Updated on March 3rd, 2025 by Bob Ciura

Investors looking to generate higher income levels from their investment portfolios should look at Real Estate Investment Trusts or REITs.

These are companies that own real estate properties and lease them to tenants, or invest in real estate backed loans, both of which generate a steady stream of income.

The bulk of their income is then passed on to shareholders through dividends.

You can see all 200+ REITs here.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

The beauty of REITs for income investors is that they are required to distribute 90% of their taxable income to shareholders annually in the form of dividends. In return, REITs typically do not pay corporate taxes.

As a result, many of the 200+ REITs we track offer high dividend yields of 5%+.

But not all high-yielding stocks are automatic buys. Investors should carefully assess the fundamentals to ensure that high yields are sustainable.

Note that while the securities in this article have very high yields, a high yield alone does not make for a solid investment. Dividend safety, valuation, management, balance sheet health, and growth are also very important factors.

We urge investors to use the analysis below as informative but to do significant due diligence before buying into any security – especially high-yield securities.

Many (but not all) high-yield securities have a significant risk of a dividend reduction and/or deteriorating business results.

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

- High-Yield REIT No. 10: Community Healthcare Trust (CHCT)

- High-Yield REIT No. 9: Chimera Investment Corp. (CIM)

- High-Yield REIT No. 8: Innovative Industrial Properties (IIPR)

- High-Yield REIT No. 7: Pennymac Mortgage Investment Trust (PMT)

- High-Yield REIT No. 6: AGNC Investment Corp. (AGNC)

- High-Yield REIT No. 5: Arbor Realty Trust (ABR)

- High-Yield REIT No. 4: Dynex Capital (DX)

- High-Yield REIT No. 3: Ellington Credit Co. (EARN)

- High-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

- High-Yield REIT No. 1: Orchid Island Capital (ORC)

High-Yield REIT No. 10: Community Healthcare Trust (CHCT)

- Dividend Yield: 10.0%

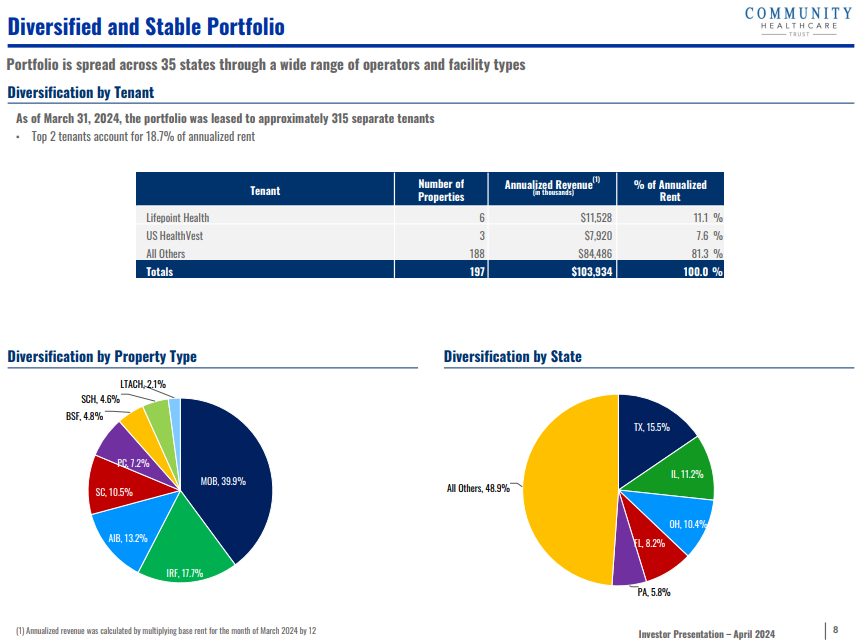

Community Healthcare Trust is an REIT which owns income-producing real estate properties linked to the healthcare sector, such as physician offices, specialty centers, behavioral facilities, inpatient rehabilitation facilities, and medical office buildings.

The trust has investments in 197 properties in 35 states, totaling 4.4 million square feet.

Source: Investor Presentation

On February 18th, 2025, Community Healthcare Trust reported fourth quarter results for the period ending December 31st, 2024.

Funds from operations (FFO) per share dipped 16% to $0.48 from $0.57 in the prior year quarter. Adjusted FFO per share, however, declined by 10% to $0.55.

