Published on October 29th, 2024 by Aristofanis Papadatos

The Dividend Kings consist of companies that have raised their dividends for at least 50 years in a row. Because of their unparalleled streak of annual dividend increases, it is common to view the Dividend Kings as among the best dividend growth stocks in the stock market.

You can see the full list of all 53 Dividend Kings here.

We also created a full list of all Dividend Kings, along with relevant financial statistics like dividend yields and price-to-earnings ratios. You can download the full list of Dividend Kings by clicking on the link below:

Consolidated Edison (ED) recently increased its dividend for the 50th consecutive year. As a result, the company now joins the exclusive list of Dividend Kings.

Over the years, utilities have become relied upon for their steady dividend payouts, even during recessions. This article will analyze the company’s business overview, future growth prospects, competitive advantages, and more.

Business Overview

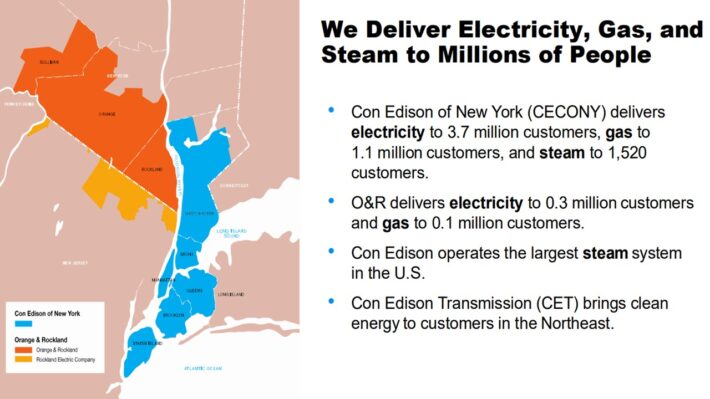

Consolidated Edison is a large-cap utility stock. The company generates nearly $15 billion in annual revenue and has a market capitalization of approximately $36 billion.

The company serves 3.7 million electric customers, and another 1.1 million gas customers, in New York.

Source: Investor Presentation

It operates electric, gas, and steam transmission businesses, with a steam system that is the largest in the U.S.

On October 1st, 2022, Consolidated Edison announced that it was selling its interest in its renewable energy business to RWE Renewables Americas, LLC for $6.8 billion. The transaction closed last year.

As a result of this transaction, Consolidated Edison has not issued common stock in each of the last two years. The company typically issues shares for financing on a regular basis.

On August 1st, 2024, Consolidated Edison announced second quarter results for the period ending June 30th, 2024. During the quarter, revenue grew 9% to $3.22 billion, which was $92 million more than expected.

Adjusted earnings of $203 million, or $0.59 per share, were 3% lower than adjusted earnings of $210 million, or $0.61 per share, in the previous year. Adjusted earnings per share exceeded the analysts’ estimates by $0.02.

As with prior periods, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets.

However, the denial of approval to capitalize costs related to the implementation of the new customer billing and information systems was a headwind to results.

Average rate base balances are expected to grow by 6.4% per year on average between 2024 and 2028, up from 6% previously. Consolidated Edison expects capital investments of nearly $28 billion during the period 2024-2028.

In its latest conference call, Consolidated Edison reaffirmed its guidance for 2024. The company expects adjusted earnings per share in a range of $5.20 to $5.40 for 2024. At the midpoint, the guidance implies 4.5% growth over the prior year.

Growth Prospects

Earnings growth across the utility industry typically mimics GDP growth. Over the next five years, we expect Consolidated Edison to grow earnings per share by 4.0% per year.

The company has provided guidance for 5%-7% average annual growth of earnings per share during 2024-2028 but we prefer to be somewhat conservative, given the 9-year average annual growth rate of 3.8% of the utility.

We expect ConEd to continue its pattern of modest growth moving forward. ConEd should continue to generate modest earnings growth each year through a combination of new customer acquisitions and rate increases, helped by the gradual improvement of the U.S. economy.

