Updated on September 23rd, 2025 by Bob Ciura

Business Development Companies, otherwise known as BDCs, are highly popular among income investors. BDCs widely have high dividend yields of 5% or higher.

This makes BDCs very appealing for income investors such as retirees. With this in mind, we’ve created a list of BDCs.

You can download your free copy of our BDC list, along with relevant financial metrics such as P/E ratios and dividend payout ratios, by clicking on the link below:

Of course, before investing in BDCs, investors should understand the unique characteristics of the sector.

This article will provide an overview of BDCs. It will also list our top 5 BDCs right now as ranked by expected total returns in the Sure Analysis Research Database.

Table Of Contents

The table of contents below provides for easy navigation of the article:

Overview of BDCs

Business Development Companies are closed-end investment firms. Their business model involves making debt and/or equity investments in other companies, typically small or mid-size businesses.

These target companies may not have access to traditional means of raising capital, which makes them suitable partners for a BDC. BDCs invest in a variety of companies, including turnarounds, developing, or distressed companies.

BDCs are registered under the Investment Company Act of 1940. As they are publicly-traded, BDCs must also be registered with the Securities and Exchange Commission.

To qualify as a BDC, the firm must invest at least 70% of its assets in private or publicly-held companies with market capitalizations of $250 million or below.

BDCs make money by investing with the goal of generating income, as well as capital gains on their investments if and when they are sold.

In this way, BDCs operate similar business models as a private equity firm or venture capital firm.

The major difference is that private equity and venture capital investment is typically restricted to accredited investors, while anyone can invest in publicly-traded BDCs.

Why Invest In BDCs?

The obvious appeal for BDCs is their high dividend yields. It is not uncommon to find BDCs with dividend yields above 5%. In some cases, certain BDCs provide 10%+ yields.

Of course, investors should conduct a thorough amount of due diligence, to make sure the underlying fundamentals support the dividend.

As always, investors should avoid dividend cuts whenever possible. Any stock that has an abnormally high yield is a potential danger.

Indeed, there are multiple risk factors that investors should know before they invest in BDCs.

First and foremost, BDCs are often heavily indebted.

This is commonplace across BDCs, as their business model involves borrowing to make investments in other companies. The end result is that BDCs are often significantly leveraged companies.

When the economy is strong and markets are rising, leverage can help amplify positive returns.

However, the flip side is that leverage can accelerate losses as well, which can happen in bear markets or recessions.

Another risk to be aware of is interest rates. Since the BDC business model heavily utilizes debt, investors should understand the interest rate environment before investing.

For example, rising interest rates can negatively affect BDCs if it causes a spike in borrowing costs.

Lastly, credit risk is an additional consideration for investors. As previously mentioned, BDCs make investments in small to mid-size businesses.

Therefore, the quality of the BDC’s portfolio must be assessed, to make sure the BDC will not experience a high level of defaults within its investment portfolio.

This would cause adverse results for the BDC itself, which could negatively impact its ability to maintain distributions to shareholders.

Another unique characteristic of BDCs that investors should know before buying is taxation. BDC dividends are typically not “qualified dividends” for tax purposes, which is generally a more favorable tax rate.

Instead, BDC distributions are taxable at the investor’s ordinary income rates, while the BDC’s capital gains and qualified dividend income is taxed at capital gains rates.

After taking all of this into account, investors might decide that BDCs are a good fit for their portfolios. If that is the case, income investors might consider one of the following BDCs.

Tax Considerations Of BDCs

As always, investors should understand the tax implications of various securities before purchasing. Business Development Companies must pay out 90%+ of their income as distributions.

In this way, BDCs are very similar to Real Estate Investment Trusts.

Another factor to keep in mind is that approximately 70% to 80% of BDC dividend income is typically derived from ordinary income.

As a result, BDCs are widely considered to be good candidates for a tax-advantaged retirement account such as an IRA or 401k.

BDCs pay their distributions as a mix of ordinary income and non-qualified dividends, qualified dividends, return of capital, and capital gains.

Returns of capital reduce your tax basis. Qualified dividends and long-term capital gains are taxed at lower rates, while ordinary income and non-qualified dividends are taxed at your personal income tax bracket rate.

The Top 5 BDCs Today

With all this in mind, here are our top 5 BDCs today, ranked according to their expected annual returns over the next five years.

