Updated on October 23rd, 2024 by Bob Ciura

Spreadsheet data updated daily

Income investors looking for quality dividend stocks typically buy large-cap stocks. This is understandable, as many companies with long histories of dividend increases have grown to dominate their respective industries.

But income investors should not automatically dismiss small-cap dividend stocks, as small-cap stocks have historically outperformed large-caps. Many small-cap dividend stocks have strong yields, in addition to their high growth potential.

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. stocks. Accordingly, the Russell 2000 Index can be an intriguing place to look for new investment opportunities.

You can download your free Excel list of Russell 2000 stocks, along with relevant financial metrics like dividend yields and P/E ratios, by clicking on the link below:

Small-cap dividend stocks, generally defined as having market capitalizations below $2 billion, are widely perceived to have better long-term growth potential than large-caps.

Investors can combine this outsized growth potential, with dividends and potential for capital gains through an expanding valuation multiple. As a result, the top small-cap dividend stocks presented here could generate superior returns over the next five years.

The top 10 small-cap stocks list below does not include BDCs, MLPs, or REITs. In addition, the list was filtered to only include stocks with Dividend Risk Scores of C or better in the Sure Analysis Research Database.

This article will list our top 10 small-cap dividend stocks right now, ranked by expected total returns over the next five years.

Table Of Contents

- Small-Cap Dividend Stock #10: Universal Corporation (UVV)

- Small-Cap Dividend Stock #9: Chesapeake Financial (CPKF)

- Small-Cap Dividend Stock #8: Westamerica Bancorporation (WABC)

- Small-Cap Dividend Stock #7: Artesian Resources Corp. (ARTNA)

- Small-Cap Dividend Stock #6: Gorman-Rupp Co. (GRC)

- Small-Cap Dividend Stock #5: Tennant Co. (TNC)

- Small-Cap Dividend Stock #4: Patterson Companies (PDCO)

- Small-Cap Dividend Stock #3: SJW Group (SJW)

- Small-Cap Dividend Stock #2: Matthews International (MATW)

- Small-Cap Dividend Stock #1: Farmers & Merchants Bancorp (FMCB)

Small-Cap Dividend Stock #10: Universal Corporation (UVV)

- 5-year annual expected returns: 9.6%

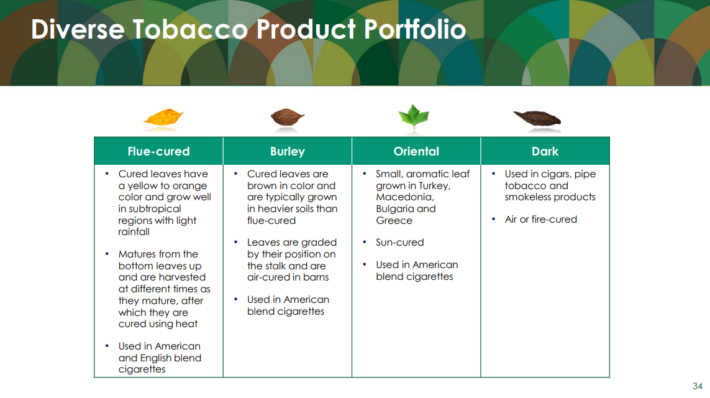

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its fourth-quarter earnings results at the end of May. The company generated revenues of $770 million during the quarter, which was 11% more than the revenues that Universal Corporation generated during the previous year’s period.

Revenues were positively impacted by product mix changes, and growth was weaker than during the previous quarter. Universal’s gross margin was up compared to the previous year’s period.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #9: Chesapeake Financial (CPKF)

