Published on June 24th, 2024 by Josh Arnold

High-yield stocks pay out dividends that are significantly more than market average dividends, and ideally, on a sustainable and growing basis. As a reference point, the S&P 500’s current yield is only ~1.3% as the index trades near all-time highs.

High-yield stocks can be very helpful to shore up income after retirement. For example, a $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

UGI Corporation is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high dividend stocks to review is UGI Corporation (UGI). UGI has a very strong 36-year dividend increase streak, a period that spans multiple recessions.

The company has been able to continue its dividend growth over the years because of the predictable nature of earnings and cash flow from its utilities segment.

Business Overview

UGI is a diversified distributor of energy products and services in 17 countries, but primarily in the US.

Source: Investor presentation

UGI traces its roots back 142 years, and extraordinarily, has paid dividends for all but two of those years. In terms of increasing its dividend, as mentioned before, it’s done so since the late-1980s.

The company serves commercial and residential customers with products such as propane and natural gas distribution, as well as pipeline and storage services, among others.

The stock trades with a market cap of just under $5 billion, and the company produces annual revenue of more than $8 billion.

UGI’s most recent earnings report was released on May 1st, 2024, and was for the company’s fiscal second quarter. Earnings-per-share was $1.97 on an adjusted, diluted basis, which was up sharply from $1.68 in the year-ago period.

UGI suffered from warmer weather across its service territories, which reduces heating demand. However, natural gas performance and lower operating expenses helped boost margins.

The management team reiterated its guidance for the year, and we have accordingly projected $2.82 in adjusted earnings-per-share for this year.

Growth Prospects

UGI’s growth has been choppy at times, but in general, has trended upward over the long-term. The company is at the mercy of weather to an extent, as it sells commodities and commodity-based services.

Demand for these services depends on how hot or cold the weather is at certain times of the year.

Source: Company website

Still, the management team is confident it can continue to sustainably generate ~5% annual earnings-per-share growth on an adjusted basis, maintain prudent leverage, and boost its rate base by at least 9% annually.

Given the regulated utility business is likely to lead the way in terms of growth, we’re estimating just 1.2% annual earnings-per-share growth from 2024 levels.

We note the possibility for more than that if the more cyclical parts of the business outperform – on colder weather, for instance – but that volatility goes both ways. For now, we are cautious on UGI’s ability to produce high earnings growth over the long-term.

Competitive Advantages & Recession Performance

Competitive advantages are tricky to come by in the businesses UGI competes in, specifically because they are solely based upon commodity demand. That means that pricing and scale are the only levers to pull, and we believe UGI does have some scale in the markets it serves.

The fact that it is present in 17 countries provides a level of diversification most utilities do not have, but we still see the company’s competitive advantages as minimal.

UGI’s recession performance was actually outstanding during the Great Recession. While the commodity-based businesses the company operates naturally limit growth, they also offer stable demand regardless of economic conditions.

UGI’s performance during the Great Recession of 2008-2009 is below:

- 2008 earnings-per-share: $1.22

- 2009 earnings-per-share: $1.57

- 2010 earnings-per-share: $1.57

We see this performance during recessions as a selling point for the stock, particularly as it relates to dividend sustainability. We’d expect the company to be able to continue to pay and raise its dividend during the next major recession.

Dividend Analysis

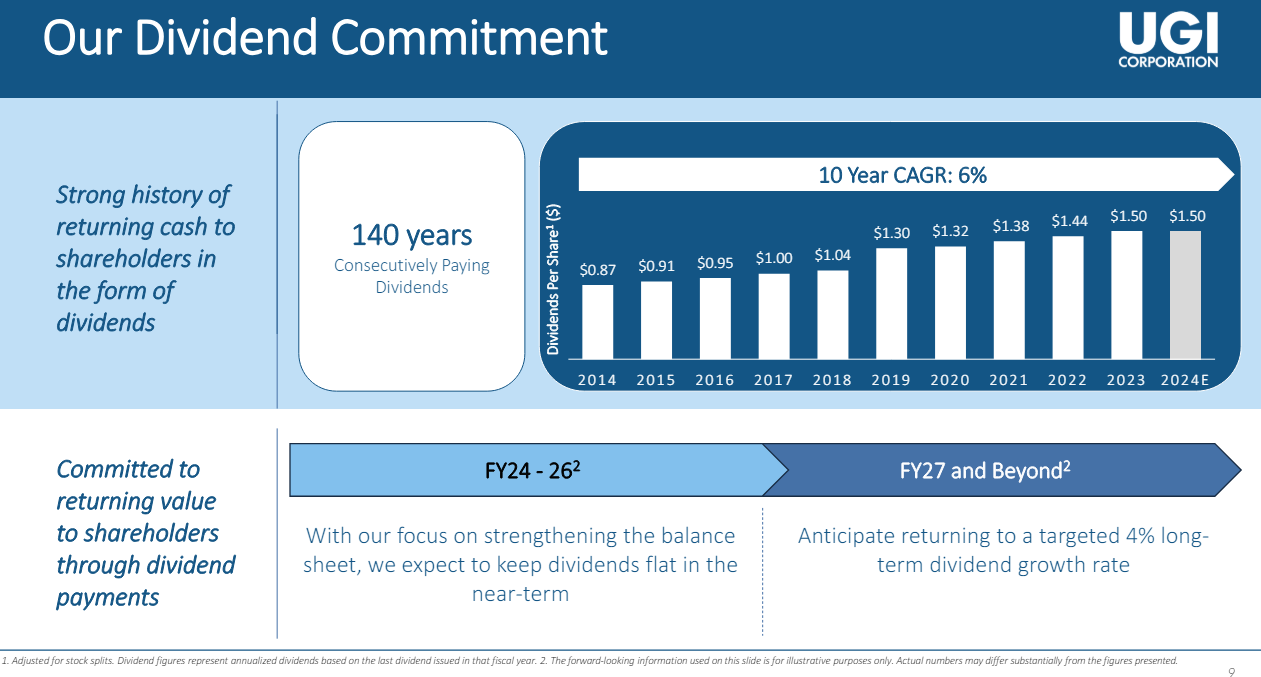

UGI’s current dividend is $1.50 per share annually, and with the stock at $23, that means the yield is a very attractive 6.6%. That is about 5 times that of the S&P 500, for reference.

Source: Investor presentation

With $2.82 in projected earnings-per-share for this year, the payout ratio is just over 50%. Given the 36 years of consecutive increases in the dividend, we see that as very manageable going forward and have no concerns about a potential cut on the horizon.

Management has been very clear about the commitment to defend the dividend and continue to raise it, and we estimate modest growth going forward, but certainly the ability to raise the payout indefinitely.

Final Thoughts

UGI’s impressive streak of nearly four decades of dividend increases certainly lends some credibility as a quality dividend stock.

In addition, the company’s stable earnings and recession resilience are big factors for dividend sustainability.

Finally, that extremely high yield is tremendously attractive, and we see the stock as a strong income stock overall due to these factors.

We see the company’s growth outlook as somewhat murky, but from the perspective of dividend investors, UGI has a lot to offer.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more