During the quarter, Community Healthcare acquired three properties for $8.2 million. These properties were 100% leased with lease expirations through 2029.

The trust also has seven properties under definitive purchase agreements, with a combined purchase price of roughly $170 million, expected to close from 2025 through 2027.

Click here to download our most recent Sure Analysis report on CHCT (preview of page 1 of 3 shown below):

High-Yield REIT No. 9: Chimera Investment Corp. (CIM)

- Dividend Yield: 10.4%

Chimera Investment Corporation is a real estate investment trust (REIT) that is a specialty finance company. The company’s primary business is in investing through subsidiaries in a diversified portfolio of mortgage assets, including residential mortgage loans, Non-Agency RMBS, Agency CMBS, and other real estate related securities.

Chimera’s income is predominantly obtained by the difference between the income the company earns on its assets and financing and hedging costs.

The company funds the purchase of assets through several funding sources: asset securitization, repurchase agreements (repo), warehouse lines, and equity capital.

On May 21st, 2024, Chimera executed a 1-for-3 reverse stock split due to its depressed stock price, which resulted from the impact of high interest rates. This was a negative development.

In mid-February, Chimera released (2/12/25) results for the fourth quarter of fiscal 2024. Its core earnings-per-share edged up sequentially, from $0.36 to $0.37, thanks to lower provisions for credit losses. Chimera missed the analysts’ consensus by $0.01.

Click here to download our most recent Sure Analysis report on CIM (preview of page 1 of 3 shown below):

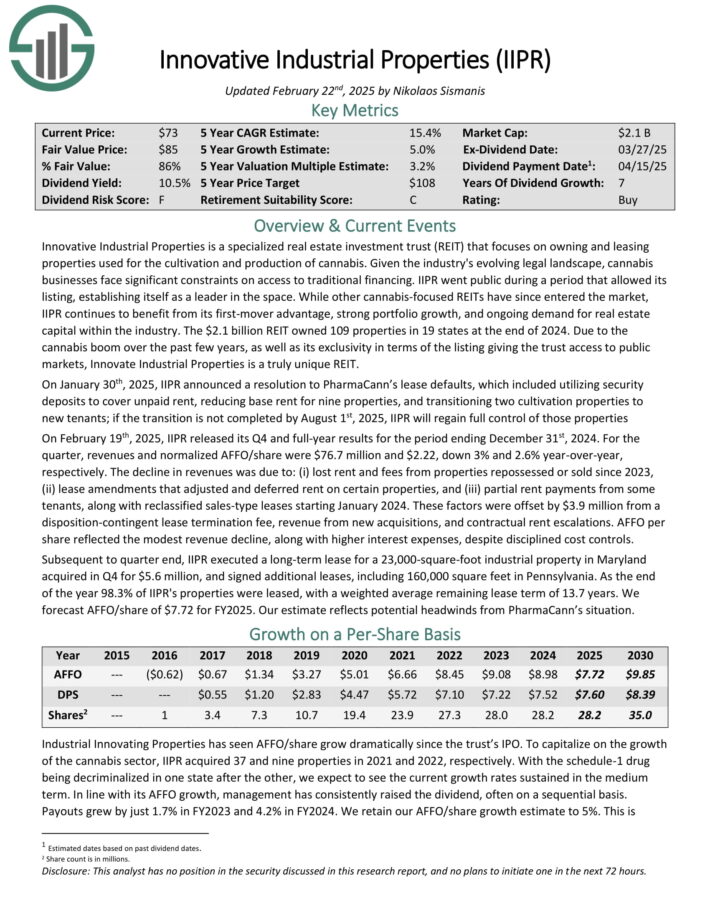

High-Yield REIT No. 8: Innovative Industrial Properties (IIPR)

- Dividend Yield: 10.6%

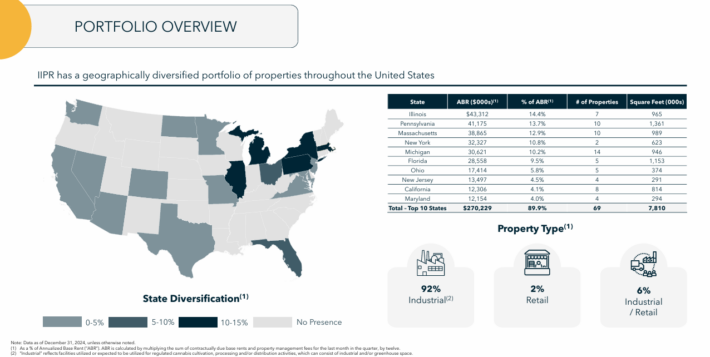

Innovative Industrial Properties, Inc. is a single-use “specialty REIT” that exclusively focuses on owning properties used for the cultivation and production of cannabis.