- 5-year annual expected returns: 9.6%

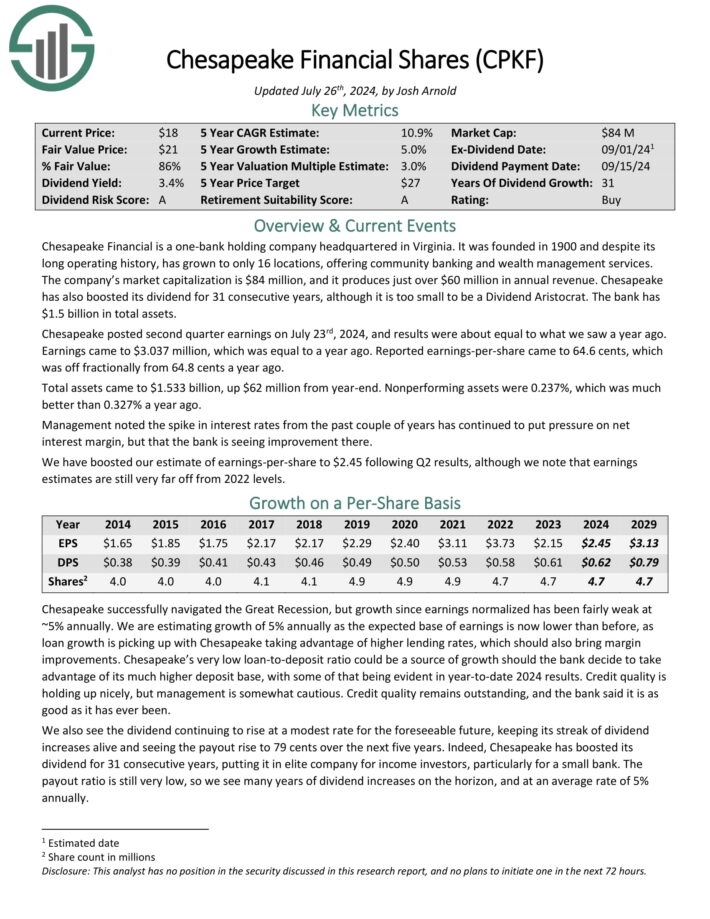

Chesapeake Financial is a one-bank holding company headquartered in Virginia. It was founded in 1900 and despite its long operating history, has grown to only 16 locations, offering community banking and wealth management services. The company produces just over $60 million in annual revenue.

Chesapeake has also boosted its dividend for 31 consecutive years. The bank has $1.5 billion in total assets.

Chesapeake posted second quarter earnings on July 23rd, 2024, and results were about equal to what we saw a year ago. Earnings came to $3.037 million, which was equal to a year ago. Reported earnings-per-share came to 64.6 cents, which was off fractionally from 64.8 cents a year ago.

Total assets came to $1.533 billion, up $62 million from year-end. Nonperforming assets were 0.237%, which was much better than 0.327% a year ago.

Management noted the spike in interest rates from the past couple of years has continued to put pressure on net interest margin, but that the bank is seeing improvement there.

Click here to download our most recent Sure Analysis report on CPKF (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #8: Westamerica Bancorporation (WABC)

- 5-year annual expected returns: 10.0%

Westamerica Bancorporation is the holding company for Westamerica Bank. Westamerica Bancorporation is a regional community bank with 79 branches in Northern and Central California. The company can trace its origins back to 1884. Westamerica Bancorporation offers clients access to savings, checking and money market accounts.

The company’s loan portfolio consists of both commercial and residential real estate loans, as well as construction loans. Westamerica Bancorporation is the seventh largest bank headquartered in California. It has annual revenues of about $325 million.

On October 17th, 2024 Westamerica Bancorporation reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue decreased 10.8% to $74.4 million, but this was $3.6 million more than expected. GAAP earnings-per-share of $1.31 compared unfavorably to $1.33 in the prior year, but this was $0.07 above estimates.

Total loans fell 8% to $831.4 million million as commercial loans were lower by 10.1% and consumer loans fell 22.1%. Commercial real estate loans, which make up more than half of the total loan portfolio, were unchanged. As of the end of the quarter, nonperforming loans decreased 25.8% to $919,000 year-over-year.

As with the second quarter, this period had no provisions for credit losses, compared to $400,000 in the third quarter of 2024. Net interest income was $62.5 million, which compares to $64.1 million for the second quarter of 2024 and $72.1 million in the third quarter of 2023.

Click here to download our most recent Sure Analysis report on WABC (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #7: Artesian Resources Corp. (ARTNA)

