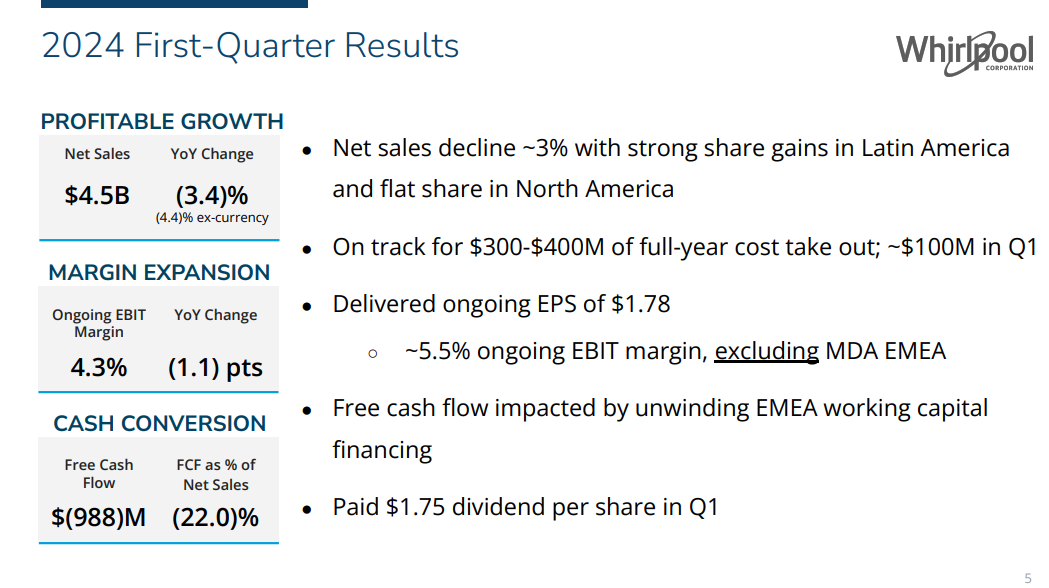

On April 24th, 2024, Whirpool reported first quarter results. For the quarter, sales came in at $4.49 billion, down 3.4% compared to the 2023 first quarter. Ongoing earnings per diluted share was $1.78 in the quarter, 33% below last year’s $2.66 per share.

Source: Investor Presentation

Whirlpool reaffirmed its 2024 guidance, which sees ongoing earnings-per-share coming in at a midpoint of $14.00 on revenue of $16.9 billion.

Additionally, Whirlpool expects cash provided by operating activities to total roughly $1.2 billion, with $600 million in free cash flow.

Growth Prospects

Over the past 10 years, Whirlpool grew earnings-per-share by an average compound rate of 4.0% per year. This growth can be attributed to an improvement in margins, and a reduction in the share count.

These items can continue to boost the bottom line but starting from a higher base makes growth more difficult.

While EPS seems to have peaked in 2021, we have a 2024 EPS forecast of $14.00 for Whirlpool, and 3% annual EPS growth over the next five years.

Strong home improvement spending, which had provided a boost to Whirlpool’s results in recent years, is subsiding as a result of rising interest rates and ongoing price inflation.

Whirlpool has also struggled with consistent losses in its international operations. To that end, Whirlpool is reshaping its geographic focus on the U.S. and developed international markets.

When it comes to product lines, Whirlpool is refocusing its portfolio on three main pillars: small appliances, major appliances, and commercial appliances.

Source: Investor Presentation

An example of this came in April 2024, when Whirlpool closed on an agreement with Arçelik A.Ş. Whirlpool is contributing its European major domestic appliance business, while Arçelik will contribute its major domestic appliance, consumer electronics, air conditioning, and small domestic appliance businesses into a newly formed entity.

Whirlpool will own 25% of this new entity, which will have combined sales of over €6 billion, while Arçelik will own the remaining 75%.

Additionally, Whirlpool agreed to sell its Middle East and Africa business to Arçelik.

The 2022 acquisition of Insinkerator is another example of Whirlpool’s changing focus. InSinkErator is the world’s largest manufacturer of food waste disposers and instant hot water dispensers for home and commercial use, which Whirlpool acquired from Emerson Electric (EMR).

Competitive Advantages

Whirlpool’s competitive advantages include its strong brands, global presence, and cost controls which is why it generates significantly higher margins than its peers.

That said, the cyclicality of housing appliances means the business is not recession-resistant. For example, during the Great Recession, the company posted per share EPS of $8.10, $5.50, $4.34, and $9.10 from 2007- 2010.

On the other hand, Whirlpool maintained its dividend payout during the 2007-2010 stretch, and EPS quickly rebounded alongside the broader economic recovery.

Dividend Analysis

Whirlpool currently pays a quarterly dividend of $1.75 per share, which it has held at this level since 2022. While the dividend payout has not been increased in the past two years, the stock has a high current yield of 6.9%.

The high yield is due primarily to Whirlpool’s declining share price. Earnings-per-share have declined meaningfully from the 2021 peak level, but the dividend remains covered.

With expected EPS of $14 at the midpoint of guidance compared with a $7 per share annual dividend payout, Whirlpool is projected to have a 50% payout ratio for 2024.

This indicates a secure payout with the current EPS trajectory, but the payout ratio remains above management’s preferred 30% range. Therefore, we are not expecting dividend increases to resume until EPS growth picks up.

Final Thoughts

Whirlpool has established itself as an industry leader in its core categories. But after a blowout performance in 2021, its financial results have declined significantly from peak levels.

The combination of inflation, high interest rates, and a slowing housing market are potential overhangs on earnings. That said, Whirlpool is profitable and generates strong free cash flow, which fuels its high dividend payout.

We see the dividend as secure, barring a deep economic downturn. Overall, we view Whirlpool as an attractive dividend stock for income investors.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Kings: 50+ years of rising dividends

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLP List

- REIT List

- BDC List