As of the end of 2024, IIPR had 109 properties, with a weighted average lease length of 13.7 years. Approximately 92% of IIPR’s properties are industrial, with retail comprising 2% and blended properties the remaining 6%.

Source: Investor Presentation

On February 19th, 2025, IIPR released its Q4 and full-year results for the period ending December 31st, 2024. For the quarter, revenues and normalized AFFO/share were $76.7 million and $2.22, down 3% and 2.6% year-over-year, respectively.

The decline in revenues was due to lost rent and fees from properties repossessed or sold since 2023, lease amendments that adjusted and deferred rent on certain properties, and (iii) partial rent payments from some tenants, along with reclassified sales-type leases starting January 2024.

These factors were offset by $3.9 million from a disposition-contingent lease termination fee, revenue from new acquisitions, and contractual rent escalations.

Click here to download our most recent Sure Analysis report on IIPR (preview of page 1 of 3 shown below):

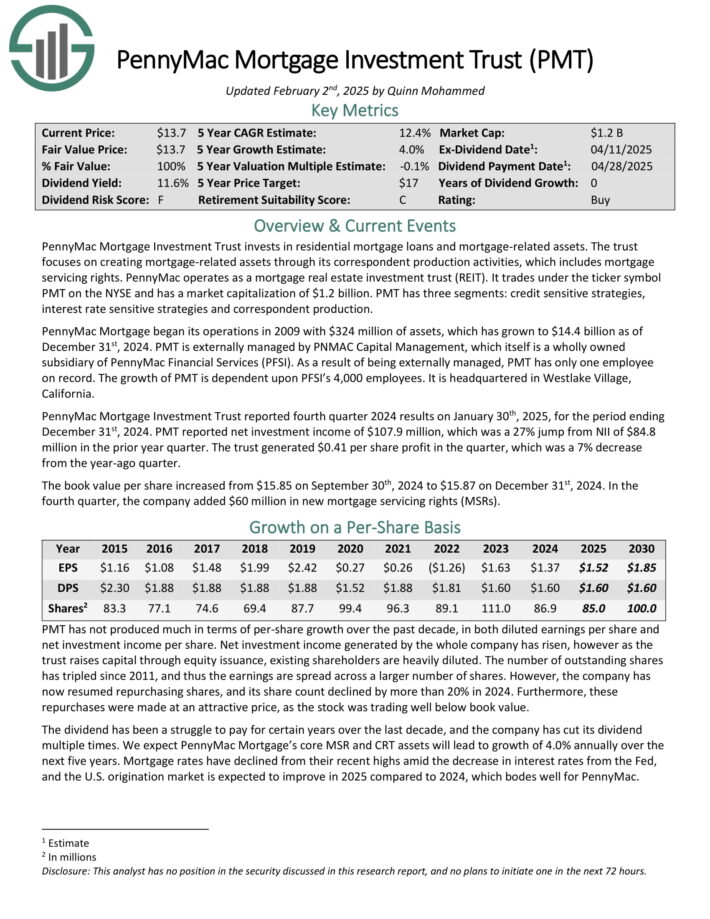

High-Yield REIT No. 7: Pennymac Mortgage Investment Trust (PMT)

- Dividend Yield: 10.9%

PennyMac Mortgage Investment Trust invests in residential mortgage loans and mortgage-related assets. PMT has three segments: credit sensitive strategies, interest rate sensitive strategies and correspondent production.

PennyMac Mortgage began its operations in 2009 with $324 million of assets, which has grown to $13.1 billion as of September 30th, 2024. PMT is externally managed by PNMAC Capital Management, which itself is a wholly owned subsidiary of PennyMac Financial Services (PFSI).