- 5-year annual expected returns: 10.4%

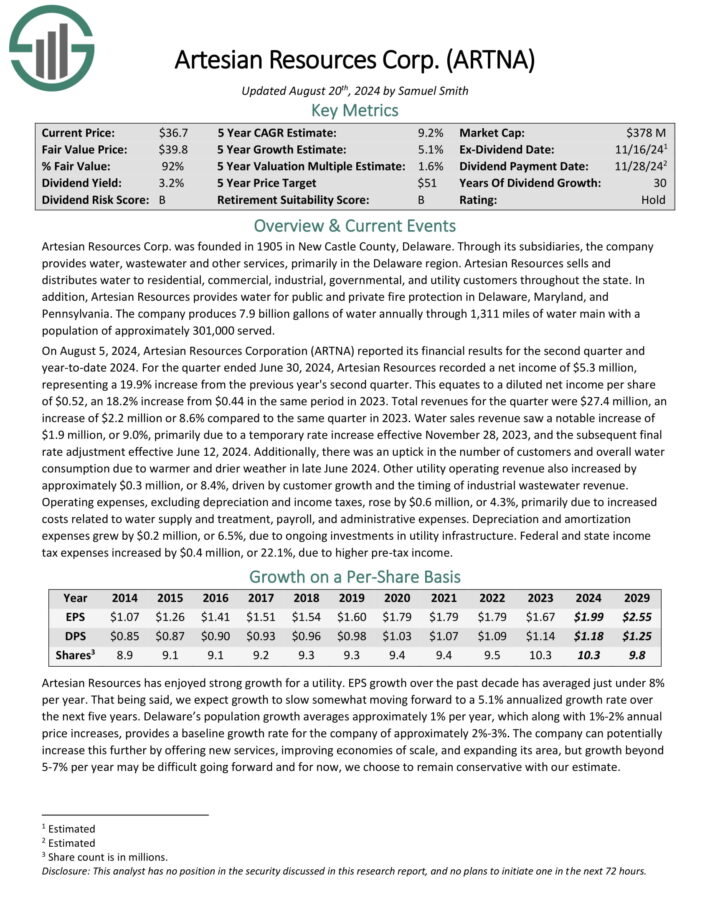

Artesian Resources Corp. was founded in 1905 in New Castle County, Delaware. Through its subsidiaries, the company provides water, wastewater and other services, primarily in the Delaware region.

Artesian Resources sells and distributes water to residential, commercial, industrial, governmental, and utility customers throughout the state.

In addition, Artesian Resources provides water for public and private fire protection in Delaware, Maryland, and Pennsylvania. The company produces 7.9 billion gallons of water annually through 1,311 miles of water main with a population of approximately 301,000 served.

On August 5, 2024, Artesian Resources Corporation (ARTNA) reported its financial results for the second quarter and year-to-date 2024. For the quarter ended June 30, 2024, Artesian Resources recorded a net income of $5.3 million, representing a 19.9% increase from the previous year’s second quarter.

This equates to a diluted net income per share of $0.52, an 18.2% increase from $0.44 in the same period in 2023. Total revenues for the quarter were $27.4 million, an increase of $2.2 million or 8.6% compared to the same quarter in 2023.

Click here to download our most recent Sure Analysis report on ARTNA (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #6: Gorman-Rupp Co. (GRC)