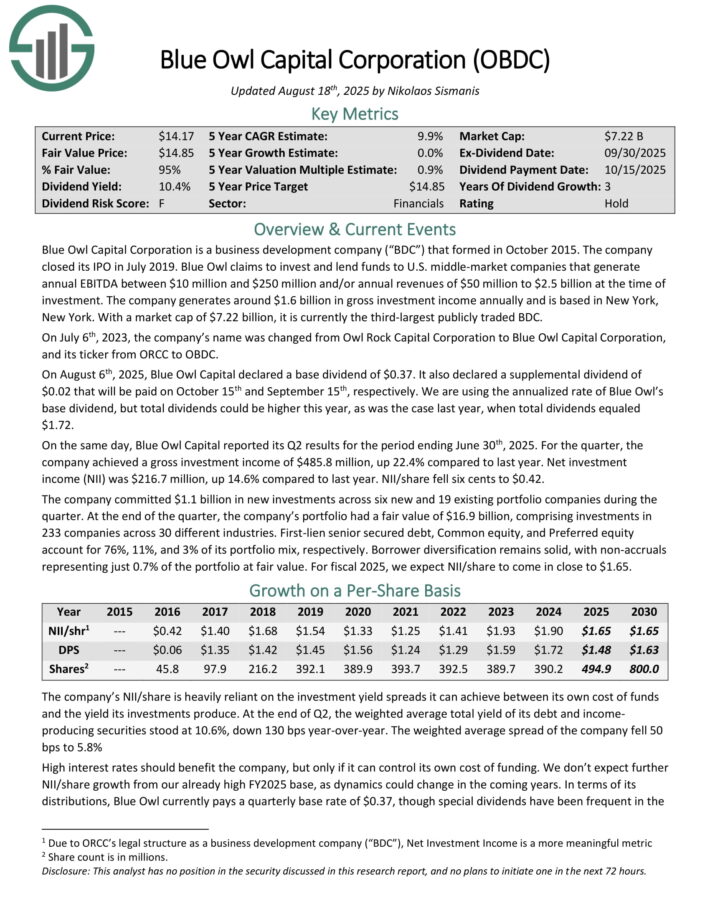

BDC #5: Blue Owl Capital (OBDC)

- 5-year expected annual return: 10.8%

Blue Owl Capital Corporation invests and lends funds to U.S. middle-market companies that generate annual EBITDA between $10 million and $250 million and/or annual revenues of $50 million to $2.5 billion at the time of investment. The company generates around $1.6 billion in gross investment income annually and is based in New York, New York.

On August 6th, 2025, Blue Owl Capital declared a base dividend of $0.37. It also declared a supplemental dividend of $0.02 that will be paid on October 15th and September 15th, respectively. We are using the annualized rate of Blue Owl’s base dividend, but total dividends could be higher this year.

On the same day, Blue Owl Capital reported its Q2 results for the period ending June 30th, 2025. For the quarter, the company achieved a gross investment income of $485.8 million, up 22.4% compared to last year. Net investment income (NII) was $216.7 million, up 14.6% compared to last year. NII/share fell six cents to $0.42.

The company committed $1.1 billion in new investments across six new and 19 existing portfolio companies during the quarter. At the end of the quarter, the company’s portfolio had a fair value of $16.9 billion, comprising investments in 233 companies across 30 different industries.

First-lien senior secured debt, Common equity, and Preferred equity account for 76%, 11%, and 3% of its portfolio mix, respectively. Borrower diversification remains solid, with non-accruals representing just 0.7% of the portfolio at fair value.

Click here to download our most recent Sure Analysis report on OBDC (preview of page 1 of 3 shown below):