PennyMac Mortgage Investment Trust reported fourth quarter 2024 results on January 30th, 2025, for the period ending December 31st, 2024. PMT reported net investment income of $107.9 million, which was a 27% jump from NII of $84.8 million in the prior year quarter.

The trust generated $0.41 per share profit in the quarter, which was a 7% decrease from the year-ago quarter.

The book value per share increased from $15.85 on September 30th, 2024 to $15.87 on December 31st, 2024. In the fourth quarter, the company added $60 million in new mortgage servicing rights (MSRs).

Click here to download our most recent Sure Analysis report on PMT (preview of page 1 of 3 shown below):

High-Yield REIT No. 6: AGNC Investment Corp. (AGNC)

- Dividend Yield: 13.8%

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

AGNC Investment Corp. reported strong financial results for the third quarter ended September 30, 2024. The company achieved a comprehensive income of $0.63 per common share, driven by a net income of $0.39 and other comprehensive income of $0.24 from marked-to-market investments.

Net spread and dollar roll income contributed $0.43 per share.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

High-Yield REIT No. 5: Arbor Realty Trust (ABR)

- Dividend Yield: 13.9%

Arbor Realty Trust is a nationwide mortgage real estate investment trust (REIT) that acts as a direct lender and operates in two reporting segments: Agency Business and Structured Business. The trust provides loan origination and servicing for multifamily, seniors housing, healthcare, and other diverse commercial real estate assets.

Arbor Realty’s specific focus is government-sponsored enterprise products, although its platform also includes commercial mortgage backed securities (CMBS), bridge and mezzanine loans, and preferred equity issuances.

Arbor Realty Trust, Inc. (ABR) reported third-quarter 2024 results with net income of $0.31 per diluted common share, matching expectations, and distributable earnings of $0.43 per share. Revenue reached $88.81 million, a 17.23% year-over-year decrease but still beating estimates by $3.10 million.

The company declared a cash dividend of $0.43 per share and announced agency loan originations totaling $1.1 billion, supporting a $33.01 billion servicing portfolio, which grew 10% year-over-year. Structured loan originations reached $258.5 million, contributing to a $11.57 billion portfolio.

Click here to download our most recent Sure Analysis report on ABR (preview of page 1 of 3 shown below):

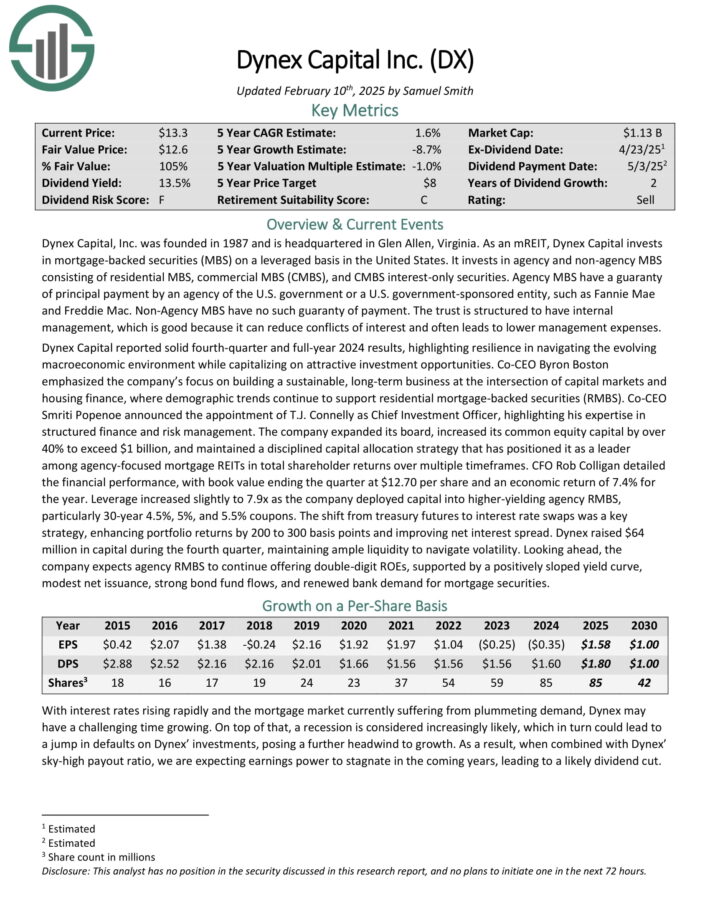

High-Yield REIT No. 4: Dynex Capital (DX)

- Dividend Yield: 14.5%

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non–agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest–only securities.

Source: Investor Presentation

Dynex Capital released its fourth-quarter 2024 financial results, with book value ending the quarter at $12.70 per share and an economic return of 7.4% for the year.

Leverage increased slightly to 7.9x as the company deployed capital into higher-yielding agency RMBS, particularly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to interest rate swaps was a key strategy, enhancing portfolio returns by 200 to 300 basis points and improving net interest spread.

Click here to download our most recent Sure Analysis report on DX (preview of page 1 of 3 shown below):

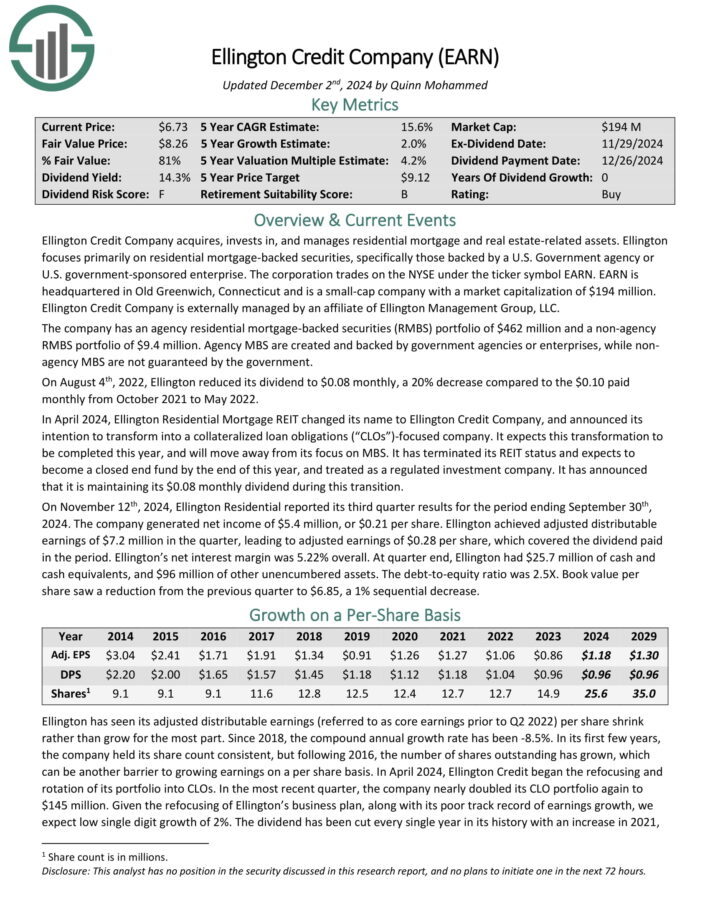

High-Yield REIT No. 3: Ellington Credit Co. (EARN)

- Dividend Yield: 14.8%

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On November 12th, 2024, Ellington Residential reported its third quarter results for the period ending September 30th, 2024. The company generated net income of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million in the quarter, leading to adjusted earnings of $0.28 per share, which covered the dividend paid in the period. Ellington’s net interest margin was 5.22% overall.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

High-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

- Dividend Yield: 15.1%

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

Source: Investor presentation

On October 23, 2024, ARMOUR Residential REIT announced its unaudited third-quarter 2024 financial results, reporting a GAAP net income available to common stockholders of $62.9 million, or $1.21 per common share. The company generated a net interest income of $1.8 million and distributable earnings of $52.0 million, equivalent to $1.00 per common share.

ARMOUR achieved an average interest income of 4.89% on interest-earning assets and an interest cost of 5.51% on average interest-bearing liabilities. The economic net interest spread stood at 2.00%, calculated from an economic interest income of 4.44% minus an economic interest expense of 2.44%.

During the quarter, ARMOUR raised $129.4 million by issuing 6,413,735 shares of common stock through an at-the-market offering program and paid common stock dividends of $0.72 per share for Q3.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

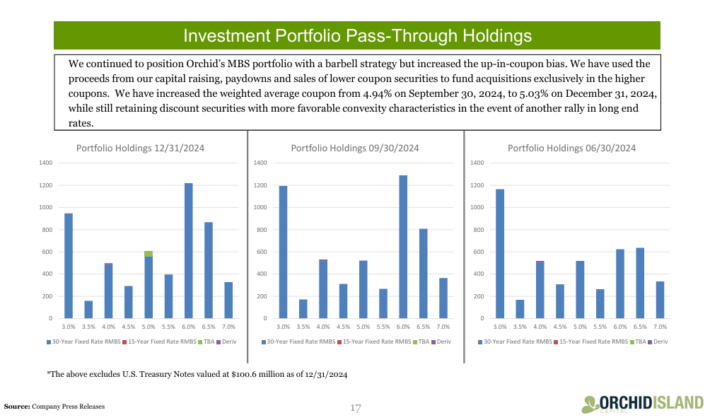

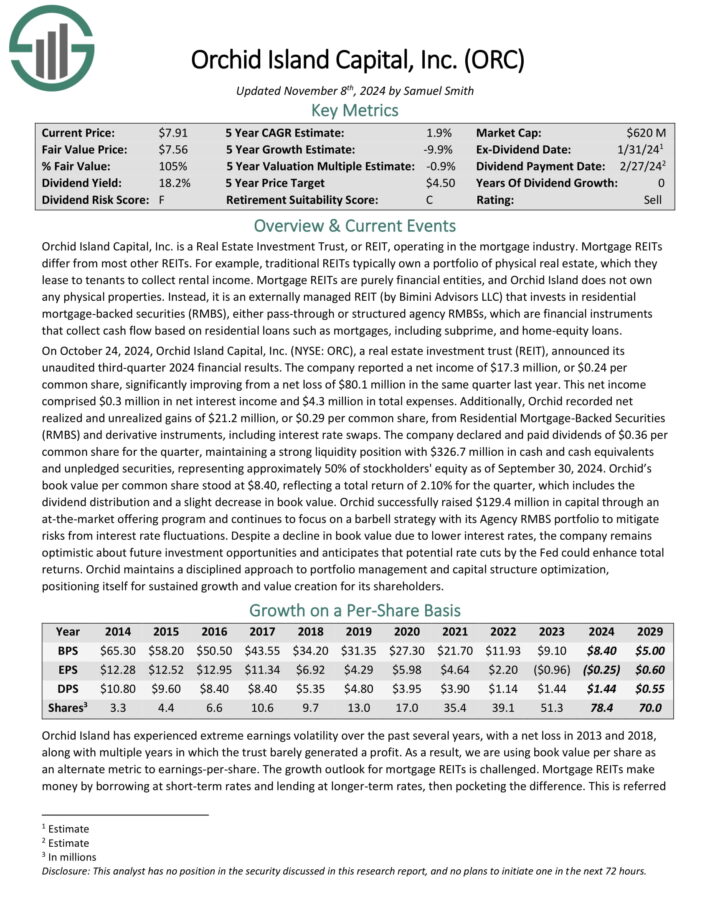

High-Yield REIT No. 1: Orchid Island Capital Inc (ORC)

- Dividend Yield: 16.8%

Orchid Island Capital is a mortgage REIT that is externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), including pass-through and structured agency RMBSs.

These financial instruments generate cash flow based on residential loans such as mortgages, subprime, and home-equity loans.

Source: Investor Presentation

The company reported a net income of $17.3 million, or $0.24 per common share, significantly improving from a net loss of $80.1 million in the same quarter last year. This net income comprised $0.3 million in net interest income and $4.3 million in total expenses.

Additionally, Orchid recorded net realized and unrealized gains of $21.2 million, or $0.29 per common share, from Residential Mortgage-Backed Securities (RMBS) and derivative instruments, including interest rate swaps.

Click here to download our most recent Sure Analysis report on Orchid Island Capital, Inc. (ORC) (preview of page 1 of 3 shown below):

Final Thoughts

REITs have significant appeal for income investors due to their high yields. These 10 extremely high-yielding REITs are especially attractive on the surface, although investors should be aware that abnormally high yields are often accompanied by elevated risks.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Monthly Dividend Stocks: Individual securities that pay out every month