- 5-year annual expected returns: 11.1%

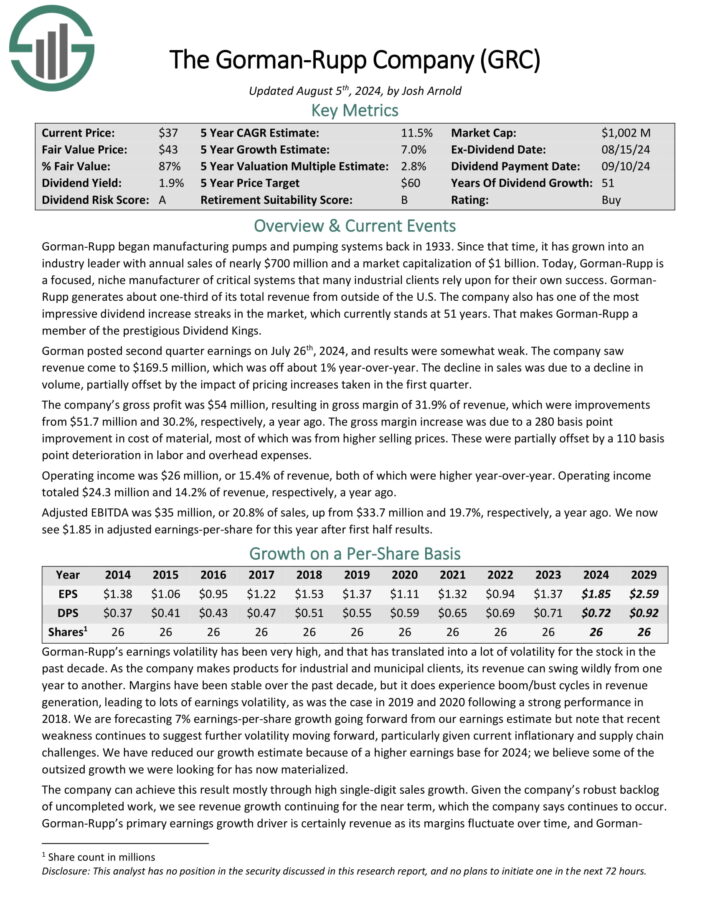

Gorman-Rupp began manufacturing pumps and pumping systems back in 1933. Since that time, it has grown into an industry leader with annual sales of nearly $700 million and a market capitalization of $1 billion. Today, Gorman-Rupp is a focused, niche manufacturer of critical systems that many industrial clients rely upon for their own success.

Gorman Rupp generates about one-third of its total revenue from outside of the U.S. The company also has one of the most impressive dividend increase streaks in the market, which currently stands at 51 years. That makes Gorman-Rupp a member of the prestigious Dividend Kings.

Gorman posted second quarter earnings on July 26th, 2024, and results were somewhat weak. The company saw revenue come to $169.5 million, which was off about 1% year-over-year. The decline in sales was due to a decline in volume, partially offset by the impact of pricing increases taken in the first quarter.

The company’s gross profit was $54 million, resulting in gross margin of 31.9% of revenue, which were improvements from $51.7 million and 30.2%, respectively, a year ago.

Click here to download our most recent Sure Analysis report on GRC (preview of page 1 of 3 shown below):

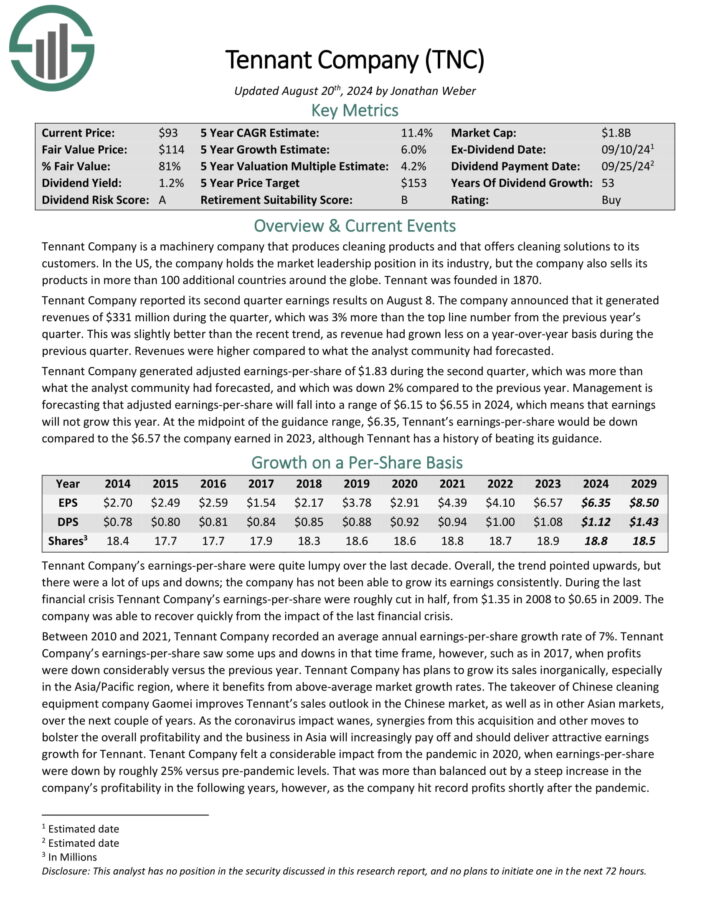

Small-Cap Dividend Stock #5: Tennant Co. (TNC)

- 5-year annual expected returns: 11.8%

Tennant Company is a machinery company that produces cleaning products and that offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe.

Tennant Company reported its second quarter earnings results on August 8. The company announced that it generated revenues of $331 million during the quarter, which was 3% more than the top line number from the previous year’s quarter.

This was slightly better than the recent trend, as revenue had grown less on a year-over-year basis during the previous quarter. Revenues were higher compared to what the analyst community had forecasted.

Tennant Company generated adjusted earnings-per-share of $1.83 during the second quarter, which was more than what the analyst community had forecasted, and which was down 2% compared to the previous year.

Management is forecasting that adjusted earnings-per-share will fall into a range of $6.15 to $6.55 in 2024, which means that earnings will not grow this year.