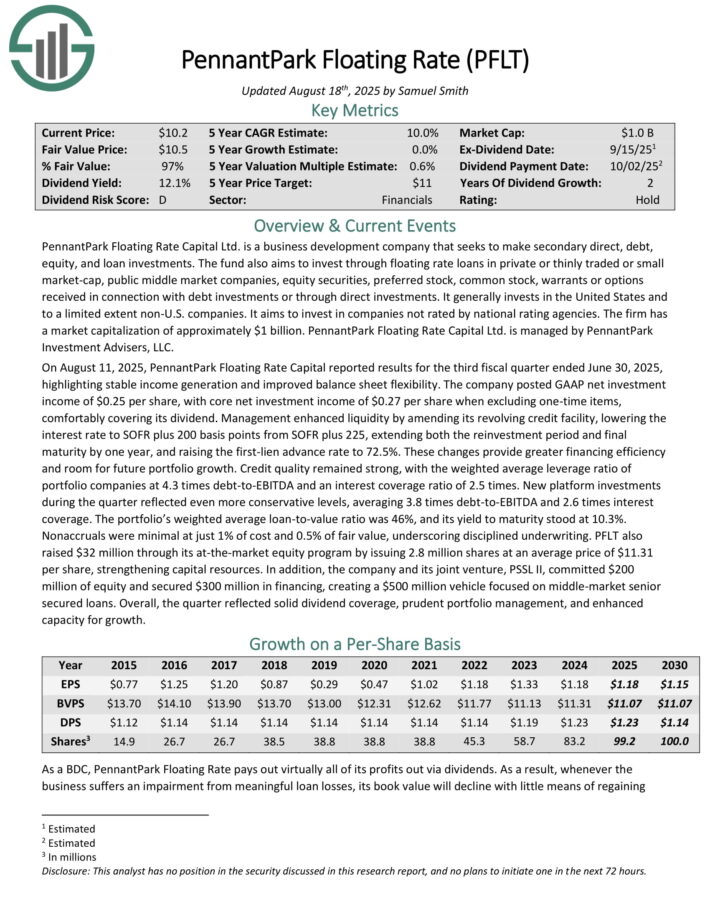

BDC #4: PennantPark Floating Rate Capital (PFLT)

- 5-year expected annual return: 11.5%

PennantPark Floating Rate Capital Ltd. is a business development company that seeks to make secondary direct, debt, equity, and loan investments.

The fund also aims to invest through floating rate loans in private or thinly traded or small market-cap, public middle market companies, equity securities, preferred stock, common stock, warrants or options received in connection with debt investments or through direct investments.

On August 11, 2025, PennantPark Floating Rate Capital reported results for the third fiscal quarter ended June 30, 2025, highlighting stable income generation and improved balance sheet flexibility.

The company posted GAAP net investment income of $0.25 per share, with core net investment income of $0.27 per share when excluding one-time items, comfortably covering its dividend.

Management enhanced liquidity by amending its revolving credit facility, lowering the interest rate to SOFR plus 200 basis points from SOFR plus 225, extending both the reinvestment period and final maturity by one year, and raising the first-lien advance rate to 72.5%.

These changes provide greater financing efficiency and room for future portfolio growth. Credit quality remained strong, with the weighted average leverage ratio of portfolio companies at 4.3 times debt-to-EBITDA and an interest coverage ratio of 2.5 times.

New platform investments during the quarter reflected even more conservative levels, averaging 3.8 times debt-to-EBITDA and 2.6 times interest coverage. The portfolio’s weighted average loan-to-value ratio was 46%, and its yield to maturity stood at 10.3%.

Nonaccruals were minimal at just 1% of cost and 0.5% of fair value, underscoring disciplined underwriting. PFLT also raised $32 million through its at-the-market equity program by issuing 2.8 million shares at an average price of $11.31 per share, strengthening capital resources.

In addition, the company and its joint venture, PSSL II, committed $200 million of equity and secured $300 million in financing, creating a $500 million vehicle focused on middle-market senior secured loans.

Click here to download our most recent Sure Analysis report on PFLT (preview of page 1 of 3 shown below):

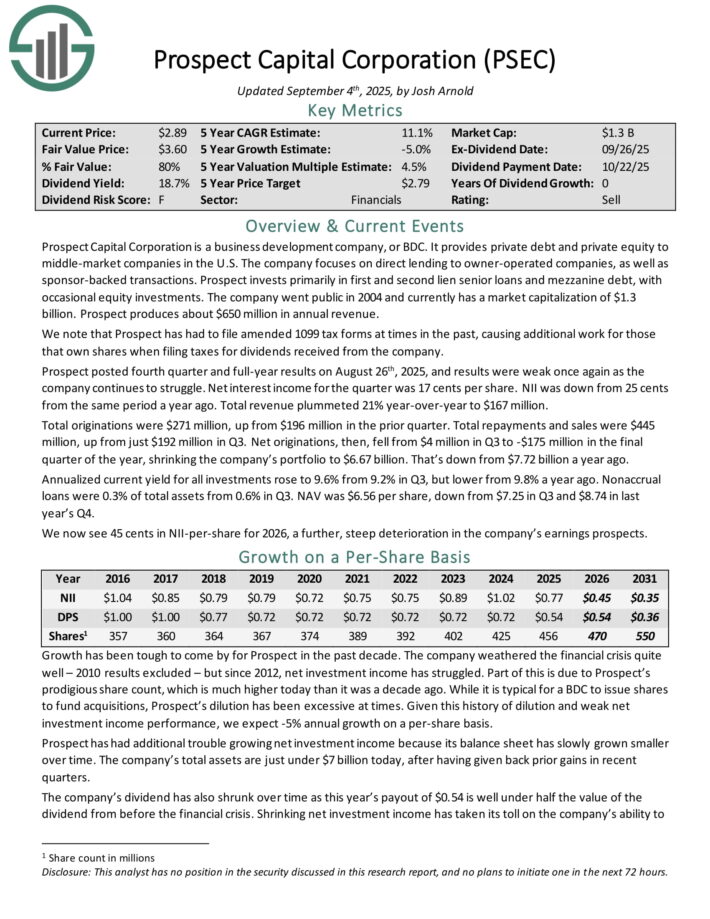

BDC #3: Prospect Capital (PSEC)