The growth drivers for Consolidated Edison are new customers and rate increases. One benefit of operating in a regulated industry is that utilities are permitted to raise rates on a regular basis, which virtually assures a steady level of growth.

Source: Investor Presentation

Consolidated Edison expects to grow its rate base by 6.4% per year on average through 2028. This is a natural way for a utility to generate steady revenue and earnings growth.

One potential threat to future growth is high interest rates, which could increase the cost of capital for companies that utilize debt, such as utilities.

The Fed just reduced interest rates thanks to a moderation of inflation and expects to reduce rates further, from 4.75%-5.0% to 2.75%-3.0% in 2026.

Lower interest rates help companies that rely heavily on debt financing, such as utilities, so investors do not need to be concerned about Consolidated Edison in a falling-rate cycle.

Even if rates remain elevated, Consolidated Edison is in strong financial condition. It has an investment-grade credit rating of A-, and a modest capital structure with balanced debt maturities over the next several years.

A healthy balance sheet and strong business model help provide security to Consolidated Edison’s dividends.

Investors can reasonably expect low single-digit dividend increases each year, at a rate similar to the company’s annual adjusted earnings-per-share growth.

Competitive Advantages & Recession Performance

Consolidated Edison’s main competitive advantage is the high regulatory hurdles of the utility industry. Electricity and gas services are necessary and vital to society.

As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides a great deal of certainty to Consolidated Edison.

In addition, the utility business model is highly recession-resistant. While many companies experienced large earnings declines in 2008 and 2009, Consolidated Edison held up relatively well. Earnings per share during the Great Recession are shown below:

- 2007 earnings-per-share of $3.48

- 2008 earnings-per-share of $3.36 (3% decline)

- 2009 earnings-per-share of $3.14 (7% decline)

- 2010 earnings-per-share of $3.47 (11% increase)

Consolidated Edison’s earnings fell in 2008 and 2009 but recovered in 2010. The company still generated healthy profits, even during the worst of the economic downturn.

This resilience allowed Consolidated Edison to continue raising its dividend each year.

The same pattern held up in 2020 when the U.S. economy entered a recession due to the coronavirus pandemic. ConEd has remained highly profitable, with record earnings per share in each of the last three years, which has allowed the company to raise its dividend every year.

Valuation & Expected Returns

Using the current share price of ~$105 and the midpoint of 2024 guidance, the stock trades with a price-to-earnings ratio of 19.8. This is much higher than our fair value estimate of 16.0, which is in line with the 10-year average price-to-earnings ratio for the stock.

As a result, Consolidated Edison shares appear to be overvalued. If the stock valuation retraces to the fair value estimate, the corresponding multiple contractions would reduce annualized returns by 4.2%.

Fortunately, the stock could still provide positive returns to shareholders, through earnings growth and dividends. We expect the company to grow earnings per share by 4.0% per year over the next five years. In addition, the stock has a current dividend yield of 3.2%.

Utilities like ConEd are prized for their stable dividends and safe payouts. Putting it all together, Consolidated Edison’s total expected returns could look like the following:

- 0% earnings growth

- -4.2% multiple reversion

- 2% dividend yield

Added up and Consolidated Edison is expected to return 2.9% per year on average over the next five years. This is a modest rate of return, but not high enough to warrant a buy recommendation.

Income investors may find the yield attractive, as the current yield is meaningfully higher than the 1.2% yield of the S&P 500 Index and grows very consistently. The company has a projected payout ratio of 63%, which indicates a sustainable dividend.

Nevertheless, we rate the stock a hold at the current valuation.

Final Thoughts

Consolidated Edison can be a valuable holding for income investors, such as retirees, thanks to its 3.2% dividend yield. The stock offers secure dividend income, and is also a Dividend King, meaning it should raise its dividend each year.

Therefore, risk-averse investors looking primarily for income right now–such as retirees–could see greater value in buying utility stocks like Consolidated Edison. However, we rate the stock as a sell at today’s current price of $105.

Additional Reading

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The Dividend Achievers List is comprised of ~400 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Best DRIP Stocks: The top 15 Dividend Champions with no-fee dividend reinvestment plans.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks