Updated on August 14th, 2024 by Bob Ciura

Dividend stocks are great for retirees and other investors that live off the income their portfolio generates. But dividend stocks are also interesting for investors that do not live off their dividends.

In this article, we will showcase 20 of the best high-yielding income stocks with strong total return outlooks that could be compelling investments in the current year and beyond.

Additionally, the free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with 5%+ dividend yields.

Why Dividend Stocks Are Attractive

Dividend stocks generate income that can be used to pay for one’s living expenses. But apart from that, income stocks can also be of value to other investors, due to several reasons.

First, dividends provide an important boost to a company’s total returns over time. Studies show that going back to 1960, 85% of the cumulative total return of the S&P 500 Index1 can be attributed to reinvested dividends and the power of compounding

Stocks that pay high dividends do not need to see their share prices expand as much as a non-dividend-paying stock in order to achieve the same total return.

Second, dividend stocks, and especially resilient dividend stocks that continue to pay dividends during tough times, can offset market declines during bear markets. While their share prices might dip temporarily, investors will at least still benefit from a steady income stream.

Third, when companies have a track record of paying out dividends, that has a disciplining effect on management.

Management teams will be less likely to pursue strategies that aren’t generating shareholder value, such as empire building, and will instead focus on generating reliable cash flow that can be paid out to the company’s owners.

The 20 Best High-Yielders With Strong Total Returns Today

This is the list of the top 20 U.S.-based stocks in our Sure Analysis Research Database that provide attractive total returns of at least 10% per year (according to our models), and that also have Dividend Risk Scores of ‘C’ or higher.

The stocks in this list are sorted from the highest to lowest dividend yields.

Table of Contents

- Best High Yield Stock #1: Walgreens Boots Alliance (WBA)

- Best High Yield Stock #2: Western Union Company (WU)

- Best High Yield Stock #3: Whirlpool Corp. (WHR)

- Best High Yield Stock #4: Enterprise Products Partners LP (EPD)

- Best High Yield Stock #5: Sunoco LP (SUN)

- Best High Yield Stock #6: Verizon Communications (VZ)

- Best High Yield Stock #7: Lincoln National Corp. (LNC)

- Best High Yield Stock #8: Healthpeak Properties (DOC)

- Best High Yield Stock #9: United Parcel Service (UPS)

- Best High Yield Stock #10: NorthWestern Corp. (NWE)

- Best High Yield Stock #11: Northwood Financial Corp. (NWFL)

- Best High Yield Stock #12: CVS Health Corp. (CVS)

- Best High Yield Stock #13: Spire Inc. (SR)

- Best High Yield Stock #14: T. Rowe Price (TROW)

- Best High Yield Stock #15: Black Hills Corp. (BKH)

- Best High Yield Stock #16: SpartanNash Co. (SPTN)

- Best High Yield Stock #17: Allete, Inc. (ALE)

- Best High Yield Stock #18: Evergy Inc. (EVRG)

- Best High Yield Stock #19: Eversource Inc. (ES)

- Best High Yield Stock #20: Interpublic Group of Cos. (IPG)

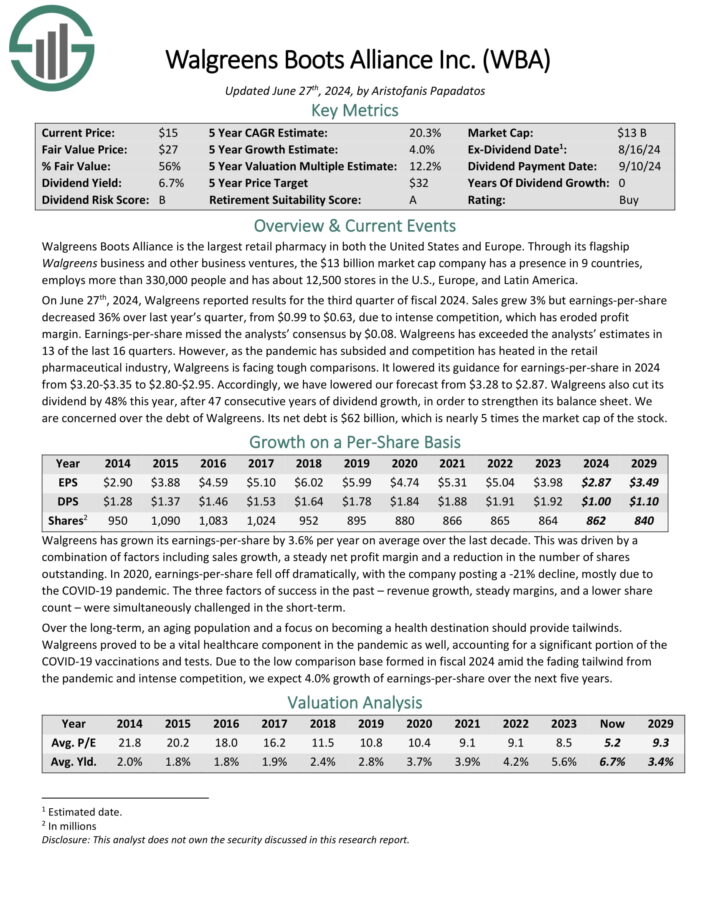

1: Walgreens Boots Alliance (WBA)

Walgreens Boots Alliance is the largest retail pharmacy in both the United States and Europe. Through its flagship Walgreens business and other business ventures, the $13 billion market cap company has a presence in 9 countries, employs more than 330,000 people and has about 12,500 stores in the U.S., Europe, and Latin America.

On June 27th, 2024, Walgreens reported results for the third quarter of fiscal 2024. Sales grew 3% but earnings-per share decreased 36% over last year’s quarter, from $0.99 to $0.63, due to intense competition, which has eroded profit margin.

Source: Investor Presentation

Earnings-per-share missed the analysts’ consensus by $0.08. Walgreens has exceeded the analysts’ estimates in 13 of the last 16 quarters.

However, as the pandemic has subsided and competition has heated in the retail pharmaceutical industry, Walgreens is facing tough comparisons. It lowered its guidance for earnings-per-share in 2024 from $3.20-$3.35 to $2.80-$2.95. Accordingly, we have lowered our forecast from $3.28 to $2.87.

Click here to download our most recent Sure Analysis report on WBA (preview of page 1 of 3 shown below):

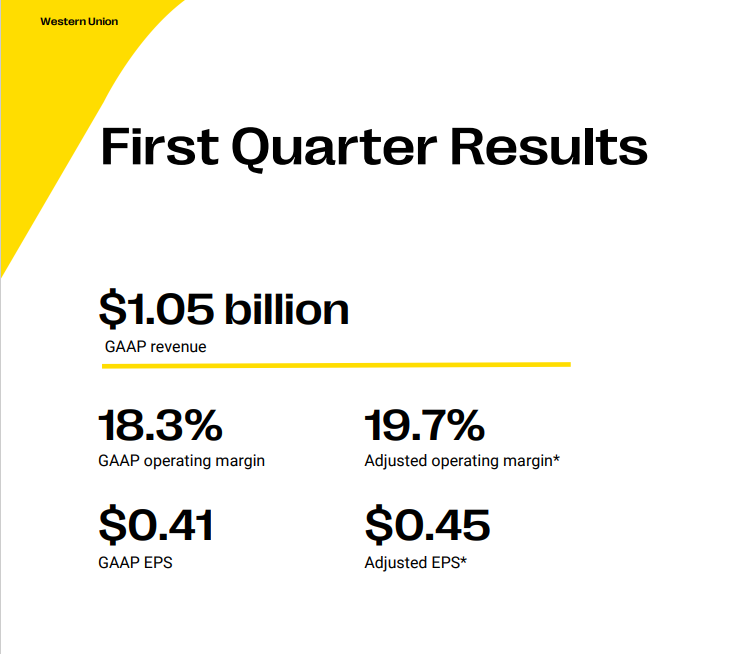

2: Western Union (WU)

The Western Union Company is the world leader in the business of domestic and international money transfers. The company has a network of approximately 550,000 agents globally and operates in more than 200 countries.

About 90% of agents are outside of the US. Western Union operates two business segments, Consumer-to-Consumer (C2C) and Other (bill payments in the US and Argentina).

Western Union reported better-than-expected Q1 2024 results on April 24th, 2024. Company-wide revenue grew 1% and diluted GAAP earnings per share increased 3% compared to the prior year.

Source: Investor Presentation

Revenue rose on higher retail and branded digital transactions. Growth occurred in North America, Middle East, and Latin and Central America. But lower revenue in Europe and Asia were headwinds

CMT revenue climbed 3% to $962.0M from $938.3M on a year-over-year basis due to 6% higher transaction volumes. Branded Digital Money Transfer CMT revenues increased 9% as volumes rose 13%. Digital revenue is now 23% of total CMT revenue and 31% of transactions.

Click here to download our most recent Sure Analysis report on WU (preview of page 1 of 3 shown below):

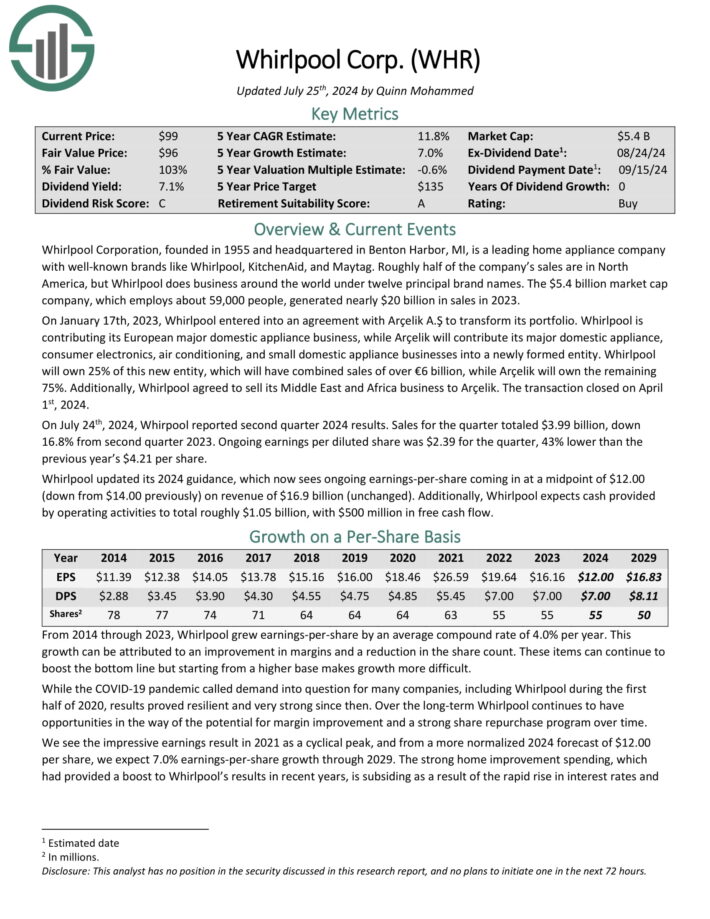

3: Whirlpool Corp. (WHR)

Whirlpool Corporation is a leading home appliance company with well-known brands like Whirlpool, KitchenAid, and Maytag.

Roughly half of the company’s sales are in North America, but Whirlpool does business around the world under twelve principal brand names.

On July 24th, 2024, Whirpool reported second quarter 2024 results. Sales for the quarter totaled $3.99 billion, down 16.8% from second quarter 2023.

Ongoing earnings per diluted share was $2.39 for the quarter, 43% lower than the previous year’s $4.21 per share.

Whirlpool updated its 2024 guidance, which now sees ongoing earnings-per-share coming in at a midpoint of $12.00 (down from $14.00 previously) on revenue of $16.9 billion (unchanged).

Additionally, Whirlpool expects cash provided by operating activities to total roughly $1.05 billion, with $500 million in free cash flow.

Click here to download our most recent Sure Analysis report on WHR (preview of page 1 of 3 shown below):

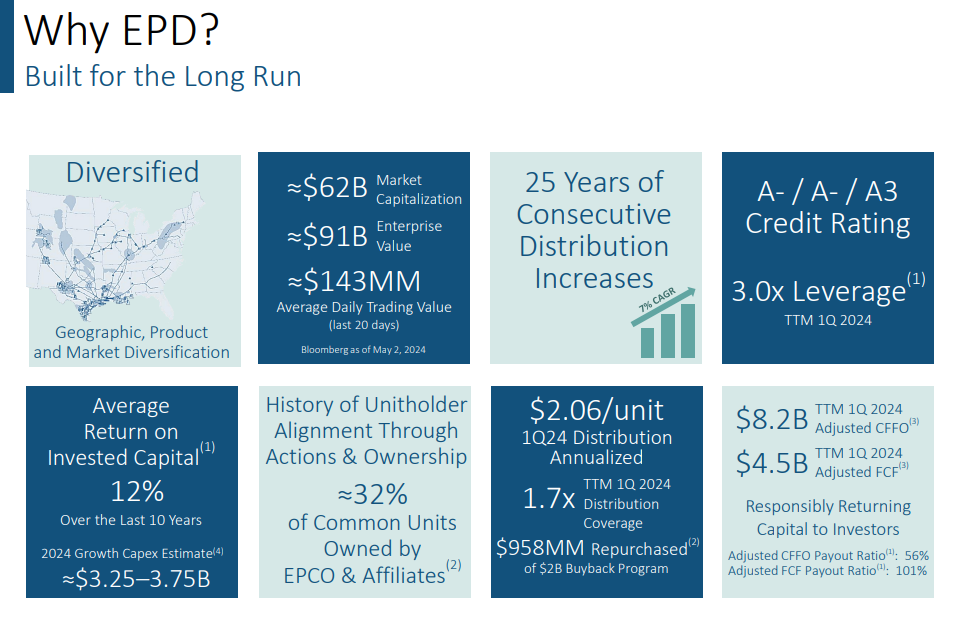

4: Enterprise Products Partners LP (EPD)

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 250 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

Enterprise reported net income attributable to common unitholders of $1.5 billion, or $0.66 per unit on a fully diluted basis, for the first quarter of 2024, marking a 5 percent increase from the first quarter of 2023. Distributable Cash Flow (DCF) remained steady at $1.9 billion for both quarters.

Distributions declared for the first quarter of 2024 increased by 5.1% compared to the same period in 2023, reaching $0.515 per common unit. DCF covered this distribution 1.7 times, with $786 million retained.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

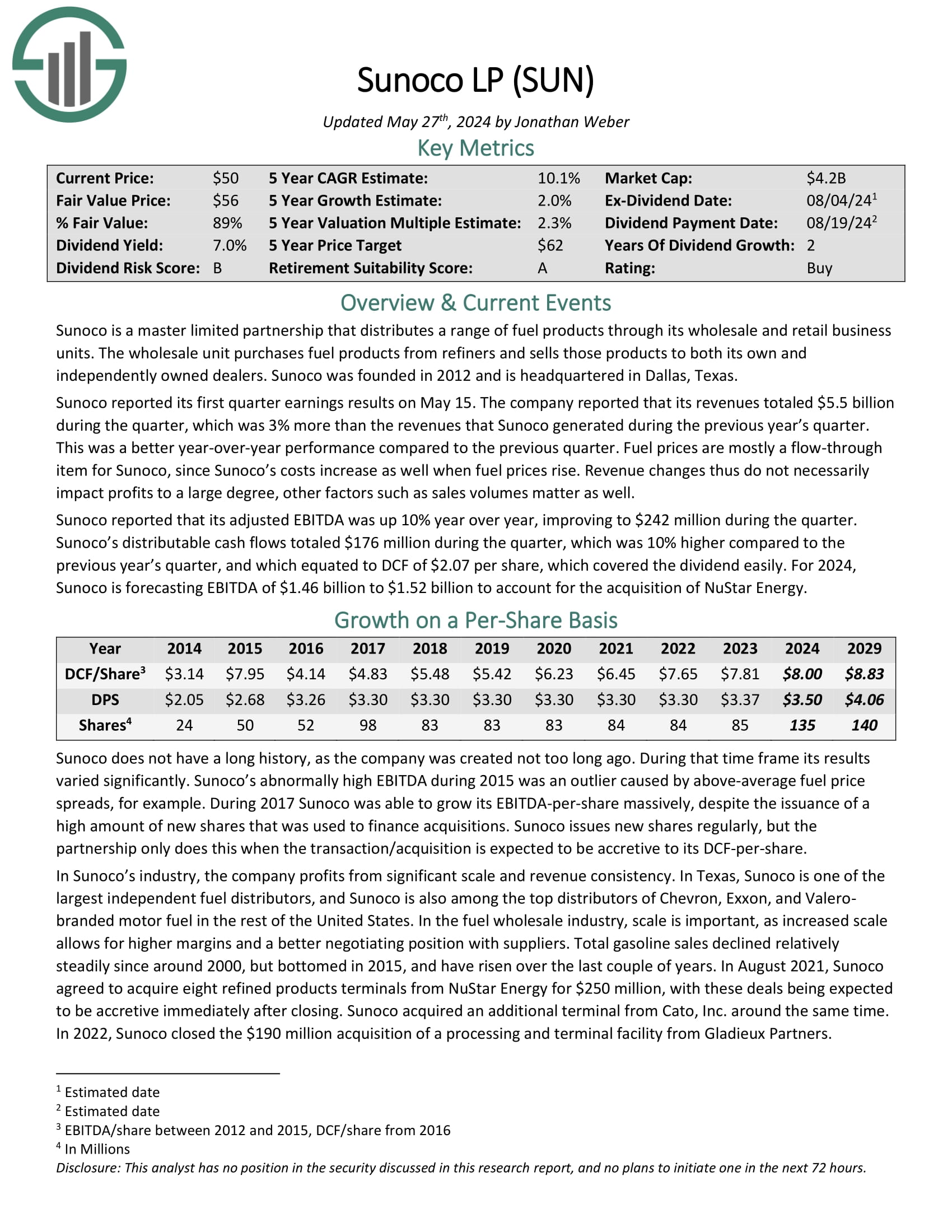

5: Sunoco LP (SUN)

Sunoco LP distributes a range of fuel products through its wholesale and retail business units. The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Sunoco reported its first quarter earnings results on May 15. The company reported that its revenues totaled $5.5 billion during the quarter, which was 3% more than the 2023 first quarter.

The company reported that its first-quarter adjusted EBITDA rose 10% year over year, improving to $242 million during the quarter. Distributable cash flow totaled $176 million during the quarter, 10% higher year-over-year.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion to account for the acquisition of NuStar Energy.

Click here to download our most recent Sure Analysis report on Sunoco (preview of page 1 of 3 shown below):

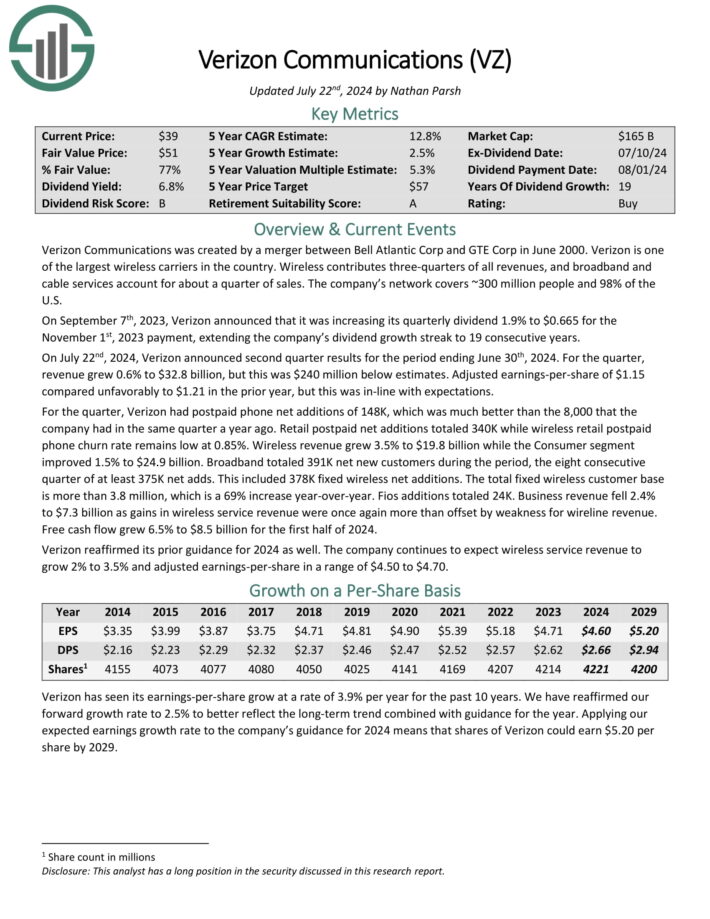

6: Verizon Communications (VZ)

Verizon Communications is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On July 22nd, 2024, Verizon announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 0.6% to $32.8 billion, but this was $240 million below estimates. Adjusted earnings-per-share of $1.15 compared unfavorably to $1.21 in the prior year, but this was in-line with expectations.

For the quarter, Verizon had postpaid phone net additions of 148K, which was much better than the 8,000 that the company had in the same quarter a year ago. Retail postpaid net additions totaled 340K while wireless retail postpaid phone churn rate remains low at 0.85%.

Wireless revenue grew 3.5% to $19.8 billion while the Consumer segment improved 1.5% to $24.9 billion. Broadband totaled 391K net new customers during the period, the eight consecutive quarter of at least 375K net adds. This included 378K fixed wireless net additions. The total fixed wireless customer base is more than 3.8 million, which is a 69% increase year-over-year.

Verizon reaffirmed its prior guidance for 2024 as well. The company continues to expect wireless service revenue to grow 2% to 3.5% and adjusted earnings-per-share in a range of $4.50 to $4.70.

Click here to download our most recent Sure Analysis report on Verizon (preview of page 1 of 3 shown below):

7: Lincoln National (LNC)

Lincoln National Corporation offers life insurance, annuities, retirement plan services and group protection. The corporation was founded in 1905.

Lincoln National reported second quarter 2024 results on August 1st, 2024, for the period ending June 30th, 2024. The company generated net income of $5.11 per share in the quarter, which compared favorably to $2.94 in the second quarter of 2023. Adjusted income from operations equaled $1.84 per share compared to $2.02 in the same prior year period.

Additionally, annuities average account balances rose by 6.8% to $158 billion and group protection insurance premiums grew 2.8% to $1.3 billion.

Click here to download our most recent Sure Analysis report on LNC (preview of page 1 of 3 shown below):

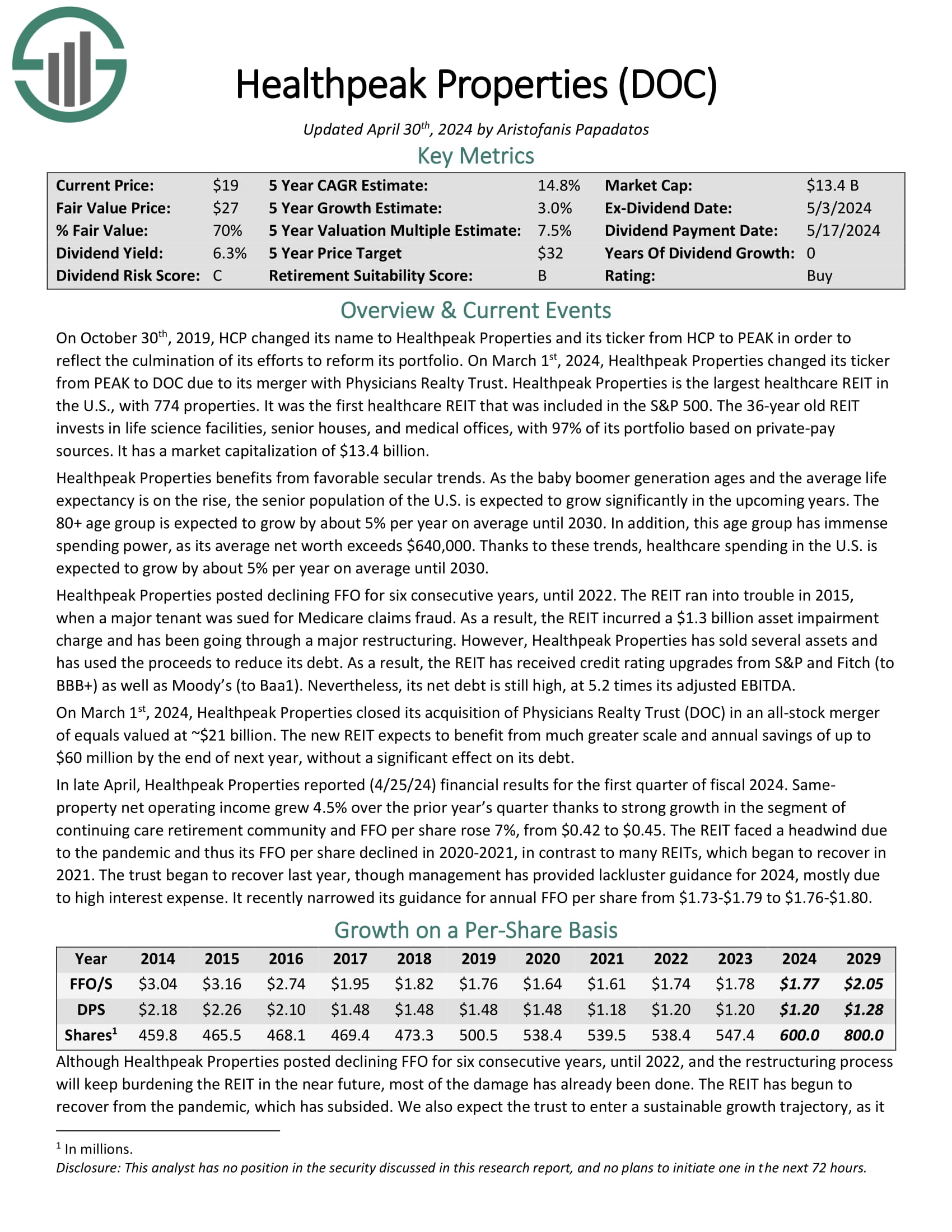

8: Healthpeak Properties (DOC)

Healthpeak Properties is the largest healthcare REIT in the U.S., with 774 properties. It was the first healthcare REIT that was included in the S&P 500. This healthcare REIT invests in life science facilities, senior houses, and medical offices, with 97% of its portfolio based on private-pay sources.

Healthpeak Properties benefits from favorable trends. As the baby boomer generation ages and the average life expectancy is on the rise, the senior population of the U.S. is expected to grow significantly in the upcoming years. The 80+ age group is expected to grow by about 5% per year on average until 2030.

In addition, this age group has immense spending power, as its average net worth exceeds $640,000. Thanks to these trends, healthcare spending in the U.S. is expected to grow by about 5% per year on average until 2030.

The recent merger with Physicians Realty is a major growth catalyst for the REIT. On March 1st, 2024, Healthpeak Properties closed its acquisition of Physicians Realty Trust (DOC) in an all-stock merger of equals valued at ~$21 billion.

Click here to download our most recent Sure Analysis report on DOC (preview of page 1 of 3 shown below):

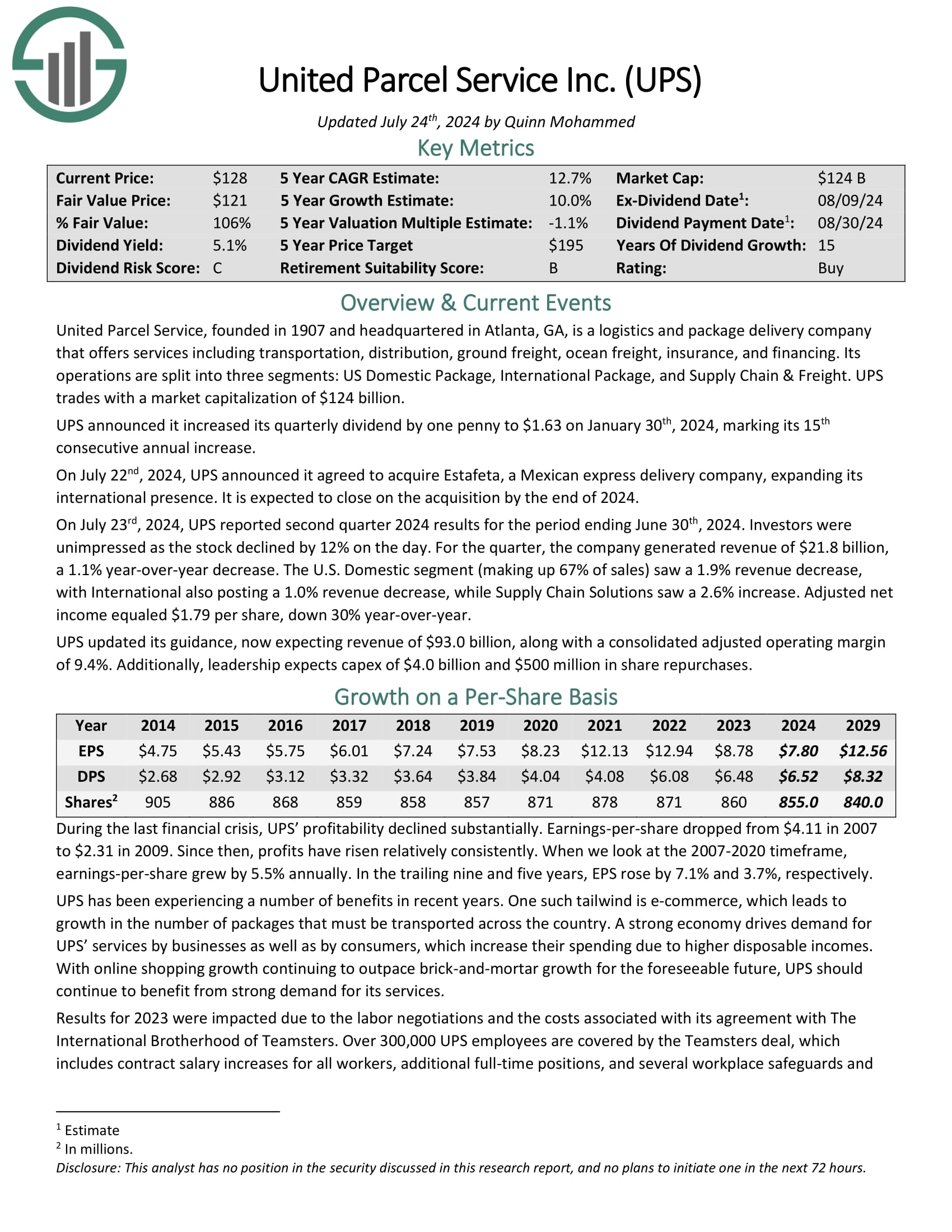

9: United Parcel Service (UPS)

United Parcel Service is a logistics and package delivery company that offers services including transportation, distribution, ground freight, ocean freight, insurance, and financing. Its operations are split into three segments: US Domestic Package, International Package, and Supply Chain & Freight.

On July 22nd, 2024, UPS announced it agreed to acquire Estafeta, a Mexican express delivery company, expanding its international presence. It is expected to close on the acquisition by the end of 2024.

On July 23rd, 2024, UPS reported second quarter 2024 results for the period ending June 30th, 2024. Investors were unimpressed as the stock declined by 12% on the day. For the quarter, the company generated revenue of $21.8 billion, a 1.1% year-over-year decrease.

The U.S. Domestic segment (making up 67% of sales) saw a 1.9% revenue decrease, with International also posting a 1.0% revenue decrease, while Supply Chain Solutions saw a 2.6% increase. Adjusted net income equaled $1.79 per share, down 30% year-over-year.

Click here to download our most recent Sure Analysis report on UPS (preview of page 1 of 3 shown below):

10: NorthWestern Corp. (NWE)

NorthWestern Corp. is a Sioux Falls, South Dakota based electricity and gas utility. It has 1,570 employees, and primarily serves the states of South Dakota and Montana. The company has been dramatically overhauling its energy generation fleet.

While NorthWestern long relied on coal for the majority of its power production, that has now shifted with wind, solar, and hydroelectric accounting for approximately 55% of total combined power generation today.

On April 26th, 2024, NorthWestern announced its Q1 2024 earnings. The results were a mixed bag and didn’t change our overall outlook. Earnings per share of $1.09 increased from $1.05 year-over-year, but missed expectations. Revenues rose 4% year-over-year to $475 million.

Management maintained its prior earnings and capital expenditure guidance for the year. Notably, the company also said it won’t require more share dilution to carry out its budgeted investment plans.

Click here to download our most recent Sure Analysis report on NWE (preview of page 1 of 3 shown below):

11: Norwood Financial Group (NWFL)

Norwood Financial is a bank holding company that operates through its subsidiary, Wayne Bank. The company is an independent community bank with over 14 offices in Northeastern Pennsylvania and approximately 16 offices in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

As of March 31st, 2024, Norwood Financial Corp. had total assets of $2.26 billion, loans outstanding of $1.62 billion, and total deposits were $1.839 billion. The company was founded in 1870 and has 260 employees.

On April 22nd, 2024, Norwood Financial Corp. released its first quarter 2024 results for the period ending March 31st, 2024.

For the quarter, the company reported earnings of $4.43 million, which represented a 23.4% decrease compared to $5.78 million earned in the same period of 2023. Reported quarterly earnings per diluted share for the same periods were $0.55 and $0.71, reflecting a decline of 22.5%.

Click here to download our most recent Sure Analysis report on NWFL (preview of page 1 of 3 shown below):

12: CVS Health Corp. (CVS)

CVS Health Corporation is an integrated healthcare services provider that operates a pharmaceutical services business, along with the country’s largest chain of pharmacies. The company operates more than 9,900 retail locations, 1,100 medical clinics, and services more than 102 million plan members.

On August 7th, 2024, CVS Health Corporation announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue improved 2.6% to $91.2 billion, but this was $230 million less than expected. Adjusted earnings-per-share of $1.83 compared very unfavorably to $2.21 in the prior year, but was $0.10 more than expected.

Revenues for Health Services, formerly known as Pharmacy Services, decreased 8.7% for the quarter, with pharmacy claims processed falling 18.3% to 471.2 million. As with the prior quarter, this decrease was largely attributed to Tyson Foods (TSN) dropping CVS Health Corporation as its pharmacy benefit manager.

Click here to download our most recent Sure Analysis report on CVS (preview of page 1 of 3 shown below):

13: Spire, Inc. (SR)

Spire Inc. is a public utility holding company based in St. Louis, Missouri. The company provides natural gas service through its regulated core utility operations while engaging in non-regulated activities that provide business opportunities.

The company has five gas utilities, serving 1.7 million homes and businesses across Alabama, Mississippi, and Missouri.

On July 31st., 2024, the company reported its FY2024 third quarter results. The company reported a net loss of $12.6

million, or $0.28 per diluted share, an improvement from the previous year’s loss of $21.6 million, or $0.48 per share.

On a net economic earnings (NEE) basis, the company recorded a loss of $4.3 million, or $0.14 per share, compared to a loss of $18.6 million, or $0.42 per share, in the same quarter last year.

Spire has adjusted its fiscal 2024 net economic earnings guidance to a range of $4.15 to $4.25 per share, down from the previous $4.25 to $4.45 per share.

Click here to download our most recent Sure Analysis report on SR (preview of page 1 of 3 shown below):

14: T. Rowe Price (TROW)

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries.

On April 26th, 2024, T. Rowe Price reported first quarter results for the period ending March 31st, 2024. For the quarter, revenue increased 13.6% to $1.75 billion, which was $50 million above estimates. Adjusted earnings-per-share of $2.38 compared to $1.69 in the prior year, which was $0.36 better than expected.

During the quarter, assets under management (AUM) improved $97.7 billion, or 6.8%, to $1.54 trillion. Market appreciation of $105.7 billion was partially offset by $8 billion of net client outflows. Operating expenses of $1.16 billion increased 10.5% year-over-year, but decreased 7.3% on a sequential basis.

Click here to download our most recent Sure Analysis report on TROW (preview of page 1 of 3 shown below):

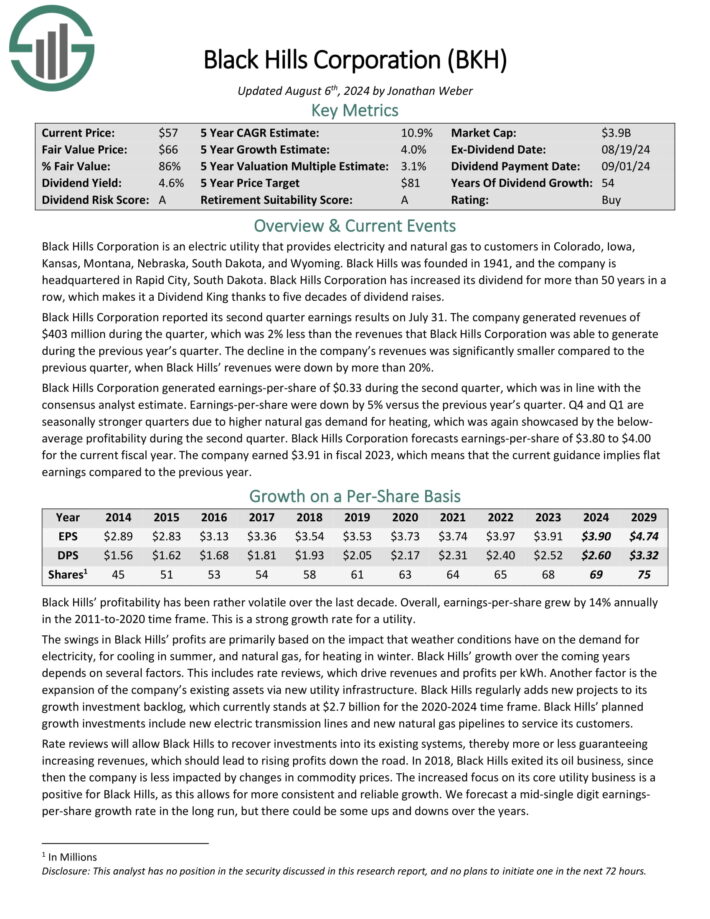

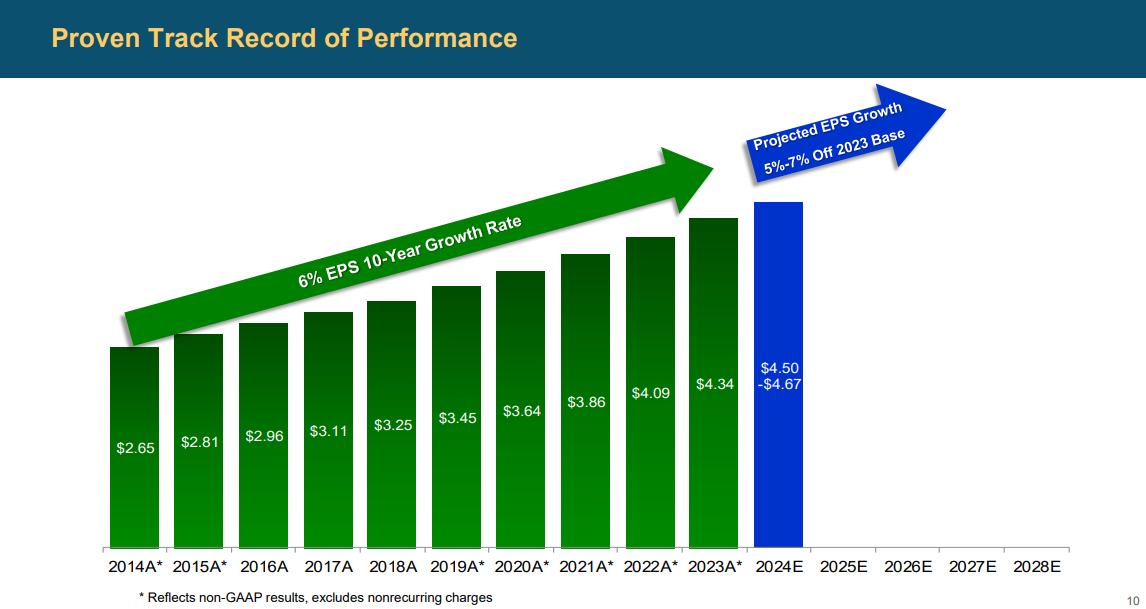

15: Black Hills Corp. (BKH)

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.33 million utility customers in eight states. Its natural gas assets include 47,000 miles of natural gas lines. Separately, it has ~9,000 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 31. The company generated revenues of $403 million during the quarter, down 2% year-over-year.

The decline in the company’s revenues was significantly smaller compared to the previous quarter, when Black Hills’ revenues were down by more than 20%.

Black Hills Corporation generated earnings-per-share of $0.33 during the second quarter, which was in line with the consensus analyst estimate. Earnings-per-share were down by 5% versus the previous year’s quarter.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

16: SpartanNash (SPTN)

SpartanNash is a wholesale grocery distributor and retailer. The corporation supplies 2,100 independent grocery retail locations in the United States.

The company itself also owns 147 supermarkets. SpartanNash operates under retail banners such as Family Fare, Martin’s Super Markets and D&W Fresh Market. The company is also a distributor of grocery products to U.S. military commissaries.

SpartanNash reported first quarter 2024 results on May 30th, 2024. Net sales of $2.81 billion was a 3.5% decrease from $2.91 billion in the same prior year period. Adjusted earnings from continuing operations decreased by 17% year-over year to $0.53 per share and Adjusted EBITDA declined by 2.5% to $74.9 million.

The net long-term debt to adjusted EBITDA ratio rose sequentially from 2.3X to 2.4X during the quarter, while long term debt and finance lease liabilities increased by $25.2 million.

Click here to download our most recent Sure Analysis report on SPTN (preview of page 1 of 3 shown below):

17: ALLETE Inc. (ALE)

ALLETE is an electric services company which operates primarily in the upper Midwest and invests in transmission infrastructure and other energy-related businesses.

ALLETE owns Minnesota Power electric utility which serves over 145,000 residents in 15 municipalities and certain large industrial customers. ALLETE’s other businesses include BNI Energy, ALLETE Clean Energy, Superior Water, Light and Power and ALLETE Renewable Resources.

ALLETE reported second quarter 2024 results on August 1st, 2024. The company reported consolidated earnings of $0.57 per share, a 37% decrease compared to $0.90 earned in Q2 2023.

The corporation’s regulated operations segment generated net income of $33.7 million, while the clean energy segment reported net income of $2.4 million.

Click here to download our most recent Sure Analysis report on Allete, Inc. (preview of page 1 of 3 shown below):

18: Evergy, Inc. (EVRG)

Evergy is an electric utility holding company incorporated in 2017 and headquartered in Kansas City, Missouri.

Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, the company serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and 6,900 industrial customers and municipalities in Kansas and Missouri.

In early May, Evergy reported (5/9/24) financial results for the first quarter of fiscal 2024. The company was negatively affected by unfavorable weather as well as higher interest expense, operating & maintenance costs and depreciation.

As a result, its adjusted earnings-per-share dipped -8% over the prior year’s quarter, from $0.59 to $0.54, and missed the analysts’ consensus by $0.10.

The business outlook of Evergy is positive, as the utility has proved resilient to high interest rates and high inflation. Due to unfavorable weather in the greater part of 2023, Evergy incurred a -5% decrease in earnings-per-share last year, but it reaffirmed its positive guidance for 2024.

Click here to download our most recent Sure Analysis report on Evergy Inc. (preview of page 1 of 3 shown below):

19: Eversource Energy (ES)

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

The company’s utilities serve more than 4 million customers after acquiring NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Gas in 2020.

Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On May 1st, 2024, Eversource Energy released its first quarter 2024 results. For the quarter, the company reported earnings of $521.8 million, an increase from $491.2 million in the same quarter of last year. Earnings-per-share of $1.49 compared with earnings-per-share of $1.41 in the prior year.

Earnings from the Electric Transmission segment increased to $176.7 million, up from $155.1 million in the prior year, primarily due to a higher level of investment in Eversource’s electric transmission system needed to address system capacity growth and deliver clean energy resources for the region.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

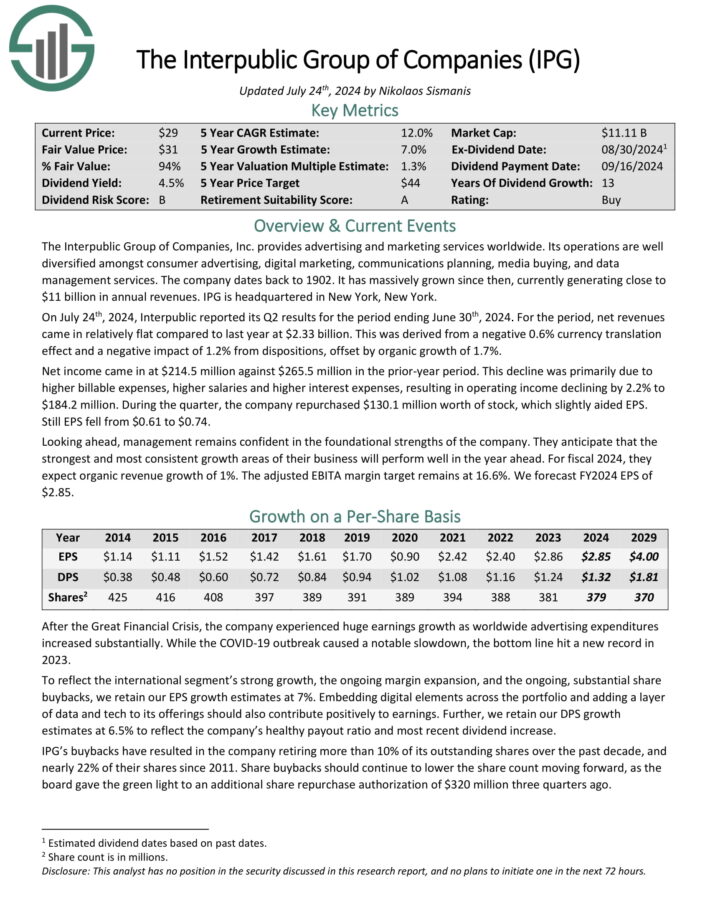

20: The Interpublic Group of Cos. (IPG)

The Interpublic Group of Companies, Inc. provides advertising and marketing services worldwide. Its operations are diversified among consumer advertising, digital marketing, communications planning, media buying, and data management services. The company generates close to $11 billion in annual revenues.

On July 24th, 2024, Interpublic reported its Q2 results for the period ending June 30th, 2024. For the period, net revenues came in relatively flat compared to last year at $2.33 billion. This was derived from a negative 0.6% currency translation effect and a negative impact of 1.2% from dispositions, offset by organic growth of 1.7%.

Net income came in at $214.5 million against $265.5 million in the prior-year period. This decline was primarily due to higher billable expenses, higher salaries and higher interest expenses, resulting in operating income declining by 2.2% to $184.2 million. During the quarter, the company repurchased $130.1 million worth of stock.

Click here to download our most recent Sure Analysis report on IPG (preview of page 1 of 3 shown below):

Final Thoughts

All of the above stocks offer strong business models that provide for relatively safe dividend yields. In addition, each name is projected to return at least 10% annually over the next five years, making them possible candidates for income and total return investors alike.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more