- 5-year expected annual return: 13.2%

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

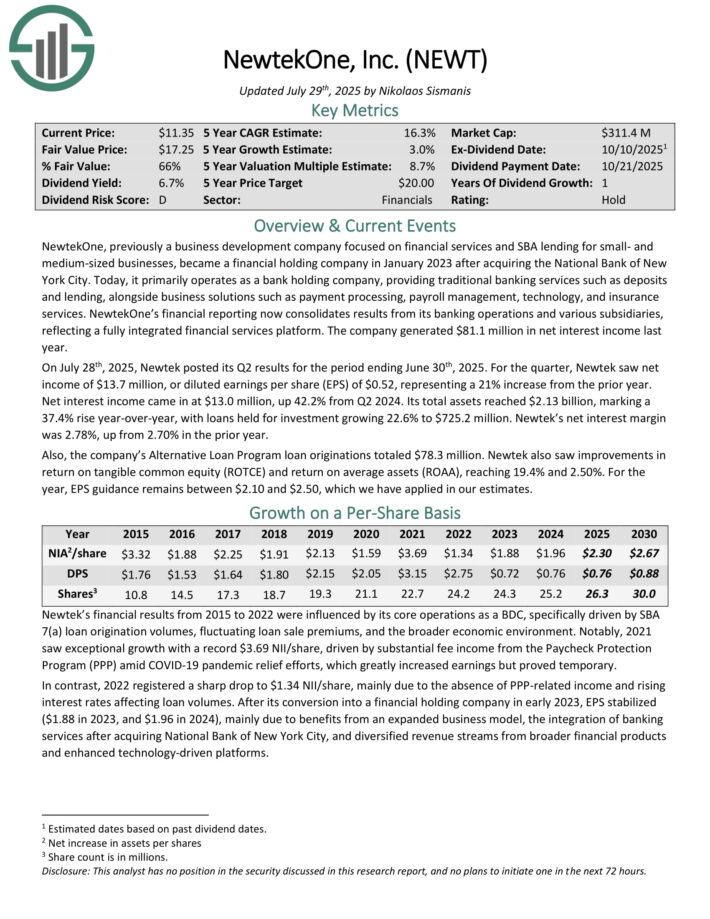

BDC #2: NewtekOne Inc. (NEWT)

- 5-year expected annual return: 14.8%

Newtek One provides financial and business services to the small- and medium-sized business market in the United States.

The company also gets a significant amount of its income from being an issuer of SBA (Small Business Administration loans), which only very few BDCs are licensed to do.

On July 28th, 2025, Newtek posted its Q2 results for the period ending June 30th, 2025. For the quarter, Newtek saw net income of $13.7 million, or diluted earnings per share (EPS) of $0.52, representing a 21% increase from the prior year.

Net interest income came in at $13.0 million, up 42.2% from Q2 2024. Its total assets reached $2.13 billion, marking a 37.4% rise year-over-year, with loans held for investment growing 22.6% to $725.2 million. Newtek’s net interest margin was 2.78%, up from 2.70% in the prior year.

Also, the company’s Alternative Loan Program loan originations totaled $78.3 million. Newtek also saw improvements in return on tangible common equity (ROTCE) and return on average assets (ROAA), reaching 19.4% and 2.50%.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

BDC #1: Horizon Technology Finance (HRZN)

- 5-year expected annual return: 15.6%

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

On August 7th, 2025, Horizon announced its Q2 results for the period ending June 30th, 2025. For the quarter, total investment income fell 4.5% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Net investment income per share (IIS) fell to $0.28, down from $0.36 compared to Q2-2024. Net asset value (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of the end of the quarter was $0.94 per share, indicating a considerable cash cushion. Management assured investors of the dividend’s stability by declaring three forward monthly dividends at a rate of $0.11.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

Final Thoughts

Business Development Companies give retail investors the opportunity to invest indirectly in small and mid-size businesses.

Previously, investment in early-stage or developing companies was restricted to accredited investors, through venture capital.

And, BDCs have obvious appeal for income investors. BDCs widely have high dividend yields above 5%, and many BDCs pay dividends every month instead of the more typical quarterly payment schedule.

Of course, investors should consider all of the unique characteristics, including but not limited to the tax implications of BDCs.

Investors should also be aware of the risk factors associated with investing in BDCs, such as the use of leverage, interest rate risk, and default risk.

If investors understand the various implications and make the decision to invest in BDCs, the 5 individual stocks on this list could provide attractive total returns and dividends over the next several years.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The Dividend Aristocrats List: S&P 500 stocks with 25+ years of dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 56 stocks with 50+ years of consecutive dividend increases.

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in the S&P 500.