Click here to download our most recent Sure Analysis report on TNC (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #4: Patterson Companies (PDCO)

- 5-year annual expected returns: 13.1%

Patterson Companies, Inc. traces its history back to 1877 in the dental market. Today the company is a large Dental and Animal Health distributor and wholesaler selling dental and animal health products, equipment, devices, office management products, and services.

The Dental segment operates in the US and Canada, while the Animal Health segment operates in North America and the UK. In FY 2024, total sales were $6.5B with ~62% coming from Animal Health and ~38% from Dental.

Patterson reported Q1 FY 2025 on August 28th, 2024. For the quarter, revenue declined 2.2% to $1,542M from $1,578M while diluted GAAP earnings per share declined to $0.15 from $0.32 on a year-over-year basis.

On an adjusted basis, earnings per share decreased to $0.24 from $0.40. Of note, gross profit margins fell -50 bps to 20.1% and operating margins decreased 110 bps to 2.3%.

The Animal Health segment sales decreased 2.8% to $982M from $1,011M in comparable periods because of falling consumable and equipment sales, offset by services.

The Dental Health segment sales decreased 3.0% to $550M from $567M in the prior year, driven by falling consumables, equipment, and services sales. The cybersecurity attack on Change Healthcare affected dental sales.

Click here to download our most recent Sure Analysis report on PDCO (preview of page 1 of 3 shown below):

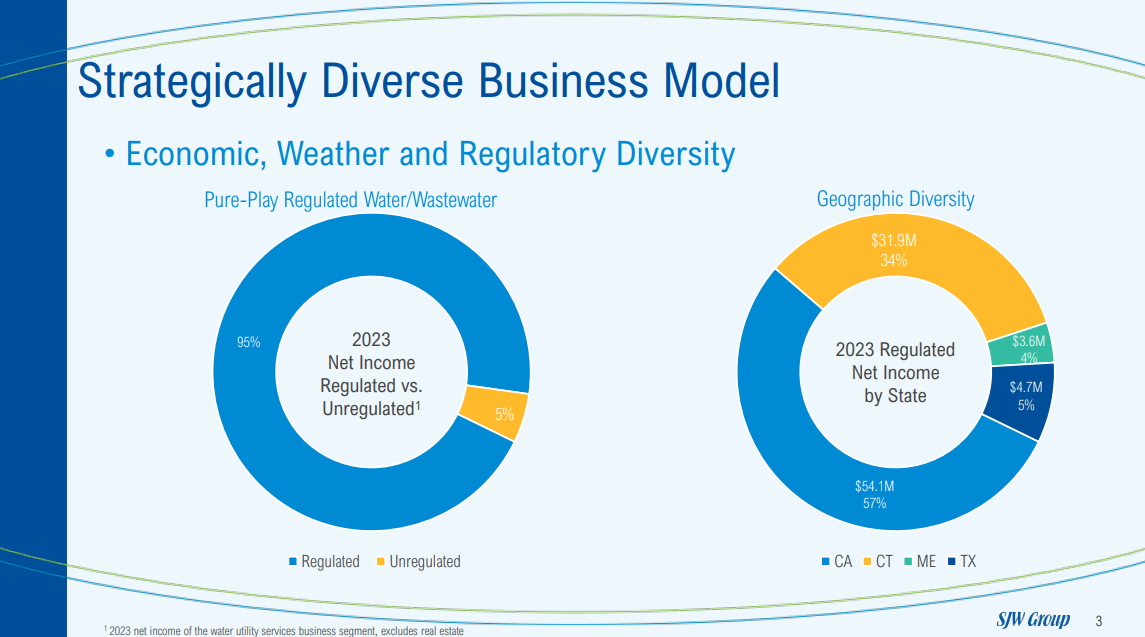

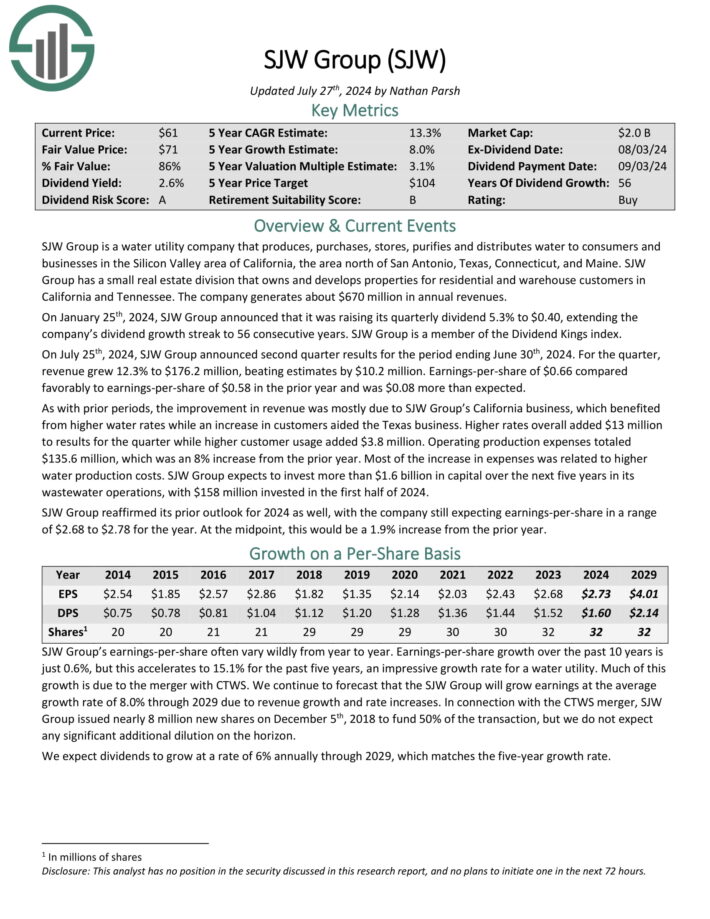

Small-Cap Dividend Stock #3: SJW Group (SJW)

- 5-year annual expected returns: 14.1%

SJW Group is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

Source: Investor Presentation

On July 25th, 2024, SJW Group announced second quarter results for the period ending June 30th, 2024. For the quarter, revenue grew 12.3% to $176.2 million, beating estimates by $10.2 million.

Earnings-per-share of $0.66 compared favorably to earnings-per-share of $0.58 in the prior year and was $0.08 more than expected. Higher rates overall added $13 million to results for the quarter while higher customer usage added $3.8 million.

Click here to download our most recent Sure Analysis report on SJW (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #2: Matthews International (MATW)

- 5-year annual expected returns: 14.6%

Matthews International Corporation provides brand solutions, memorialization products and industrial technologies on a global scale.

The company’s three business segments are diversified. The SGK Brand Solutions provides brand development services, printing equipment, creative design services, and embossing tools to the consumer-packaged goods and packaging industries.

The Memorialization segment sells memorialization products, caskets, and cremation equipment to funeral home industries.

The Industrial technologies segment is smaller than the other two businesses and designs, manufactures and distributes marking, coding and industrial automation technologies and solutions.

Matthews International reported third quarter results on August 1st, 2024. The company reported sales of $428 million, a 9.3% decline compared to the same prior year period.

The decrease was the result of a significant 30% sales decline in its Industrial Technologies segment.

Adjusted earnings were $0.56 per share, a 24% decrease from $0.74 a year ago. The company’s net debt leverage ratio rose sequentially from 3.6 to 3.8.

Click here to download our most recent Sure Analysis report on MATW (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #1: Farmers & Merchants Bancorp (FMCB)

- 5-year annual expected returns: 15.3%

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap and its low liquidity, it passes under the radar of most investors.

F&M Bank has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 58 consecutive years.

In mid-July, F&M Bank reported (7/17/24) financial results for the second quarter of fiscal 2024. The bank grew its adjusted earnings-per-share 5% over the prior year’s quarter, from $28.03 to $29.39. It posted 5% growth of loans and flat deposits.

Net interest income dipped -3% due to a contraction of net interest margin from 4.28% to 3.91% amid higher deposit costs. Management remains optimistic for the foreseeable future, as the bank enjoys one of the widest net interest margins in its sector.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

Small-cap dividend stocks could generate stronger growth than their large-cap peers, due to their smaller sizes. In addition, many small-cap stocks pay dividends to shareholders.

The 10 small-cap dividend stocks on this list all pay dividends, have a positive growth outlook, and could generate solid total returns.

In addition to small cap dividend stocks, Sure Dividend maintains similar databases on the following useful universes of stocks:

- The Dividend Aristocrats List: 66 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases.

- High Dividend Stocks: Stocks with 5%+ dividend yields.

- Monthly Dividend Stocks: our database currently contains more than 30 stocks that pay dividends every month.

- Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.